Is ETH currently being undervalued?

ETH investors may be disappointed with a 12.5% price decrease over the past three weeks, but does a deeper analysis of the asset's data bring more hope?

A part of the recent correction may be attributed to macroeconomic scenarios, as the market no longer anticipates the U.S. Federal Reserve cutting interest rates in March. However, the ETH futures contract spread has decreased to its lowest in three months, leaving traders speculating about what else might be exerting pressure on ETH prices.

Ethereum Dencun Upgrade Could Bring Positive Price Dynamics

The Ethereum network's high gas fees have been a consistent source of frustration for traders and investors, creating substantial pressure to compete with blockchains focused on scalability such as BNB Chain, Solana, and Avalanche. Despite the differences in hierarchy among networks, the overall user experience of layer 1 solutions tends to be more convenient. Therefore, the associated costs of Ethereum scaling solutions are significant.

On February 1st, Ethereum core developer Tim Beiko announced the successful testing of the recent Ethereum network upgrade. The Dencun hard fork will introduce the proto-danksharding feature, aiming to reduce costs for rollup scaling solutions. Analysts anticipate the mainnet activation in March, although the Ethereum Foundation has not officially announced the exact timeline.

In terms of the importance of layer 2 solutions, only four leading networks—Arbitrum, Optimism, Manta, and Base—hold a total locked value (TVL) of $4.2 billion, surpassing the $3.5 billion deposited into BNB Chain's smart contracts, according to DefiLlama. Moreover, in the past week, Ethereum rollups have processed transactions more than 4.2 times the mainnet, as reported by L2Beat.

Demand for leveraged ETH long positions has decreased.

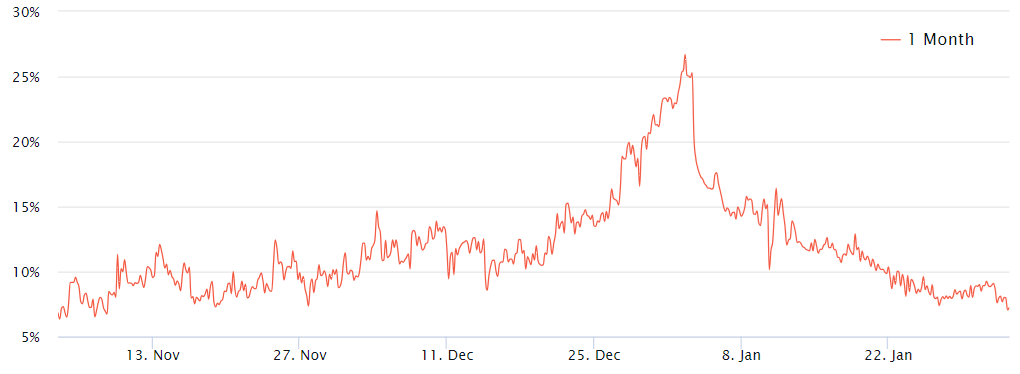

Professional traders prefer monthly futures contracts due to the absence of a funding rate. In neutral markets, these tools trade with a spread fee ranging from 5% to 10% to extend the settlement period.

The data reveals that the spread fee for ETH futures contracts has been trending downwards since January 2, but still remained above the 10% threshold until January 23. Interestingly, during the period from January 2 to February 2, ETH price only experienced a modest 2.2% decrease and reached a peak of $2,715 on January 12 due to FOMO around the launch of the Bitcoin ETF spot market. In essence, the current 7% neutral spread fee for ETH futures contracts might be attributed to an overly optimistic market expectation for prices in the cryptocurrency market.

For comparison, the last time ETH futures contracts reached a 7% spread fee was on November 4, 2023, when the ETH price was at $1,860. Furthermore, historical data indicates 110 days of trading below the $1,900 resistance level, indicating a lack of confidence at that time. However, those who took a bold stance on the price increase in November 2023 were rewarded as ETH surged 21.5% from $1,850 to $2,250 within 30 days. Therefore, a lack of interest in long leverage does not necessarily imply impending negative price volatility.

The ETH options market reflects a clear lack of confidence in ETH prices.

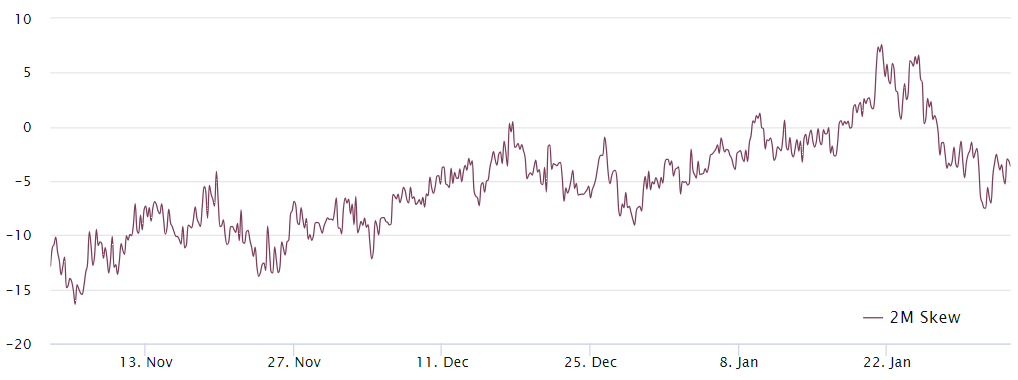

To eliminate external factors that could influence ETH futures contracts, it's crucial to analyze the options market. The 25% delta skew can assess whether the rejection at $2,600 on January 11 impacted investor sentiment negatively. In summary, if traders anticipate a decrease in ETH prices, the skew index will rise above 7%, while bullish periods typically have a skew of -7%.

Note that ETH options were tilted towards a -7% skew on January 31 but quickly returned to a neutral level. In fact, the last time the 25% delta skew for ETH remained in the positive range for over 24 hours was on December 4, 2023, after prices moved from $1,560 to $2,250 within 7 weeks. Therefore, the current neutral options indicator reflects more of a lack of clarity than skepticism about the potential price of ETH.

Bullish interest is focused on the potential approval of the Ethereum ETF spot market. On January 24, the U.S. Securities and Exchange Commission (SEC) postponed the decision on BlackRock's proposal. Bloomberg ETF analyst Eric Balchunas expects the SEC's final decision before May 23, setting the approval rate at 70%. With this catalyst and historical precedents, reducing the spread fee of ETH futures contracts to 7% should not be interpreted as a sign of a downtrend.

![[LIVE] Engage2Earn: Sam Rae for Hawke boost](https://cdn.bulbapp.io/frontend/images/6b43c624-bd70-48c8-b0bc-7bc27c86e0ee/1)

![[ℕ𝕖𝕧𝕖𝕣] 𝕊𝕖𝕝𝕝 𝕐𝕠𝕦𝕣 𝔹𝕚𝕥𝕔𝕠𝕚𝕟 - And Now What.... Pray To The God Of Hopium?](https://cdn.bulbapp.io/frontend/images/79e7827b-c644-4853-b048-a9601a8a8da7/1)