ICONOMI Review 2024: TradFi Ease Meets Crypto!

The financial world has always been a hotbed of innovation, adapting and evolving to meet the changing needs and opportunities of the times. A pivotal moment in this evolutionary journey occurred in the early 20th century with the birth of the mutual fund. This financial instrument democratized investment, revolutionary in its day, allowing individuals of varying means to participate in diversified portfolios previously accessible only to the wealthy. The concept was simple yet powerful: pooling resources from many investors to buy a diversified collection of stocks or bonds managed by a professional.

This historical leap mirrors a more recent disruption in the world of finance – the advent and rise of cryptocurrency and digital assets. Just as mutual funds once opened the doors of the stock market to the general public, platforms like ICONOMI are striving to do the same for cryptocurrency investments. ICONOMI stands at the forefront of this paradigm shift, a digital asset management platform that echoes the principles of mutual funds while embracing the complexities and opportunities of the digital age.

In this ICONOMI review, we delve deep into the world of ICONOMI, exploring its features and offerings and how it stands as a beacon of innovation in the crypto asset management space. We will trace its origins and examine its platform and the unique tools it offers. Our journey will take us through an assessment of ICONOMI’s security measures, fee structure, and the community, providing a comprehensive analysis for potential investors and users.

As we embark on this exploration, we must consider the volatile nature of the cryptocurrency market and the risks involved. Our objective is to provide an in-depth, balanced view of ICONOMI, equipping readers with the knowledge to understand its place in the digital asset landscape and to make informed decisions about engaging with this platform or similar technologies.

By bridging the gap between traditional investment wisdom and the frontier of digital assets, ICONOMI is not just a platform but a symbol of financial evolution. It is a testament to how far we have come since the days of the first mutual funds and a hint at the potential paths lying ahead.

Iconomi Key Features:

- Powerful yet beginner-friendly platform for managing crypto portfolios

- Offers a range of features such as buy/sell price optimization, recurring buy/sell execution, portfolio rebalancing, algorithmic trading and automation

- Exchange aggregation ensures traders receive competitive prices and ample liquidity

- Trading strategies can be copied and automated

- Support for over 10,000 pairs

- Highly secure with audits from leading accountancy firms and regulated

ICONOMI Summary:

ICONOMI’s platform allows users to invest in cryptocurrencies and manage investment strategies through a structure reminiscent of mutual funds. Crypto strategies offer a means to diversify investments in a notoriously volatile market and simplify the investing experience with its user-friendly interface.

ICONOMI Overview

ICONOMI is a digital asset management platform that offers a variety of services related to cryptocurrency trading and investment. It enables users to invest in cryptocurrencies and manage crypto investment strategies through diversified portfolios similar to traditional investment funds but focused on digital assets.![]()

The platform simplifies investing in cryptocurrencies, making it more accessible to a broader range of investors, including those who may not have the expertise or time to manage individual cryptocurrency investments. ICONOMI provides tools for creating, managing, and marketing Crypto Strategies and allows users to invest in strategies developed by others.

The platform offers four broad products to its registered users:

- Buy/Sell Cryptocurrencies: Investors can trade over 150+ cryptocurrencies, including Bitcoin, Ethereum, Solana, Stablecoins and many more.

- Crypto Strategies: They are collections of crypto assets investors choose under a plan of action to achieve an investment goal. Investors can create new strategies or copy strategies other investors make on the platform.

- Affiliate Program: The ICONOMI affiliate program allows participants to earn monthly rewards by inviting new users to the platform. These users then engage in activities like adding funds or copying Crypto Strategies. Affiliates earn a share of the fees generated from these activities, creating a long-term earning opportunity rather than a one-time reward.

- ICONOMI Business: It tailors the platform experience for banks, family offices, or investment funds.

ICONOMI stands out as a comprehensive digital asset management platform, catering to a diverse range of investors by simplifying cryptocurrency investment and trading. It offers a unique blend of services, including a wide selection of cryptocurrencies for trading, customizable Crypto Strategies for tailored investment approaches, a rewarding affiliate program for long-term earnings, and specialized services for businesses. This blend of accessibility, variety, and innovation positions ICONOMI as a significant player in the evolving digital asset management landscape.

Crypto Strategies

Earlier in this review, we began our discussion by acknowledging the impact of mutual funds on promoting inclusion and accessibility to sound investment strategies in traditional finance.

To judiciously invest in any financial or asset market, one needs three essential qualities – Time, Knowledge, and Resources. Successful investors spend significant time meticulously researching companies, projects, and industries in search of value gaps that they can exploit to extract returns. Considerable knowledge of investing principles is essential in hunting for such opportunities. Knowledge about markets includes both – Technical and Fundamental knowledge. Technical knowledge helps investors gauge the market’s volatility to find optimum entry points, while fundamental knowledge helps them find the ideal assets to invest in.

A good investor deploys a blend of technical and fundamental principles to devise an investing strategy. Finally, and most importantly, one needs time to execute all these practices effectively. After all, investing is a skill that needs to be learned, requiring practice and experimentation to perfect.

Unfortunately, not everybody has the time in their busy lives to learn investing and personal finance skills. Anyone who has had a crack at personal finance understands how quickly it starts to suck up more and more of your time in a day. Before you know it, it is demanding more significant time and attention than your full-time job, business, or family. Time, or lack thereof, was one of the primary drivers of the success of mutual funds. Now, ICONOMI is bringing the same idea to the world of cryptocurrencies.

ICONOMI Crypto Strategies is a feature that simplifies cryptocurrency investing. Like mutual funds, it allows investors to buy a basket of assets and manage it under customizable rules. An ICONOMI user following a particular strategy diversifies their portfolio without investing in the underlying assets individually and instructs the ICONOMI trading engine on which investments to buy or sell according to the strategy template.

Therefore, Crypto Strategies on ICONOMI are similar to mutual funds, enabling instant diversification of investments under predetermined rules. However, unlike mutual funds that accrue resources from the investors to create an investment pool, the users always retain control over the assets their funds have been diversified across and can exit those investments at any time. Users can play one of the following role as a user of ICONOMI Crypto Strategies:

The Strategist

Strategists are akin to fund managers in the traditional finance world. They are investing professionals who formulate Crypto Strategies and can share their strategies with others to follow. They can choose what assets to include in their basket and their weights. Furthermore, they can automate their strategy with time- and price-based rules, like Stop Loss and Take Profit.

Just like mutual fund managers charge a fee for their expertise in generating optimum returns, strategists can charge fees to others who wish to copy their strategy and profit from their investing skills.

The Copiers

Copiers are users who wish to expose themselves to someone else’s Crypto Strategy on the platform. A copier following a particular strategy has its crypto holdings automatically rebalanced according to the strategy. They might also pay interest to the strategist for the right to copy their strategy. Copiers always retain control over their funds and can stop following a strategy whenever they like. There are hundreds of strategies live on ICONOMI today.

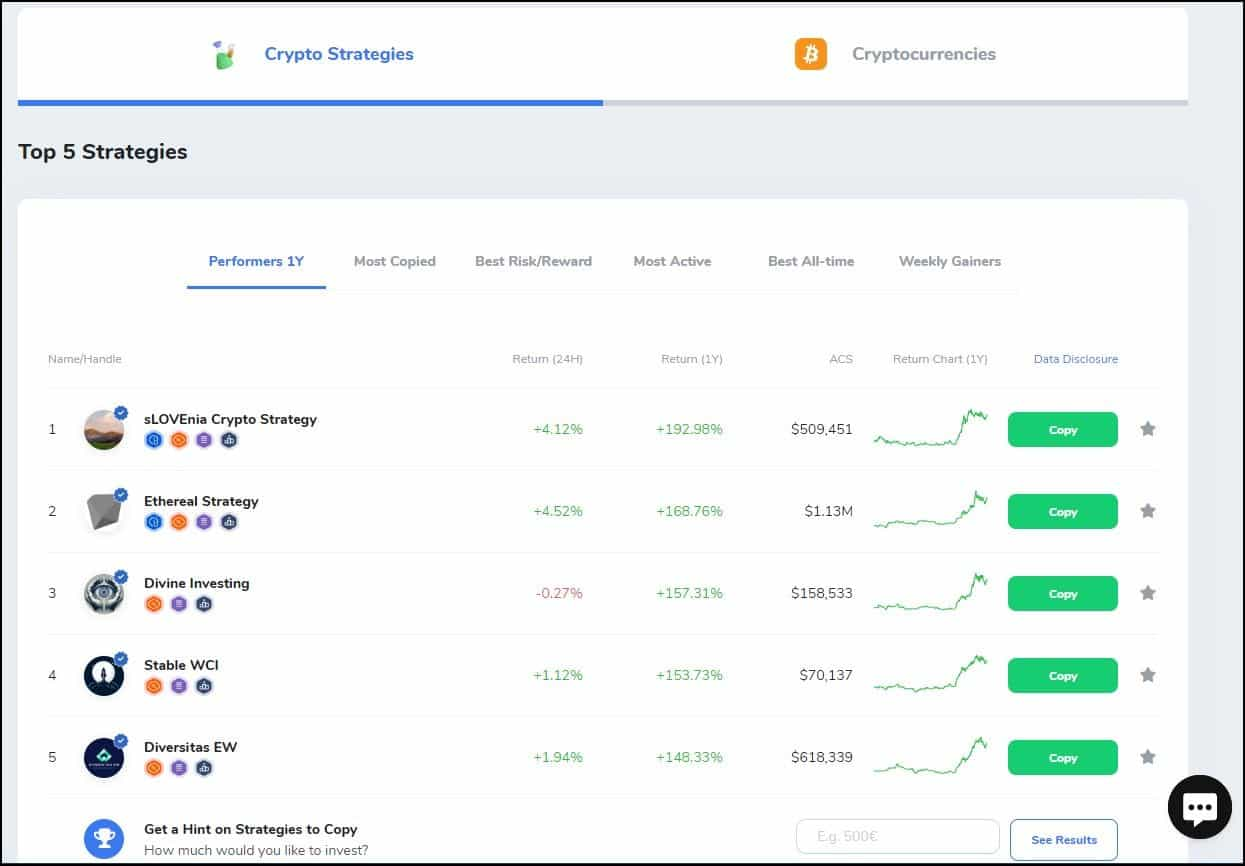

Here are some of the well-known and top performing Crypto Strategies on the platform:

Blockchain Index

Blockchain Index is an actively managed Crypto Strategy that invests in established crypto projects. It weighs the investments by market cap with a fixed weight for BTC and ETH. The strategy invests in 27 cryptocurrencies and updates its balances every 30 days. It charges a copying fee of 3% annually. More than 4,500 users on ICONOMI follow this strategy, allocating over $14 million under its management.![]()

Diversitas

Diversitas is an actively managed crypto strategy that invests in established crypto projects like Bitcoin, Ethereum, Chainlink, and THORChain. The strategy focuses on projects in the crypto sector with high growth potential. Diversitas has about $10 million under management spread across 2561 copiers. It follows an aggressive investment outlook focusing on growth, significantly outperforming Bitcoin last year.![]()

Future Chain Index

Future Chain Index is an actively managed strategy. This strategy invests in blockchain protocols with the most growth potential. The idea behind the strategy is simple: invest early in ecosystem projects that might blow up down the line. The funds under this strategy are spread relatively equally across two projects – Aptos and Sui. About 500 users on ICONOMI copy this strategy, allocating over $100,000 to it.![]()

Crush Crypto Core

It is an actively managed Crypto Strategy that seeks to outperform an investment basket comprising equal parts Bitcoin and Ethereum. The strategy invests in undervalued cryptocurrencies and maintains a flexible asset allocation strategy to ensure it beats the price action of BTC and ETH. The strategy invests most of its assets in Lido DAO at the time of writing and is followed by 1144 copiers, allocating $2.89 million to the strategy. Crush Crypto Core charges a hefty 15% performance fee, which is only levied if the strategy makes a profit.![]()

Ethereal Strategy

The focus of the Ethereal strategy is simple: invest in projects that operate in the Decentralized Finance space. With only 328 followers and $1.14 million in AUM, the Strategy is small but has significantly outperformed Bitcoin last year. The cherry on top is that the strategy does not charge any performance fee but an annual 1.3% copying fee, which is understandable because finding winners in the DeFi space takes considerable research and due diligence. At the time of writing, the strategy only invests in BTC and SOL.![]()

Trading Cryptocurrencies

ICONOMI users can invest in several leading cryptocurrencies on its trading interface. The platform lists over 160 cryptocurrencies and 10,000 pairs and offers various purchasing options, from fiat to crypto. ![]()

ICONOMI Trading Features

Here are some key characteristics of the investing experience on ICONOMI:

- Asset Pricing: ICONOMI pulls pricing data from multiple centralized crypto exchanges to calculate the average price of every asset. This approach ensures that the platform's pricing is accurate and on par with real-time values on other platforms.

- Trading Experience: The platform is designed to cater to value investing, focusing on longer holding times. The trading experience emphasizes ease of investing over offering advanced trading features. Therefore, users on ICONOMI lack access to shorting, advanced trading charts, order books, or other trading-centric features.

- Simple UI: The platform’s UI design seems to target investors from traditional finance who want to obtain exposure to cryptocurrencies without traversing the learning curve of handling blockchain-based assets. Investors can buy crypto assets with fiat and hold cryptocurrencies directly in their accounts without managing keys. Users who do wish to go on-chain have the option to withdraw their holdings to their custodial wallet of choice.

- Advanced Trading Tools: ICONOMI offers some advanced trading tools called Smart Rules to automate buying/selling individual cryptocurrencies or Crypto Strategies on the platform. The tools are as follows:

- Recurring Buy

- Recurring Copy

- Take Profit

- Stop Loss

- Social Feed: Do you ever feel uncertain about your investing strategy and seek second opinions from others who are also investing in the same asset? If yes, you will find the ‘Posts’ page on ICONOMI incredibly useful. ICONOMI Posts is an interactive social feed where you can share your thoughts and trading strategies with others. The feed is lush, with users sharing trading insights, breaking news, technical analysis, and informative content that will surely aid your investing journey.

![]()

ICONOMI Fees, Deposits and Withdrawals

On ICONOMI, users can either trade cryptocurrencies or invest in crypto strategies. Different fee models are applicable to the various services available on the platform. Here’s a breakdown of the fee structure:

- Trading Fee: A trading fee of 0.5% or a minimum of 0.5EUR is applicable on each trade. If a trade involves multiple steps to execute, the fee applies to each step.

- Rebalancing Fee: Whenever a strategist alters the portfolio's structure, all the copier portfolios are automatically rebalanced and charged a fee for changing the structure. A fee of 0.37% is charged to the copiers in case of rebalancing.

- The platform does not charge any fee on crypto deposits or fiat deposits via bank transfers.

- Fiat deposits via bank cards come with a 3% transaction fee.

- Fiat Withdrawals: The platform only supports bank withdrawals and charges a fee of 0.5-1.5 EUR.

- Crypto Withdrawals:

- Bitcoin (BTC): 0.0005 BTC (minimum withdraw amount 0.002 BTC)

- Ether (ETH): 0.005 ETH (minimum withdraw amount 0.04 ETH)

- USD Coin (USDC): 10 USDC (minimum withdraw amount 40 USDC)

- Tether (USDT): 10 USDT (minimum withdraw amount 40 USDT)

ICONOMI Security and Privacy Measures

ICONOMI has implemented a range of security measures to ensure the safety of users’ funds in cryptocurrency and fiat. Here is an analysis of ICONOMI’s security framework:

ICONOMI Crypto Security Features

- Omnibus Accounts: All platform assets are secured across several omnibus accounts scattered across multiple well-known exchanges. Moreover, the assets are further spread across multiple wallets on each exchange to ensure further asset diversification.

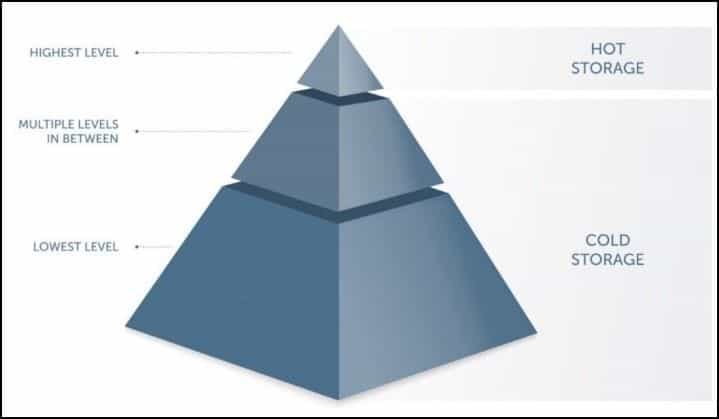

- Multi-layer, Multisignature Wallets: On-chain security comes at the cost of time and resources. The ICONOMI storage wallets adopt a layered design that optimizes for security and performance.

- Wallet Layers: The top layer is a hot wallet managing just the right amount of capital to maintain smooth operation. The lower levels are multisignature cold wallets that hold an increasing amount of funds, and a higher number of signers participate in its signature. The design allows a flexible flow of funds at an optimum cost.

- Ownership and Control: Although ICONOMI claims that users retain control and ownership of their assets at all times, it's important to note that absolute ownership in the cryptocurrency sense typically means holding one's private keys, which is not the case here. However, ICONOMI's documentation affirms the platform's solvency.

ICONOMI Fiat Security Features

- Bank Accounts for Fiat Operations: ICONOMI uses at least two bank accounts, each with a different bank, to manage deposits and withdrawals and maintain reserve liquidity for fiat currency trading pairs.

- Asset Distribution Across Exchanges: A portion of ICONOMI's fiat assets is held on various exchanges that offer fiat trading pairs, facilitating trading activities involving fiat currencies.

NOTE: Reverse liquidity occurs when assets normally easily converted into cash become difficult to sell at their true value. This often happens during financial crises or market instability, where the usual demand for these assets drops sharply, leading to a decrease in their liquidity. It's a significant risk in investment, as it challenges the usual assumption that certain assets can be quickly and efficiently liquidated.

Audits and Compliance

- Deloitte Audit: ICONOMI has undergone an audit by Deloitte, one of the Big Four accounting firms, adding credibility and trustworthiness to its operations. You can also refer to ICONOMI’s Proof of Solvency.

- FCA Registration: The platform has successfully completed registration with the Financial Conduct Authority (FCA), indicating compliance with necessary regulatory standards.

- Asset Listing Standards: ICONOMI maintains high standards for listing and delisting assets, which is crucial for ensuring the quality and reliability of investment options.

Privacy Measures

- Know Your Customer Requirements: As a centralized and regulated digital asset management platform, ICONOMI must comply with the KYC/AML requirements of its operating countries. Users must disclose their identity to trade and provide proof of residence to enable withdrawals on the platform.

- 2-Factor Authentication Options: ICONOMI supports two-factor authentication to add an extra layer of security while users access their accounts. Plenty of 2FA options are available while logging in, including Google Authenticator, Authy, LastPass, and others.

- Partnership with Elliptic for AML: ICONOMI has partnered with Elliptic, specialists in anti-money laundering (AML) and compliance, to enhance its real-time crypto wallet screening capabilities. This partnership helps identify and prevent financial crimes, thereby protecting both ICONOMI and its users from illegal activities.

Security Analysis

ICONOMI’s approach to security appears robust, incorporating a mix of technological measures and compliance with regulatory standards. Diversified storage for digital assets and multi-layered wallet security show a commitment to protecting user assets from various risks, including hacking and internal fraud.

The audits conducted by Deloitte and the registration with the FCA lend additional credibility, demonstrating ICONOMI’s dedication to transparency and regulatory compliance. The audits are especially important in cryptocurrency's relatively new and often volatile field.

Moreover, ICONOMI's partnership with Elliptic underscores its proactive stance on AML and financial crime prevention. This is crucial in an industry that is frequently scrutinized for its potential misuse in illegal activities.

Security Analysis Conclusion:

In summary, ICONOMI has established a comprehensive security framework that aligns with industry best practices and regulatory requirements. While no system can be entirely risk-free, especially in the dynamic field of cryptocurrency, ICONOMI’s efforts in security and compliance suggest a strong commitment to protecting its users' investments. ICONOMI also deserves a nod for their approach to transparency, clearly identifying their security approach and framework. However, users should always exercise due diligence and consider the inherent risks associated with digital asset investments.

For further details and updates, it's recommended to regularly check ICONOMI’s official communications and trusted financial news sources.

ICONOMI: Navigating the Platform

The ICONOMI user interface is reminiscent of centralized cryptocurrency exchanges, which ensures navigating the platform is simple and intuitive for new traders. The registration involves typical steps of creating an account with an email address and setting up a password.

Trading services are locked by default and are only accessible to users who have complied with KYC requirements. My experience completing the KYC process was swift and straightforward. It only took a couple of minutes to complete. I recommend using your phone for KYC because it typically has a higher success rate. Once registered, let me walk you through two major operations you will perform on the platform:

Buying Cryptocurrencies

ICONOMI is available on the web, as well as iOS or Android. The broad steps to buying cryptocurrencies on ICONOMI are as follows:

- Go to Invest.

- Select the Cryptocurrencies tab.

- Select the asset you wish to buy.

- Click/tap Buy.

- Select euro or British pound under Fiat currencies, or the cryptocurrency you want to use to make the payment.

- Enter the amount to spend or the amount to receive.

- Follow the on-screen instructions.

Copying a Crypto Strategy

The steps involved in copying a strategy are similar to buying cryptocurrencies:

- Go to Invest.

- Choose Crypto Strategies.

- Select the Crypto Strategy you want to copy.

- Copy/Add funds.

- Select the euro or British pound under Fiat currencies, or the cryptocurrency you want to use.

- Enter the amount you wish to spend.

- Follow the on-screen instructions.

Remember that when copying a strategy, you allow the Strategist to manage your funds, but you always retain control over them. You can choose to exit any strategy or impose additional Smart Rules like Stop Los or Take Profit on specific strategies to fit your investing preferences.

Risks and Demerits Associated With ICONOMI

Like any other centralized cryptocurrency trading and investment services provider, ICONOMI has its fair share of risks worth exploring for anyone registering with the platform. Maintaining a subjective view of these risks is essential, as some aspects might be a deal breaker for one and ideal for another.

- Ownership Risk: User funds are stored in Omnibus accounts, meaning no individual addresses store user funds. While ICONOMI does claim they are solvent, custodial storage will always be more vulnerable than self-custodial storage options. Users are advised to move access or unused funds to self-custodial wallets for optimum security and asset control.

- Privacy Risk: ICONOMI, or any other regulated digital assets platform, records KYC information and is not ideal for individuals prioritizing privacy.

- Uninventive Strategies: While Crypto Strategies on ICONOMI do significantly ease diversification, the ones I reviewed lacked originality and were easily replicable. Thankfully, the platform hosts numerous strategies that must include some hidden gems. Users are advised to conduct thorough research while searching for strategies to copy to cut back on having to pay interest where it is not worth it.

- Risks of Copying Strategies: The Strategist retains complete control over their strategy's rules and parameters and may update it to their liking. If left unattended, a strategy may deviate considerably from its initial path and no longer fulfil a copier’s preferences. Therefore, copiers are advised to frequently monitor the terms of the strategies they follow and exit if they notice a deviation.

- Platform risk: Centralized and custodial platforms always run a risk of insolvency, hacks and exploits. Impressively, ICONIMI is audited by one of the Big Four auditing firms, which is a highly respectable security standard. However, self-accountability and ownership are typically the safer long-term asset ownership alternatives.

- Slippage and Market Risk: Cryptocurrency markets are subject to extreme volatility and liquidity swings. ICONOMI sources liquidity from multiple centralized exchanges, which lowers liquidity risks, but instances of industry-wide stress during times of extreme volatility are not an uncommon occurrence in the cryptosphere.

Investors looking to explore ICONOMI as their crypto investment vehicle must be aware of these risks. However, I must review these risks in another light and emphasize their subjectivity. For instance, an investor may prefer regulated platforms and all the legislative guarantees that they offer, or someone uninitiated in the principles of custodial management of crypto might find comfort in having someone else do it for them.

I conducted this risk analysis with the notion that crypto investing should gravitate toward self-custody and services available on-chain, and users should access regulated services as an intermediary stepping stone towards migrating on-chain. However, for investors who have no interest in the ethos of cryptocurrency simply looking to gain asset exposure, ICONOMI offers a highly attractive platform. In summation, every user must evaluate these risks in a personal light and asses if they are worth the trade-off.

ICONOMI Review: Conclusion

Let’s explore ICONOMI with a backdrop of the idea of Web 2.5. Web 2.5 is seen as a transitional phase between the current internet (Web 2.0) and the future decentralized internet (Web 3.0). ICONOMI combines elements of both, maintaining the user-friendly features of Web 2.0 while integrating emerging blockchain technologies characteristic of Web 3.0.

ICONOMI, with its focus on digital asset management and allowing users to create and invest in Crypto Strategies, aligns with this Web 2.5 concept. It retains the user-centric approach of Web 2.0 platforms, offering an accessible interface and services while incorporating blockchain technology, which is a key component of Web 3.0.

This integration positions ICONOMI in a unique space where traditional web services merge with the decentralized and transparent aspects brought by blockchain technology, and it serves this space well. It provides a very user-friendly and familiar investing environment, making the volatility and spontaneous dynamic of cryptocurrency investing more palatable for novice investors. It upholds regulatory, liquidity and security standards and has been operating for a considerable time. ICONOMI also successfully creates a thriving community by providing a platform for new investors to interact with seasoned ICONOMI users.

Overall, ICONOMI is a sound crypto asset management platform that not only eases passive investing & diversification but also encourages learning and experimentation, motivating users to earn new skills and get better at investing.

![[LIVE] Engage2Earn: auspol follower rush](https://cdn.bulbapp.io/frontend/images/c1a761de-5ce9-4e9b-b5b3-dc009e60bfa8/1)