GET 10.000$ on the SOL restaking plaftorms and AIRDROP Journey: A Step-by Step Guide

Unveiling the Secrets of Solana Airdrop Season: A Strategist's Playbook

The Solana ecosystem is buzzing with excitement as the airdrop season unfurls, presenting a plethora of opportunities each day. If you're aiming to optimize your engagement and yield substantial rewards from your time and capital, strategizing your airdrop activities to qualify for the maximum number is crucial.

In this meticulously curated guide, I'll share an updated strategy I'm personally harnessing to navigate through these lucrative waters. We'll focus on positioning ourselves to qualify for not one, but six enticing airdrops:

- Solblaze

- Stake City

- MarginFi

- Kamino

- Sharky

- Tensor

This guide will not only detail the steps to qualify for these airdrops but also provide an insightful overview of each platform, including the airdrop criteria. You'll learn exactly what actions are necessary to meet the qualifications, along with a transparent analysis of the potential returns and inherent risks.

Embarking on the Journey

Disclaimer: This strategy, which I am actively implementing, incorporates certain elements of leverage and acknowledges the inherent risk of loss. Key risks are highlighted throughout this guide to aid your decision-making process. It's crucial to fully comprehend the risk profile before emulating this strategy and to seek advice from a financial advisor if deemed necessary.

Step 1: Stake SOL on Solblaze for bSOL and for a Stake City Airdrop

Understanding Solblaze (including airdrop criteria):

Solblaze revolutionizes staking in the Solana ecosystem by offering a liquid asset, bSOL, for staked SOL, allowing you to be eligible for the $BLZE token airdrop, valued at $.002. Learn more about Solblaze's model.

Qualifying for the Airdrop:

- Option 1: Kickstart your journey by steering your browser to the Solblaze staking portal. Here, you'll decide the amount of SOL you're ready to stake. In return, you'll receive bSOL at a predetermined rate, marking your initial stride into this venture. Should you wish to support my journey while embarking on your own, feel free to use my referral link.to

Solblaze staking: STAKE SOLBLAZE

Solblaze staking

Solblaze staking

- Option 2: New airdrop opportunity with Stake City

- Stake City (a custom validator for Solana staking) now has a points program if you delegate your staking to them directly

- To do this:

- - Navigate to Solblaze staking

- - Click on “custom validators”

- - Search for “Stake city”

- - Select “Stake City + MEV”

- - You can then stake directly with Stake City (as per the below screenshot)

- If you navigate to the Stake City website you will be able to track the points you are earning from staking

- Returns: The current APY on staked SOL is ~8.5%, with 1.71% of this coming from $BLZE tokens (the rest in SOL)

- Risks: The main risk here is a bug in the smart contract (inherent in any DeFi platform where you lock away your funds) that leads to a hack. However, Solblaze has audited their smart contract seven times by five different organizations as per their whitepaper (https://stake-docs.solblaze.org/protocol/audits)

Step 2a: Lend bSOL on marginfi and/or lend bSOL on Kamino (see step 2b)

- What is marginfi (including airdrop criteria):

- MarginFi is a Solana borrowing and lending platform, enabling you to earn yield on your assets and borrow on others

- MarginFi has introduced a points system, which is highly likely to be converted directly for a marginfi token. Currently, you earn 1 point per $1 lent, and 4 points per $1 borrowed

- What you need to do to qualify:

- Navigate to marginfi. Put the display on “pro mode” (at the bottom), and click “supply” next to bSOL. Then supply (i.e. lend) all of your bSOL tokens.

You can use my referral link here to access marginfi: REF LINK

- Note: If you have additional assets you can lend these as well, which will help for step 3, as you will be able to borrow more collateral

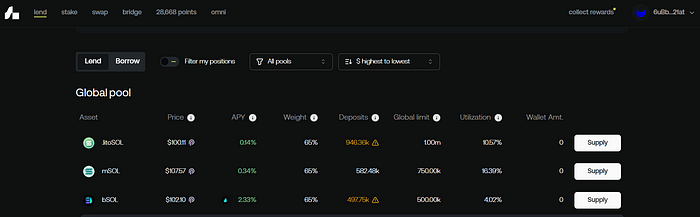

bSOL’s lending pool on marginfi

bSOL’s lending pool on marginfi

- Returns: Current APY is ~2.3%, with 1 marginfi point per $1 lent

- Risks: Smart contract risk (as above). There is also liquidation risk, if the price of bSOL falls below a certain price (which will be displayed on marginfi)

Step 3: Borrow SOL on marginfi and/or borrow SOL on Kamino (see step 3c)

- What you need to do to qualify:

- Navigate to marginfi. Switch from “Lend” to “Borrow” and borrow SOL (noting that this pool is often heavily utilized so you may need to wait until some SOL becomes available)

- Returns: You will pay ~5% APR in interest, but earn 4 points $1 lent

- Risks: Liquidation risk — a liquidation price will display, which changes according to how much collateral you have lent and how much you have borrowed.

Step 2b: Lend bSOL on Kamino Finance

- What is Kamino Finance (including airdrop criteria):

- Kamino Finance is a Solana borrowing and lending platform like MarginFi

- Kamino Finance (on the 19th of January 2024) launched a points system, that will last for 3 months and then result in an airdrop of their token $KMNO. There will be additional rounds of airdrops

Kamino website’s overview of their points system

Kamino website’s overview of their points system

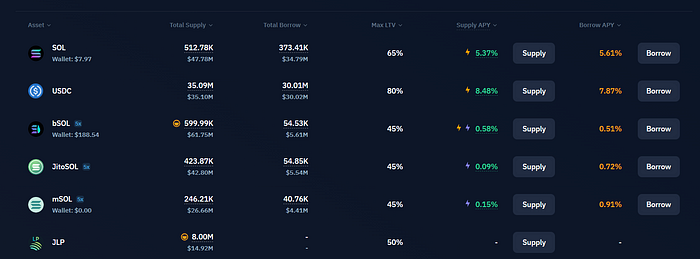

- What you need to do to qualify:

- Navigate to Kamino Finance and click “supply” next to bSOL. Then supply (i.e. lend) all of your bSOL tokens (noting that this pool is often heavily utilized so you may need to wait until some bSOL becomes available)

- Returns: Current APY is ~0.6%, with 1 Kamino point per $1 lent

- Risks: Smart contract risk and liquidation risk at a portfolio level

Step 3c: Borrow SOL on Kamino Finance

- What you need to do to qualify:

- Click on “borrow” for SOL and enter the amount of SOL you would like to borrow. Make sure you understand and are conformatble with your loan to value ratio here

- Returns: You will pay ~5% APR in interest, but earn 1 points $1 lent (noting currently Kamino has a 5x point boost for borrowing SOL)

- Risks: Liquidation risk — a liquidation price will display, which changes according to how much collateral you have lent and how much you have borrowed. Monitor this in the Loan Health dashboard

Step 4: With the borrowed SOL, lend it against an NFT on Sharky

- What is Sharky (including airdrop criteria):

- Sharky is an NFT lending and borrowing platform on Solana.

- They have announced a token called $HARK, which is almost certainly going to be airdropped. Sharky has said that borrowing and lending on their platform will be “rewarded” (i.e. with $HARK)

- What you need to do to qualify:

- I have previously written a detailed guide on Medium along with a twitter thread on how to lend on Sharky

- The main iteration here is lending against an NFT that is in the top 100 collections by volume on Tensor. Ideally, it is also an NFT that you would be happy to own, so in the event of a default of the NFT you would be happy to hold it

- I have written a Twitter thread on Solcasino NFTs, and am typically lending against those NFTs (which I’m happy to hold in the event of a default)

Sharky loan interface

Sharky loan interface

- Returns: You earn interest on each of your loans, at a predetermined APY (e.g., Solcasino.io’s APY is 200%)

- Risks: Default risk — if the floor price of the NFT falls below your loan amount, the borrower will usually elect to default -leaving you with an NFT

Step 5: Put a collection level bid on Tensor OR list any defaulted NFTs from Sharky

- What is Tensor:

- Tensor is the largest NFT marketplace on Solana. It has adopted a similar “season” style points system like Blur. Tensor is currently in season 3, and is heavily speculated to have an airdrop

- As per Tensor’s website, you can earn points by 1) Putting collection level bids on top 100 projects and 2) Listing top 100 project NFTs

- What you need to do to qualify:

- List defaulted NFTs: If you have any NFTs from Sharky that have defaulted, you can list these on Tensor. The duration of your listing counts towards your points (along with proximity to the floor price), so try to put it relatively close to the floor price

Tensor points requirements

- Put collection level bids: Using the SOL you borrowed (or existing SOL), put a collection level bid on an top 100 NFT collection. Again your best bet is to put a bid on a collection where you are happy to hold the NFT. You get more points for the longer your bid is active, so ideally, put a price a bit lower than the floor value

Monitor your exposure to avoid liquidation when NFT prices change. #SOLANA #SOLBLAZE #TESNET #RESTAKE #BULB

Monitor your exposure to avoid liquidation when NFT prices change. #SOLANA #SOLBLAZE #TESNET #RESTAKE #BULB

![[FAILED] Engage2Earn: Dutton's Australia sucks](https://cdn.bulbapp.io/frontend/images/0d8a3939-e926-4422-a643-5ff414ebcfc8/1)