5 Promising Altcoins to Watch in 2024

5 noteworthy altcoins to monitor in 2024.

2023 is nearing its end, it's time to prepare to welcome the crypto market in 2024.

There are various events that the crypto community is looking forward to in 2024, one of which is the Bitcoin halving. It is hoped that the halving will bring not only the price of Bitcoin, but also the prices of other altcoins to rise.

This article discusses five potential altcoins in 2024 which have been researched from various data sources by Coinvestasi analysts. This article is for information and education only, not investment advice.

Celestia (TIA)

Celestia is a modular blockchain crypto project, an innovative development of the existing blockchain (monolithic blockchain). Modular blockchains are claimed to work more efficiently than monolithic blockchains such as Ethereum.

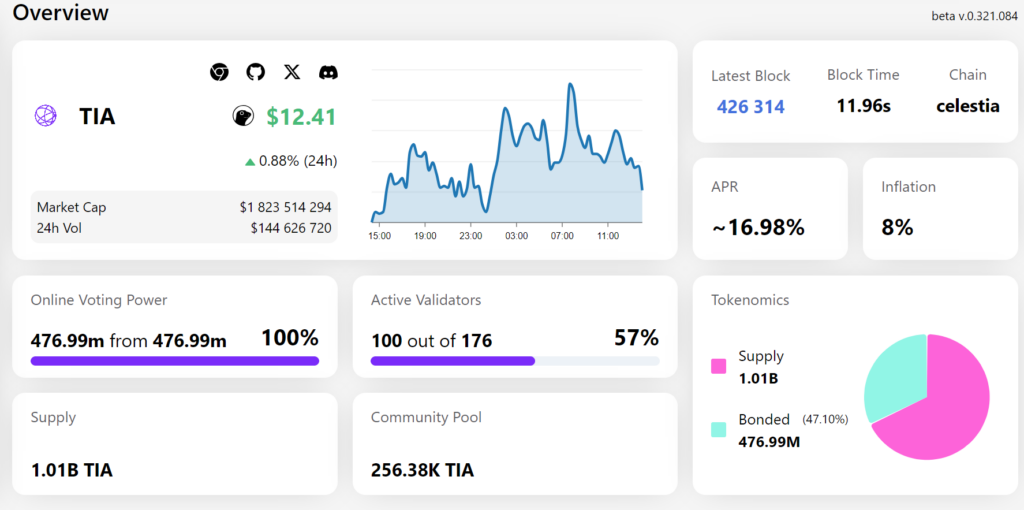

There are not many modular blockchain projects around today, and Celestia is the first in this sector. For example, Ethereum is a blockchain pioneer with smart contracts, Celestia is a modular blockchain pioneer. So, this project deserves attention. Image: Details Celestia. Source : Explorers Guru

Image: Details Celestia. Source : Explorers Guru

Holders of TIA coins can use their coins to earn passive income through staking with an annual return (APR) range of 16.98%. Staking can also be done on the LSD protocol on the Celestia network such as MilkyWay, so holders can use TIA in a liquid manner.

TIA coin has risen around +500% from its listing price post airdrop < a i=4>around US$2 to US$12. This shows that the level of confidence of TIA holders in this project is high, even though giving airdrops usually creates selling pressure.

As of this article (28/12/23), TIA is ranked 43rd with a market cap of US$1.9 billion.

Arbitrage (ARB)

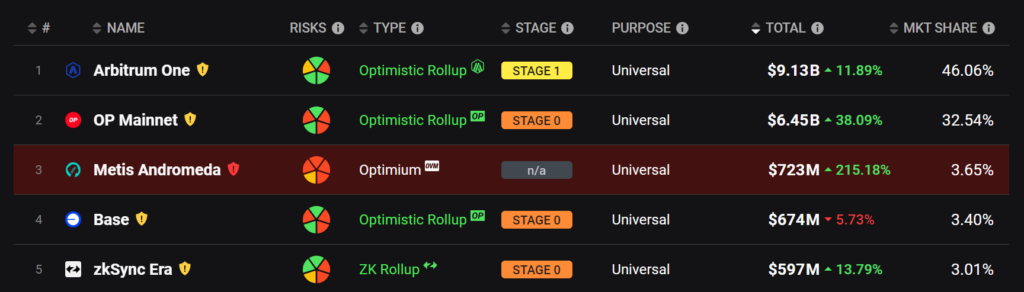

Arbitrum is a layer-2 project on the Ethereum network developed by the company Offchain Labs. Based on L2beat data, Arbitrum is the largest layer-2 in terms of total value locked (TVL), controlling around 46% of the overall layer-2 TVL. Image: Top 5 TVL layer-2. Source: L2beat

Image: Top 5 TVL layer-2. Source: L2beat

However, in terms of market capitalization, the ARB token is still below its closest competitor, namely Optimism (OP), with OP's market capitalization of US$3.44 billion while the new ARB is US$2 billion.

In terms of Marketcap vs. TVL, the ARB ratio value is somewhat smaller so the current ARB price can be said to be undervalued. However, there is a big unlock event in March 2024 equivalent to US$1.47 billion which might cause the ARB price to correct. However, after this unlock , ARB price has the potential to be bullish.

Arbitrum is worth paying attention to because it is undervalued against its competitors, and the layer-2 narrative with the EIP-4844 Proto Danksharding upgrade will make layer- 2 becomes cheaper and more efficient.

As of this article (28/12/23), ARB is ranked 41st with a market cap of US$2 billion.

Ronin (RON)

Ronin is a sidechain of the Ethereum network focused on the GameFi ecosystem developed by Sky Mavis, the company behind game Axie Infinity. RON tokens are gas fee tokens for transactions on the Ronin network.

GameFi seems to refuse to die due to bear market 2022. As proof, from only having Axie Infinity in 2021, now the Ronin ecosystem has many other games such as: Pixels, Tribesters, Zoids Wild Arena, The Machines Arena , and Wild Forest Picture: Pixels daily active wallet. Source: DappRadar

Picture: Pixels daily active wallet. Source: DappRadar

One of the games, Pixels, is widely played with daily active wallets reaching an average of 100 thousand wallets. With the return of GameFi, it is hoped that in-game token transactions will be numerous so that demand for RON tokens will increase.

As of this article (28/12/23), ARB is ranked 103rd with a market cap of US$572 million.

Pendle (PENDLE)

Pendle is a DeFi protocol with innovation in yield management (yield) through a tokenization process. What makes this platform interesting is that users can speculate with yield before yield is paid.

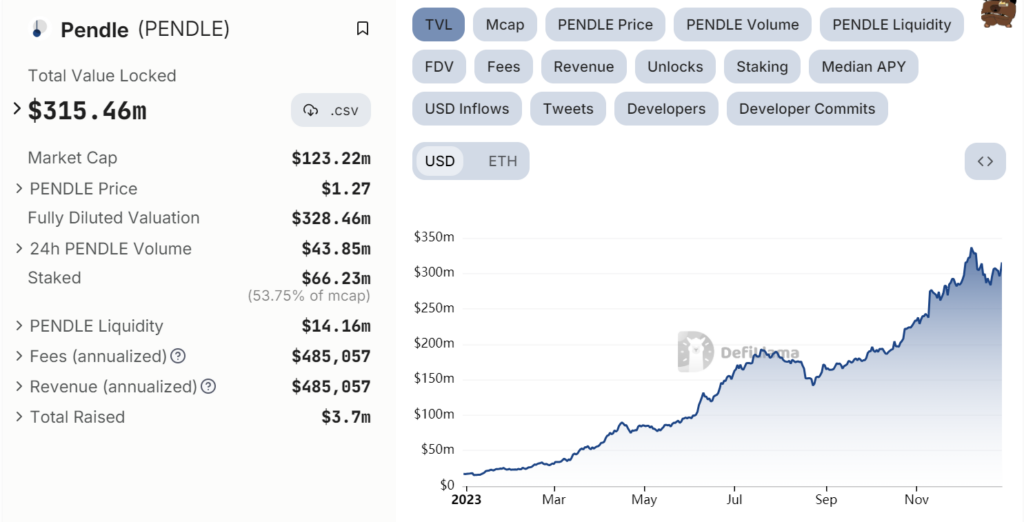

This allows users to earn extra yield without having to have large initial assets. Image: Pendle TVL development. Source: DefiLlama

Image: Pendle TVL development. Source: DefiLlama

2023 is a year of good development for Pendle with TVL consistently increasing from the beginning of 2023. In addition, Pendle brings several potential narratives on one platform, namely real world assets < /span>(LST) through products on the platform.liquid staking tokens (RWA) and

As of this article (28/12/23), PENDLE is ranked 172nd with a market capitalization of US$300 million.

Radiant Capital (RDNT)

Radiant Capital is an omnichain lending platform on the Arbitrum, Binance Chain, and Ethereum networks with RDNT as the protocol's governance token.

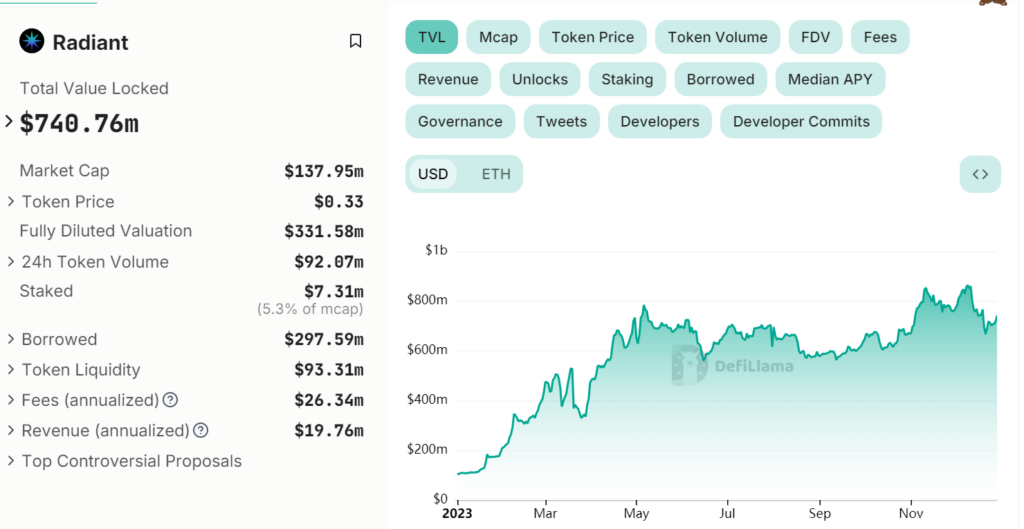

Radiant introduces a dynamic liquidity pool (dLP) mechanism that allows users to lock dLP and earn returns revenue protocol. Image: Radiant Capital TVL Development. Source: DefiLlama

Image: Radiant Capital TVL Development. Source: DefiLlama

Throughout 2023, Radiant Capital's TVL will experience a significant increase. Interestingly, the ratio Marketcap vs. The TVL of Radiant is only 0.19. When compared with lending protocols such as Aave with a ratio of 0.26 and Compound with a ratio of 0.44, then the price of RDNT is said to be undervalued.

As of this article (28/12/23), RDNT is ranked 299th with a market capitalization of US$140 million.

![[ℕ𝕖𝕧𝕖𝕣] 𝕊𝕖𝕝𝕝 𝕐𝕠𝕦𝕣 𝔹𝕚𝕥𝕔𝕠𝕚𝕟 - Is Trump Dying? Or Only Killing The Market?](https://cdn.bulbapp.io/frontend/images/a129e75e-4fa1-46cc-80b6-04e638877e46/1)

![[LIVE] Engage2Earn: McEwen boost for Rob Mitchell](https://cdn.bulbapp.io/frontend/images/c798d46f-d3b8-4a66-bf48-7e1ef50b4338/1)