What Is Altcoin Season?

Introduction

In the field of cryptocurrencies, the phrase "altcoin season" is frequently used to characterize a window of time during which altcoin prices frequently beat those of Bitcoin. Navigating this turbulent market and comprehending some of the potential contributing elements to the altcoin season might be difficult. We explore the nuances of an altcoin season in this essay.

Key Takeaways:

- When altcoins beat Bitcoin during a market cycle, it's referred to as "altcoin season."

- Altcoin season may be influenced by a number of variables, including as a general uptrend in the cryptocurrency market, the introduction of new altcoins or significant changes to existing ones, and a decline in the dominance of Bitcoin.

- Many traders view altcoin season as a chance to increase the diversification and potential return on their cryptocurrency holdings.

What Is an Altcoin?

The abbreviation "altcoin" stands for "alternative coin." Any cryptocurrency that is not Bitcoin is referred to by it. Since the invention of Bitcoin, thousands other altcoins have been created, many of which have special features or are intended for use in particular scenarios. Ethereum (ETH), Litecoin (LTE), Dogecoin (DOGE), and Cronos (CRO) are a few instances of altcoins.

Altcoins, which are substitutes for Bitcoin, might serve as more than just electronic payment methods; they might also have unique characteristics or advantages. These can include enabling smart contracts, enhancing privacy, lowering fees, and expediting transaction times.

What Is Altcoin Season?

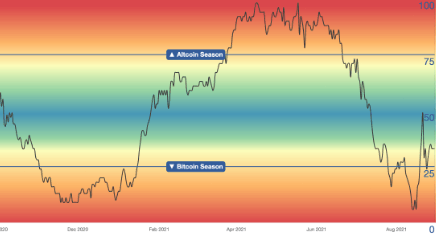

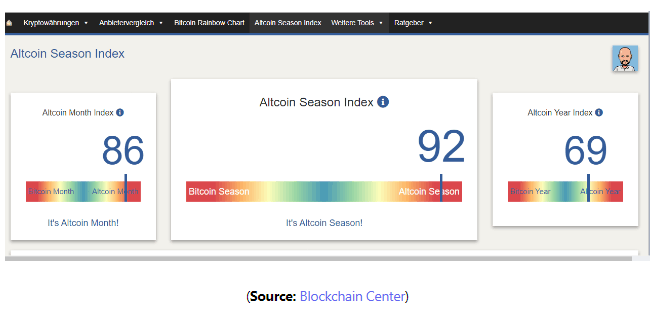

The term "altcoin season" describes a window of opportunity when altcoin values sharply increase and surpass those of Bitcoin (BTC).

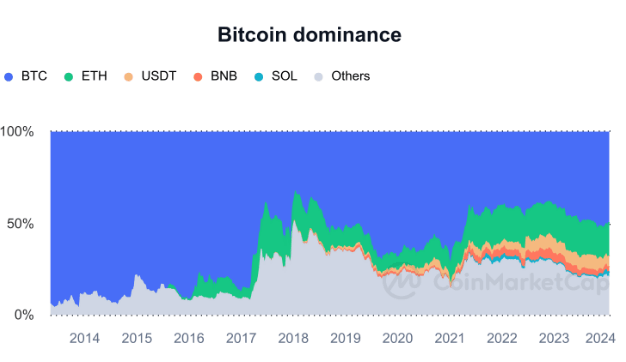

The majority of trading volume in the cryptocurrency market is driven by Bitcoin, which is the largest cryptocurrency by market capitalization. One important statistic in market analysis is the Bitcoin to non-Bitcoin (altcoin) ratio. The term "Bitcoin dominance" is quite fitting.

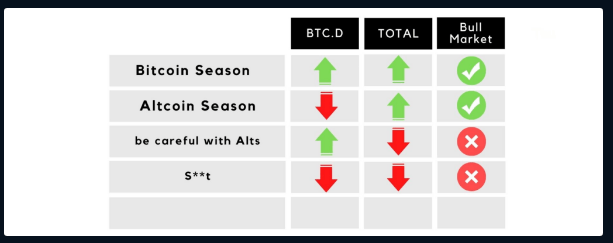

Bitcoin dominated the market in the early days of cryptocurrencies, but as altcoins gained traction, that dominance began to wane. These days, an altcoin season can occasionally be predicted by the total amount of altcoins growing to surpass the market capitalization of Bitcoin.

Traders frequently use this phase, when altcoins tend to outperform Bitcoin, as an opportunity to diversify their cryptocurrency portfolios in favor of altcoins.

Furthermore, a broad bullish feeling in the cryptocurrency market, which may be attributed to a number of variables, is generally associated with altcoin season.

What Causes Altcoin Season?

Decreasing Interest in Bitcoin

As previously said, traders may choose to diversify their holdings by investing in other cryptocurrencies, which would move the market cap to BTC alternatives, which would lead to an end to Bitcoin's dominance and the emergence of altcoin season.

In the past, the price of bitcoin has tended to stabilize after a notable uptrend and stay high for extended periods of time. This may lead investors looking for quick profits to consider selling their bitcoin and switching to other cryptocurrencies. However, new cryptocurrency buyers may find the high price of Bitcoin prohibitive and opt to purchase altcoins instead, which would lead to a general shift in the market capitalization toward non-BTC currencies.

New Crypto Trends Like DeFi, NFTs, and Web3

Furthermore, the introduction of new altcoins or modifications to already-existing ones might pique interest and increase demand. This is particularly true if the altcoins offer distinctive features or handle issues that other cryptocurrencies haven't yet tackled, and if they are introduced as a part of a wider trend.

The emergence of decentralized finance, or DeFi, in 2020 was a contributing factor to the altcoin boom. Another one was sparked in 2021 by the non-fungible tokens' (NFTs) explosive rise in popularity. Early in 2022, Web3 also sparked a new wave of adoption for cryptocurrency tokens.

Positive Outlook for the Overall Economy

A strong economy, bullish stock market, and overall positive sentiment in the crypto market can all also influence the popularity of altcoins. The increasing appetite for risk and higher returns during bull markets often gives even small market cap altcoins an upwind, boosting the overall market cap of altcoins.

How to Know When Altcoin Season Is Starting

With the three factors discussed above in mind, a trader can look for the following signals, amongst others, that may indicate an altcoin season might be around the corner:

Bitcoin is enjoying a lasting bull run.

A lasting Bitcoin bull run can make new buyers favour altcoins, which are more affordable than BTC.

Market caps of the top altcoins are on the rise.

Keep an eye on the top 20 altcoins. If there is an upwards trend of, for example, ETH, SOL, or ADA, a wider altcoin season might be about to kick off.

New Web3 and blockchain trends are popping up.

If new trends in the space are dominating the media and social media, like discussions on Discord and Twitter, this may soon bring new altcoin launches that will elevate the market cap.

Final Words on Altcoin Season

Altcoin season can be a time in which many crypto holders diversify their portfolios. Keep up with the latest news and developments in the cryptocurrency market, as well as the wider economy. However, while altcoin season may be an exciting time to trade, remember that it’s just one part of the long-term cryptocurrency market cycle.

![[ℕ𝕖𝕧𝕖𝕣] 𝕊𝕖𝕝𝕝 𝕐𝕠𝕦𝕣 𝔹𝕚𝕥𝕔𝕠𝕚𝕟 - And Now What.... Pray To The God Of Hopium?](https://cdn.bulbapp.io/frontend/images/79e7827b-c644-4853-b048-a9601a8a8da7/1)

![[LIVE] Engage2Earn: McEwen boost for Rob Mitchell](https://cdn.bulbapp.io/frontend/images/c798d46f-d3b8-4a66-bf48-7e1ef50b4338/1)