Navigating the Crypto Seas: How to Choose the Right Exchange Platform for Trading

In the ever-expanding world of cryptocurrency, choosing the right exchange platform can be a daunting task. With numerous options available, each boasting its own features, fees, and security measures, it's essential to do your research before diving in. Whether you're a seasoned trader or a newcomer to the crypto space, finding the platform that best suits your needs is crucial for successful and secure trading.

First and foremost, consider the reputation and trustworthiness of the exchange. Look for platforms that have been operating for a significant amount of time and have built a solid reputation within the crypto community. Reading reviews and feedback from other users can provide valuable insights into the platform's reliability and customer service.

Next, consider the range of cryptocurrencies offered by the exchange. While major coins like Bitcoin and Ethereum are widely available on most platforms, if you're interested in trading lesser-known altcoins, make sure the exchange supports the ones you're interested in. A diverse selection of cryptocurrencies can provide more trading opportunities and flexibility in your investment strategy.

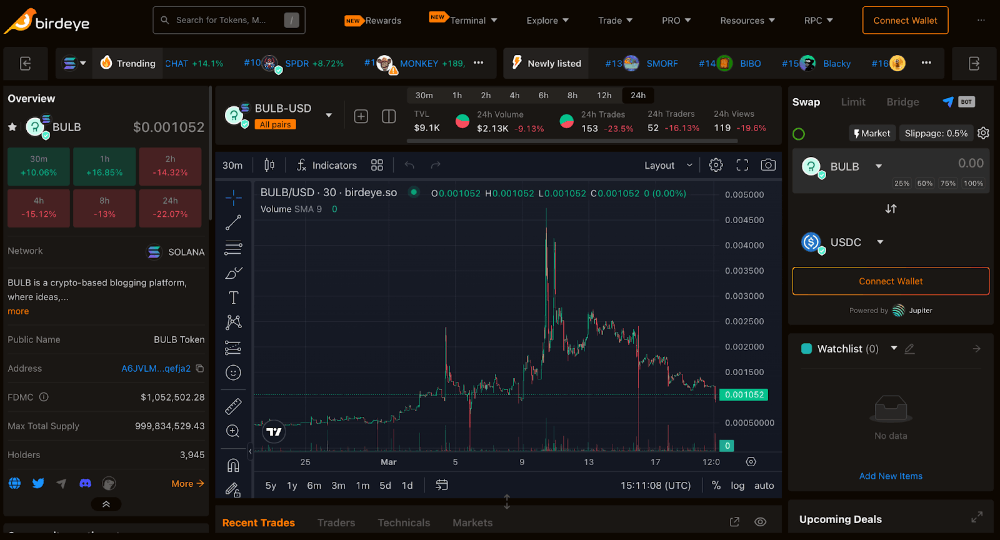

User experience and interface design also play a significant role in choosing the right exchange. A user-friendly platform with intuitive navigation and clear charting tools can make the trading process smoother and more enjoyable. Additionally, consider whether the exchange offers mobile apps or desktop applications for convenient access to your account and trading activities on the go.

Liquidity is another critical factor to consider, especially if you're planning to trade large volumes of cryptocurrency. Exchanges with higher liquidity tend to have narrower spreads and fewer price discrepancies between buy and sell orders, making it easier to execute trades at favorable prices.

Regulatory compliance is increasingly important in the crypto space, as governments around the world implement stricter regulations on digital asset trading. Choose exchanges that adhere to regulatory standards and have transparent compliance practices to minimize the risk of regulatory scrutiny or legal issues down the line.

Finally, consider the level of customer support provided by the exchange. In the fast-paced world of cryptocurrency trading, having access to responsive customer support can be invaluable, especially in times of technical difficulties or account-related issues.

In conclusion, choosing the right crypto exchange platform for trading requires careful consideration of various factors, including reputation, security, cryptocurrency offerings, fees, user experience, liquidity, regulatory compliance, and customer support. By conducting thorough research and evaluating your own trading needs and preferences, you can find the platform that best aligns with your goals and maximizes your trading success.

![[ℕ𝕖𝕧𝕖𝕣] 𝕊𝕖𝕝𝕝 𝕐𝕠𝕦𝕣 𝔹𝕚𝕥𝕔𝕠𝕚𝕟 - And Now What.... Pray To The God Of Hopium?](https://cdn.bulbapp.io/frontend/images/79e7827b-c644-4853-b048-a9601a8a8da7/1)

![[LIVE] Engage2Earn: Julian Hill Bruce boost](https://cdn.bulbapp.io/frontend/images/dbf23bb3-aba5-43ea-9678-e8c2dbad951c/1)