Liquid Staking Tokens on Solana

Introduction

H1 of 2024 saw the launch of many Liquid Staking Tokens (LSTs) on Solana.

Staking helps to secure proof-of-stake networks and typically involves locking up network tokens (like SOL) via a validator. However, locked-up tokens are illiquid and have limited utility for users.

LSTs change this dynamic by issuing tokens that represent the value of the underlying stake. While LSTs maintain the benefits of traditional staking, they can be utilised on various DeFi platforms in the ecosystem.

In this article, we'll explore some benefits of LSTs, look into main LST platforms like Sanctum and guide you on how to understand an LST transaction using the SolanaFM Explorer.

Key benefits of LSTs

LSTs provide users with a number of benefits which are briefly highlighted in the context of Solana.

1) Unlocked liquidity

As mentioned a key benefit of LSTs are unlocked liquidity. In a typical staking transaction, your staked assets will remain locked until a certain period of time or until you decide to unstake them.

When acquiring LSTs on Solana, users unlock liquidity of the token and make it composable across the ecosystem.

2) Network participation

LSTs allow users to participate in the network by delegating a chosen amount of SOL to staking.

Solana as a proof-of-stake blockchain functions because users stake SOL via validators that each provide consensus to the network.

3) Earning Yield

When deploying their LSTs on other platforms, users can earn additional yields on top of their staked tokens.

For instance, users can earn fees when providing LSTs to liquidity pool on Meteora or Kamino or profit when trading them on a DEX.

Risks:

LSTs carry certain risks. By using LSTs, users become dependent on third-party providers and can be exposed to price fluctuations.

It's important to note that LSTs rarely mimic the price of SOL; instead, they represent the underlying value of the staked tokens with a respective slippage tolerance.

Depending on where LSTs are deployed, users may incur losses when using their LSTs on DEXes or other DeFi platforms.

Explore LSTs on Sanctum

One way to acquire LSTs is via the Sanctum app.

Sanctum is a launchpad for LSTs on Solana, enabling users to search for various LSTs in the ecosystem while earning staking yields and trading fees.

Moreover, Sanctum has a multi-LST pool (Infinity Pool) with their native token Infinity (INF), enabling users to swap LSTs interchangeably.

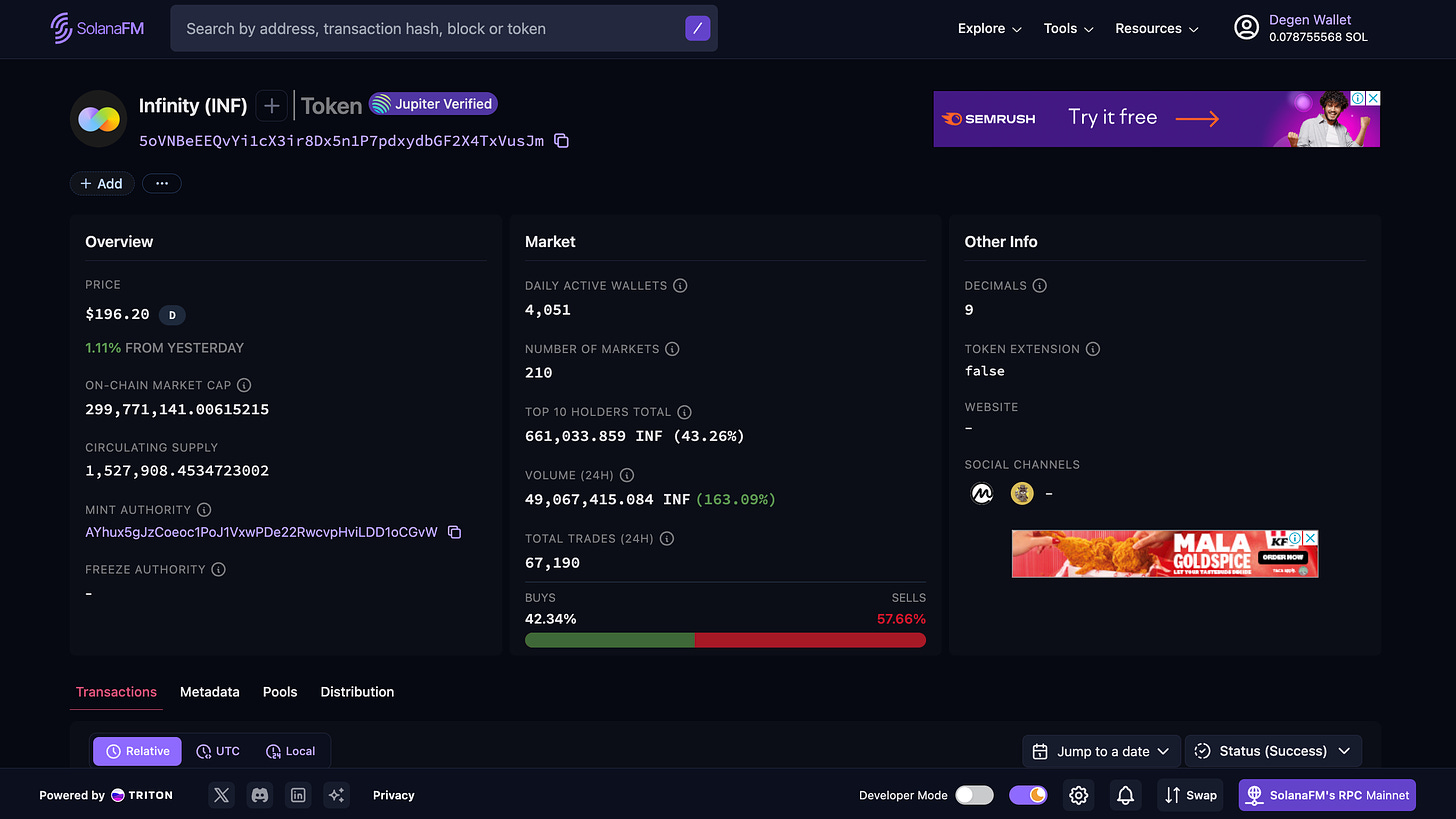

For more information on Sanctum you can also refer to the SolanaFM deep dive on the Sanctum program. The Infinity (INF) Token Page on SolanaFM

The Infinity (INF) Token Page on SolanaFM

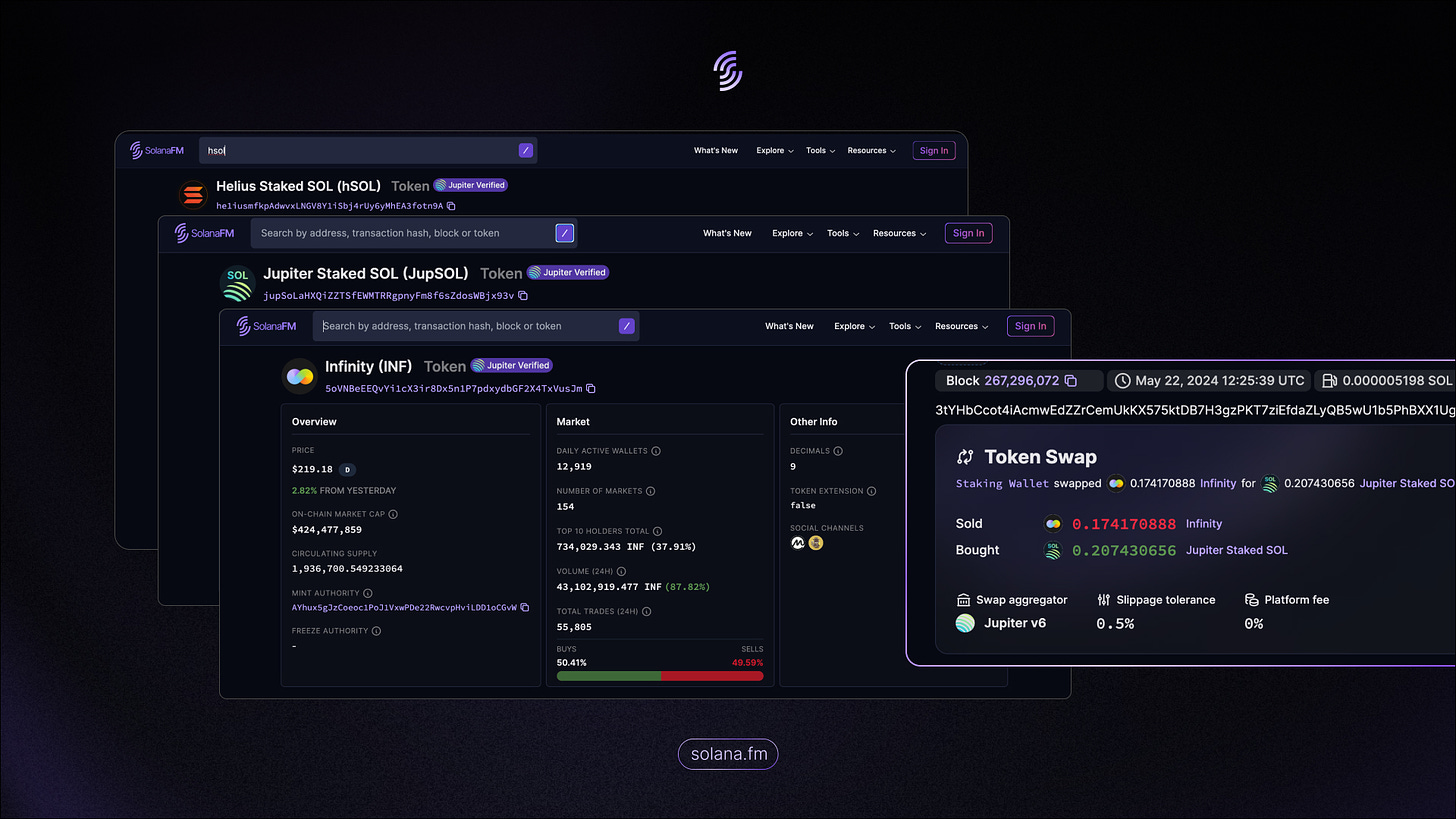

In this part, you will see a simple breakdown of an LST transaction on Sanctum. As an example, we will stake SOL in return for Helius staked SOL (hSOL).

Analysing the steps on-chain, we see that staking SOL in return for an LST is a Token Swap. The LST received by users acts as a receipt confirming that they have staked SOL tokens to the network. An LST Swap on-chain with the SolanaFM Transaction Overview

An LST Swap on-chain with the SolanaFM Transaction Overview

Once users are in possession of the LST, they can make use of the wide range of DeFi offerings on Solana.

For instance, they can provide liquidity on platforms like Meteora, Orca or Kamino.

LSTs on Solana

You can view verified LSTs with the SolanaFM Token Page

You can view verified LSTs with the SolanaFM Token Page

Since Solana is home to various LSTs, it is essential for users to view them on-chain to ensure their legitimacy and avoid interacting with counterfeits or scam tokens.

Verified Solana LSTs are tagged on the SolanaFM Explorer and can be searched by copy-pasting the token hash in the search bar. This will also enable users to view key metrics like market cap, circulating supply & trading volume.

Below are a couple of LSTs on Solana:

BlazeStake Staked SOL (bSOL): https://solana.fm/address/bSo13r4TkiE4KumL71LsHTPpL2euBYLFx6h9HP3piy1

Bonk SOL (bonkSOL): https://solana.fm/address/BonK1YhkXEGLZzwtcvRTip3gAL9nCeQD7ppZBLXhtTs

CogentSOL (cgntSOL): https://solana.fm/address/CgnTSoL3DgY9SFHxcLj6CgCgKKoTBr6tp4CPAEWy25DE

Compass SOL (compassSOL): https://solana.fm/address/Comp4ssDzXcLeu2MnLuGNNFC4cmLPMng8qWHPvzAMU1h

Helius Staked SOL (hSOL): https://solana.fm/address/he1iusmfkpAdwvxLNGV8Y1iSbj4rUy6yMhEA3fotn9A

Jito Staked SOL (JitoSOL): https://solana.fm/address/J1toso1uCk3RLmjorhTtrVwY9HJ7X8V9yYac6Y7kGCPn

Jupiter Staked SOL (JupSOL): https://solana.fm/address/jupSoLaHXQiZZTSfEWMTRRgpnyFm8f6sZdosWBjx93v

Laine Stake Token (laineSOL): https://solana.fm/address/LAinEtNLgpmCP9Rvsf5Hn8W6EhNiKLZQti1xfWMLy6X

Liquid Staking Token by MarginFi (LST): https://solana.fm/address/LSTxxxnJzKDFSLr4dUkPcmCf5VyryEqzPLz5j4bpxFp

Marinade Staked SOL (mSOL): https://solana.fm/address/mSoLzYCxHdYgdzU16g5QSh3i5K3z3KZK7ytfqcJm7So

SolanaHub Staked SOL (hubSOL): https://solana.fm/address/HUBsveNpjo5pWqNkH57QzxjQASdTVXcSK7bVKTSZtcSX

Bottom Line

LSTs will continue to play an important role in the Solana ecosystem. They keep the network active and enable both users and validators to earn rewards.

With SolanaFM, users can explore LSTs to understand key on-chain metrics and track the latest transactions. Platforms like Sanctum allow users to interchange among various LSTs they may hold.

As the LST space evolves rapidly, staying informed about new developments is essential for contributing to the LST and the wider Solana ecosystem.

![Nekodex – Earn 20K+ NekoCoin ($20) [Highly Suggested]](https://cdn.bulbapp.io/frontend/images/b4f0a940-f27c-4168-8aaf-42f2974a82f0/1)

![[LIVE] Engage2Earn: Dutton = MAGA](https://cdn.bulbapp.io/frontend/images/e12661b2-74fa-4cd8-b554-51be7f6fec4f/1)

![[ℕ𝕖𝕧𝕖𝕣] 𝕊𝕖𝕝𝕝 𝕐𝕠𝕦𝕣 𝔹𝕚𝕥𝕔𝕠𝕚𝕟 - OM(G) , My Biggest Bag Was A Scam????](https://cdn.bulbapp.io/frontend/images/99de9393-38a8-4e51-a7ab-a2b2c28785bd/1)