Top 7 outstanding Launchpad platforms in 2024

Launchpad playground is always a topic that attracts investors thanks to the opportunity to access potential projects early and the ability to make high profits. But when the market has so many launchpads appearing, which is the right launchpad? What criteria evaluate launchpad?

Launchpad evaluation criteria

Launchpad platforms were born with the purpose of supporting Web3 projects to open token/NFT sales for the first time to the community. Users participating in launchpad must meet a number of requirements depending on each platform such as performing KYC, minimum capital... to have the opportunity to buy assets at low prices and receive ROI (Return On Investment).

The launchpad puzzle has seen rapid growth in recent years. However, this market also recorded the appearance of many fraudulent projects, designed to attract FOMO investors, then problems such as rug pulling and platform hacking occurred. ..

Therefore, before joining any launchpad, users should also consider some of the following criteria:

- Project team: Should be people with experience in the field of crypto, technology and finance. It doesn't necessarily have to be big names, but the team needs to show efficiency in evaluating listed projects.

- Investors: Find out information such as who is the backer, the number of investors participating, the total amount of money raised...

- ROI (Return on Investment): Shows the level of profit or loss based on the amount of capital invested, helping users evaluate the performance of Launchpads.

- Token sale mechanism: A factor that can affect the token distribution rate of investors. Each Launchpad will have different mechanisms, but the general purpose is to bring fairness and encourage users to participate.

- Raised capital: Is the total amount of money that projects have successfully raised on launchpad. The higher the amount of capital raised, it proves that the platform has a certain level of prestige and effectiveness in the market.

- advertising

- User experience: Some factors users can consider include: participation process, minimum capital to access, transaction fees, platform interface, investor support services...

Top 7 outstanding Launchpad projects in 2024

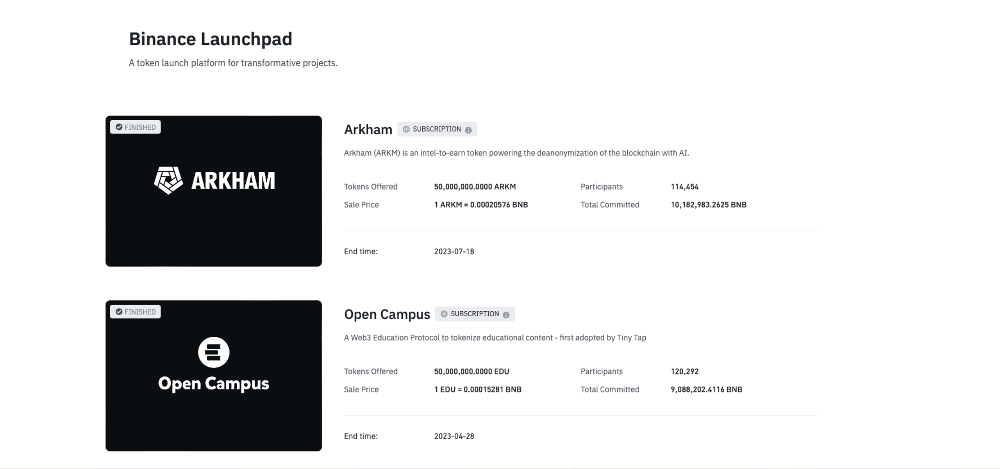

- Binance Launchpad

Binance Launchpad is a capital raising platform operating in the form of IEO, built in 2017 by the Binance team. After a period of operation, the platform has supported projects that have raised more than 133 million USD in capital, with an average ROI of 23x.

To participate in Binance Launchpad, users need to hold BNB tokens and register to buy tokens within the specified time. The number of tokens users can purchase is based on the participation limit*.

Participation limit* is a user's purchase limit, calculated based on the average BNB balance over a certain period of time, usually 7 days.

Although users can earn high ROI on Binance Launchpad, getting projects listed on this platform is relatively difficult. Currently, there are only 35 projects supported by Binance Launchpad to raise capital, which limits users' access to potential projects as well as investment opportunities to earn profits.

- Gate.io Startup

Gate.io Startup is a fundraising platform in the form of IEO, built by the Gate.io exchange. Gate.io Startup allows users to buy tokens of potential projects with a similar participation process to Binance Launchpad. However, Gate.io Startup requires that participant accounts must reach a certain VIP level.

Gate.io Startup has supported 495 token sale projects with an average ROI for users of 1.35x. Among them, the GameFi category accounts for the majority of projects listed on the platform.

- DAO Maker

DAO Maker is an IDO launchpad, with an average ROI on the platform of 1.48x. The project provides a variety of products such as: Social Mining, Strong Holder Offering (SHO), Dynamic Coin Offering (DYCO), Lending Margin...

The highlight of DAO Maker is the SHO token sale mechanism, with the purpose of bringing benefits to users holding DAO tokens. SHO operates in the form of a lottery, which means the more DAO tokens a user holds, the higher the odds of winning the project's whitelist.

As of the time of writing, DAO Maker has launched 154 projects with some successful names such as Orion Protocol, My Neighbor Alice, LaunchX, DAFI Protocol... with a total capital raised of more than 91 million USD. Projects belonging to the GameFi puzzle account for the largest proportion of the for-sale list on DAO Maker.

- Starship

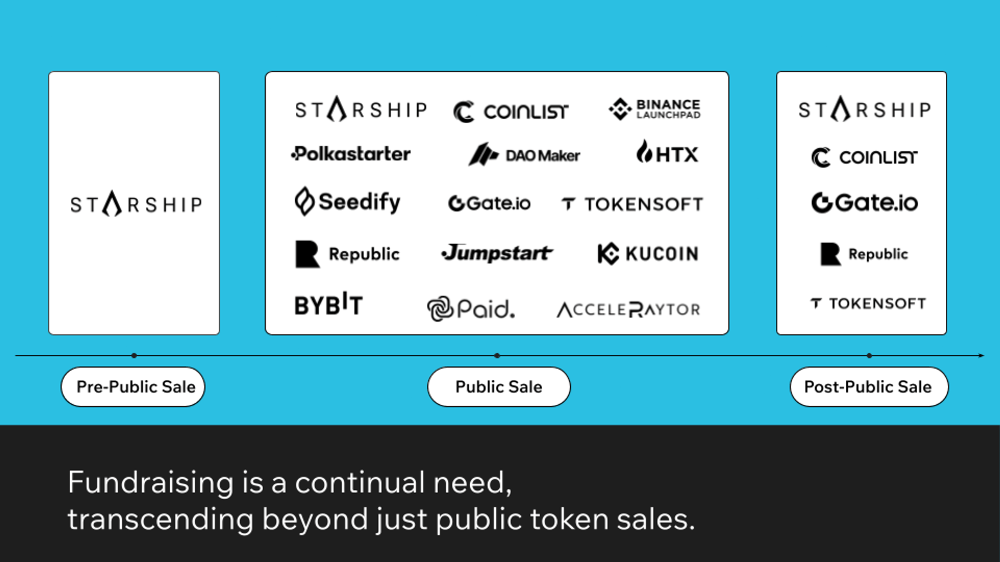

Starship is a multi-chain fundraising platform in the form of IDO, developed by the Ninety Eight team. Starship aims to bring fairness and transparency to participating parties through applying a different token sale model.

Accordingly, most launchpad platforms will only support capital raising projects in 1 of 3 rounds: pre-public sale, public sale and post public sale. Meanwhile, Starship allows projects to access all 3 stages. This helps the project have enough resources and capital to build and develop in the future.

Starship supports projects with additional capital raising in all 3 stages

In addition, unlike holding tokens for a chance to win the whitelist like many other launchpads, Starship issues NFT "Starship Membership", which acts as a guarantee ticket (guarantee) allowing users to join the launchpad.

NFT Starship has a fixed total supply of 10,000 with related utilities to ensure the rights of holders. Users who do not hold Starship NFTs can still purchase tokens on the platform, however the allocation rate will be lower.

On April 12, 2024, SA World was the first project released on Starship. SA World successfully raised capital of 1 million USD after just 30 minutes of opening. This has proven the attraction and reputation of the platform.

- Polkastarter

Polkastarter is a decentralized capital raising platform operating on many different networks, allowing projects to sell limited tokens to the community before officially listing. Users have early access to the project through two pools:

POLS Pool: For users holding POLS tokens, they will have a higher chance of being on the whitelist, and will be allocated a higher token purchase rate.

Public Pool: For those who do not hold POLS tokens, the whitelist winning rate is more competitive as well as the number of tokens purchased is lower.

There are currently 109 projects opening token sales on Polkastarter, including some prominent names such as Wilder World, Ethernity Chain, Polytrade, Stratos Network... The average ROI on the platform is 1.11x.

- Seedify

Seedify is an IDO Launchpad, focusing on launching projects in the GameFi field with a rate of 71%. The platform offers two main products, IDO Launchpad and INO Launchpad, allowing users to participate by:

IDO Launchpad: Stake SFUND tokens to get early access and purchase project tokens.

INO Launchpad: Stake SNFT tokens for a chance to win the whitelist and buy NFTs issued by the platform.

Seedify has supported 91 successful fundraising projects on the platform with a total amount of more than 35 million USD. Some outstanding projects include Bloktopia, Cryptoblades Kingdoms, Monsters Clan, Pocoland... and bring investors an average ROI of about 1.67x.

- Coinlist

Coinlist is a launchpad operating in the form of ICO, founded in 2017 by CoinList Markets LLC, headquartered in California, USA. Unlike most other launchpads that focus on the gaming field, Coinlist mainly lists chain projects with a ratio of 33.3%.

Coinlist has supported 54 projects, prominent among them are Solana, Near, Flow... The average ROI on Coinlist is 13.5x.

Despite being one of the prominent names in the launchpad puzzle, Coinlist currently does not support users in Vietnam. This will cause inconvenience for new users when switching IPs to other countries to join the platform.

![[ℕ𝕖𝕧𝕖𝕣] 𝕊𝕖𝕝𝕝 𝕐𝕠𝕦𝕣 𝔹𝕚𝕥𝕔𝕠𝕚𝕟 - And Now What.... Pray To The God Of Hopium?](https://cdn.bulbapp.io/frontend/images/79e7827b-c644-4853-b048-a9601a8a8da7/1)

![[LIVE] Engage2Earn: Julian Hill Bruce boost](https://cdn.bulbapp.io/frontend/images/dbf23bb3-aba5-43ea-9678-e8c2dbad951c/1)