Top cryptocurrencies to watch this week: SOL, BOME, SUI

Last week, top cryptocurrencies Solana (SOL), Book of Meme (BOME), and Sui (SUI) saw notable price shifts as the volatile cryptocurrency market reached a peak of $1.71 trillion before dropping to $1.54 trillion.

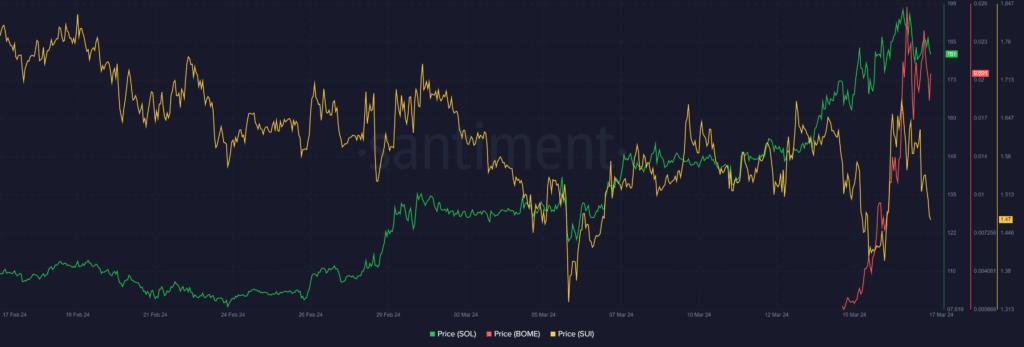

Last week, top cryptocurrencies Solana (SOL), Book of Meme (BOME), and Sui (SUI) saw notable price shifts as the volatile cryptocurrency market reached a peak of $1.71 trillion before dropping to $1.54 trillion. SOL, BOME and SUI prices – March 17 | Source: Santiment

SOL, BOME and SUI prices – March 17 | Source: Santiment

Solana up 32%

Solana recorded an impressive price surge last Monday, rallying 20.78% from March 11 to 14 amid four consecutive days of gains.

It surged to a high of $178 on March 14 before facing a mild retracement. This retracement spilled into the next day, with the asset dropping to $164.

Nonetheless, the cryptocurrency initiated a full-blown recovery to end March 15 above the $183 price territory, securing a spot among the top gainers.

Solana continued to attain greater heights amid sustained bullish momentum but witnessed a drop on March 16, finishing the day with a mild 1.03% loss.

The asset recovered the losses of March 16 the following day despite the persistent market drawdown which saw Bitcoin collapse below $65,000.

Solana is up 32% heading into this week, changing hands at $192 at the reporting time, as it looks to recover the much-coveted $200 psychological threshold.

BOME surges 29,900%

The recently launched Solana-based meme coin Book of Meme rode on a surge of interest to record the largest weekly rally the market has witnessed in a long while.

Data from CoinGecko indicates that BOME changed hands at $0.00005880 on March 14, the day it began trading.

The meme coin quickly garnered attention from market participants, leveraging the positive sentiments surrounding the Solana meme coin market. Amid the market interest, BOME capitalized on a surge in demand to skyrocket 9,814% to a high of $0.00583 on March 15 before witnessing a retracement.

As reported by crypto.news, data suggests that the meme coin’s successful pre-sale contributed to its meteoric surge. Its social presence saw a spike when Binance announced on March 16 that it plans to list the asset.

Bybit also disclosed similar plans.

You might also like:

CryptoQuant: US government holds 210k Bitcoins with $14.4b unrealized profit

BOME rallied to a high of $0.02703 on March 16, as investors pushed to ride on the uptrend. This price marked a massive 39,000 surge from its earliest trading price of $0.000005880, leading to an increase in its market cap.

This surge resulted in BOME securing a spot among the top 100 assets.

Despite a collapse from the $0.02703 shortly after the Binance listing, BOME still holds up well above the $0.017 price territory. The crypto asset is up 29,900% from the $0.00005880 price recorded on March 14, with a current market cap of $978 million.

SUI holds above $1.50

Sui did not perform as well as Solana and BOME this week, but it held up quite well against the shenanigans of the bears.

The asset began the week strong, rallying 9% from $1.5552 on March 11 to a high of $1.6970 on March 13, as the broader market recorded an upsurge.

However, Sui saw two days of intense bearish action, collapsing 8% on March 14 and 15. Sui eventually dropped below the pivotal $1.50 price territory, slumping to a 10-day low of $1.3396 on March 15.

Nonetheless, a recovery campaign stationed by the bears helped the cryptocurrency reclaim the $1.50 price territory, allowing it to soar to a new weekly high of $1.7200. This recovery push was short-lived, as Sui faced another price drop triggered by the bears.

Despite the latest bearish action, the crypto asset has held above the $1.50 territory, as a drop below this level could lead to steeper price declines.

Sui is down 1.71% for the week.

Read more:

Sam Bankman-Fried’s list of ‘random probably bad ideas’ included a Tucker Carlson Q&A

Sam Bankman-Fried, the disgraced founder of the collapsed FTX crypto exchange, seemingly intended to rehabilitate his image by appearing on Tucker Carlson’s show and criticizing the “woke agenda.”

Sam Bankman-Fried, the disgraced founder of the collapsed FTX crypto exchange, seemingly intended to rehabilitate his image by appearing on Tucker Carlson’s show and criticizing the “woke agenda.”

On March 15, a Google Document titled “random probably bad ideas” surfaced as part of Bankman-Fried’s prosecutors’ sentencing submission.

Bankman-Fried’s lawyers, meanwhile, are advocating for a 50-year prison sentence as opposed to the maximum sentence of 115 years in prison.

With a 50-year sentence, Bankman-Fried would be 82 years old at the time of release.

Noteworthy among the suggestions on Bankman-Fried’s list of “random” ideas was the proposal to sit for an interview with former Fox broadcaster Tucker Carlson and publicly declare his affiliation with the U.S. Republican political party.

Bankman-Fried intended to leverage this opportunity as a way to critique the bankruptcy lawyers overseeing FTX’s fraud case and to voice his dislike of the “woke agenda.”

Bankman-Fried never appeared on Carlson’s show, which Fox News canceled in 2023.

Per the leaked document, Bankman-Fried conveyed a stark assessment, stating, “Discuss how the consortium of attorneys is eroding value and sacrificing entrepreneurs to mask the ineptitude of legal practitioners.”

The document cautions that the ideas expressed therein are unverified and potentially flawed. Bankman-Fried articulated his views in one list entry, expressing a clear focus on restoring value to customers while condemning the Chapter 11 team’s actions as detrimental.

In another entry, he criticized the team’s incompetence in managing the FTX case, characterizing it as colonial and dominated by a cabal of lawyers.

Other entries highlighted his advocacy for crypto and freedom, as well as a desire to engage in debates, including with Matt Levine, a Bloomberg financial journalist, who critiqued the defense strategy as being overly complex and potentially ineffective.

Following Bankman-Fried’s indictment on seven counts of fraud and conspiracy in November 2022, he was convicted of embezzling $8 billion from clients of the now-defunct cryptocurrency exchange FTX.

Prosecutors pushed for a 50-year prison sentence and an $11 billion judgment, effectively labeling his fraud as one of the largest in history.

Since his incarceration, Bankman-Fried’s conduct has drawn scrutiny. Reports surfaced in February indicating his provision of cryptocurrency investment advice to prison guards at the Metropolitan Detention Center in Brooklyn, signaling a departure from his earlier prison activities, such as trading canned mackerels as currency.

You might also like:

FTX case unwinnable, says Sam Bankman-Fried’s lawyer

SBF’s future uncertain

Bankman-Fried’s sentencing is scheduled for March 28. He intends to appeal his conviction.

Prosecutors argue that his actions inflicted substantial financial harm on over a million victims, warranting a lengthy prison term.

On Feb. 28, Bankman-Fried’s lawyer advocated for a lenient sentence, emphasizing that most funds would be returned to the affected customers.

The lawyer, Marc Mukasey, suggested a prison term ranging between 5-1/4 and 6-1/2 years to U.S. District Judge Lewis Kaplan, who is scheduled to deliver the sentence on March 28.

Bankman-Fried’s psychiatrist and his Stanford law professor-parents, Joseph Bankman and Barbara Fried, also submitted letters of support stating that their son was uninterested in material wealth.

You might also like:

FTX brass spent more than $2.5m in customer funds on a luxury yacht

Bankman-Fried is a graduate of the Massachusetts Institute of Technology and worked at Wall Street before riding a boom in the values of digital assets such as Bitcoin (BTC).

His net worth — once estimated to be $16 billion — vanished when FTX filed for bankruptcy in November 2022 following a series of customer withdrawals.

The decision now lies with U.S. District Judge Lewis Kaplan, who is tasked with weighing the conflicting recommendations to determine the appropriate sentence.

This case underscores the intricacies of white-collar crime sentencing and the delicate balance between accountability, rehabilitation, and the impact of criminal actions on victims.

The outcome of this sentencing will undoubtedly reverberate throughout Bankman-Fried’s life and shape the broader legal landscape concerning financial crimes and crypto.

Read more:

Sam Bankman-Fried insider claims image of former FTX founder in jail is legit

Follow Us on Google News

Starbucks ends Odyssey NFT program, promises to ‘evolve’

Starbucks is closing its Odyssey Beta program, marking a significant transition away from blockchain rewards for the foreseeable future.

The Seattle-based company informed customers of Odyssey’s sunsetting through email and in an update on its FAQ page.

“The Starbucks Odyssey Beta must come to an end to prepare for what comes next as we continue to evolve the program,” the company stated.

Starbucks has announced that they will be sunsetting their Odyssey Beta Program and closing the Discord, with the program officially sunsetting March 31st

See the full announcement: pic.twitter.com/sfTlFV0luR

— The Nifty (@niftyportal) March 15, 2024

The program garnered widespread attention for its integration of blockchain technology with customer loyalty initiatives when it first launched in late 2022.

On March 31, it will officially end.

Members of the program have until March 25 to complete any outstanding activities and so-called “journeys” — a reward program of sorts where members could earn, buy, and trade non-fungible tokens (NFTs) stamps.

The first NFT collection was made up of 2,000 “Journey Stamps” and sold out within the first 20 minutes of hitting the market.

Details regarding how many jobs will now be cut are unclear.

In a heartfelt statement, the program’s community lead shared the personal impact of this decision, reflecting on the vibrant community built around Starbucks and the Odyssey program.

Sharing some very tough personal news – Starbucks has decided to sunset Odyssey. There’s a ton of uncertainty about my future now because I just lost my full-time job, but I'm doing my best to look at the positives.

I'm incredibly grateful for Starbucks and the opportunity they…

— Steve 🤙 (@NFTbark) March 15, 2024

Going by the handle @NFTbark, they expressed a mixture of gratitude and sorrow, thankful for the experiences gained during their tenure with Starbucks.

You might also like:

Book of Meme skyrockets 345% in 24 hours, Binance jumps on bandwagon

Despite the emotional attachment departing harder, @NFTbark shared an optimistic outlook on facing the uncertainty ahead while cherishing memories with Starbucks, like enjoying a cold brew and a birthday cake pop.

However, they made it clear that they would not be speaking on behalf of Starbucks or about the Starbucks Odyssey program further.

Starbucks: Stamps remain accessible via Nifty

Whether Starbucks lives up to its promise to “evolve” the program remains to be seen. The coffee retailer did pledge one final benefit to Odyssey members who have achieved Level 1 status or higher, which will be communicated via email by the end of March.

Furthermore, the fate of members’ accumulated points and Odyssey Stamps has been outlined. Points are set to expire with the program’s conclusion, with no additional benefit selection periods planned.

However, Odyssey Stamps will remain accessible through Nifty Gateway, and the Odyssey marketplace will transition to the Nifty marketplace, allowing for continued buying, selling, and transferring of stamps.

Stamps can be withdrawn to an external wallet for trading on other platforms. However, the dedicated Discord server for the Odyssey community will shut down on March 19, though the coffee retailer is exploring new ways to maintain community engagement.

Starbucks isn’t the only major corporation to pull the plug on its NFT programs. In October 2022, The Vault by CNN NFT marketplace project ended, as the media outlet ceased selling digital collectibles.

And in March 2023, Meta announced that it was “winding down” its work with NFTs on both Facebook and Instagram.

Read more:

El Salvador moves $386m worth of Bitcoin into cold storage

Amid BTC highs and XRP woes, Koala Coin presale thrives

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

The launch of Koala Coin’s presale introduces an interesting alternative amid Bitcoin’s record highs and Ripple’s ongoing challenges. Priced at $0.014, Koala Coin emerges with the promise of enriching the meme coin landscape.

The digital currency sector is witnessing notable activity with the introduction of Koala Coin (KLC), poised to enter the presale market. Priced at $0.014, Koala Coin aims to offer a new perspective within the meme coin category, potentially influencing the broader financial landscape.

Nestled among the tumultuous peaks and valleys shaped by industry stalwarts such as Bitcoin (BTC) and Ripple (XRP), Koala Coin aims to be the endearing new memecoin.

Koala Coin emerges as a value-driven utility

Koala Coin expects to become the beacon of internet culture and the alchemy of memes. Its infrastructure aims for swift transactions, minimal fees, and a sturdy blockchain backbone.

With its platform tailored for ease of use and its Koala Coin tokens embodying a deflationary approach, token holders are rewarded with governance privileges, staking perks, and a treasure trove of unique meme content.

You might also like:

Koala Coin presale sparks interest among investors

Bitcoin remains the unshakable titan

Continuing its reign as the pioneering cryptocurrency, Bitcoin upholds its supremacy in the market. Recently, Bitcoin clinched a new all-time high of $70,842.72.

Although Bitcoin has receded to $67,740 with a modest 7-day change at 0.19% increase and an astonishing 30-day leap of 29.51%, Bitcoin’s enduring value and growth underscore its foundational role in the volatile digital finance domain.

Ripple faces regulatory waves

Ripple (XRP), with its innovative real-time settlement system, navigates its unique challenges and achievements. Currently priced at $0.62, Ripple demonstrates resilience with a 7-day change of 0.39% and a 30-day increase of 17.54%.

Despite regulatory hurdles and market volatility, Ripple’s commitment to facilitating seamless global payments underscores its persistent relevance.

You might also like:

Ripple market cap soars; Polkadot rival attracts capital

Koala Coin draws attention

While Bitcoin exemplifies market fortitude and Ripple showcases international utility, Koala Coin offers a new proposition: joining a community that cherishes humor alongside fiscal prosperity.

The opportunity to participate in the early stages of Koala Coin’s presale presents a chance to be part of an ecosystem with potential for growth. Engaging in this phase allows individuals to contribute to the development of this new initiative.

Merging meme culture with advanced blockchain technology positions Koala Coin as a promising economic venture and a journey into a fun community engagement.

As Bitcoin continues its journey as a digital asset pioneer and Ripple navigates its regulatory challenges, Koala Coin presents a fresh and engaging alternative.

![[LIVE] Engage2Earn: auspol follower rush](https://cdn.bulbapp.io/frontend/images/c1a761de-5ce9-4e9b-b5b3-dc009e60bfa8/1)