"Bitcoin's Vanguard: BlackRock's Ambitious Leap Beyond ETFs"

Cryptocurrency Market Impact - Analyzing BlackRock's Bitcoin ETF and its Potential Influence

BlackRock's entry into the Bitcoin ETF arena has sent ripples through the cryptocurrency market. As the world's largest asset manager, their move holds the potential to reshape the dynamics of digital assets. This analysis delves into the specifics of BlackRock's Bitcoin ETF, exploring its features, implications for market liquidity, and the subsequent reactions from both retail and institutional investors.

Examining the fund's structure and investment strategy, we aim to decipher how BlackRock's involvement could impact the valuation and adoption of Bitcoin. Additionally, this piece investigates the broader effects on other cryptocurrencies, considering the interconnected nature of the crypto market.

By understanding BlackRock's stance on cryptocurrency and their approach to risk management within the ETF, readers can gain insights into potential future trends in institutional involvement in the digital asset space. This analysis provides a comprehensive overview, shedding light on the intricacies of this pivotal moment and its far-reaching consequences for the cryptocurrency landscape.

Investor Sentiment Shift - Exploring the Impact of BlackRock's Bitcoin ETF on Market Perception

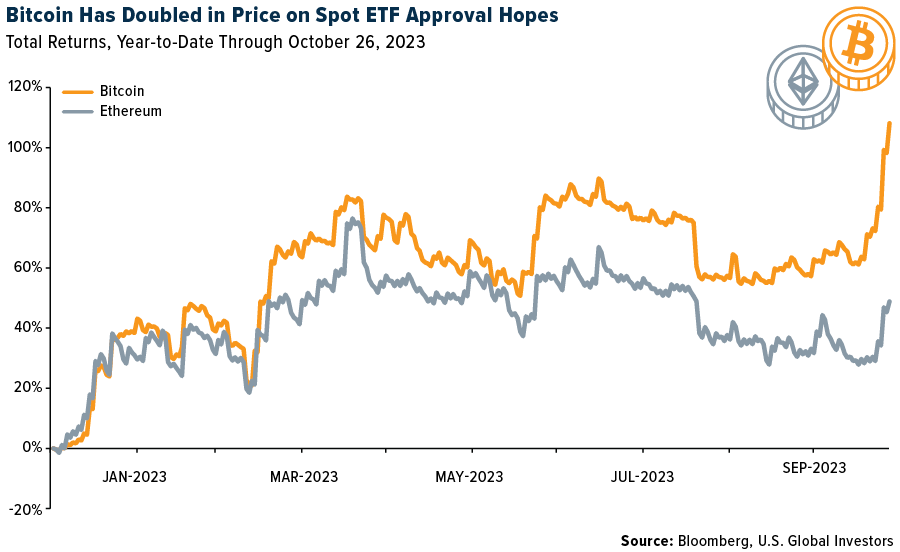

BlackRock's recent venture into Bitcoin ETFs signifies more than a mere financial move; it marks a profound shift in investor sentiment. This exploration delves into the transformation of attitudes among retail and institutional investors following BlackRock's strategic embrace of cryptocurrency.

Examining the psychological and emotional aspects of investor behavior, we analyze how BlackRock's endorsement has influenced market confidence in digital assets. From the potential surge in retail participation to the reassessment of risk perceptions among institutional players, this piece dissects the evolving sentiments within the investment community.

By unraveling the narratives and reactions from various stakeholders, we aim to provide a nuanced understanding of how BlackRock's move has not only legitimized Bitcoin but has also triggered a broader reconsideration of cryptocurrencies as a viable and mainstream investment option. This in-depth analysis illuminates the intricate interplay between market sentiment and institutional decisions, offering readers valuable insights into the evolving landscape of digital asset perception.

Financial Industry Adaptation - BlackRock's Bitcoin ETF as a Catalyst for Change

BlackRock's entry into the Bitcoin ETF realm is not just a strategic move; it represents a pivotal moment in the adaptation of traditional financial institutions to the evolving landscape of digital assets. This analysis dissects the profound implications of BlackRock's foray into cryptocurrencies, exploring the broader trend of financial industry adaptation to the growing significance of decentralized finance.

Examining the underlying motivations behind BlackRock's decision, we uncover the strategic considerations and risk assessments that led to this momentous shift. Furthermore, we delve into the potential domino effect on other major financial institutions, observing how this move might serve as a catalyst for widespread acceptance of cryptocurrencies.

From regulatory challenges to technological innovations, this piece navigates the intricate web of factors influencing the financial sector's integration with blockchain-based assets. By understanding the mechanisms at play, readers gain insights into the transformative journey of traditional finance towards a more inclusive and technologically advanced future. The analysis not only interprets BlackRock's specific actions but also contextualizes them within the broader narrative of the financial industry's dynamic response to the rise of cryptocurrencies.

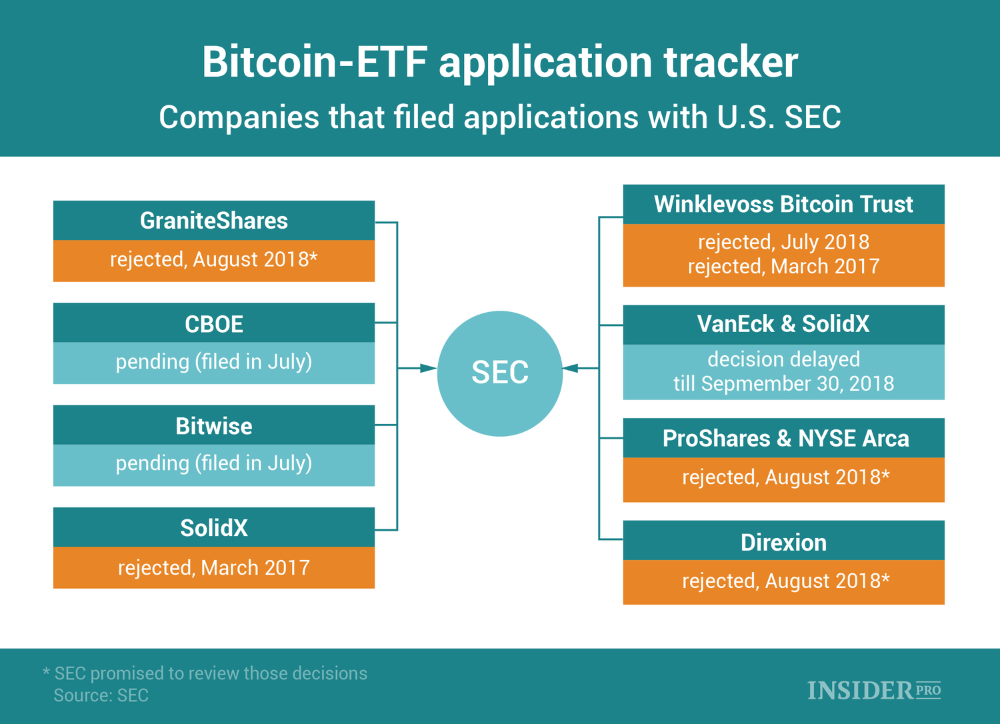

Regulatory Implications - Navigating the Impact of BlackRock's Bitcoin ETF on Financial Oversight

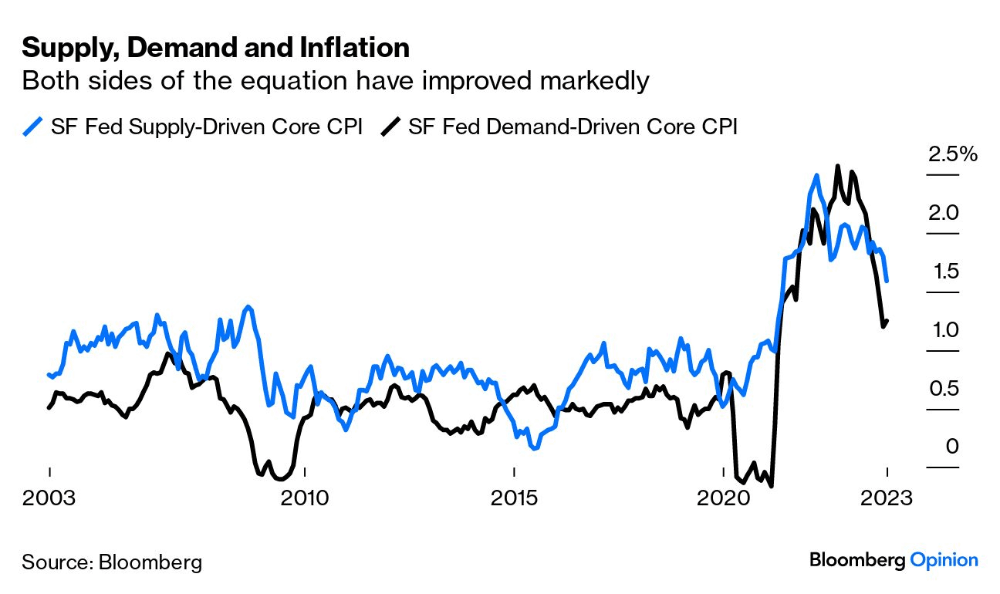

BlackRock's entry into the Bitcoin ETF arena brings forth a cascade of regulatory considerations that extend beyond the financial markets. This exploration delves into the intricate web of regulatory implications stemming from BlackRock's adoption of cryptocurrency, shedding light on how this move influences the broader regulatory landscape.

Analyzing the reactions of regulatory bodies to BlackRock's initiative, we scrutinize the potential shifts in policy, compliance requirements, and the overall regulatory framework for digital assets. This piece aims to unravel the delicate balance between fostering innovation and safeguarding investor interests in a rapidly evolving financial ecosystem.

From discussions on investor protection to the potential impact on anti-money laundering measures, this analysis provides a comprehensive overview of the regulatory challenges and opportunities that arise with the growing integration of traditional finance with cryptocurrencies. By understanding the regulatory dynamics triggered by BlackRock's move, readers gain valuable insights into the evolving governance structures that will shape the future of cryptocurrency adoption within a tightly regulated financial environment.

Bitcoin's Institutional Acceptance - BlackRock's Endorsement and the Paradigm Shift in Finance

In the wake of BlackRock's monumental step into Bitcoin ETFs, a seismic shift is underway, transcending mere financial transactions. This comprehensive exploration delves deep into the significance of BlackRock's embrace of cryptocurrency, unraveling the intricate threads that weave the narrative of Bitcoin's institutional acceptance.

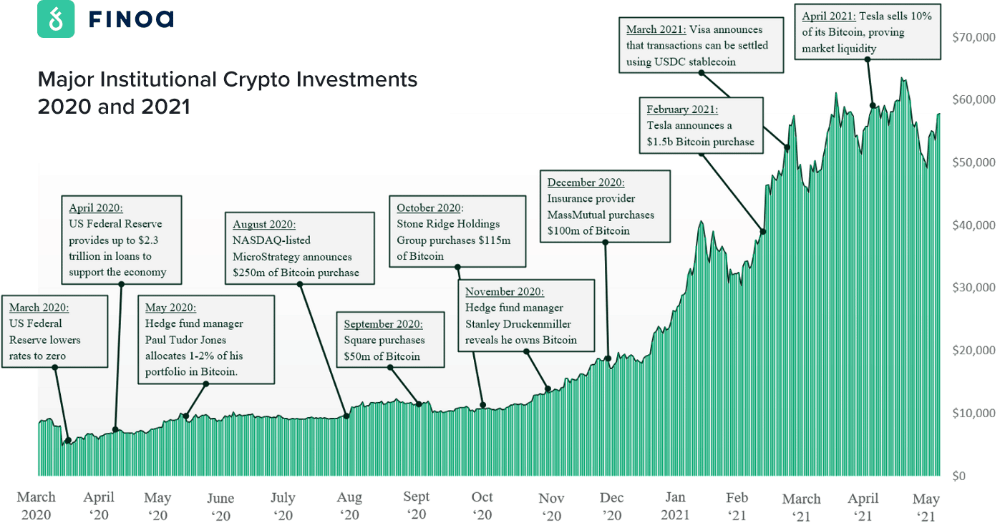

The analysis begins by tracing the historical skepticism surrounding Bitcoin within the institutional realm, providing context for the groundbreaking nature of BlackRock's move. By dissecting BlackRock's strategic considerations, risk assessments, and the underlying motivations for entering the cryptocurrency space, readers gain a nuanced understanding of the institutional mindset towards digital assets.

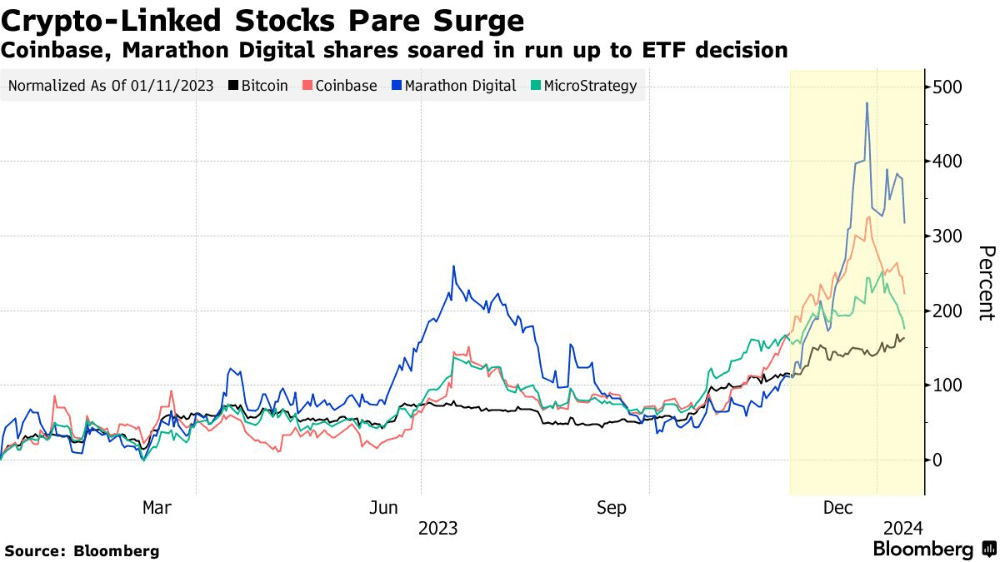

As we navigate the complex landscape of financial institutions adapting to the rise of cryptocurrencies, the discussion extends to how BlackRock's endorsement could serve as a harbinger of broader acceptance within the traditionally risk-averse financial sector. The exploration covers the potential impact on market dynamics, investor portfolios, and the reshaping of investment strategies in the face of evolving economic landscapes.

Furthermore, the analysis scrutinizes the implications for Bitcoin as a legitimate and recognized asset class. From the recalibration of risk perceptions to the integration of blockchain technology in mainstream finance, this piece aims to provide a panoramic view of the transformative journey towards institutional acceptance of Bitcoin.

By shedding light on the broader implications for the financial industry, regulatory bodies, and the global economy, this in-depth analysis seeks to capture the essence of a pivotal moment that extends far beyond the realm of cryptocurrency markets. It invites readers to contemplate the dawn of a new era in finance, where Bitcoin's institutional acceptance becomes a cornerstone in the evolution of the financial ecosystem.

![Nekodex – Earn 20K+ NekoCoin ($20) [Highly Suggested]](https://cdn.bulbapp.io/frontend/images/b4f0a940-f27c-4168-8aaf-42f2974a82f0/1)

![[ℕ𝕖𝕧𝕖𝕣] 𝕊𝕖𝕝𝕝 𝕐𝕠𝕦𝕣 𝔹𝕚𝕥𝕔𝕠𝕚𝕟 - OM(G) , My Biggest Bag Was A Scam????](https://cdn.bulbapp.io/frontend/images/99de9393-38a8-4e51-a7ab-a2b2c28785bd/1)

![[LIVE] Engage2Earn: Dutton = MAGA](https://cdn.bulbapp.io/frontend/images/e12661b2-74fa-4cd8-b554-51be7f6fec4f/1)