Solana (SOL) February End Price Prediction

Amidst concerns sparked by a network outage, Solana (SOL) has demonstrated a remarkable bounce-back by the second week of February, allaying fears of a market downturn. On Feb. 6, 2024, Solana encountered a significant disruption that brought network operations to a halt for more than two hours, prompting speculations about its potential impact on the cryptocurrency’s performance.

In the aftermath of the outage, SOL experienced a dip below the $100 threshold. Nevertheless, Solana’s recovery has been both swift and robust. After trading at $94.49 on Jan. 15, SOL surged by 6.2% to reach $100.44 on Feb. 2. However, the network interruption on February 6 led to a temporary setback, with SOL dropping to $96.86. Despite this challenge, Solana swiftly rebounded, reaching $112.96 on Feb. 16, signaling a sustained upward trend in its value. For February 2024, cryptocurrency experts are leveraging insights from the market’s performance in early 2023 to project an average SOL rate of $114.59. The forecasted minimum and maximum prices are estimated at $101.67 and $127.50, respectively, providing valuable guidance for investors navigating Solana’s market dynamics.

For February 2024, cryptocurrency experts are leveraging insights from the market’s performance in early 2023 to project an average SOL rate of $114.59. The forecasted minimum and maximum prices are estimated at $101.67 and $127.50, respectively, providing valuable guidance for investors navigating Solana’s market dynamics.

Also Read: Solana Weekend Price Prediction: Can SOL Go Higher?

Here’s How High Solana Will Trade During The End of February

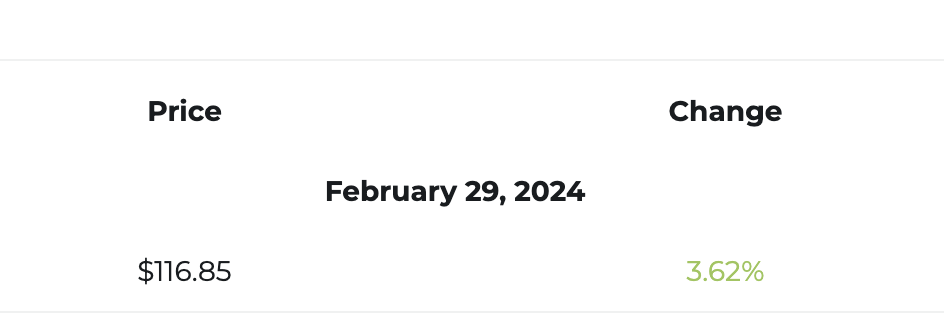

Zooming in on the forecast for Solana’s end-of-February performance, analysis from Changelly indicates that SOL is anticipated to trade at $116.85. This projection represents a 3.62% increase from its current level, offering potential opportunities for investors as the month draws to a close on Feb. 29. Source

Source

The projected price uptick underscores Solana’s ability to rebound from challenges, such as the recent network disruption. Despite facing temporary hurdles, SOL has demonstrated its capability to bounce back and sustain an upward trajectory, instilling confidence among investors in its long-term prospects.

Also Read: Solana: Pattern Suggests SOL Could Hit $123, Predicts Analyst

Furthermore, Solana’s February end price prediction underscores its capacity to overcome obstacles and maintain momentum. With a projected increase in value and a robust recovery from the recent network outage, SOL emerges as an attractive investment option for those seeking to capitalize on the cryptocurrency market’s growth potential.

Ripple [XRP]: How High Can XRP Rise in 2024?

Source – Unsplash

Source – Unsplash

Ripple’s XRP has been attracting widespread attention from investors and enthusiasts alike due to its recent surge. As Bitcoin surged past resistance levels to hit $52,500, altcoins like XRP also saw significant gains, reaching a peak of $0.5590. This upward movement in altcoin prices coincided with Bitcoin’s bullish momentum, signaling a broader market recovery. Source

Source

Within just 24 hours, XRP’s market capitalization skyrocketed from $28.66 billion to $29.66 billion, marking an impressive addition of $1.18 billion and a growth rate of 4.12%. This surge underscores the revived interest and confidence in XRP among investors.

Looking ahead, investors and analysts are eager to forecast XRP’s trajectory for the remainder of 2024. Utilizing historical price data and market trends, Changelly, a leading cryptocurrency exchange platform, has offered insights into the potential price movements of XRP for February 2024. Also Read: Ripple XRP: How To Be a Millionaire If XRP Reaches $5

Also Read: Ripple XRP: How To Be a Millionaire If XRP Reaches $5

Ripple [XRP] February 2024

According to Changelly’s projections, the average price of XRP in February 2024 is expected to hover around $0.635, with minimum and maximum price estimates of $0.537 and $0.733, respectively. These forecasts provide valuable guidance for investors seeking to optimize their trading strategies.

Taking a broader view of the year ahead, Changelly’s projections shed light on the long-term trajectory of XRP’s price. The anticipated minimum price of XRP for 2024 is $0.524, indicating a baseline level of support for the cryptocurrency. Conversely, the maximum projected price for XRP in 2024 is $0.676, suggesting potential upside potential for investors.

Also Read: Ripple (XRP) Could Hit $413, Here’s When

Furthermore, Changelly anticipates the average trading price of XRP to be approximately $0.827 throughout 2024. These forecasts offer valuable insights into XRP’s potential performance over the coming months, highlighting both opportunities and challenges that investors may face in the dynamic cryptocurrency market.

How Much Shiba Inu & Bitcoin Does Robinhood Hold?

Source – Reuters

Source – Reuters

Robinhood Markets has surprised Wall Street with its latest quarterly earnings report, revealing a notable move towards profitability driven by an uptick in cryptocurrency deposits and an increase in monthly active users. The platform announced a profit of $30 million, or 3 cents per share, marking a remarkable turnaround from the previous year’s loss of $166 million, or 19 cents per share, in the same quarter.

The Payoff from Crypto Focus

A strategic focus on cryptocurrencies has been pivotal for Robinhood, fueling its financial resurgence. Witnessing a substantial $4 billion surge in crypto deposits in January alone, the platform experienced its most rapid growth month since early 2021. This surge notes Robinhood’s success in gaining market share from traditional brokerage giants.

Bitcoin Holdings: Demonstrating Strength

Robinhood’s cryptocurrency holdings, particularly in Bitcoin (BTC) and Shiba Inu, have been key contributors to its financial success. Data from Arkham Intelligence reveals that Robinhood currently holds over $6 billion worth of Bitcoin in a single wallet, accumulated over several months. This positions Robinhood as the third-largest Bitcoin holder globally, trailing only behind major crypto exchanges Binance and Bitfinex. Source

Source

Also Read: Shiba Inu: Robinhood & MetaMask Team Up to Simplify SHIB Purchases

Shiba Inu Holdings: Exploring New Frontiers

In addition to its significant Bitcoin holdings, Robinhood has also made substantial investments in Shiba Inu, holding a total of 36.745 trillion tokens valued at $353.49 million. This diversification reflects Robinhood’s strategic move into emerging cryptocurrencies, seizing opportunities beyond Bitcoin.

Robinhood’s success in the cryptocurrency market underscores its resilience and adaptability in an ever-changing financial landscape. As the platform continues to broaden its crypto offerings and attract a wider user base, its potential for further growth and profitability remains promising. Robinhood’s strategic focus on cryptocurrencies has not only facilitated its financial turnaround but has also solidified its position as a major player in the digital asset arena.

Also Read: Dogecoin: Robinhood Moves 250 Million DOGE Amidst Price Surge

Robinhood’s shift towards profitability, driven by its robust cryptocurrency holdings, signals a significant change in the financial industry’s landscape. With cryptocurrencies gaining increasing acceptance and adoption, Robinhood’s strategic diversification and innovation position it for sustained success in the rapidly evolving market. Backed by its impressive crypto portfolio and expanding user base, Robinhood is poised to redefine the future of finance and continue its mission of democratizing access to financial markets for all.

Ethereum: Here’s When ETH Could Reclaim The $4000 Level

Ethereum (ETH) is following the market-wide rally, surging above $2.8k for the first time since May 2022. ETH has rallied 2.7% in the daily charts, 16.3% in the weekly charts, 23.8% in the 14-day charts, and more than 11% over the previous month. Moreover, ETH’s price has surged by 68.4% since February 2023. Source: CoinGecko

Source: CoinGecko

Also Read: Ethereum Weekend Price Prediction; ETH Eyes $3,000

ETH is currently following Bitcoin’s (BTC) trajectory. BTC’s latest rally could be due to increased inflows into spot BTC ETF (Exchange Traded Fund) investment vehicles. However, ETH is still down by over 40% from its all-time high of $4878, which it attained in November 2021.

When will Ethereum (ETH) reclaim its all-time high?

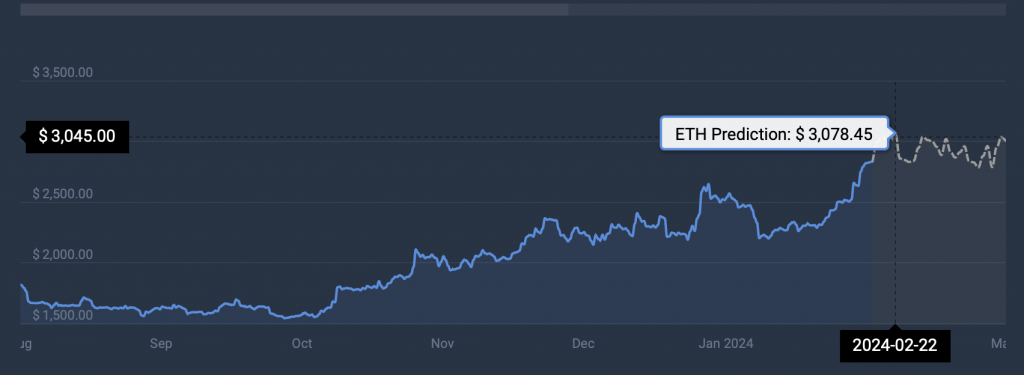

According to CoinCodex, Ethereum (ETH) will breach the $3000 level by next week. The platform anticipates the second-largest cryptocurrency to hit $3078.45 on Feb. 22, 2024, a rise of about 7.9% from current levels. However, CoinCodex predicts ETH to fall below $3000 soon after.

According to CoinCodex, Ethereum (ETH) will breach the $3000 level by next week. The platform anticipates the second-largest cryptocurrency to hit $3078.45 on Feb. 22, 2024, a rise of about 7.9% from current levels. However, CoinCodex predicts ETH to fall below $3000 soon after. Source: CoinCodex

Source: CoinCodex

Also Read: Ethereum Shock: $113K Gas Fee Spree Leads to Crypto Catastrophe

Changelly anticipates Ethereum (ETH) to reclaim its all-time high in 2025. The platform predicts ETH to hit a maximum price of $6,263.37 next year, a rise of nearly 120% from current levels.

Telegaon, on the other hand, anticipates Ethereum (ETH) to reclaim its all-time high in 2024. The platform predicts ETH to hit a maximum price of $5,054.04 in 2024, a rise of over 77% from current levels. However, the platform does not clarify which month ETH could reclaim its all-time high.

However, there is a possibility that ETH could reclaim its 2021 peak very soon. There is a lot of talk about the US SEC (Securities and Exchange Commission) approving a spot ETH ETF later this year. A spot ETH ETF, along with BTC’s halving in April, could usher in a bull run for the crypto market.

![[LIVE] Engage2Earn: auspol follower rush](https://cdn.bulbapp.io/frontend/images/c1a761de-5ce9-4e9b-b5b3-dc009e60bfa8/1)