What is EIP-7540? New possibilities for the Real World Asset (RWA) sector.

What is EIP-7540?

EIP-7540 is a proposed improvement on the Ethereum network aimed at addressing the shortcomings of the ERC-4626 standard. The standard focuses on lending through multi-chain and flexible staking transactions.

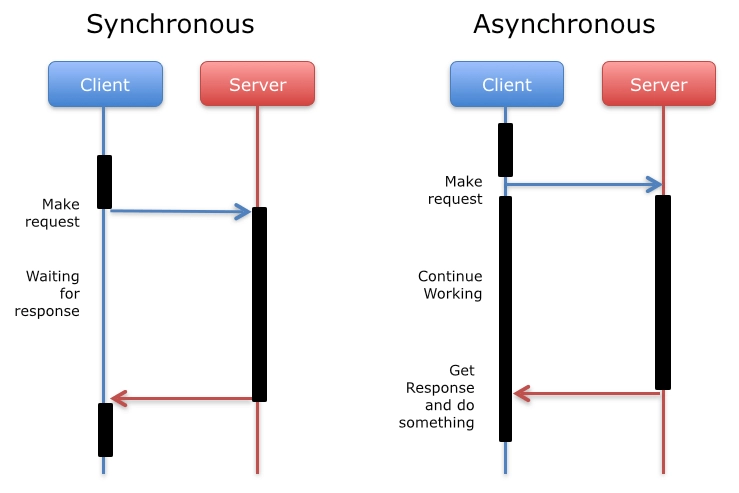

A novel aspect of EIP-7540 is "asynchronous," in contrast to the commonly used "synchronous" approach. Specifically:

- Synchronous requests, or synchronous proposals, require users to wait for the completion of previous commands and the final result before subsequent commands can be executed.

- Asynchronous requests, or asynchronous proposals, enable the execution of commands in parallel, allowing the next request to be processed more quickly. This helps creators and investors save time and costs.

In examples of token deposit and withdrawal commands: Users submit requests to deposit cryptographic assets into the vault, and immediately the data is received and processed. If a synchronous request requires the transaction party to wait for the completion of the processing of the initial deposit information, an asynchronous request will continue to record data related to the transaction even if the initial deposit command has not yet completed 100%. The same happens when withdrawing cryptographic funds; investors will request the withdrawal of assets first, and then the "processing" status is activated. When new funds are added to the wallet, the withdrawal request is quickly updated and transferred to the owner's "hands."

In examples of token deposit and withdrawal commands: Users submit requests to deposit cryptographic assets into the vault, and immediately the data is received and processed. If a synchronous request requires the transaction party to wait for the completion of the processing of the initial deposit information, an asynchronous request will continue to record data related to the transaction even if the initial deposit command has not yet completed 100%. The same happens when withdrawing cryptographic funds; investors will request the withdrawal of assets first, and then the "processing" status is activated. When new funds are added to the wallet, the withdrawal request is quickly updated and transferred to the owner's "hands."

EIP-7540 completely eliminates the inconvenience of ERC-4626 during the process of depositing and withdrawing cryptographic funds, allowing for the possibility of splitting the deposited amount and withdrawing multiple times without canceling the smart contract. This makes the process of depositing and withdrawing assets asynchronous over a certain period, eliminating difficulties in seizing potential investment opportunities.

Read more: https://coinbay.io/vi/real-world-assets-va-tiem-nang-ung-dung-trong-the-gioi-thuc-28205

Applications of ERC-7540

Liquid Staking

EIP-7540 removes the major limitation of Liquid Staking, which only supports withdrawing funds within a specific time frame. This makes the Liquid Staking Token (LST) protocol more user-friendly, convenient, and significantly reduces complexity.

Users can now withdraw funds anytime, and the withdrawal will only be officially processed when the assets in the pool are in the "ready" state.

DeFi Protocols

The initial goal of ERC-4626 was to reuse capital and connect liquidity between DeFi protocols. However, the synchronous nature of ERC-4626 made it challenging for DeFi protocols to interact smoothly due to differences in the timing of recording new balances.

EIP-7540, with its asynchronous capability, eliminates these limitations, enabling DeFi protocols to connect and interact more smoothly.

Real World Asset (RWA)

EIP-7540, initiated and developed by Centrifuge, a prominent project in the Real World Asset (RWA) field, aims to bring the advantages of the new standard to real-world assets.

ERC-4626 helps package yields and connect DeFi protocols. Still, its lack of synchronization between on-chain and off-chain processes requires more time to verify proposals for depositing, withdrawing, and transferring cryptographic funds. This characteristic of ERC-4626 is not suitable for the RWA field, leading to the creation of EIP-7540.

EIP-7540 has received high praise from many analysts and is expected to usher in a new era for the real-world asset field. The potential of the standard is most evident at the present time in its ability to optimize treasury management.

KYC

EIP-7540 is considered a standardized solution, bridging the gap between identity verification and the DeFi community. KYC (know your customer), if developed in the right direction, will accelerate the transformation of traditional assets in a decentralized, fast, convenient manner, and comply with the regulations of specific regions and countries.

Conclusion

EIP-7540 is recognized by many investors and analysts as a new trend in the Real World Asset (RWA) sector in the coming time. The standard has addressed some unreasonable points of ERC-4626 through the asynchronous request mechanism. However, investors should conduct thorough research before deciding to participate in the platform.

![[ℕ𝕖𝕧𝕖𝕣] 𝕊𝕖𝕝𝕝 𝕐𝕠𝕦𝕣 𝔹𝕚𝕥𝕔𝕠𝕚𝕟 - And Now What.... Pray To The God Of Hopium?](https://cdn.bulbapp.io/frontend/images/79e7827b-c644-4853-b048-a9601a8a8da7/1)

![[LIVE] Engage2Earn: McEwen boost for Rob Mitchell](https://cdn.bulbapp.io/frontend/images/c798d46f-d3b8-4a66-bf48-7e1ef50b4338/1)