Looking ahead to a new cycle in the crypto market

After each Halving milestone, we often expect the next wave of market growth. However, looking at the nature, changes coming from internal factors of the market are the premise for a price breakthrough in the future.

The article will accompany readers through perspectives from macro to internal factors and also go straight into the problems and challenges of the crypto and web3 markets in the new cycle.

Macro lens

The two main factors of the market are projected through a macro lens, including basic economic indicators (CPI, interest rates) and the legal framework for crypto.

The era of cheap money is over

During the FOMC session last April, CPI showed signs of decreasing from 3.5% to 3.4%. However, this number is still high and persistent compared to the 2% target set by the Fed. Looking historically, current U.S. inflation figures have been above 3% for 37 consecutive months - a stretch surpassed only by the hyperinflation of the late 1980s.

Long history of US CPI above 3%

To cope with the persistent inflation problem, the FED's tightening process has taken longer than expected and expectations for interest rate cuts this year are gradually fading compared to the initial period. year. It can be said that the "cheap money" period in previous cycles is gradually passing, the global financial market will have to get used to the high interest rate environment in the coming years.

As a result, capital flows into the crypto market through investment funds (VC) are much lower than in previous cycles. Compared to the period 2021-2022, the amount of capital raised in Q1 2024 is only ¼ of 1 billion USD/month - on par with the 2018 period. This is the consequence of three big issues: (1) arbitrage policy FED long term, (2) risk-off sentiment after the collapse of FTX and (3) unclear legal framework.

For a sustainable growth cycle, capital flows into the market need to be proportional to Bitcoin price. However, the correlation is showing a divergence as Bitcoin price has surpassed its old peak amid a liquidity shortage. According to Coinbase, this stems from capital inflows from institutional investors through spot Bitcoin ETFs.

Unlike previous cycles, this time the money flow only flows into Bitcoin (and possibly Ethereum) instead of going down to altcoin and low-cap projects. In the current context, with the exception of Bitcoin and Ethereum, most of the remaining money in the market is just moving back and forth between narratives driven by VCs and the game of attention.

To continue growing in the next cycle, the market needs one of the following two major changes:

Macro change

Changes in legal framework

In particular, the improvement of the legal framework, especially in the United States, is an important premise that allows projects to develop with peace of mind as well as attract more capital flows from the traditional market (TradFi).

Positive signs in the legal framework

The spot Bitcoin ETF event is not only a bridge in terms of cash flow but also a psychological turning point from the TradFi market to the crypto market. Following the above success, the market is expecting the Ethereum spot ETF to be approved, thereby opening up new money flows directly into this ecosystem and beyond the DeFi market.

During the congressional session on May 22, the US SEC approved 8 filings related to spot Ethereum ETFs in the form of 19b-4, officially recognizing Ethereum as not a security. However, it takes up to 3 more months for ETFs to officially trade after the FED approves the S-1 filing.

Also in the above session, the US House of Representatives officially passed the FIT 21 Act - an extremely important premise to help build a comprehensive legal framework for the entire crypto industry, including:

Allows blockchain projects to be released in the United States with peace of mind.

Clarifying the boundaries between the roles of the SEC and CFTC. From there, it helps to clearly classify the role of digital assets between securities and commodities.

Ensuring the safety of American investors through regulations supervising trading floors.

Important legal events in Q1 2024

For Tradfi investment funds, an investment environment with a clear and transparent legal framework will easily help capital flow into the market.

For projects, having a safe playground will promote the development of new ideas without worrying about legal sanctions. It can be said that solving the legal problem will be the main growth driver of the market, in the context that the majority of funds and projects are coming from the United States.

Internal factors are gradually moving towards mass adoption

When legal issues are removed and capital flows and investor groups return to the market, will projects be ready to welcome the next cycle?

Before answering the above question, let's look at the dynamics of a crypto cycle.

Starting with the development of the infrastructure layer that underpins the dapps. When dapps prove their value with a large enough user base, it will require an upgrade of the infrastructure layer. This development loop is called the app-infra cycle with the sequential development of the infrastructure layer and dapp over time.

The growth cycle between infra and app

Compared to previous cycles, there are three major shifts in the internal factors of the market: (1) the development of extensible solutions, (2) improvements in UI/UX and (3) new The application is gradually coming to life.

Scalable solutions are growing day by day

Solving the blockchain trilemma problem is always the goal that blockchain platform projects aim for. Let's look at the previous cycle:

· Ethereum (2015) helps expand Bitcoin's capabilities.

· Alt-L1 and Sidechain (2019-2020) help expand Ethereum's capabilities.

· Layer 2 and non-EVM blockchain (2021-2022) with new designs to expand execution capabilities.

· Modular stack (2023) helps solve the DA layer congestion problem for Layer 2.

· The app-infra growth cycle in the crypto market

It can be seen that scalable solutions are always developed through each cycle with innovations to fill in the shortcomings of previous technologies. At the present time, most expansion solutions are focusing on the execution stage with two main directions:

Modular blockchain

Monolithic blockchain with parallel execution design

For the first group, the premise for development comes from increasingly expanded and optimized middleware and CDK toolkits for creating layers on Ethereum. In particular, the Restaking initiative from EigenLayer allows projects to reuse the crypto-economic security from Ethereum.

For monolithic blockchain projects, the development of hardware technology (Moore Law) is an important premise for these expansion solutions. After the success of Solana, blockchains with parallel structures are being promoted in different virtual machine environments such as SVM (Solana & Eclipse), MoveVM (Sui, Aptos & Movement) or even EVM (Monad & Sei V2).

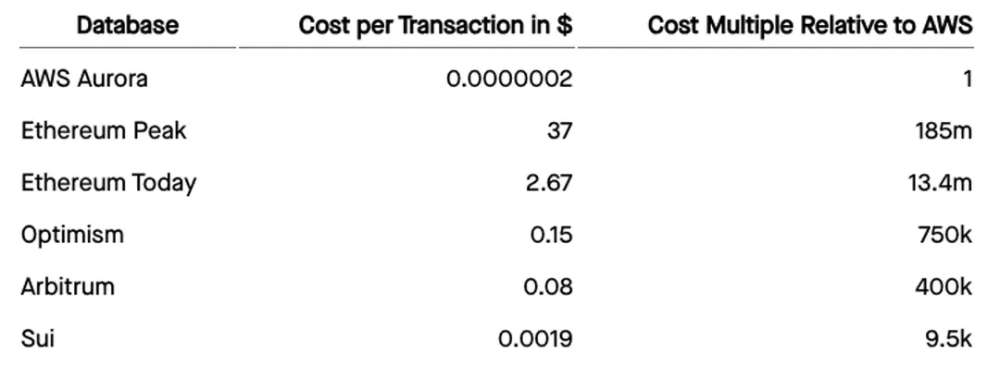

Solutions like nil's zkSharding, Paradigm's Reth client or Solana's Firedancer client are being awaited and promise to change a lot in the way blockchains expand in the future. As throughput increases at increasingly lower costs, the development and birth of dapps is an inevitable trend. The expansion trend will continue to develop and the beneficiaries will be the end users.

Improvements in how users interact with Web3

In the future, infrastructure competition will gradually reach its limit when the throughput and cost of blockchains are equally effective. Then the competition of blockchains will lie in killer apps, thereby moving towards approaches through integration solutions such as wallets, crypto phones or mini apps.

Recent examples can be seen from blockchains such as Base, Solana and Ton Network.

Compete through compatibility with Web2 users

Compared to previous cycles, Web2 users face many major barriers in accessing and using Web3 dapps due to limitations in UI/UX as well as key management on EOAs wallets.

In the past period, proposals related to wallet UI/UX have been increasingly improved with the introduction of Account Abstraction technology with ERC-4337 standard, or more recently EIP 7702. Wallet technologies such as social login and embedded wallet are gradually blurring the gap between Web2 and Web3.

Blockchains like Ton and Base with Telegram Wallet and Coinbase Smart Wallet have simplified the process of creating wallets and storing keys. From there, it helps attract Web2 users to these blockchains easily. Besides, the strategy of releasing crypto devices such as Solana Saga, Jambo phone and SuiPlay0X1 is a new market access trend of blockchains.

Finally, new forms of Web3 application experience are gradually changing with prominent names such as Telegram Mini Apps (TMAs) or Farcaster Frames. With TMAs, users can interact directly with Web3 applications directly on the Telegram channel. As for Farcaster Frames, this feature has opened up new development directions in terms of content through the application of blockchain technology.

Blockchain applications are gradually coming to life

From the development of the infrastructure layer above, Web3 applications can gradually enter daily life. At the current stage, the potential of this technology is being strongly observed and applied in areas such as payments, tokenization and beyond, AI.

Crypto Payment - More than just payments

Compared to previous cycles, payment solutions are limited to an on-off ramp, making applications primarily revolve around cross-border transactions with high legal risks.

At the current stage, blockchains like Solana or Base are actively cooperating with major payment gateways to connect with Web2 users. Solana is actively cooperating with parties such as Stripe, Paypal USD (PYUSD), Visa to expand its customer base and applications outside of Web3.

Besides, another giant, Coinbase, is also allowing its users to trade and pay for Web2 services with USDC on Base at almost zero cost through Coinbase Commerce. From there, expand payment solutions that directly use crypto in everyday life.

Real World Assets - Waiting for the 4th revolution

The RWA project team started with stablecoin projects through tokenizing fiat money in the 2019-2020 cycle. Following is the RWA Private Credit project group with names such as Maple Finance, Goldfinch or Centrifuge in the period 2020-2021. The third wave appeared with the RWA Treasury project group in early 2023 amid rising interest rates from the traditional market.

In the RWA Treasury segment, projects with legal advantages with support from financial institutions such as Securitize (Blackrock) or Franklin Templeton Benji are leading the game, followed by DeFi project groups such as Ondo, Matrixdock and Maple Finance.

At the present time, the above project group still mainly serves B2B customers such as DAO or stablecoin projects (MakerDao, Tether) due to legal restrictions on retail. In the future, when the above difficulties are resolved, this project group can target retail customers (B2C & B2B2C), while improving yield sources through integration with DeFi stack layers (lending & borrowing, yield trade, staking,...).

Finally, as the need to own Tradfi onchain assets is increasing, the RWA Equity project group, Index or ETFs will be the next steps of development.

Artificial Intelligence (AI) - Long-term potentials

In 2018, founder of Founder Fund - Peter Thiel made a comment: "Crypto Is Libertarian, AI Is Communist". This implies that most of the power of AI technology is in the hands of a group of large technology companies from data collection and processing, model training, and fine-tuning. fine-tuning and prediction.

Some blockchain technologies or cryptographic techniques such as ZKPs, FHE, MPC are applied to most of the processing and computing processes of big data models (LLMs).

Then, the quality of the input data as well as the model's calculation process will be effective. From there, LLMs models will reduce their dependence on data volume as well as computing power.

According to Vitalik, the intersection between blockchain and AI will increase in the future. However, at present, only a few blockchain applications can be applied to AI safely, reliably and effectively.

This comes from the superior performance of centralized data processing platforms (centralized platforms) compared to decentralized solutions. However, it is still too early and the market needs more time to effectively combine these two technologies.

Challenges in the next cycle

Along with potential internal factors, there are still new challenges in the current market context.

One of the topics that has received attention recently is High FDV, Low Float. This is a situation where the following projects listed on CEX are overpriced with low circulating supply. Specifically, the MC/FDV ratio of projects released in 2024 is at 12.2% (as of April 14, 2024) compared to 41.2% and 26.7%% in 2022 and 2023.

Besides, the average FDV level of recent projects such as Starknet ($27.1B), Ethena ($21B) or Jupiter ($18.1B) is too high, nearly equal to the average level of the top 10 largest projects. currently (except Bitcoin, Ethereum and stablecoins). This makes the opportunities for retail (individual investors) in the current cycle not as many as in previous periods.

High FDV, Low Float is the result, not the problem

There are many factors that contribute to changes in the current market, the lack of liquidity as presented in part 1 is one of the main causes.

For retail, the gradual lack of attractive narratives (a consequence of the lack of cash flow) compared to previous cycles has caused the level of speculation to increase in the current cycle, this is reflected in the growth of memecoin - according to Regan Bozmant in an interview with Bankless.

Specifically, retailers will tend to choose investment strategies that bring quick profits and leave quickly. This is demonstrated by the low asset holding period and short-term satisfaction of crypto investors - according to research by Pantera Research Lab.

This group of investors is collectively called casino players as they come to the market with a speculative mentality. Compared to those who believe in technology - computer players, the casino investor group is the majority at the current stage.

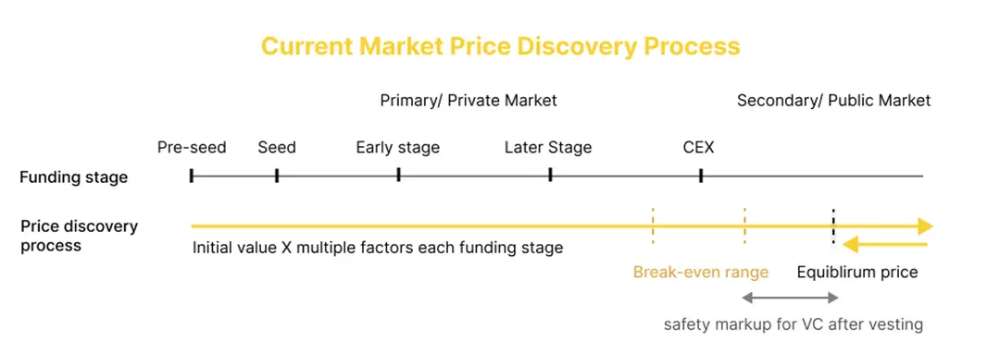

On the VC side, legal regulations have led most projects to choose to distribute tokens through airdrops. From there, causing VC to face price risk after vesting (the process of gradually unlocking tokens after listing). Therefore, in order to ensure profits for limited partners (LPs), high valuations have become the industry standard in the context of cash flow difficulties.

Therefore, the price discovery process will mostly take place in the private market between VCs and projects. When listed, the price will tend to gradually decrease towards the fair price to ensure profits for VC.

It can be seen that, with the current game, both retail and VC are aiming for the best tactical options for themselves. However, with the advantage of asymmetric information, VCs have advantages over retail. However, the game can change when retail understands this rule and chooses reasonable tactics to gain its own advantages.

From zero-sum game to positive sum game

A recent emerging trend is that retail is shifting to memecoin projects with a total supply of 100% unlocked for the community (community-backed token). A number of memecoin projects are being developed that bring a lot of value to holders, beyond simple price plays. However, the risk for investors is huge when participating in this game.

Some proposals include creating a new playground such as crowdfunding (ECO & PartyDAO) or pre-market platforms (Aevo & Hyperliquid) that allow retailers to access projects at an early stage.

Choose between community token and VC token

Looking at the traditional market, the downward price trend after IPO also occurs with an average decrease of 19.5% within 3 years, according to research from the University of Florida from 1980-2022 with 9,127 samples. Research also shows that VC-backed projects tend to decline much lower than non-VC backed projects (12.5% versus 24.2%).

Parameters of IPOs on the US stock market

It can be seen that having supporting investment funds is not necessarily a bad thing. However, in the current crypto market, there is a lack of VCs with a long-term vision for projects. VC investment decisions are mainly based on short-term factors such as narrative-market-fit instead of internal factors (cash flow, product-market-fit (PMF),...).

In the future, when legal issues are resolved, professional investment funds will participate and contribute to making the market more efficient. From there, distribute cash flow more effectively for projects with PMF. Finally, helping to expand and develop Web3 applications with applications that go into daily life creating a sustainable growing market (positive sum game).

Looking ahead to a new cycle in crypto

Predicting the market in the short term is impossible. However, looking at the positive changes in the market's internal factors, we can expect the next development cycle. Any breakthrough technological development needs to bring together all the elements of time, attention and internality to progress gradually into everyday life.

At the present time, consequences from macro factors such as cash flow and unclear legal framework are somewhat affecting the market. However, improvements in the legal framework will be a key factor in helping cash flow return. Since then, a new gate has opened with many large institutional investors participating in this market, making the market more efficient.

In the next cycle, the competitive advantage of pioneers or VCs will no longer be much, opportunities will belong to those who keep an open mind and quickly change according to the new locks of the market. Requires investors to find new approaches, enhance their position and find their own advantages to achieve long-term profits.