Binance Users Deposit $24.6 Billion in Crypto to Exchange in 2024

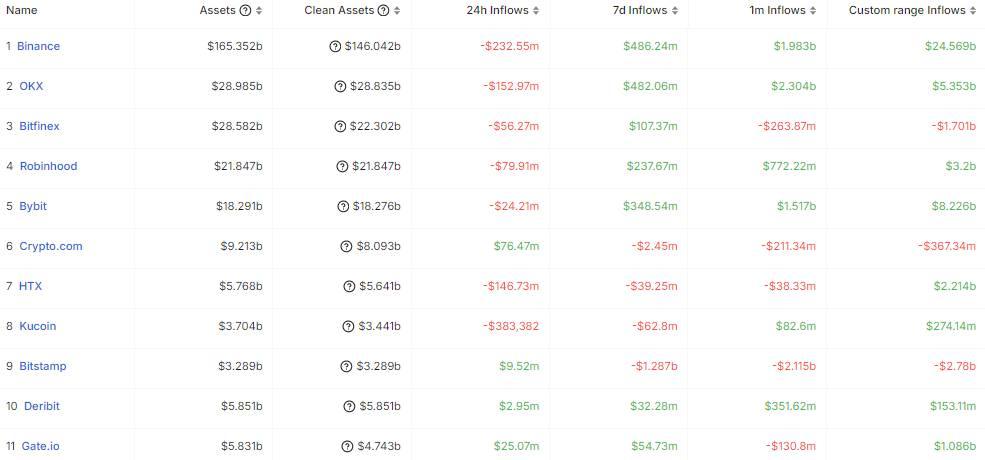

The amount of deposits and assets held on Binance are both higher than the next 10 exchanges combined.

Binance Dominates in User Assets

According to data from DefiLlama, from January 1, 2024 to early December 2024, Binance recorded a surge in the amount of crypto assets deposited by users, thereby continuing to maintain its leading position.

Specifically, in 2024, investors deposited nearly $24.6 billion in cryptocurrencies to Binance, up to 40% higher than the total deposits to the next 10 platforms combined.

Binance also revealed that the average Bitcoin deposit value of users has increased from 0.36 BTC to 1.65 BTC, while the average USDT deposit value has increased from 19,600 USD to 230,000 USD.

The amount of assets of users on Binance is currently 165 billion USD, also higher than the total of the 10 exchanges ranked below combined.

Also in 2024, Binance recorded another major milestone of reaching a total cumulative trading volume of 100 trillion USD after only 8 years of operation. The number of global users of the exchange also increased from 170 million at the end of 2023 to 250 million users at present, equivalent to 47%.

The exchange representative commented that this is a sign that Binance is gradually becoming a trading location trusted by large investors and financial institutions. The biggest catalyst of the year was undoubtedly the emergence of Bitcoin ETFs in the US, opening the crypto floodgates to Wall Street investors, who bought up to 500,000 BTC in the past 11 months, bringing their holdings to over 1.1 million BTC (more than Satoshi), helping push Bitcoin past its historic $100,000 mark earlier this December.

Binance Market Share Recovers from 4-Year Low

As previously reported, Binance’s market share of spot and futures trading volume in September 2024 fell to a four-year low, with other platforms gaining ground.

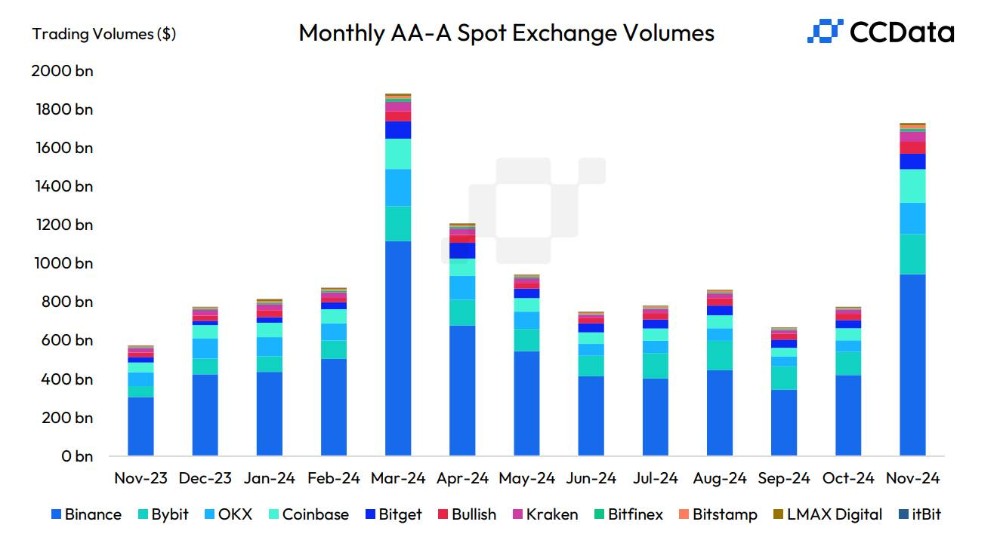

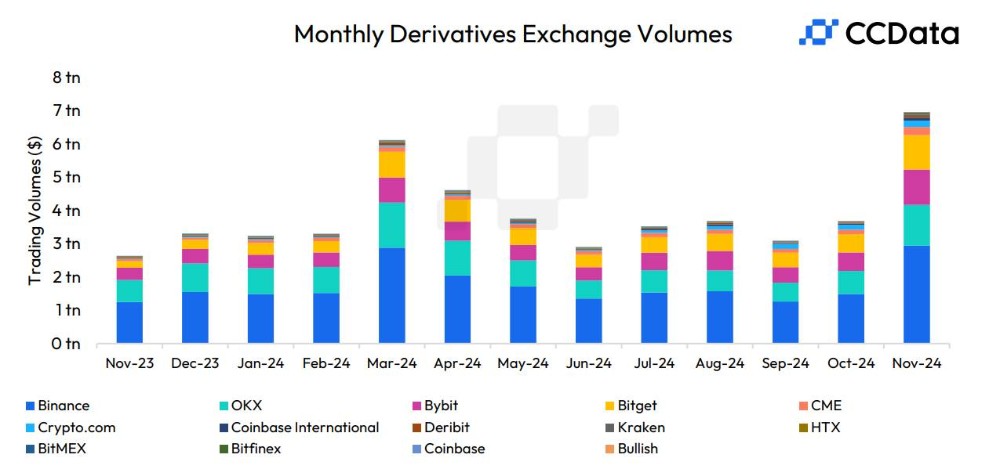

However, by November, Binance had seen a strong recovery and maintained its position as the top exchange by asset turnover, with November spot volume up 124% to $944 billion, while futures volume increased 98% to $2.95 trillion. The exchange’s spot and futures volume market share was 54.5% and 42.2%, respectively.

CCData data added that the entire crypto industry set a record for derivatives volume in November, with $6.99 trillion traded. The total spot trading volume last month was $3.43 trillion, surpassing March 2024’s $2.9 trillion to become the second-best performance on record, behind only May 2021.

![[ℕ𝕖𝕧𝕖𝕣] 𝕊𝕖𝕝𝕝 𝕐𝕠𝕦𝕣 𝔹𝕚𝕥𝕔𝕠𝕚𝕟 - OM(G) , My Biggest Bag Was A Scam????](https://cdn.bulbapp.io/frontend/images/99de9393-38a8-4e51-a7ab-a2b2c28785bd/1)

![Nekodex – Earn 20K+ NekoCoin ($20) [Highly Suggested]](https://cdn.bulbapp.io/frontend/images/b4f0a940-f27c-4168-8aaf-42f2974a82f0/1)