ezETH loses peg: What's happening with Renzo Protocol

Renzo is the next project on Binance Launchpool. However, after announcing tokenomics, the project encountered a wave of criticism from the community.

A quick overview of Renzo

Renzo is a cross-chain staking project built on the EigenLayer platform. The project allows users to participate in retake ETH on many chains of Ethereum, Arbitrum, Linea... to receive ezETH. Holding ezETH will help users receive reward points and project tokens in the future.

On February 22, 2024, Renzo Protocol received an undisclosed amount of investment from Binance Labs. On April 23, 2024, Binance Launchpool continued to announce Renzo as the 53rd project on the platform.

Controversy over Renzo tokenomics

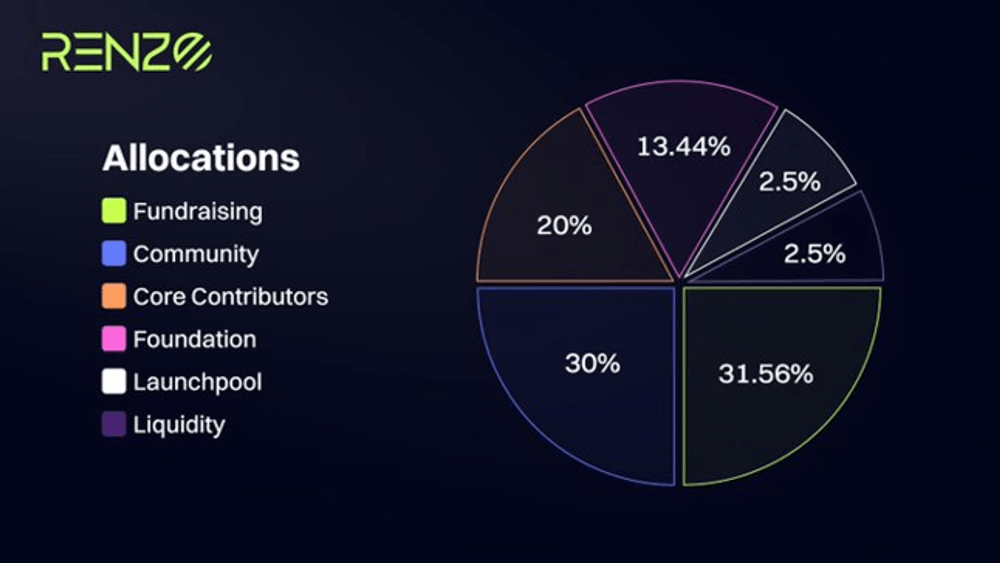

Soon after, Renzo launched tokenomics and information related to the REZ token. The project information released has encountered a lot of controversy from the community. Accordingly, Renzo announced about the REZ token:

- 31.56% is for capital raising

- 30% community reward allocation, of which 5% will be reserved for Airdrop Campaign season 1.

- 20% to key contributors

- 13.44% for Foundation

- 2.5% for Launchpool

- 2.5% is for liquidity creation

Total supply is 10,000,000,000

The initial total supply is 1,050,000,000

After tokenomics was launched, the project received a wave of criticism from the community for the following reasons:

first.

The 2 illustration parts of 2.5% are exaggerated to be equal to the 20% of Core Contributors, the 62% parts of Fundraising and Community only take up half of the image, creating a feeling of deceiving the community.

2.

Token Allocation is unreasonable when the project team is said to be able to hold up to 95% of the total supply. Only 5% from Lauchpool and Liquidity is reserved for the community.

3.

Users who participate in staking on Renzo early will only receive a 5% airdrop. Previously, the project mentioned that the airdrop portion was only 5% of 30% (ie 1.5%), this airdrop number is much smaller than expected from the community, In fact, it is less than the share for Binance Launchpool and has to be shared with other NFT projects (Milady & SchizoPosters) that are not really related to the project.

4.

Users can only claim REZ on May 2, 2024, 2 days after TGE, this is considered an unusual point for the project to be ahead of users.

5.

The project does not allow reverse redemption from ezETH to ETH, users can only swap ETH back through pools on DEX.

Renzo depeg's ezETH consequence

The frustration after receiving information about tokenomics caused a group of users to no longer want to hold ezETH and sell ezETH on a large scale. This immediately caused ezETH to lose peg relative to ETH.

Users who used the ezETH lending strategy as collateral to borrow out restaking ETH to create a loop were immediately affected. This strategy is theoretically quite safe as ezETH and ETH fluctuate in the same direction.

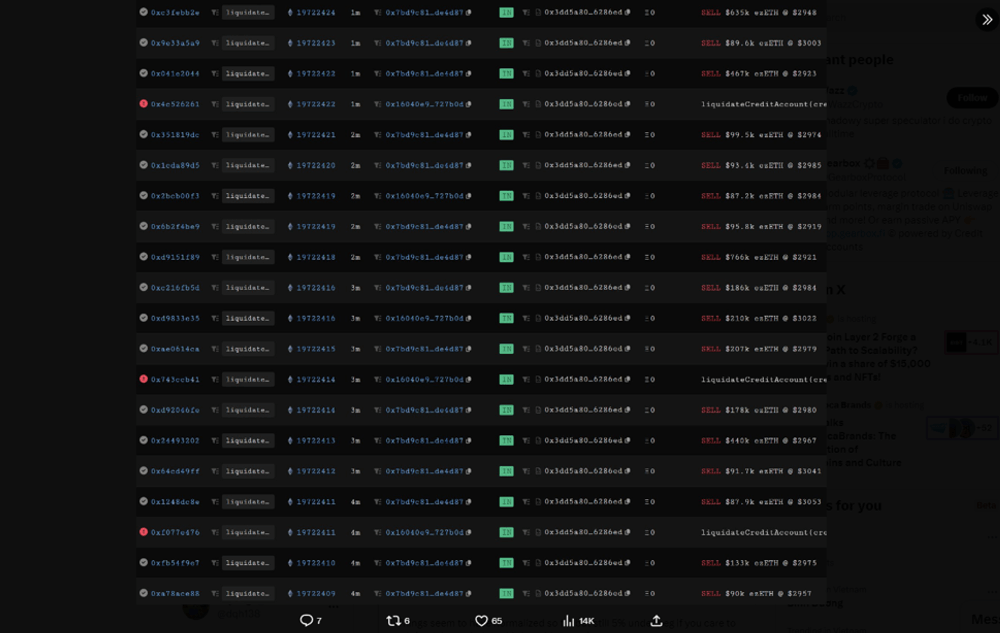

However, the above event caused the peg ezETH to decrease compared to ETH, increasing the Loan to Value of the loan and causing a group of users to be liquidated on Lending platforms.

Price difference between ezETH and ETH on Uniswap.

At the most stressful time, the price of ezETH dropped 20% to 2700 USD compared to ETH, causing users using leverage lending strategies on some platforms Gearbox, Morpho... to liquidate their assets. There was about 340 million USD of ezETH liquidated in the recent depeg, this is a group of users using 4-5x leverage or more.

Liquidate ezETH on Gearbox.

Although this also creates opportunities for ezETH arbitrage traders on different blockchains, Blast's Thruster is a project with stable ezETH-ETH liquidity and users are already using this pool and a few DEXs on other chains for arbitrage. This also contributed to the price of ezETH returning to the correct peg.

To ease the situation, Renzo added a condition for receiving the airdrop: not selling ezETH before the end of Season 1 (April 26, 2024), Campaign Season 2 will begin immediately after.

Lessons for other projects

Renzo's TGE event was not as successful as expected and left a bad impression. Other Liquid staking projects should take this case as a model to learn from:

Make sure the redeem feature is allowed before the airdrop, then users will have a high need to withdraw capital.

Ensuring the ability to transfer assets between chains, this will help arbitrage capital flows keep peg.

Consider using a portion of TVL as ETH to ensure peg.

Even though LRT projects allow redemption, they still need to consider the risk of depeg due to liquidity on DEX.

Allowing the use of LRT as collateral means allowing the use of leverage. When this group faces liquidation risk, the risk of a sell-off and loss of peg is quite high.

Projects should consider when designing tokens, properly awarding rewards to the project's users.

Conclusion

Renzo had a not very successful launch when it was unpopular with the community, the project had a few small updates in response to the above situation. Currently, related projects are still in the process of statistics and ensuring risk management, in case of bad debt caused by the depeg situation.

![[LIVE] Engage2Earn: Save our PBS from Trump](https://cdn.bulbapp.io/frontend/images/c23a1a05-c831-4c66-a1d1-96b700ef0450/1)

![[ℕ𝕖𝕧𝕖𝕣] 𝕊𝕖𝕝𝕝 𝕐𝕠𝕦𝕣 𝔹𝕚𝕥𝕔𝕠𝕚𝕟 - And Now What.... Pray To The God Of Hopium?](https://cdn.bulbapp.io/frontend/images/79e7827b-c644-4853-b048-a9601a8a8da7/1)