arclParcl Testnet 2.0 Is Live

Welcome to Parcl Testnet 2.0!! The first Testnet took place from March 30th until April 10th. Our community left an abundance of feedback, and we read through all of it, and in the time since we have made many of the changes you wanted to see. Our team has grown significantly since then, and we’ve never been in better shape to bring real estate to everyone.

With Testnet 2.0, we invite our community, old and new, to stress-test and provide feedback on the latest version of the Parcl protocol, this time with new features.

Our latest and largest addition to our protocol is adding the ability to provide concentrated liquidity.

If you want to learn the basics of operating our Testnet, click here

What is Concentrated Liquidity?

In simple terms, providing concentrated liquidity refers to the ability of liquidity providers (LPs) to customize the price range in which they provide liquidity.

Essentially, it’s a way to make your money work more efficiently and maximizes any gains while reducing the risk of asset devaluation. The tighter the range you set for the concentrated liquidity, the higher the fee revenue that you’ll earn.

A Guide To Providing Concentrated Liquidity On Parcl

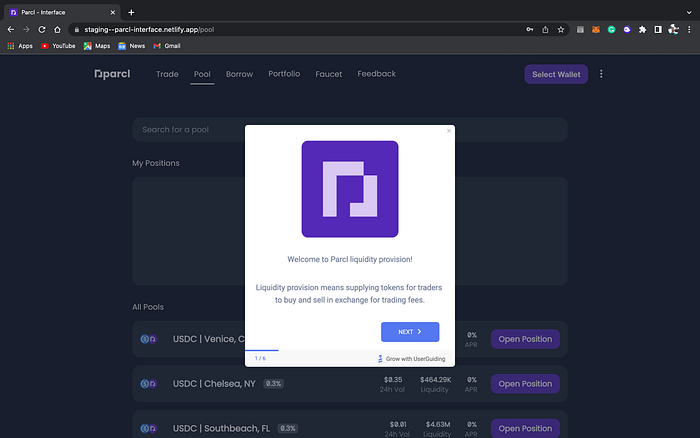

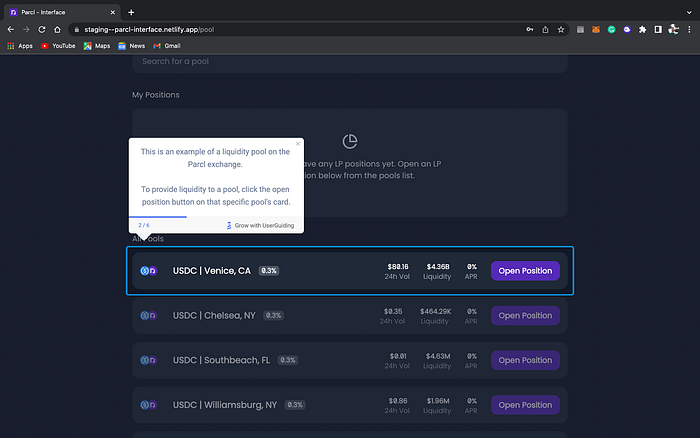

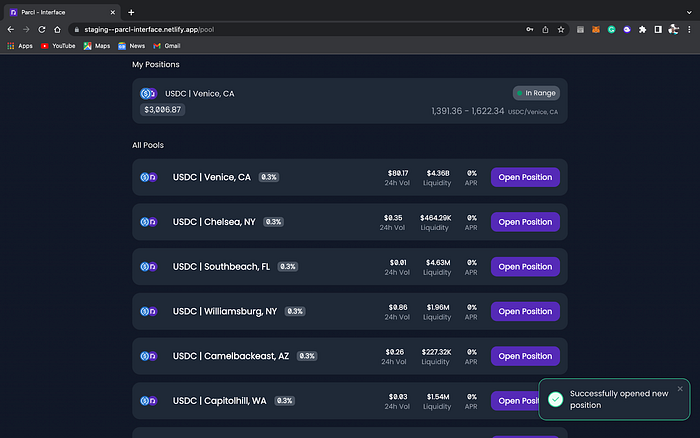

Begin by heading to Parcl.co and selecting which location pool you’d like to provide liquidity to. In this example we’ll use Venice, CA.

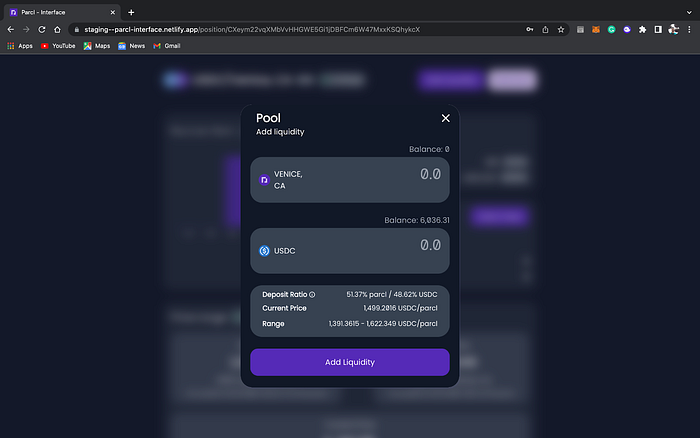

Simply click the button “Open Position” and it’ll take you to the next screen in which you can choose which liquidity strategy you’d like to go with.

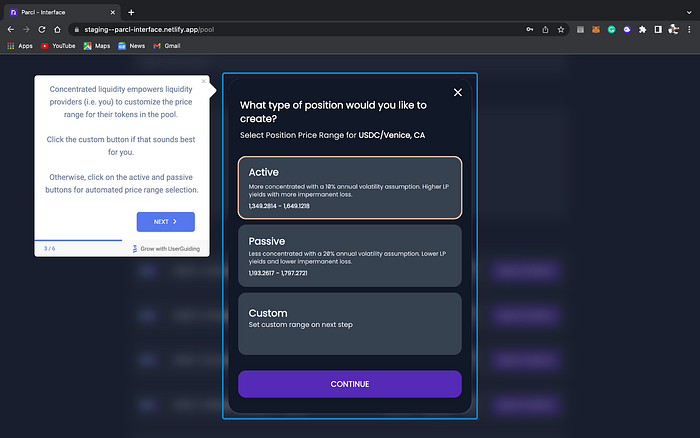

You have three options to choose from, active, passive or custom, which allows you to customize the price ranges in which you are comfortable investing your capital. For this example, we’re going to select custom.

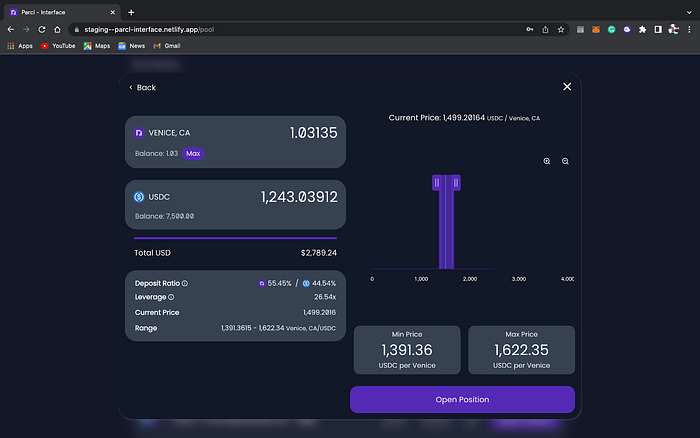

You then simply drag and drop the sliders on the liquidity price graph on the right hand side to your desired areas and click “Open Position”.

Congratulations you have now successfully provided concentrated liquidity!

You can also provide additional liquidity to your already open liquidity positions.

![[ℕ𝕖𝕧𝕖𝕣] 𝕊𝕖𝕝𝕝 𝕐𝕠𝕦𝕣 𝔹𝕚𝕥𝕔𝕠𝕚𝕟 - OM(G) , My Biggest Bag Was A Scam????](https://cdn.bulbapp.io/frontend/images/99de9393-38a8-4e51-a7ab-a2b2c28785bd/1)

![Nekodex – Earn 20K+ NekoCoin ($20) [Highly Suggested]](https://cdn.bulbapp.io/frontend/images/b4f0a940-f27c-4168-8aaf-42f2974a82f0/1)