XRP Starts Moving Earlier, Solana (SOL) Already Stronger Than Everyone Else; Does Ethereum (ETH) Nee

As of the latest trends, XRP has been testing the support level around $0.50, a crucial psychological threshold for the asset. A sustained move below this level could signal further bearish momentum, potentially leading the price to test the next significant support zone around $0.47.

XRP/USDT Chart by TradingViewOn the flip side, if XRP manages to stabilize and bounce back from the current support, the initial resistance is likely to be encountered near the $0.54 mark, where the 50-day moving average currently lies. This moving average has historically acted as a dynamic resistance level, and a breakout above could propel XRP toward the $0.56 level, which aligns with the 100-day moving average.

Further complicating the chart is the downward trendline that has been in play since the local high established in November. This trendline has repeatedly acted as resistance, pushing the price downward each time it has been tested. For a true reversal to be confirmed, XRP would need to break above this trendline with significant volume to validate the move.

Solana is leading pack

Solana is manifesting its strength as the top performer among the top 10 cryptocurrencies by market capitalization. Despite overall market volatility, SOL's price action has been signaling a stronger recovery compared to other assets.

At the time of analysis, Solana is trading around the $90 mark, having rebounded with considerable momentum from the support level near $78.35. This pivotal point, bolstered by the 100-day Exponential Moving Average (EMA), has served as a springboard for the recent bullish trend. The price of SOL has been consistently creating higher lows, indicative of strong buying interest at these levels.

Resistance for SOL is currently looming at the $100 psychological level, a breakthrough of which could propel the price toward the next significant resistance at $110.

The relative strength of Solana is further substantiated by the resurgence of a risk appetite on the market, particularly evidenced by the blossoming of meme coins. This renewed interest in higher-risk assets typically bodes well for ecosystems like Solana that support a variety of decentralized applications and niche crypto projects.

Ethereum needs push

The Ethereum market is currently facing a confluence of challenges as it searches for the momentum to sustain its position. A recent chart analysis reveals an indecisive atmosphere among investors, with Ethereum struggling to find a strong directional move.

At present, Ethereum is hovering around the $2,200 mark, a level that has seen significant activity and is currently acting as a temporary support. However, the lack of bullish conviction suggests that this support level may not hold if a new wave of selling pressure emerges.

Resistance levels are observed near the $2,400 range, where previous attempts to break higher have been met with a firm rejection, indicating a substantial barrier to upward movement.

The selling pressure is partly attributed to the recent news of Celsius Network liquidating approximately $1 billion worth of Ethereum holdings. This substantial amount has the potential to saturate the market, overwhelming current liquidity and triggering a downturn. As a result, the $2,000 psychological level is eyed as the next critical support zone, a breach of which could see a sharp decline toward the $1,950 region, where the 200-day moving average lies, providing stronger historical support.

On the flip side, if Ethereum can absorb the selling pressure and gain the necessary "fuel," a push above the $2,400 resistance could open the path toward the $2,500 area before challenging the more formidable resistance at $2,600, which aligns with the 50-day moving average.

Bitcoin as legal tender in El Salvador and the CAR: key lessons

Analysis of El Salvador and the Central African Republic’s experiences with Bitcoin adoption showed mixed outcomes. Which countries could be next?

Blending crypto with the mainstream, El Salvador became the first country to adopt Bitcoin (BTC) as legal tender in Sep. 2021, a decision announced by President Nayib Bukele at the Bitcoin 2021 conference in Miami.

This historic decision was made to address economic challenges and leverage the growing trend of digital currencies.

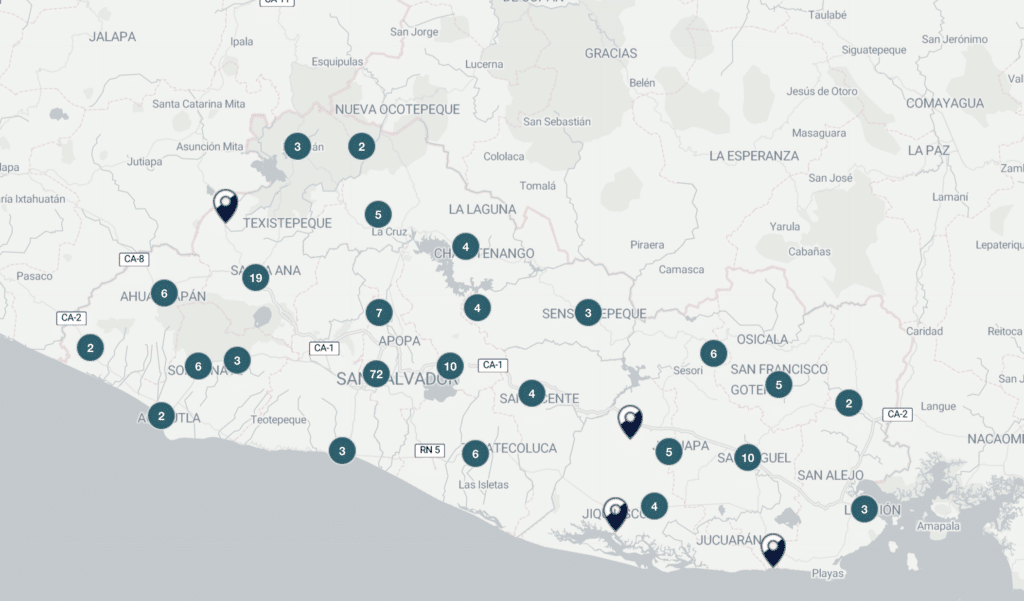

However, the rollout was marred by various operational and regulatory challenges, including issues with the government’s digital crypto wallet, Chivo Wallet, and skepticism from the public and international financial experts. Chivo ATMs installed in El Salvador | Source: CoinATMradar

Chivo ATMs installed in El Salvador | Source: CoinATMradar

El Salvador’s economy, already strained by the COVID-19 pandemic, faced increased scrutiny and uncertainty with the adoption of Bitcoin, leading to volatility in its sovereign debt ratings.

Following suit, the Central African Republic (CAR) adopted Bitcoin as an official currency in Apr. 2022, becoming the first African country and the second globally to do so.

Despite its abundant natural resources, the CAR is one of the least-developed countries, with ongoing challenges related to rebel violence. The adoption, unanimously approved by its parliament, sparked both concerns and excitement.

Experts and international bodies like the IMF cautioned against the move, emphasizing the necessity of a legislative and governance framework.

Where do these countries stand today? Let’s explore the current situation in these nations and which countries could be next in line to adopt BTC as a legal tender.

BTC in El Salvador: mixed outcomes

El Salvador’s adoption of Bitcoin as legal tender, marked by the launch of the Chivo Wallet, reveals a complex, multifaceted scenario.

A recently published study by Yale researchers highlights key insights into the Salvadoran population’s engagement with Bitcoin and Chivo Wallet.

Despite significant awareness and initial adoption (68% aware, 78% of those attempting to download the app), the actual utilization paints a different picture.

The study found that incentives like a $30 Bitcoin bonus and transaction fee waivers weren’t sufficient to sustain app usage. Nearly 20% of people who downloaded Chivo Wallet hadn’t used their bonus, and most stopped using the app after spending it.

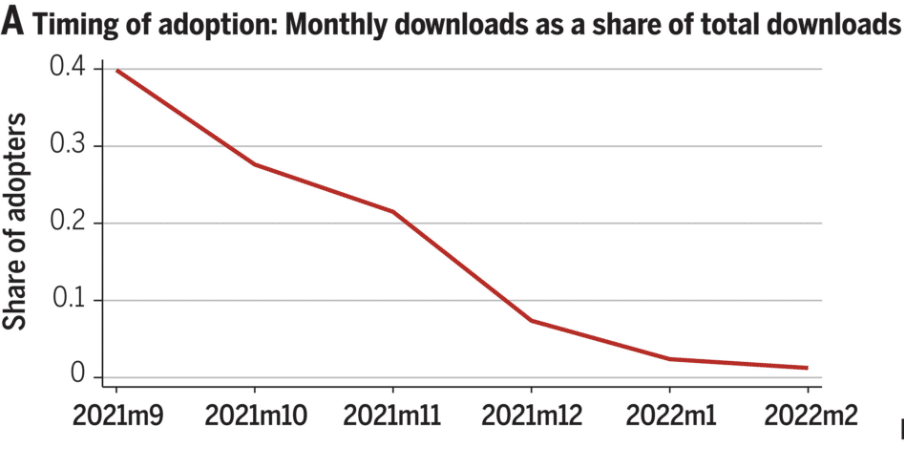

Moreover, over 20% knew about the app but chose not to download it, citing trust issues and a preference for the anonymity provided by cash. Monthly downloads of Chivo Wallet | Source: Science.org

Monthly downloads of Chivo Wallet | Source: Science.org

These findings suggest a reluctance among Salvadorans to fully embrace digital currency, contrary to the government’s expectations.

The lack of anonymity with digital currencies compared to cash appears to be a significant deterrent. Furthermore, blockchain data corroborates this trend, showing a peak in transactions around Bitcoin’s adoption, followed by a significant decrease.

You might also like: BTC predictions roundup: How much can BTC surge post Bitcoin ETF approval?

Meanwhile, the policy’s broader implications and effectiveness remain debated. Mónica Taher, a former Salvadoran official, argues that it’s premature to label the Bitcoin policy as a failure, anticipating long-term benefits and a potential domino effect on the traditional monetary system.

On the other hand, digital activist Mario Gómez, who faced legal challenges for his opposition to BTC as a legal tender, suggests that the policy might be more about providing a safe haven for cryptocurrency firms against international regulation, noting the involvement of major crypto operators like Bitfinex and Binance in El Salvador.

Amid this, President Bukele’s narrative positions Bitcoin as a symbol of economic freedom and a rebranding tool for the country.

However, this contrasts with concerns over other types of freedom, especially following the government’s authoritarian measures against gangs, resulting in numerous detentions without due process.

Hence, while BTC has helped achieve some level of rebranding for El Salvador, the lack of widespread and sustained public adoption, coupled with international skepticism, presents a mixed and questionable picture of the current state of affairs.

CAR’s crypto U-turn

In Apr. 2022, the CAR became the first African nation to adopt Bitcoin as legal tender, echoing El Salvador’s earlier decision.

This bold move was part of a “visionary plan” to tokenize land and natural resources through the country’s blockchain project, Sango.

The government aimed to leverage digital currencies as financial tools to unlock new opportunities in a country rich in minerals but plagued by economic instability and political violence.

The decision initially stirred excitement among Bitcoin enthusiasts globally, who saw this as another testbed for the cryptocurrency’s adoption. However, the CAR’s context significantly differed from ideal test conditions.

The country faced severe infrastructural challenges, including a 90% lack of internet access among its citizens, a critical barrier to adopting any digital currency.

Moreover, the project faced regulatory hurdles. Shortly after making Bitcoin legal tender, the Banking Commission of Central Africa (COBAC) reminded the government of its existing ban on crypto.

You might also like: Crypto vs. traditional finance: what investments performed better in 2023

Observers also speculated on the geopolitical motives behind the CAR’s crypto interest, suggesting it was a strategy to deepen ties with Russia and potentially circumvent sanctions.

As a result, CAR reversed its decision in Mar. 2023. The reversal was likely influenced by multiple factors, including the practical challenges of poor infrastructure, low internet penetration, and a general lack of understanding about Bitcoin among the populace.

However, the most significant obstacle was perhaps a lack of public trust, exacerbated by unfulfilled political promises from the same politicians who failed to deliver earlier.

Which countries could be next to adopt BTC?

As the world evaluates the potential of Bitcoin as a legal tender, several countries, particularly in Latin America, are showing interest in this possibility.

Panama and Mexico are among the nations that could be considering the adoption of Bitcoin as legal tender.

In 2021, Panama’s congressman, Gabriel Silva, proposed a draft law aimed at officially recognizing specific cryptocurrencies. Fast forward to April 2022, the national assembly gave its initial approval. This legislative move intended to open the door for various cryptocurrencies, including Bitcoin, to be accepted for “taxes, fees, and other tributary obligations.”

*Traducido a inglés*

Today we proposed The Crypto Law. We want Panama to be compatible with blockchain, cryptoassets, and the internet.

This has the potential to creat jobs, attract investment and bring transparency

English version of the project: https://t.co/Gg3PZa3Fbl https://t.co/dhhmtWCaTJ pic.twitter.com/jBHLRT9qWW

— Gabriel Silva (@gabrielsilva8_7) September 7, 2021

Despite the hopeful strides, in July 2023, Panama’s supreme court struck down the proposed law.

In Mexico, Senator Indira Kempis has been spearheading discussions around the potential adoption of Bitcoin as a legal tender. In 2022, she proposed a bill to officially recognize Bitcoin as a valid form of payment in the country. This legislative effort aims to tackle the issues of limited access to financial products and education faced by many Mexican citizens.

However, so far, the bill faces resistance from established financial institutions.

This trend of adopting Bitcoin as legal is fueled by various factors, including hyperinflation in some economies and the limitations of fiat currencies, which are often subject to government performance and policy effectiveness.

Bitcoin’s appeal lies in its resistance to inflation, efficiency as a transaction medium, and accessibility, especially in regions with a high number of unbanked individuals.

However, challenges such as Bitcoin’s volatility, technical complexity, and reliance on internet connectivity remain significant hurdles.

The future of Bitcoin as a widespread legal tender is still uncertain, but the interest and consideration it has garnered indicate a growing recognition of its potential in the global economy.

Read more: How crypto becomes a big player in the 2024 presidential elections

![[LIVE] Engage2Earn: McEwen boost for Rob Mitchell](https://cdn.bulbapp.io/frontend/images/c798d46f-d3b8-4a66-bf48-7e1ef50b4338/1)

![[ℕ𝕖𝕧𝕖𝕣] 𝕊𝕖𝕝𝕝 𝕐𝕠𝕦𝕣 𝔹𝕚𝕥𝕔𝕠𝕚𝕟 - And Now What.... Pray To The God Of Hopium?](https://cdn.bulbapp.io/frontend/images/79e7827b-c644-4853-b048-a9601a8a8da7/1)