SOL struggles to meet investor expectations; O2T’s token gains interest

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

As Solana (SOL) posts modest gains, the crypto market’s dynamic shifts toward Option2Trade (O2T), an emerging contender that has soared by 400%, attracting investors in search of unique technology and rapid returns.

In the ever-competitive realm of cryptocurrency, the performance of established platforms like Solana (SOL) is continually under the microscope. Despite Solana’s impressive architecture and its recent 8.29% gains, investor expectations are soaring higher than ever, often leaving them seeking more substantial growth opportunities.

Amid this landscape, a new cryptocurrency, Option2Trade (O2T), has surged into the spotlight, rallying 400% and capturing peak public interest.

You might also like:

SOL and new digital AI exchange token O2T shine in March

Solana shows mixed bag of performance

Solana has been celebrated for its high-speed blockchain, capable of processing thousands of transactions per second, a feature that positions it as a strong competitor to Ethereum. Yet, its recent gains of 8.29%, while commendable, have fallen short of the explosive growth many investors crave in the fast-paced crypto market.

This has led to a sense of underwhelm among certain segments of the investment community, prompting them to explore other avenues with higher risk-reward profiles.

Option2Trade emerges as a promising contender

Option2Trade has quickly risen through the ranks to become a standout in the crypto community, offering something fresh and technologically advanced. It stands at the intersection of artificial intelligence and blockchain, providing a platform that not only simplifies trading but also offers predictive market insights, which have been pivotal in its remarkable 400% rally.

The appeal of Option2Trade

- Technological edge: Option2Trade leverages AI to offer enhanced trading experiences, a stark contrast to Solana’s focus on transaction speed and scalability. This technological edge has piqued the interest of tech-savvy investors looking for the next big thing in crypto.

- Rapid growth: The 400% rally of Option2Trade has showcased its potential for rapid growth, drawing in investors who are looking to maximize returns in short periods. This growth trajectory starkly contrasts with Solana’s more moderate gains, making O2T a more attractive option for those seeking quick wins.

- Unique platform: Beyond its impressive rally, Option2Trade is building a reputation for its platform that combines AI with cryptocurrency trading. This has not only bolstered its appeal among investors but has also set a new benchmark.

- Market positioning: Option2Trade has successfully positioned itself as a cryptocurrency that addresses the demand for smarter, more efficient trading tools. This positioning has helped it capture the imagination of the public and investors alike, differentiating it from Solana and other established currencies.

- Community engagement: The rapid ascent of Option2Trade has been supported by a growing community of engaged investors and enthusiasts. This community-driven approach has amplified its growth and visibility, something that Solana also values.

You might also like:

Traders foresee rise of O2T against meme giants DOGE and SHIB

Conclusion

The contrast between Solana’s recent gains and the explosive growth of Option2Trade encapsulates the shifting dynamics of the cryptocurrency market. While Solana remains a formidable player with a solid technological foundation, the meteoric rise of Option2Trade reflects the market’s appetite for innovation, rapid growth, and platforms that blend cutting-edge technology with cryptocurrency.

For more information on the Option2Trade presale, visit the website, Telegram or Twitter.

Read more:

From BONK to O2T: 2.6 million raised as Option2Trade sees 400% gains

Disclosure: This content is provided by a third party. crypto.news does not endorse any product mentioned

Solana SHORT traders face $143 million losses if this happens

Solana (SOL) price has failed to break above the $200 level this week despite brimming capital inflows from the meme coin rave, can the recent spikes in DeFi activity intensify the bullish momentum?

Intense profit-taking among Solana traders has left SOL price nestled below the $200 territory in the past week. But with rising DeFi volumes, speculative traders are now piling on bullish bets in anticipation of another major breakout.

Solana DeFi TVL nears $5 billion first time since February 2022

Solana is trading at $190 at the time of writing on March 28, on course to end the month with gains in excess of 60%. Much of the Solana March rally has been attributed to the parabolic surge in interest surrounding native memes like Dogwifhat (WIF) and BONK and newly-launched SLERF and Book of Meme (BOME).

However, in the past week, the Solana boon has spread towards the defi sector. After flipping Ethereum (ETH) in terms of Dex trading volumes, Solana is now jet set on leapfrogging BNB chain on the global Total Value Locked (TVL) rankings.

DeFillama chart below provides real-time TVL data on the total assets deposited on a blockchain network. Solana (SOL) defi TVL, March 28, 2024 | Source: DeFillama

Solana (SOL) defi TVL, March 28, 2024 | Source: DeFillama

As seen above, despite the recent price pull back, Solana defi TVL continues to rise. While SOL price action has been subdued with the $180 – $190 range since March 23, SOL defi ecoystem has received over 600 million worth of capital inflows during that period.

At the time of writing, the SOL TVL has now reached the $4.6 billion mark for the first time since February 2022.

When the TVL in decentralized finance protocols increases during a price consolidation phase, it may indicate several bullish underlying dynamics.

Firstly, it reflects growing confidence in the stability and reliability of Solana’s DeFi protocols. More importantly, it shows that investors are turning to defi platforms to earn yield or interest on their holdings during the ongoing price consolidation phase, rather than exit or book early profits.

This reduction is selling pressure puts SOL in prime position for an accelerated price breakout during the next surge in market demand.

Speculative traders betting big on next Solana price breakout

Speculative traders have started making strategic moves to front run the next Solana price rally. According to recent data trends observed in the derivatives markets SOL bulls are paying increased fees to keep their long positions open.

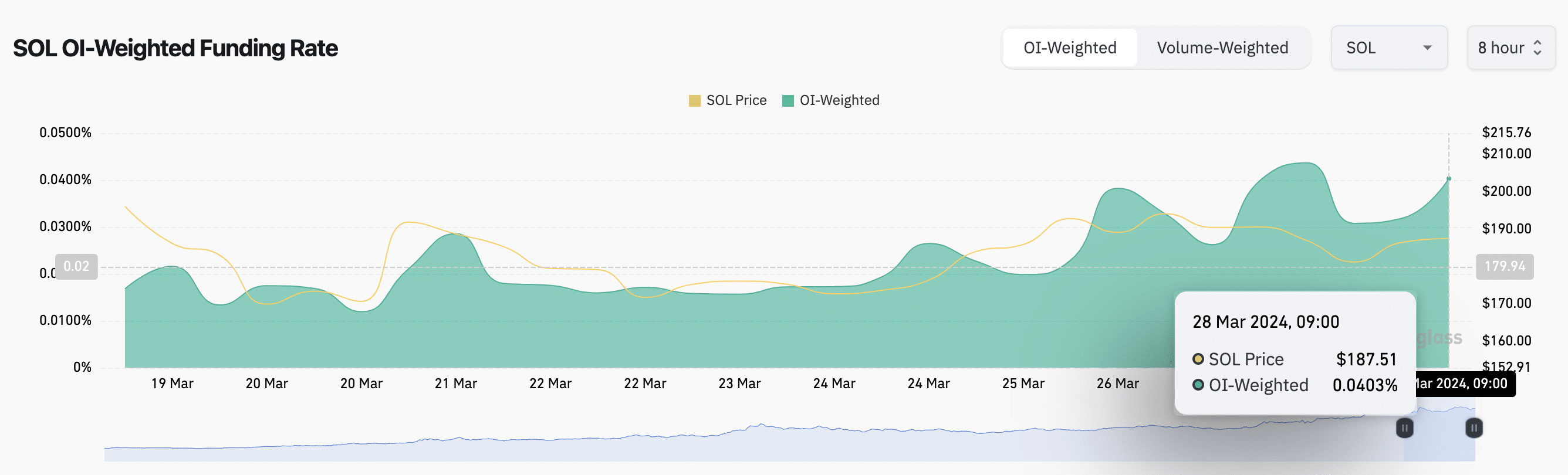

Coinglass’ funding rate metric tracks the aggregate fees paid by long traders to shorts, or vice versa, in perpetual futures markets. This metric serves as a real-time indicator of the dominant market sentiment. Solana (SOL) funding rate vs price | Source: Coinglass

Solana (SOL) funding rate vs price | Source: Coinglass

Between March 20 and March 28, SOL’s aggregate funding rate has surged from 0.01% to $0.04%, based on the most recent data sourced from Coinglass.

This uptick in positive values of the funding rate indicates that not only are long contracts outnumbering short contracts, but leveraged long position holders are also increasingly willing to pay higher fees in anticipation of continued bullish momentum in the SOL spot price market.

SOL Price Forecast: Bears to book $140M losses if $209 resistance caves

Drawing insights from the $600 million growing in defi tvl and 400% jump in funding rate over the past week, Solana price looks set for a breakout towards $210 in the weeks ahead.

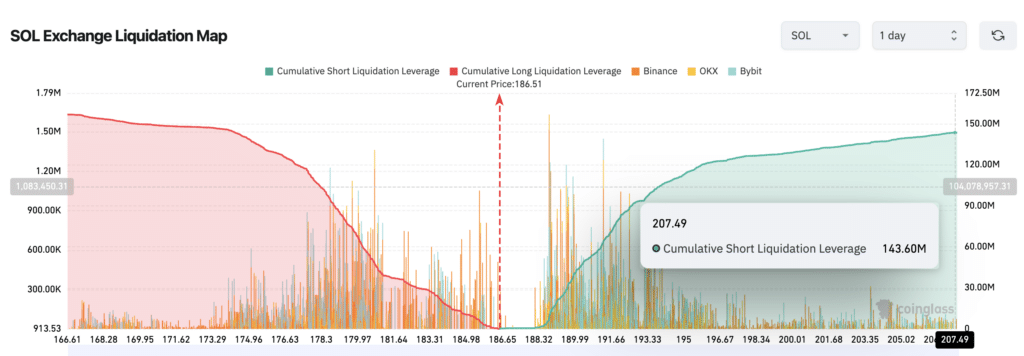

However, another vital derivatives market data shows that the bears have mount a major resistance to prevent prices surging to new 2024 peaks above $209.

Based on the active leverage positions data outlined above, SOL short traders face a potential liquidation losses of over $143 million if prices cross the $207.5 mark. To mitigate such large losses, the short traders could trigger early stop-loss orders to liquidate some of their positions as prices approach that $207 range. Solana (SOL) price forecast | Liquidation map, March 28, 2024 | Source: Coinglass

Solana (SOL) price forecast | Liquidation map, March 28, 2024 | Source: Coinglass

Considering the high volume positions listed around at that range, the large scale sell-offs could put significant downward pressure on SOL price action in the near-term.

But if the growing defi traction persists, the bulls could garners sufficient momentum to scale that sell-wall and drive prices to new yearly peaks above $210.

On the flip side however, if the sell-offs trigger an outsized downward market reaction, SOL price stands the risk of tumbling toward the $165 area.

Read more:

Solana’s Jupiter DEX launches native DAO, secures $137m in initial capital

Follow Us on Google News

Solana Emerges As Ethereum Successor: Celestia COO

Celestia COO Nick White believes that Solana is the "next" Ethereum owing to the network's scalability and performance.

STORY HIGHLIGHTS

- The debate about Solana and Ethereum's rivalry has taken a new turn with Celestia COO's comment.

- Celestia COO Nick White expressed that Solana is capable of replacing Ethereum.

- He highlighted the network's growing scalability and impeccable performance.

In a recent statement, Celestia’s Chief Operating Officer (COO), Nick White, made waves in the blockchain community by boldly declaring Solana (SOL) as the heir to Ethereum’s (ETH) throne. White’s declaration comes amid Solana’s remarkable performance in the realm of blockchain scalability and adoption.

Celestia COO Lauds Solana’s Potential

Drawing parallels between Solana and Ethereum, White emphasized the striking similarity in the filling of blocks on both networks. He stated, “Solana’s blocks are filling up like Ethereum’s.” This underscores the significance of Solana’s rapid adoption and burgeoning transaction volumes.

White’s confidence in Solana’s potential as the next Ethereum is further boosted by insights from a Solana blog post. Posting a screenshot from the blog, he highlighted the network’s impressive compute capacity. The Celestia COO spotlighted that recently the blocks reached a total compute cap of 48 million CU during periods of congestion.

Moreover, the blog outlined strategies for optimizing program efficiency to accommodate increased transaction throughput, showcasing Solana’s commitment to scalability and user accessibility. Hence, White’s admiration for Solana’s achievements shone throughout his statement as he urged observers to “admire and respect” the network’s monumental strides in blockchain technology.

Also Read: Issuance.Swiss Unveils Ethereum, Solana, and Cardano ETPs with Staking

SOL Co-founder Provides Insight

Earlier, last week, the co-founder of Solana Labs adopted a friendly approach toward Ethereum volumes following SOL DEX’s achievement of reaching a $50 billion trading milestone. Data released on Saturday revealed that Solana DEX volumes rivaled those of Ethereum DEX. Moreover, it indicated a surge in trading activity driven by notable expansion of Solana’s market cap.

The volume of transactions on the Solana blockchain DEX reached an all-time high at the time. Furthermore, this uptick aligned with the recent trend of significant growth in the cryptocurrency market over a short period. In addition, the surge followed the previous week’s data, which indicated that Solana’s weekly DEX volume exceeded $13.3 billion.

At the time, the trading volume stood at $50 billion, according to DeFiLlama dara. This underscored the increasing importance of blockchain technology in the decentralized finance (DeFi) sector.

Also Read: 2 Top Reasons Why Ethereum Price Poised For $500 Dump To $3k This Week

Solana Emerges As Ethereum Successor: Celestia COO

Celestia COO Nick White believes that Solana is the "next" Ethereum owing to the network's scalability and performance.

STORY HIGHLIGHTS

- The debate about Solana and Ethereum's rivalry has taken a new turn with Celestia COO's comment.

- Celestia COO Nick White expressed that Solana is capable of replacing Ethereum.

- He highlighted the network's growing scalability and impeccable performance.

In a recent statement, Celestia’s Chief Operating Officer (COO), Nick White, made waves in the blockchain community by boldly declaring Solana (SOL) as the heir to Ethereum’s (ETH) throne. White’s declaration comes amid Solana’s remarkable performance in the realm of blockchain scalability and adoption.

Celestia COO Lauds Solana’s Potential

Drawing parallels between Solana and Ethereum, White emphasized the striking similarity in the filling of blocks on both networks. He stated, “Solana’s blocks are filling up like Ethereum’s.” This underscores the significance of Solana’s rapid adoption and burgeoning transaction volumes.

White’s confidence in Solana’s potential as the next Ethereum is further boosted by insights from a Solana blog post. Posting a screenshot from the blog, he highlighted the network’s impressive compute capacity. The Celestia COO spotlighted that recently the blocks reached a total compute cap of 48 million CU during periods of congestion.

Moreover, the blog outlined strategies for optimizing program efficiency to accommodate increased transaction throughput, showcasing Solana’s commitment to scalability and user accessibility. Hence, White’s admiration for Solana’s achievements shone throughout his statement as he urged observers to “admire and respect” the network’s monumental strides in blockchain technology.

Also Read: Issuance.Swiss Unveils Ethereum, Solana, and Cardano ETPs with Staking

SOL Co-founder Provides Insight

Earlier, last week, the co-founder of Solana Labs adopted a friendly approach toward Ethereum volumes following SOL DEX’s achievement of reaching a $50 billion trading milestone. Data released on Saturday revealed that Solana DEX volumes rivaled those of Ethereum DEX. Moreover, it indicated a surge in trading activity driven by notable expansion of Solana’s market cap.

The volume of transactions on the Solana blockchain DEX reached an all-time high at the time. Furthermore, this uptick aligned with the recent trend of significant growth in the cryptocurrency market over a short period. In addition, the surge followed the previous week’s data, which indicated that Solana’s weekly DEX volume exceeded $13.3 billion.

At the time, the trading volume stood at $50 billion, according to DeFiLlama dara. This underscored the increasing importance of blockchain technology in the decentralized finance (DeFi) sector.

Also Read: 2 Top Reasons Why Ethereum Price Poised For $500 Dump To $3k This Week

![Nekodex – Earn 20K+ NekoCoin ($20) [Highly Suggested]](https://cdn.bulbapp.io/frontend/images/b4f0a940-f27c-4168-8aaf-42f2974a82f0/1)

![[ℕ𝕖𝕧𝕖𝕣] 𝕊𝕖𝕝𝕝 𝕐𝕠𝕦𝕣 𝔹𝕚𝕥𝕔𝕠𝕚𝕟 - OM(G) , My Biggest Bag Was A Scam????](https://cdn.bulbapp.io/frontend/images/99de9393-38a8-4e51-a7ab-a2b2c28785bd/1)