The Currency of the Future: Financial Transformation with Digital Turkish Lira

First of all ı would like to explain what is the Central Bank Digital Currency before Digital Turkish Lira. Allow me to first explain the central bank's digital currency, and then I will provide a detailed explanation of the Digital Turkish Lira.

Central Bank Digital Currency :Electronic cash (virtual forex, virtual foreign money, or digital foreign money) is a virtual entity with traits including value, attractiveness, change, accumulation, and lending, much like traditional paper or steel forex but with a few differences. Central Bank Digital Currency (CBDC) basically refers to digital money. Like conventional coins, the character protecting it has the commitment of the primary financial institution. Electronic bills and transfers can also be made with it. Digital currencies, created via an authority much like physical currencies from a felony point of view, have transactions inside the community regulated centrally. A relevant database controlled via the relevant bank problems the forex and assigns a completely unique serial variety to each unit to pick out it, similar to the serial numbers on banknotes. Central banks frequently peg the virtual currency to the prevailing national foreign money. Digital currencies use community-linked electronic resources to facilitate fee transactions. Central Bank Digital Currency (CBDC) is a time period used globally for tokens created with the aid of critical banks, representing the criminal forex of the united states, and generally primarily based on distributed ledger technology. CBDCs, in the simplest phrases, are virtual currencies issued to symbolize a rustic's personal currency. While most CBDCs use comparable era to cryptocurrencies, the 2 asset lessons range in a few elements.

Digital Turkish Lira

"Economically, virtual currency is the digital form of the banknote used as the country wide forex. Digital forex is legally described via a criminal framework as a lawful method of charge, representing social consensus by means of deriving its power from countrywide sovereignty, and serving as a brand new shape of the countrywide foreign money, that's the sole unit of countrywide value size. In this context, it's miles severely vital to internalize that digital currency and crypto-assets are completely distinct concepts both economically and legally. For instance, the virtual Turkish lira refers to the digital shape of the Turkish lira, with its unit being the Turkish lira, just like in the existing physical currency. The digital Turkish lira may be designed and evolved to harness new technological potentials and hastily digitizing financial activities, specially elevated by the pandemic. While new technology can provide capability profits for money, they cannot alter the character of cash. Designs are made considering the fundamental capabilities of money. If added into flow, it is anticipated that the digital Turkish lira could make contributions to increasing economic inclusivity, setting up a complementary payment channel in step with the principle of uninterrupted and continuous operation of payments, making sure consistency in digital bills, and laying the basis for innovative use cases by getting ready the infrastructure for programmable payments. The critical point for the Digital Turkish Lira System is highlighted in the file as the training of a system that completely meets the requirements and concepts of digital foreign money, in preference to the technology itself. In this context, it's far stated that during Phase-1, essential additives together with the digital identification machine, virtual forex gadget, abstraction layer, service layer, and pockets application had been identified. These were developed and examined using open-source code in accordance with R&D concepts, with various solutions experimented, which includes distributed ledger, vital ledger, and hybrid answers."

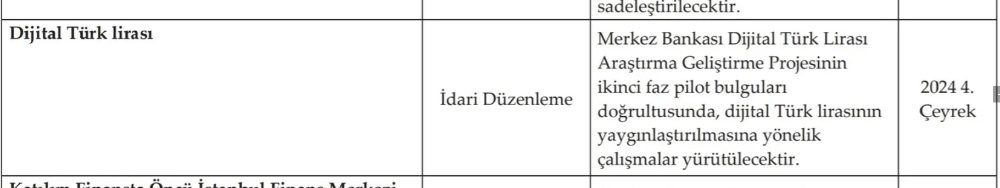

"The administrative regulation for the Digital Turkish Lira, evolved by using the Central Bank of the Republic of Turkey (CBRT), has been determined. The Medium-Term Program (2024-2026) file, prepared by the Ministry of Treasury and Finance and the Strategy and Budget Presidency, outlines desires related to the Digital Turkish Lira. The felony regulation for the Digital Turkish Lira is targeted to be carried out inside the fourth region of 2024. Until this date, efforts towards the huge adoption of the Digital Turkish Lira could be performed based at the effects obtained from the second-segment pilot research."

Benefits of the Digital Turkish Lira

- • Monetary transactions can be carried out in the virtual realm via the internet, without time and place constraints, and operate 24/7.

- • Financial transactions are obvious and difficulty to the supervision and law of regulatory authorities.

- • Since Central Bank Digital Currency (CBDC) is digitally produced in a digital environment, the production value is 0. This substantially increases the government's seigniorage revenue. • In the CBDC machine, as most of these transactions are predicted to be easy and price-powerful within the virtual surroundings, the transaction costs arising from strategies consisting of storing cash, delivering to banks, retaining in banks, withdrawing from banks, and transportation might also tend toward zero.

- • With the Central Bank Digital Turkish Lira, recording transactions among establishments and businesses in Turkey turns into simpler, and capability troubles all through transaction execution can be prevented.

"How will the safety of the Digital Turkish Lira be ensured?

The security and information analytics efforts for the Digital Turkish Lira are being controlled by means of HAVELSAN. The information can be hosted on HAVELSAN servers. Activities which includes attack detection, occasion tracking and analysis, vulnerability assessment, protection evaluation, leakage detection, and penetration testing are also performed inside HAVELSAN."

What are the variations between digital forex and cryptocurrency?

- Digital currencies are issued and controlled via an authority, making them centralized. Cryptocurrencies, alternatively, are decentralized and don't have any valuable authority in the back of them.

- Since digital currencies are created via an expert, similar to bodily forms of cash, transactions inside the community are regulated centrally. For example, governments or banks can create virtual currency. Transactions with digital forex require approval from the authority.

- Due to the backing of crucial government, the price of digital currencies stories minimal fluctuations. Cryptocurrencies, but, showcase a much more unstable nature.

- Transactions with digital currencies, whether or not for shopping or investment, require a real user identification, making the transactions much less non-public. In evaluation, cryptocurrency transactions do no longer require private statistics, and customers are often nameless, with transactions more often than not being personal. However, given that all transactions are recorded, the sender and receiver are known to the community, enabling entire traceability. This guarantees that all transactions can be tracked, and as soon as completed, they can't be altered or deleted.

- Information about transactions with digital foreign money is stored on centralized networks, with structures designed to be stable towards capability cyberattacks and malfunctions. Cryptocurrencies, utilising blockchain technology, encrypt facts, making them extra secure against cyberattacks."

source :

https://research.icrypex.com/

https://www.tcmb.gov.tr/

![[LIVE] Engage2Earn: auspol follower rush](https://cdn.bulbapp.io/frontend/images/c1a761de-5ce9-4e9b-b5b3-dc009e60bfa8/1)