Blast Review and Airdrop

Blast Review and Airdrop

Blast is the only Ethereum L2 that provides native returns for ETH and stablecoins. Blast yield comes from ETH staking and RWA protocols. Revenue generated from these decentralized protocols is automatically transferred back to Blast users. The default interest rate on other L2s is 0%. On Blast, this rate is 4% for ETH and 5% for stablecoins. So what exactly is Blast, how to use it, how does it work, adding metamask ?

What is Blast?

Blast is an EVM-compatible, optimistic rollup that increases underlying yield for users and developers without changing the experience crypto natives have come to expect.

After the merger , Ethereum provides a 4% return on ETH. On-chain T-Bill protocols provide 5% returns on stablecoins. If users fail to meet or exceed these rates, they lose money due to some form of inflation.

L2s today do not have this efficiency. Naturally combining ETH and stablecoin yield requires a new L2 designed from scratch. This yield makes it possible to create new business models for Dapps that are not possible in other L2s.

How Does Blast Work?

ETH itself, not WETH, STETH or any other ERC20, is inherently L2 based. For EOAs, the ETH balance is automatically rebased. Smart contracts can be involved in this rebasing, making it easier to deploy existing Dapps on Blast without any changes.

Blast's native stablecoin, USDB, is also automatically rebased. Like ETH on Blast, USDB automatically rebases for EOAs. USDB also automatically rebases for smart contracts. Smart contracts can opt out of this reclassification.

L1 Staking

Blast was only possible after Ethereum's Shanghai upgrade . The ETH yield from staking L1, originally Lido, is automatically transferred to users through rebasing ETH in L2. In the future, the Blast community will have the power to complement or even completely replace Lido Blast's native solutions or other third-party protocols.

T-Invoice Return

Users who bridge stablecoins receive USDB, Blast's automatically rebased stablecoin. USDB yield comes from MakerDAO's on-chain T-Bill protocol. USDB can be converted to USDC while bridging back to Ethereum. In the future, the Blast community will have the power to complement or even completely replace MakerDAO with Blast native solutions or other third-party protocols.

Gas Revenue Sharing

Other L2s keep the revenue from gas fees for themselves. Blast returns net gas revenue back to Dapps programmatically. Dapps developers can keep this revenue for themselves or use it to subsidize users' gas fees.

How to Use Blast? (Blast Usage)

Blast Mainnet can be added as a private network to any EVM-compatible wallet (e.g. MetaMask ) .

To add Blast Mainnet as a private network to MetaMask:

- Go to Blast Explorer at blastscan.io .

- Scroll down and click the Add Blast Mainnet button in the footer .

- Confirm adding the network to the MetaMask prompt that opens.

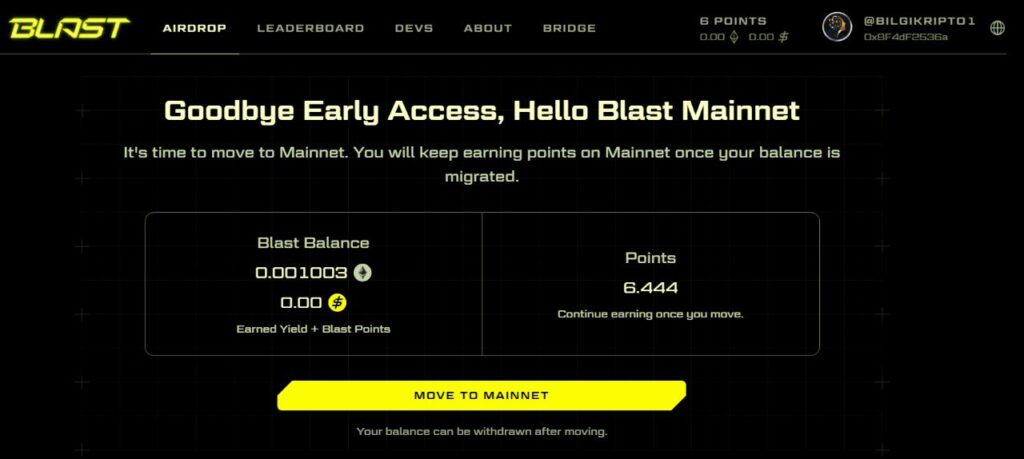

Blast Airdrop

50% of the Blast Airdrop is allocated to Blast Points. Your wallet will automatically earn Points with each block based on your ETH/WETH/USDB balance. This is reflected in real-time in your Blast.io Airdrop dashboard.