Bitcoin Option Investors Optimistic About BTC Reaching $70K by End of May

Bitcoin Option Investors Optimistic About BTC Reaching $70K by End of May

Bitcoin options set to expire on May 31, 2024, worth a total of $6.5 billion, show a strong bullish sentiment towards Bitcoin's price. Investors stand to gain $270 million if BTC manages to surpass $70,000.

Based on the $6.5 billion worth of Bitcoin options expiring on May 31, 2024, investors remain bullish on Bitcoin's price. Over 91% of these options are placed at a strike price of $70,000 or higher, indicating that investors are betting on a continued rally leading up to the expiry date.

Analyzing the Bullish Potential of BTC Options

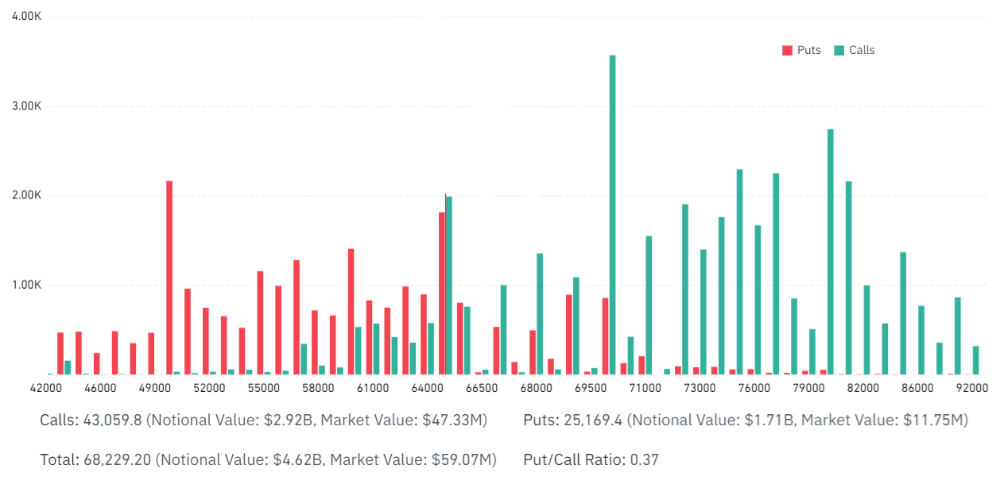

To understand the potential at each BTC expiration price level, it's essential to analyze the open interest in call and put options.

Although call options dominate with a nominal value 70% higher, Deribit’s open interest of $4.62 billion is likely to be significantly lower, as 99% of these options will be considered worthless if BTC trades below $70,000 on May 31. Similarly, put option investors will incur losses if Bitcoin stays around $67,800 on the monthly expiration day since only 5% of the $1.7 billion in contracts are placed at $68,000 or higher.

If Bitcoin remains around $67,800 on May 31, 2024, the aggregate open interest for call options will be $135 million, while for put options at $68,000, it will be $145 million.

Essentially, this level is quite balanced. However, if BTC prices drop to $65,900 at expiration, put options will benefit by $95 million. Conversely, if BTC ends at $70,000 or higher, call options will generate a profit of $270 million.

Due to the substantial profit potential of $270 million for call options, investors are clearly optimistic that BTC will reach $70,000 by May 31, 2024. Otherwise, they will face losses.

Conclusion

The current sentiment among Bitcoin option investors suggests strong optimism for Bitcoin's price, with the majority betting on a significant rally by May 31, 2024. With $6.5 billion in options set to expire and 91% of these placed at or above $70,000, investors anticipate substantial gains if BTC reaches or exceeds this target. The potential profit of $270 million from call options highlights this bullish outlook, contrasting with the balanced but less optimistic stance of put options. Overall, the market reflects confidence in Bitcoin's upward trajectory as the expiration date approaches.

Read too : Argentina Partners with El Salvador to Boost Bitcoin Adoption

*Disclaimer:

This content aims to enrich reader information. Always conduct independent research and use disposable income before investing. All buying, selling, and crypto asset investment activities are the reader's responsibility.

![[LIVE] Engage2Earn: McEwen boost for Rob Mitchell](https://cdn.bulbapp.io/frontend/images/c798d46f-d3b8-4a66-bf48-7e1ef50b4338/1)

![[ℕ𝕖𝕧𝕖𝕣] 𝕊𝕖𝕝𝕝 𝕐𝕠𝕦𝕣 𝔹𝕚𝕥𝕔𝕠𝕚𝕟 - And Now What.... Pray To The God Of Hopium?](https://cdn.bulbapp.io/frontend/images/79e7827b-c644-4853-b048-a9601a8a8da7/1)