Unlocking Passive Income on the Blockchain: Revenue Share, Airdrops, Staking, Referrals

In the ever-evolving landscape of blockchain technology, investors are constantly seeking new avenues to generate passive income. From automated trading bots to decentralized finance (DeFi) protocols, the blockchain offers a plethora of opportunities for those looking to grow their wealth without the need for constant oversight. In this comprehensive guide, we delve into five key strategies for passive income with cryptocurrencies on the blockchain: Telegram trading bots, Solana launchpads, reflections from SPL22 tokens, LP staking opportunities, and SUI LP staking/new protocol investments.

Telegram Trading Bots: Rewarding Crypto Trading

![]()

Sigma Bot – ETH AVAX BSC ARB BASE BLAST

Telegram trading bots have gained popularity among cryptocurrency investors seeking to capitalize on market fluctuations without the need for manual trading. These bots are programmed with algorithms designed to execute trades based on predefined parameters or signals. Traders can customize these bots to implement various strategies, including arbitrage, market making, and trend following. Revenue share, referral incentives and use based point systems, make great passive income opportunities.

The allure of Telegram trading bots lies in their ability to operate 24/7, leveraging advanced trading strategies and reacting swiftly to market movements. By automating trading activities, investors can potentially exploit profitable opportunities while minimizing emotional decision-making biases.

Beyond their convenience, Telegram trading bots offer multiple avenues for passive income generation. Revenue sharing mechanisms allow users to earn a portion of the profits generated by the bot’s trading activities, providing a steady stream of income over time. Additionally, referral programs incentivize users to expand the bot’s user base, earning rewards for each new sign-up they bring in. Airdrops further sweeten the deal, offering users free tokens or rewards simply for participating in the bot’s ecosystem.

Passive Income Opportunities:

Passive Income/Revenue Share: Though either staking protocol tokens such use $HYPE or $UNIBOT, investors are credited with a share of the revenue gathered through trade fees, partnerships and other revenue generation.

- Example: Hold 10 Minimum $UNIBOT to earn Revenue Shares on all Unibot Fees

Airdrops: Some protocols incentivize users by awarding airdrops for future token launches and/or points that can be redeemed once accumulated.

Referrals: By referring new users to a telegram bot or dex, you may have an opportunity to use a referral code to capture a percentage of fees generated by that users trade on the protocol, creating passive income for the life of the user on the protocol.![]()

- Example : Refer Users to collect 25% of fees generated. Get your referral code: HERE

By combining convenience with various passive income opportunities, Telegram trading bots empower investors to grow their wealth in a hassle-free manner.

Full List of Telegram Bots Free To Get, No code : HERE

Solana Launchpads:

Revenue Shares

Early Access to Promising Projects

Solana launchpads serve as platforms for the launch of new projects on the Solana blockchain. These platforms provide investors with early access to token sales, often at discounted prices, before the projects are made available to the broader market.

Participating in Solana launchpads can be lucrative for investors who identify promising projects with strong fundamentals and growth potential. Early backers may benefit from significant price appreciation and passive income opportunities if the projects gain traction within the blockchain ecosystem.

However, the landscape of launchpads is highly competitive, with numerous projects vying for investors’ attention. Thorough research and strategic allocation of funds are essential to maximize returns and mitigate risks associated with early-stage investments.

Passive Income/Revenue Shares: Some Protocols Offer Revenue shares generated from fees gathered from new token launches and services provided by the protocol. Such as but not limited to: Launchpad Fees, Commission Fees, Promo Fees, Airdrop Fees

EXAMPLE LaunchPad w/ Revenue Potential:

SolPad #SPAD | The Future Of Decentralized Funding

SolPad stands as a decentralized launchpad and staking ecosystem, purpose-built on the Solana network. This innovative platform strives to simplify the process of project launches, smart contract creation and deployment, and secure token staking.

SolPad offers a rich set of features, including token creation, an intuitive interface, automated smart contract deployment, node deployment, and seamless interoperability with other decentralized applications (dApps). Notably, it ensures the security of staked tokens through a transparent and reliable staking mechanism.

More Launchpads that offer revenue share:

Bank AI | $BANK

BYTE ON BLAST | $BYTE

Memespad | $MEMES

Reflections from SPL22 Tokens:

Passive Rewards for Token Holders

SPL22 tokens, built on the Solana blockchain using the SPL token standard, offer a unique mechanism for generating passive income through token reflections. Reflections involve redistributing a portion of transaction fees or other revenues generated by the project to token holders in proportion to their holdings.

By holding SPL22 tokens in compatible wallets, investors can passively accrue additional tokens over time, creating a steady stream of income without active participation in trading or staking activities. This incentivizes long-term holding and community engagement within the project ecosystem.

Reflections from SPL22 tokens provide investors with a passive income stream while contributing to the overall growth and sustainability of the project. However, investors should carefully assess the project’s viability and tokenomics before committing funds to ensure the sustainability of passive income generation.

Example Solana Reflection Tokens

Print Protocol

$PRINT ca: HKYX2jvwkdjbkbSdirAiQHqTCPQa3jD2DVRkAFHgFXXT

Featuring Print Protocol’s custom Hold 2 Earn (H2E) rewards mechanism. Holding $PRINT grants you continual SOL returns. Print Protocol Dex in Development with Exclusive Token Launches and Revenue share towards $PRINT buybacks

- 8% tax on buys

- 6% Solana Rewards distributed to

- holders

- 2% to Operations Wallet

REWARD PROTOCOL

$REWD ca: 2eu1K3wvfPC7gVj1CK8ohv4ggusdN6qxyxpjHyTCkjZT

Reward Protocol stands as the pioneering platform to integrate Hold to Earn (H2E) and Hold to Win (H2W). By holding tokens, you not only earn reflections but also gain the opportunity to win a Daily Jackpot, enhancing the value and excitement of your investment.

- 1M REWD = 1 Ticket for Daily Jackpot

- Continuous SOL Reward Airdrops

Both the reflections and Jackpot are automatically sent to wallets in SOL

3% Converted to SOL and sent directly to your

wallet

3% Converted to SOL and sent directly to Jackpot

Recommended Trade Bot For SPL22 Tokens

SPL22 Tokens are notoriuosly hard to trade, even on the Fluxbeam site where most SPL22 tokens are available. If trading SPL22 Tokens, i recommend the FUXBOT by FLUXBEAM. Fluxbot finds the token fast and trades it quickly. Set up limits and snipe launches. Try the FLUXBOT.

LP Staking Opportunities:

Providing Liquidity for Passive Income

Liquidity Provider (LP) staking involves providing liquidity to decentralized exchanges (DEXs) by depositing pairs of tokens into liquidity pools. In return, LPs receive trading fees generated by the exchange and, in some cases, additional rewards in the form of governance tokens or other incentives.

LP staking presents an attractive opportunity for investors to earn passive income while facilitating liquidity provision within the decentralized finance ecosystem. By contributing to liquidity pools, investors play a vital role in enabling efficient and seamless token swaps on DEXs.

However, LP staking carries inherent risks, including impermanent loss and smart contract vulnerabilities. Investors should carefully evaluate the risk-reward profile of LP staking opportunities and diversify their holdings across multiple liquidity pools to mitigate potential losses.

Interesting Lp Opportunities

FLASH TRADE : Solana Network

- Asset backed trading with zero price impact and on demand liquidity. Trade Futures up to 100x Leverage. Flash handling smoothly: 1. 100x leverage over majors (BTC, ETH, & SOL) 2. 200x leverage over forex & metals (stonks soon) 3. 20x leverage over JUP, PYTH, & JTO (highest onchain leverage available for these assets) While giving highest onchain yield on all your fav assets!

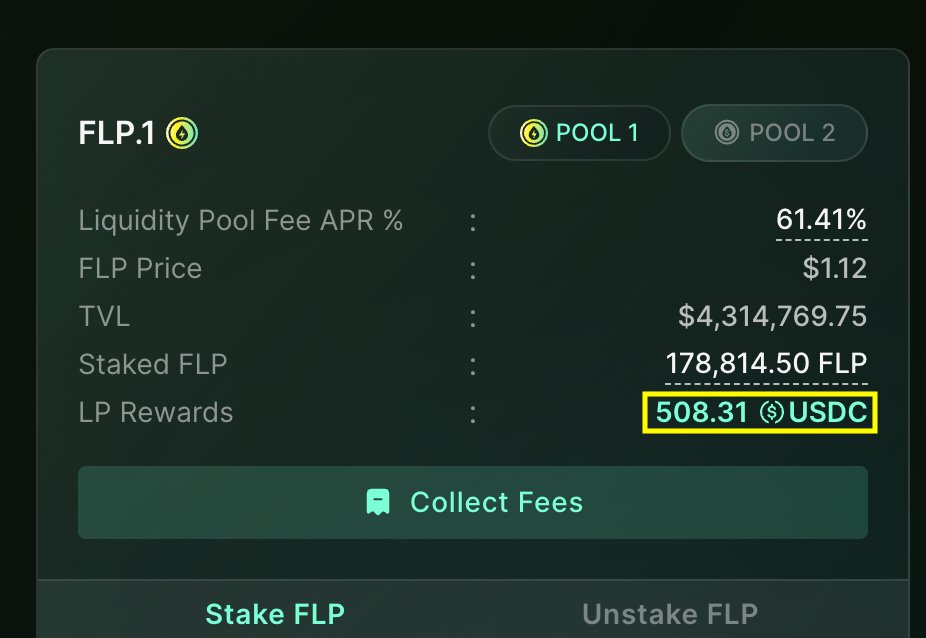

Flash Liquidity Pools (FLP’s) and $FLP.x tokens

Add liquidity and collect USDC , currently 80+ APR EARN HERE

Collect Beast NFTS to get added rewards

Aftermath Finance : SUI NETWORK

LP tokens may also be deposited into Farms to earn additional rewards, such as a collection’s corresponding meme coin. Farms can emit multiple tokens, allowing the issuance of coins which are freely tradeable for passive income, and others which are redeemable for equipables or dynamic upgrades.

The Sui Network is a great upcoming Block chain and one to keep an eye on. Many protocols are offering staking and lp incentives.

Recommended Trade Bot for Sui Network : Suiba BOT

Staking/New Protocol Investment:

Exploring Emerging Protocols

SUI LP staking, or staking liquidity provider tokens for the SUI protocol, represents an emerging opportunity for investors to earn passive income while supporting innovative blockchain protocols. By staking LP tokens, investors can participate in governance decisions and receive rewards in the form of additional tokens or fees generated by the protocol.

Investing in new protocols, such as SUI, via LP staking, presents both opportunities and challenges. While early adoption can yield significant returns, it also carries higher risks, including project failure or regulatory scrutiny. Thorough research and due diligence are paramount when considering investments in emerging protocols.

Some Staking/New Protocols Examples:

Vapor Dao – SUI NETWORK

Simply put, Vapor DAO an experimental Defi project on the Sui blockchain. The VAPOR currency is backed by a token treasury that is managed by the DAO. The DAO buys assets from investors (to be deposited in the Treasury) and issues VAPOR tokens to replace them.

Whenever the protocol has an excess of reserves per token (when the RFV of the treasury is higher than the assets needed to back VAPOR), the protocol will mint and distribute tokens to the stakers. The amount minted and distributed is controlled by a variable named the reward rate.

This is the % of supply that is rebased. This massively slows down how fast the protocol expands supply, as doing so is detrimental to the health (rapid expansion without backing causes a price collapse).

VAPOR and sVAPOR have an increasing conversion ratio, meaning that the redemption amount is based on an increasing ratio accrued through protocol rebase.

When a rebase occurs, the treasury deposits VAPOR into the distributor contract, which deposits it in the staking contract. Since there is now more VAPOR then there is sVAPOR, the sVAPOR is rebased to keep them in parity.

Stake Vapor HERE

Trader Joe : AVAX

- Buy and stake $JOE HERE to Claim your share of protocol revenue generated for passive income in USDC.

- A % fee is deducted from every swap and used to buy a stablecoin which is distributed to all sJOE stakers.

- Rewards are distributed every few days, and you can Harvest at any time.

LOOTBOT

Ethereum Passive Income and Airdrops

LootBot is a powerful and innovative full-suite on-chain terminal with a focus on streamlining your airdrop participation. With LootBot, you can securely & effortlessly discover, participate in, and track your airdrop farming journey across various all upcoming chains and protocols.

To be eligible for revenue sharing, users must hold at least 1,000 $LOOT or 1 $xLOOT in their wallet.

Epoch

In the context of $LOOT and $xLOOT rewards, an “Epoch” refers to a specific time cycle that occurs every 24 hours.

Before each Epoch, a snapshot of token holdings is taken to determine the distribution of rewards among participants. This regular time interval ensures a fair and consistent distribution of rewards over time.

Minimum Threshold

To claim rewards using your $LOOT and $xLOOT tokens, you need to meet a minimum threshold. This threshold is set at 0.1 ETH worth of accumulated unredeemed rewards. Once your unredeemed rewards reach or exceed this threshold, you become eligible to initiate the reward claiming process.

Distribution Ratio

- 2/3 of RevShare (66,7%) will be shared to both x$LOOT & $LOOT holder

- 1/3 of RevShare (33,3%) will be shared to x$LOOT holder only

These are only a few examples of passive income opportunities on the blockchain in these categories. Find a chain you like and search x for the right protocol for you.

In conclusion, passive income opportunities within the blockchain ecosystem offer investors a diverse array of strategies to grow their wealth and achieve financial independence. From automated trading bots to decentralized finance protocols, the blockchain provides fertile ground for innovation and experimentation in the pursuit of passive income. However, investors should approach these opportunities with caution, conducting thorough research and risk management to navigate the complexities of the blockchain landscape effectively. By embracing innovation and staying informed, investors can unlock the full potential of passive income on the blockchain.

![[ℕ𝕖𝕧𝕖𝕣] 𝕊𝕖𝕝𝕝 𝕐𝕠𝕦𝕣 𝔹𝕚𝕥𝕔𝕠𝕚𝕟 - Did This Poor Baby Make A Profit On The BTC He Sold?](https://cdn.bulbapp.io/frontend/images/255151e6-9e83-4151-9644-80af06e53b74/1)