How to Use Binance Strategy Trading to Trade Like a Pro.

Table of contents

- Key Takeaways 2. Introduction 3.What is Binance Strategy Trading?4.Benefits of Binance Strategy Trading 5.What is Binance Futures Grid Trading?6.What is TWAP Algorithmic Trading? 7.What is Volume Participation Algorithmic Trading? 8.How to Use Strategy Trading Landing Page 9.Using the Mock Trading Environment to Practice Strategy 10. Conclusion 11. Disclaimer

Photo Credit: Binance

Photo Credit: Binance

Key Takeaways

- Traders that employ market-neutral tactics can benefit regardless of the direction of the bitcoin market.

- This strategy can help cushion the blow of extreme market volatility and price swings.

- Traders need to weigh the pros and downsides of market-neutral techniques, which may be slightly more complicated than simple buying and selling.

- Binance offers a lot of trading incentives and you can enjoy these conveniences by signing up for a Binance user account below.

Introduction

Binance, a one of the world’s largest cryptocurrency exchanges, announced today that it would be opening up trading for Tron (TRX) on its platform. This move comes as Tron looks to build on its impressive gains so far in 2018 and solidify its position as a top-ten cryptocurrency. Binance said that it would open up TRX/BNB and TRX/USDT trading pairs at 10:00 am (UTC) on Thursday, May 31st. With this addition, Binance will now list 13 cryptocurrencies. This news is sure to excite Tron enthusiasts who can now take advantage of Binance’s high liquidity and 24/7 customer support.

What is Binance Strategy Trading?

Binance Strategy Trading is a system that allows users to trade cryptocurrencies on the Binance exchange. The system uses three different types of orders: market orders, limit orders, and stop-limit orders. Market orders are used to buy or sell cryptocurrency at the best available price. Limit orders allow users to set a specific price at which they are willing to buy or sell. Stop-limit orders are used to limit losses by setting a stop price and a limit price. The system also offers a variety of charting tools and technical indicators to help users make informed trading decisions. Binance Strategy Trading is an essential tool for anyone looking to trade cryptocurrencies on the Binance exchange.

Benefits of Binance Strategy Trading.

Binance is one of the world’s leading cryptocurrency exchanges, offering a wide variety of digital assets for trading. In addition to traditional spot trading, Binance also offers margin and derivatives trading. Recently, Binance launched a new feature called Strategy Trading, which allows users to trade multiple cryptocurrencies simultaneously. Here are some of the benefits of using Binance Strategy Trading:

1. Increased Profitability: By allowing users to trade multiple cryptocurrencies at once, Strategy Trading can potentially increase profits.

2. Reduced Risk: When diversifying investments across multiple assets, there is less risk involved than if all eggs were in one basket.

3. Enhanced Flexibility: Strategy Trading gives users more flexibility in how they allocate their funds and how they execute trades.

4. Greater Efficiency: Rather than having to manage several different portfolios, Strategy Trading lets users manage all their investments from one platform.

5. Lower Fees: Binance offers competitive fees for Strategy Trading, making it an affordable option for investors.

Overall, Binance Strategy Trading is a versatile tool that can be used to increase profits, reduce risk, and improve efficiency. For these reasons, it is an increasingly popular option among cryptocurrency traders. Photo Credit: Binance

Photo Credit: Binance

What is Binance Futures Grid Trading?

Binance Futures Grid Trading is a type of algorithmic trading that enables users to place buy and sell orders at pre-determined price levels. The system automatically adjusts the price levels according to market conditions and executes orders when the prices reach the predetermined levels. Grid trading is a popular trading strategy among institutional traders and hedge funds. It is a highly-efficient way to trade large volumes of assets without incurring heavy slippage.

The main advantage of Binance Futures Grid Trading is that it allows users to capitalize on both rising and falling markets. In a rising market, the system places buy orders at increasingly higher price levels. Another advantage of Binance Futures Grid Trading is that it is highly adaptive to changing market conditions. The system constantly monitors market conditions and adjusts the price levels accordingly.

Binance Long, Short grid is an innovative new trading strategy that allows you to take advantage of both long and short term market movements. This strategy is designed to provide you with the flexibility to trade in both directions, while still managing your risk. The key to this strategy is to place your buy and sell orders at different levels, which allows you to take advantage of both rising and falling markets.

This approach can be used in any time frame, but is particularly well suited for day trading. If you are looking for a way to potential profits in both directions, the Binance Long, Short grid may be right for you. Grid limit orders can begin instantly or be set to activate at a certain market price. If the selected price (Last price or Mark price) goes above or below the trigger price you enter, the corresponding grid orders will be executed.

The basic framework involves calculating a range of prices based on the current market price (buy, sell, mid-price), then placing sell limit orders at a price higher than the market price and purchase limit orders at a price lower than the market price and waiting for the orders to be activated.

The tactic will begin in a position of complete randomness on neutral grids. Once the market closes above or below the initial construction’s nearest price point, the initial position will be activated. We will start by placing sell orders for the neutral grid at a price higher than the current market price. The buy orders, meanwhile, will be filled at a price lower than the current market price.

Keep in mind that the closest price to the market would be disregarded. Users have the option of stopping the grid manually or by configuring a Stop Trigger.

If you have a Stop Trigger set up, the grid will shut down if the market price goes above Stop upper limit or below Stop lower limit, respectively, signaling that the market is no longer following a swaying trend. When the grid is halted, the user has the option of manually or automatically canceling all orders and closing all positions.

Any unfilled orders for the symbol will be canceled when the grid is halted if the option to “cancel all orders on stop” has been selected. As soon as the grid is stopped, all open positions are instantly closed at the current market price for the symbol if the close all positions on stop option is turned on.

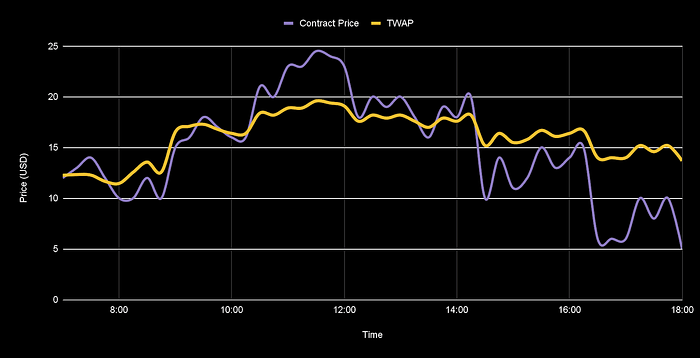

What is TWAP Algorithmic Trading? Photo Credit: Binance

Photo Credit: Binance

TWAP algorithmic trading is a type of trading that uses computer algorithms to trade on behalf of a client at a predetermined price. TWAP, which stands for “time-weighted average price”, is a method of trading that ensures that the client receives the average price of the security over the course of the trading period.

This type of trading is often used by institutional investors, such as pension funds and hedge funds, who need to trade large volumes of securities without moving the market prices. TWAP algorithmic trading is typically executed by a broker-dealer on behalf of the client. TWAP algorithmic trading is also used by individual investors who want to ensure that they are getting the best possible price for their trades.

Setting up TWAP on Binance is a simple process that only takes a few minutes. First, log in to your account and go to the “Trade” page. From there, select “TWAP” from the list of trading options. Next, enter the amount that you want to trade, along with the timeframe for your TWAP. Finally, click “Submit” to place your trade. That’s all there is to it!

With TWAP, you can trade with confidence knowing that you’re getting the best possible price for your coins. There are some limitations to using this method. First, order size limits may prevent the TWAP from being an accurate measure of the security’s true value. Second, the timing of orders can also impact the TWAP. If trades are not executed evenly throughout the day, the TWAP will not be an accurate reflection of the security’s price. Finally, market conditions can also impact the accuracy of the TWAP.

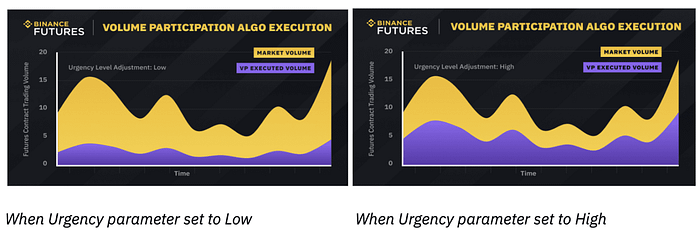

What is Volume Participation Algorithmic Trading?

Volume Participation Algorithmic Trading (VPAT) is a type of algorithmic trading that uses volume information to make trading decisions. VPAT systems rely on the fact that large trades tend to move markets, so they aim to execute trades when there is significant volume. VPAT systems are designed to trade on multiple exchanges and can trade across asset classes. VPAT systems typically use limit orders, which means that they will only trade at a certain price or better.

This limits the risk of slippage, which can occur when markets are volatile. VPAT systems may also use other types of orders, such as market orders or stop-loss orders. VPAT systems are often used by institutional investors, such as hedge funds, to execute large trades. There are three main ways to set up volume participation algorithmic trading:

- Use a traditional broker that offers this type of trading.

- Use an online broker that specializes in volume participation algorithmic trading.

- Use a software program that enables you to trade using volume participation algorithms.

The most important thing when choosing a method is to find one that best suits your trading style and preferences. If you want the simplest setup possible, using a traditional broker is probably the best option. However, if you’re looking for more control over your trades and want to be able to customize your algorithms, using an online broker or trading software may be a better fit.

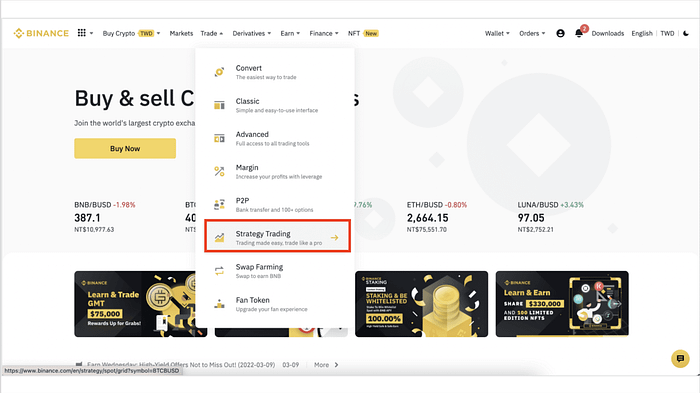

How to Use Strategy Trading Landing Page {step-by-step guide} Photo Credit: Binance

Photo Credit: Binance

Define your trading strategy.

The first step is to define your trading strategy. This will help you determine the best way to enter and exit trades, as well as how to manage your risk. There are many different strategies that can be used, so it’s important to find one that fits your personality and objectives.

Set up your trading platform.

The next step is to set up your trading platform. This will give you the ability to place trades and track your progress. There are many different platforms available, so it’s important to find one that meets your needs.

Test your strategy

Once you have a defined strategy, it’s important to test it out before you start trading with real money. This will help you ensure that your strategy is effective and that you’re comfortable with it.

Start trading

Once you’ve tested your strategy and are comfortable with it, you can start trading with real money. Be sure to manage your risk carefully and always follow your strategy.

Monitor your progress

It’s important to monitor your progress as a trader. This will help you identify any areas where you need to improve and make adjustments to your strategy. The Strategy landing page is a great resource for anyone looking to learn more about the strategy process.

To access the Landing Page for Strategy Trading, visit Binance and choose [Trade] — [Strategy Trading]. The Strategy Trading Landing Page is also accessible via the trading interface of Binance Futures by clicking [Strategy Trading] — [Overview]. Strategy Trading Landing Page provides rapid access to a variety of automated trading methods, including Spot Grid, Futures Grid, TWAP, and VP algorithmic trading bots.

Spot Grid

Spot Grid Trading is a trading bot that automates Spot trading purchases and sales. Its primary function is to automatically enter market orders at regular intervals within a user-specified price range. When prices move within a narrow band, Binance Spot Grid Trading shines.

Futures Grid

Futures Grid Trading enables users to apply Grid Trading Strategies to Futures Contracts on Binance Futures, allowing them to raise their position sizes with leverage and optimize their profit potential.

Smart Algorithmic Trading

1. TWAP Algo

The TWAP trading algorithm lets traders break up large orders into smaller ones and have them carried out at regular intervals without manual intervention, thus reducing the potential for a domino effect on the market price.

2. VP Algo

Volume Participation (VP) is a trading algorithm that executes large orders with a defined urgency level. By adhering to the predetermined volume participation level, it attempts to execute trades at a rate that corresponds to a fraction of the actual volume in the prevailing market at any given time.

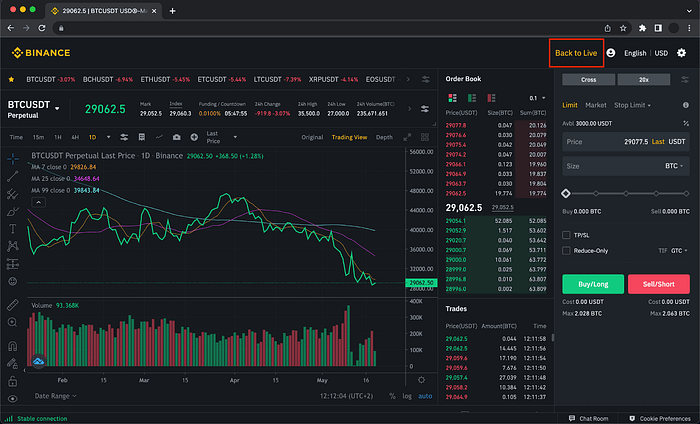

Using the Mock Trading Environment to Practice Strategy Trading Photo Credit: Binance

Photo Credit: Binance

The mock trading environment is an essential tool for any trader who wants to test their strategies before putting real money on the line. By simulating actual market conditions, the mock trading environment allows traders to see how their strategies would perform under real-world conditions.

This is an invaluable opportunity to fine-tune strategies and identify potential flaws before they result in actual losses. In addition, the mock trading environment can also be used to practice new trading strategies without incurring any risk. This is a great way to learn the ins and outs of a new strategy before committing to it in the real world.

Binance mock trading environment is a way for people to learn and practice trading without putting any actual money at risk. It is a valuable tool for both beginners and experienced traders alike. By using a mock trading environment, traders can test out new strategies and tactics without fear of losing any money.

In addition, mock trading can help traders hone their skills and become more familiar with the Binance platform. The Binance mock trading environment is an excellent way for people to learn about trading without risking any actual money.

There are a few different ways that you can access a mock trading environment. One option is to sign up for an online stock simulator. These simulations typically use real-time market data, so you can get a feel for how stock prices move throughout the day.

Mock trading platforms provide users with virtual currency that can be used to buy and sell stocks. These platforms typically offer a variety of features, such as charts and news feeds, to help users make informed decisions. In addition, mock trading environments often allow users to set up automatic trades so that they can track their progress over time. Photo Credit: Binance

Photo Credit: Binance

Conclusion

Binance is one of the most popular cryptocurrency exchanges in the world. It offers a wide range of features for users, including a variety of coins to trade and low fees. Binance also has its own token, BNB, which can be used to reduce trading fees on the platform. Binance Strategy Trading is a technique that uses the order book to identify buying and selling opportunities.

The idea behind it is that you buy when there’s high demand (i.e., when buyers are pushing the price up) and sell when there’s low demand (i.e., when sellers are pushing the price down). This method allows you to take advantage of market fluctuations and make profits while minimizing your risk. you can opt to learn more about Binance strategy trading by visiting page: ww.binance.com/en/futures/BTCUSDT?ref=11515767

Disclaimer

This article does not in any way represent finance advice. It is your responsibility to do your own research and consult a financial adviser or a blockchain expert before involving in any crypto trading.

Note

I featured this piece on Medium. It can be accessed via https://medium.com/@mikhailikpoma/how-to-use-binance-strategy-trading-to-trade-like-a-pro-e3ba49b83f4e

![[ℕ𝕖𝕧𝕖𝕣] 𝕊𝕖𝕝𝕝 𝕐𝕠𝕦𝕣 𝔹𝕚𝕥𝕔𝕠𝕚𝕟 - I Think I Have Crypto PTSD](https://cdn.bulbapp.io/frontend/images/819e7cdb-b6d8-4508-8a8d-7f1106719ecd/1)