As Bitcoin’s Consolidation Continues, Crypto Analyst Compares BTC’s Movements to Previous Cycles

With Bitcoin (BTC) falling nearly 7% in the last week, one widely followed crypto analyst believes the correction is all part of the process.

Digital assets trader Michaël van de Poppe tells his 705,000 followers on the social media platform X that BTC’s downward trend may be a result of a pre-halving peak.

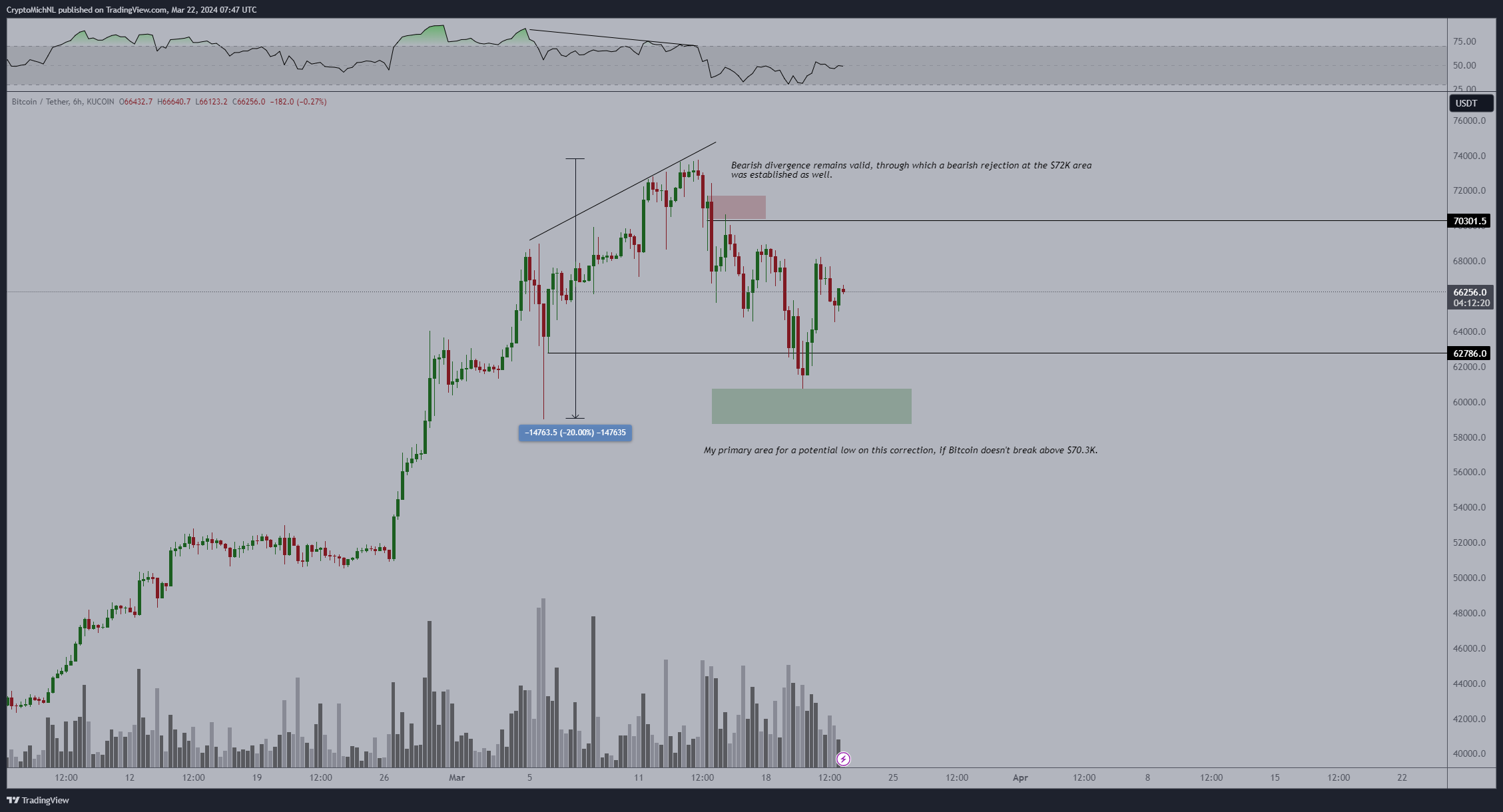

“The consolidation on Bitcoin continues.

I don’t think we’ll see much spectacle coming from Bitcoin; if we do, it will need to break $70,300.

Above, there is time for new all-time highs, but I suspect we’re still seeing the case of peaking pre-halving.

Just like any other cycle.”

The BTC halving refers to the quadrennial event when Bitcoin’s mining rewards are cut in half. The next halving is expected next month.

According to the analyst, BTC’s current price chart is similar to the 2016-2017 cycle chart.

“In some way, the price action of Bitcoin is comparable to the 2016-2017 cycle.

Peak four weeks before the halving takes place.

Consolidation and another correction, after which a slow upward grind happens until acceleration 6 months later.”

Van de Poppe also claims that BTC’s correction only strengthens his bullish thesis.

“Bitcoin still correcting down.

My main thesis is that we’ve seen the pre-halving hype and that we’re going to have a long, massive bull market.

Anything in the lower boundaries -> buy opportunity.

Interested in buying dips on altcoins too.”

With Bitcoin (BTC) falling nearly 7% in the last week, one widely followed crypto analyst believes the correction is all part of the process.

Digital assets trader Michaël van de Poppe tells his 705,000 followers on the social media platform X that BTC’s downward trend may be a result of a pre-halving peak.

“The consolidation on Bitcoin continues.

I don’t think we’ll see much spectacle coming from Bitcoin; if we do, it will need to break $70,300.

Above, there is time for new all-time highs, but I suspect we’re still seeing the case of peaking pre-halving.

Just like any other cycle.”

The BTC halving refers to the quadrennial event when Bitcoin’s mining rewards are cut in half. The next halving is expected next month.

According to the analyst, BTC’s current price chart is similar to the 2016-2017 cycle chart.

“In some way, the price action of Bitcoin is comparable to the 2016-2017 cycle.

Peak four weeks before the halving takes place.

Consolidation and another correction, after which a slow upward grind happens until acceleration 6 months later.”

Van de Poppe also claims that BTC’s correction only strengthens his bullish thesis.

“Bitcoin still correcting down.

My main thesis is that we’ve seen the pre-halving hype and that we’re going to have a long, massive bull market.

Anything in the lower boundaries -> buy opportunity.

Interested in buying dips on altcoins too.”

With Bitcoin (BTC) falling nearly 7% in the last week, one widely followed crypto analyst believes the correction is all part of the process.

Digital assets trader Michaël van de Poppe tells his 705,000 followers on the social media platform X that BTC’s downward trend may be a result of a pre-halving peak.

“The consolidation on Bitcoin continues.

I don’t think we’ll see much spectacle coming from Bitcoin; if we do, it will need to break $70,300.

Above, there is time for new all-time highs, but I suspect we’re still seeing the case of peaking pre-halving.

Just like any other cycle.”

The BTC halving refers to the quadrennial event when Bitcoin’s mining rewards are cut in half. The next halving is expected next month.

According to the analyst, BTC’s current price chart is similar to the 2016-2017 cycle chart.

“In some way, the price action of Bitcoin is comparable to the 2016-2017 cycle.

Peak four weeks before the halving takes place.

Consolidation and another correction, after which a slow upward grind happens until acceleration 6 months later.”

Van de Poppe also claims that BTC’s correction only strengthens his bullish thesis.

“Bitcoin still correcting down.

My main thesis is that we’ve seen the pre-halving hype and that we’re going to have a long, massive bull market.

Anything in the lower boundaries -> buy opportunity.

Interested in buying dips on altcoins too.”

With Bitcoin (BTC) falling nearly 7% in the last week, one widely followed crypto analyst believes the correction is all part of the process.

Digital assets trader Michaël van de Poppe tells his 705,000 followers on the social media platform X that BTC’s downward trend may be a result of a pre-halving peak.

“The consolidation on Bitcoin continues.

I don’t think we’ll see much spectacle coming from Bitcoin; if we do, it will need to break $70,300.

Above, there is time for new all-time highs, but I suspect we’re still seeing the case of peaking pre-halving.

Just like any other cycle.”

The BTC halving refers to the quadrennial event when Bitcoin’s mining rewards are cut in half. The next halving is expected next month.

According to the analyst, BTC’s current price chart is similar to the 2016-2017 cycle chart.

“In some way, the price action of Bitcoin is comparable to the 2016-2017 cycle.

Peak four weeks before the halving takes place.

Consolidation and another correction, after which a slow upward grind happens until acceleration 6 months later.”

Van de Poppe also claims that BTC’s correction only strengthens his bullish thesis.

“Bitcoin still correcting down.

My main thesis is that we’ve seen the pre-halving hype and that we’re going to have a long, massive bull market.

Anything in the lower boundaries -> buy opportunity.

Interested in buying dips on altcoins too.”

With Bitcoin (BTC) falling nearly 7% in the last week, one widely followed crypto analyst believes the correction is all part of the process.

Digital assets trader Michaël van de Poppe tells his 705,000 followers on the social media platform X that BTC’s downward trend may be a result of a pre-halving peak.

“The consolidation on Bitcoin continues.

I don’t think we’ll see much spectacle coming from Bitcoin; if we do, it will need to break $70,300.

Above, there is time for new all-time highs, but I suspect we’re still seeing the case of peaking pre-halving.

Just like any other cycle.”

The BTC halving refers to the quadrennial event when Bitcoin’s mining rewards are cut in half. The next halving is expected next month.

According to the analyst, BTC’s current price chart is similar to the 2016-2017 cycle chart.

“In some way, the price action of Bitcoin is comparable to the 2016-2017 cycle.

Peak four weeks before the halving takes place.

Consolidation and another correction, after which a slow upward grind happens until acceleration 6 months later.”

Van de Poppe also claims that BTC’s correction only strengthens his bullish thesis.

“Bitcoin still correcting down.

My main thesis is that we’ve seen the pre-halving hype and that we’re going to have a long, massive bull market.

Anything in the lower boundaries -> buy opportunity.

Interested in buying dips on altcoins too.”

With Bitcoin (BTC) falling nearly 7% in the last week, one widely followed crypto analyst believes the correction is all part of the process.

Digital assets trader Michaël van de Poppe tells his 705,000 followers on the social media platform X that BTC’s downward trend may be a result of a pre-halving peak.

“The consolidation on Bitcoin continues.

I don’t think we’ll see much spectacle coming from Bitcoin; if we do, it will need to break $70,300.

Above, there is time for new all-time highs, but I suspect we’re still seeing the case of peaking pre-halving.

Just like any other cycle.”

The BTC halving refers to the quadrennial event when Bitcoin’s mining rewards are cut in half. The next halving is expected next month.

According to the analyst, BTC’s current price chart is similar to the 2016-2017 cycle chart.

“In some way, the price action of Bitcoin is comparable to the 2016-2017 cycle.

Peak four weeks before the halving takes place.

Consolidation and another correction, after which a slow upward grind happens until acceleration 6 months later.”

Van de Poppe also claims that BTC’s correction only strengthens his bullish thesis.

“Bitcoin still correcting down.

My main thesis is that we’ve seen the pre-halving hype and that we’re going to have a long, massive bull market.

Anything in the lower boundaries -> buy opportunity.

Interested in buying dips on altcoins too.”

With Bitcoin (BTC) falling nearly 7% in the last week, one widely followed crypto analyst believes the correction is all part of the process.

Digital assets trader Michaël van de Poppe tells his 705,000 followers on the social media platform X that BTC’s downward trend may be a result of a pre-halving peak.

“The consolidation on Bitcoin continues.

I don’t think we’ll see much spectacle coming from Bitcoin; if we do, it will need to break $70,300.

Above, there is time for new all-time highs, but I suspect we’re still seeing the case of peaking pre-halving.

Just like any other cycle.”

The BTC halving refers to the quadrennial event when Bitcoin’s mining rewards are cut in half. The next halving is expected next month.

According to the analyst, BTC’s current price chart is similar to the 2016-2017 cycle chart.

“In some way, the price action of Bitcoin is comparable to the 2016-2017 cycle.

Peak four weeks before the halving takes place.

Consolidation and another correction, after which a slow upward grind happens until acceleration 6 months later.”

Van de Poppe also claims that BTC’s correction only strengthens his bullish thesis.

“Bitcoin still correcting down.

My main thesis is that we’ve seen the pre-halving hype and that we’re going to have a long, massive bull market.

Anything in the lower boundaries -> buy opportunity.

Interested in buying dips on altcoins too.”

![[ℕ𝕖𝕧𝕖𝕣] 𝕊𝕖𝕝𝕝 𝕐𝕠𝕦𝕣 𝔹𝕚𝕥𝕔𝕠𝕚𝕟 - OM(G) , My Biggest Bag Was A Scam????](https://cdn.bulbapp.io/frontend/images/99de9393-38a8-4e51-a7ab-a2b2c28785bd/1)