Will Bitcoin History Repeat in Q4 2024?

With the beginning of Q4 2024, Bitcoin investors and traders are eagerly watching the market to see if the historical trend of a strong fourth quarter for the cryptocurrency will continue. Historically, Q4 has been a pivotal period for Bitcoin, often marking some of its most significant gains during a bull market year.

In the current market, where macroeconomic factors, institutional interest, and market sentiment are continuously evolving, the question remains: Will Bitcoin history repeat itself in Q4 2024?

Historical Performance in Q4

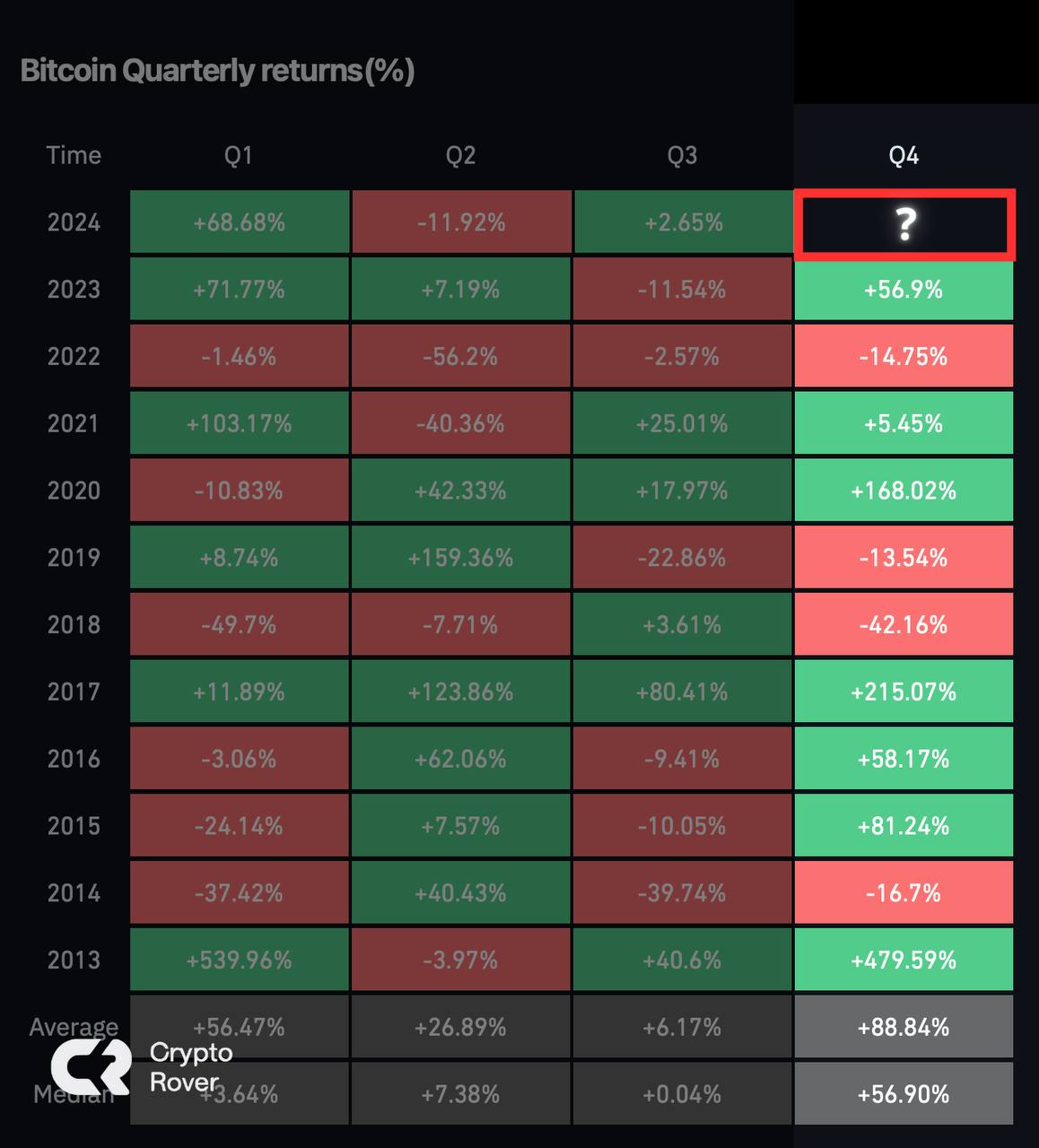

Looking back at Bitcoin’s past, Q4 has historically been one of its best-performing quarters. For instance, in 2017, Bitcoin surged nearly 200% from October to December, fueled by increased retail interest and global media attention as it reached its then all-time high of around $20,000. In 2020, during another bull market year, Bitcoin saw a tremendous rally, gaining nearly 170% from October through December and setting a new all-time high above $29,000.

One of the reasons for Bitcoin’s historically strong performance in the fourth quarter is the influx of institutional investment and broader adoption. Many institutional investors begin to adjust their portfolios during this period, which often results in a surge of capital flowing into high-growth assets like cryptocurrencies.

Furthermore, Q4 tends to coincide with year-end speculative investments as both individual and institutional investors look for high-reward opportunities to close out the year.

Market Sentiment and Predictions for Q4 2024

As we enter Q4 2024, several market analysts have provided insights into what could be another strong quarter for Bitcoin. Crypto analyst Benjamin Cowen has highlighted Bitcoin’s historical patterns and believes that the cryptocurrency’s performance in the final quarter of this year will depend largely on whether it can break past its Bull Market Support Band (BMSB). Cowen explains that in previous years like 2013, 2016, and 2020, Bitcoin had fallen below this critical level during the summer months, only to rally sharply in Q4.

Other market analysts share a similarly optimistic outlook, with predictions of Bitcoin reaching as high as $95,000 before the end of the year. This prediction is based on the observation that only a few out of 120 key indicators are bearish on Bitcoin, suggesting that the probability of a significant rally is much higher than a decline.

Despite these positive forecasts, it's essential to consider that Bitcoin’s price movement is still influenced by broader macroeconomic factors, including inflation, interest rates, and regulatory developments. For instance, the ongoing regulatory scrutiny in various jurisdictions could affect investor confidence and slow down the anticipated bull market momentum.

Will Institutional Investors Drive Bitcoin Higher?

Institutional investors have played a key role in driving Bitcoin’s price higher in previous years, and they are expected to remain a significant factor in Q4 2024. In recent years, the acceptance of Bitcoin as a legitimate asset class has grown considerably, with large institutions like MicroStrategy and Tesla making multi-billion-dollar investments in the cryptocurrency.

Furthermore, investment products such as Bitcoin ETFs have made it easier for traditional investors to gain exposure to the crypto market, potentially adding to the overall demand during Q4.

The approval of more Bitcoin spot ETFs in the U.S. could be a game-changer in Q4 2024, as it would allow a broader range of investors to participate in the market without needing to purchase and hold the cryptocurrency directly. This would likely increase the inflow of capital into Bitcoin, driving up prices.

In addition to institutional interest, Bitcoin’s scarcity is another factor that could contribute to its Q4 performance. Bitcoin’s fixed supply of 21 million coins means that as demand increases, particularly from institutional investors, the price is likely to rise due to supply constraints.

Macroeconomic and Regulatory Factors

While Bitcoin’s historical trends and growing institutional adoption suggest a strong Q4 2024, it’s important to acknowledge the broader economic and regulatory environment. The Federal Reserve’s monetary policy, including interest rate decisions, will have a significant impact on Bitcoin and other risk assets. If the Fed decides to pause or reverse its current tightening cycle, it could lead to an influx of liquidity into the market, benefiting high-growth assets like Bitcoin.

However, regulatory uncertainty remains one of the biggest challenges for Bitcoin’s Q4 outlook. Over the past few years, governments and regulatory bodies worldwide have been increasing their scrutiny of cryptocurrencies, citing concerns about fraud, market manipulation, and money laundering.

For instance, the U.S. Securities and Exchange Commission (SEC) has taken a cautious stance on approving Bitcoin ETFs, which has limited the influx of capital into the market. If there are any unfavorable regulatory developments in Q4 2024, it could dampen Bitcoin’s bullish momentum.

What to Expect From Bitcoin in Q4 2024?

As we look ahead to the final quarter of 2024, the key question on everyone’s mind is whether Bitcoin will follow its historical pattern of strong Q4 performance. Several factors suggest that it could, including the potential for institutional investment, broader adoption, and favorable macroeconomic conditions.

However, as with any investment, there are risks involved. Bitcoin remains highly volatile, and its price is subject to a wide range of factors, including regulatory decisions, market sentiment, and macroeconomic trends. Investors should approach the market with caution and ensure that they are well-informed before making any significant investment decisions.

While history suggests that Q4 could be another strong quarter for Bitcoin, it’s essential to keep an eye on both macroeconomic and regulatory developments. The combination of institutional interest, Bitcoin’s scarcity, and favorable market conditions could drive the cryptocurrency to new highs, but the risks associated with regulatory changes and market volatility cannot be ignored.

![[LIVE] Engage2Earn: auspol follower rush](https://cdn.bulbapp.io/frontend/images/c1a761de-5ce9-4e9b-b5b3-dc009e60bfa8/1)