A Comprehensive Guide to Cryptocurrency Trading

Introduction

A cryptocurrency, crypto-currency, or crypto[a] is a digital currency designed to work as a medium of exchange through a computer network that is not reliant on any central authority, such as a government or bank, to uphold or maintain it.[2] A logo for Bitcoin, the first decentralized cryptocurrency

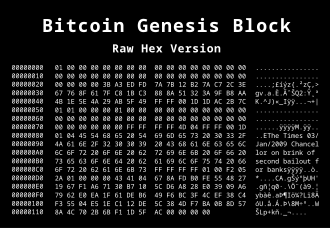

A logo for Bitcoin, the first decentralized cryptocurrency The genesis block of Bitcoin's blockchain, with a note containing The Times newspaper headline. This note has been interpreted as a comment on the instability caused by fractional-reserve banking.[1]: 18

The genesis block of Bitcoin's blockchain, with a note containing The Times newspaper headline. This note has been interpreted as a comment on the instability caused by fractional-reserve banking.[1]: 18

Individual coin ownership records are stored in a digital ledger, which is a computerized database using strong cryptography to secure transaction records, control the creation of additional coins, and verify the transfer of coin ownership.[3][4][5] Despite their name, cryptocurrencies are not considered to be currencies in the traditional sense, and while varying treatments have been applied to them, including classification as commodities, securities, and currencies, cryptocurrencies are generally viewed as a distinct asset class in practice.[6][7][8] Some crypto schemes use validators to maintain the cryptocurrency. In a proof-of-stake model, owners put up their tokens as collateral. In return, they get authority over the token in proportion to the amount they stake. Generally, these token stakers get additional ownership in the token over time via network fees, newly minted tokens, or other such reward mechanisms.[9]

Cryptocurrency does not exist in physical form (like paper money) and is typically not issued by a central authority. Cryptocurrencies typically use decentralized control as opposed to a central bank digital currency (CBDC).[10] Though, the cryptographic keys of the wallets are largely centralized in a few exchanges. When a cryptocurrency is minted, created prior to issuance, or issued by a single issuer, it is generally considered centralized. When implemented with decentralized control, each cryptocurrency works through distributed ledger technology, typically a blockchain, that serves as a public financial transaction database.[11]

The first cryptocurrency was Bitcoin, which was first released as open-source software in 2009. As of June 2023, there were more than 25,000 other cryptocurrencies in the marketplace, of which more than 40 had a market capitalization exceeding $1 billion.[12] Throughout their existence, cryptocurrencies have been involved in criminal activities and multi-billion-dollar fraud schemes. Some economists and investors, such as Warren Buffett, considered cryptocurrencies to be a speculative bubble.

Understanding the Risks and Requirements

Cryptocurrency is a digital or virtual form of currency that uses cryptography for security and operates independently of a central authority, such as a government or financial institution. It relies on blockchain technology, which is a decentralized and distributed ledger that records all transactions across a network of computers.

Trading cryptocurrency involves buying and selling these digital assets on various online platforms known as exchanges. To trade cryptocurrency effectively, one needs to understand several key concepts:

- Market Analysis: Traders need to analyze market trends, price movements, and trading volumes to make informed decisions about when to buy or sell cryptocurrencies. This requires knowledge of technical analysis, which involves studying historical price data and chart patterns, as well as fundamental analysis, which involves evaluating the underlying technology and adoption of a particular cryptocurrency.

- Risk Management: Cryptocurrency markets are known for their volatility, with prices often experiencing significant fluctuations in short periods. Traders must have strategies in place to manage risk, such as setting stop-loss orders to limit potential losses and diversifying their portfolios to spread risk across different assets.

- Security: Securing one's cryptocurrency holdings is crucial to prevent theft or hacking. This involves using secure wallets, implementing two-factor authentication, and being cautious of phishing attempts or scams.

- Regulatory Compliance: Depending on one's jurisdiction, there may be regulatory requirements or tax implications associated with trading cryptocurrencies. Traders should familiarize themselves with relevant laws and regulations to ensure compliance.

Despite the potential for profit, cryptocurrency trading is not suitable for everyone, especially those without much knowledge or experience. Several reasons contribute to this:

- Volatility: Cryptocurrency markets can be highly volatile, leading to rapid and unpredictable price movements. Without a solid understanding of market dynamics, inexperienced traders may struggle to navigate these effectively.

- Complexity: Cryptocurrency trading involves technical concepts such as blockchain technology, cryptography, and decentralized finance (DeFi). Without a strong grasp of these concepts, traders may struggle to understand the factors influencing price movements and make informed decisions.

- Risk of Loss: Trading cryptocurrencies carries inherent risks, including the potential for significant financial loss. Inexperienced traders may be more susceptible to emotional decision-making, such as panic selling during market downturns, which can result in substantial losses.

- Lack of Regulation: Unlike traditional financial markets, cryptocurrency markets are relatively unregulated, making them more susceptible to manipulation, fraud, and security breaches. Without proper knowledge and precautions, traders may fall victim to scams or cyberattacks.

In conclusion, while cryptocurrency trading offers opportunities for profit, it also carries significant risks, especially for those without much knowledge or experience. It requires a solid understanding of market dynamics, risk management strategies, and security measures to trade successfully. As such, it is not suitable for everyone, and individuals should carefully consider their level of expertise and risk tolerance before engaging in cryptocurrency trading.

References

- Pagliery, Jose (2014). Bitcoin: And the Future of Money. Triumph Books. ISBN 978-1629370361. Archived from the original on 21 January 2018. Retrieved 20 January 2018.

- ^ Milutinović, Monia (2018). "Cryptocurrency". Ekonomika. 64 (1): 105–122. doi:10.5937/ekonomika1801105M. ISSN 0350-137X. Archived from the original on 16 April 2022. Retrieved 18 April 2022.

- ^ Jump up to:a b Andy Greenberg (20 April 2011). "Crypto Currency". Forbes. Archived from the original on 31 August 2014. Retrieved 8 August 2014.

- ^ Polansek, Tom (2 May 2016). "CME, ICE prepare pricing data that could boost bitcoin". Reuters. Archived from the original on 23 April 2022. Retrieved 3 May 2016.

- ^ Pernice, Ingolf G. A.; Scott, Brett (20 May 2021). "Cryptocurrency". Internet Policy Review. 10 (2). doi:10.14763/2021.2.1561. ISSN 2197-6775. Archived from the original on 23 October 2021. Retrieved 23 October 2021.

- ^ "Bitcoin not a currency says Japan government". BBC News. 7 March 2014. Archived from the original on 25 January 2022. Retrieved 25 January 2022.

- ^ "Is it a currency? A commodity? Bitcoin has an identity crisis". Reuters. 3 March 2020. Archived from the original on 25 January 2022. Retrieved 25 January 2022.

- ^ Brown, Aaron (7 November 2017). "Are Cryptocurrencies an Asset Class? Yes and No". www.bloomberg.com. Archived from the original on 1 April 2022. Retrieved 25 January 2022.

- ^ Bezek, Ian (14 July 2021). "What Is Proof-of-Stake, and Why Is Ethereum Adopting It?". Archived from the original on 5 August 2021. Retrieved 5 August 2021.

- ^ Allison, Ian (8 September 2015). "If Banks Want Benefits of Blockchains, They Must Go Permissionless". International Business Times. Archived from the original on 12 September 2015. Retrieved 15 September 2015.

- ^ Matteo D'Agnolo. "All you need to know about Bitcoin". timesofindia-economictimes. Archived from the original on 26 October 2015.

- ^ "Cryptocurrencies: What Are They?". Schwab Brokerage. Archived from the original on 14 September 2023. Retrieved 14 September 2023. However, as of June 2023, there were more than 25,000 digital currencies in the marketplace, of which more than 40 had a market capitalization exceeding $1 billion

![[LIVE] Engage2Earn: auspol follower rush](https://cdn.bulbapp.io/frontend/images/c1a761de-5ce9-4e9b-b5b3-dc009e60bfa8/1)