bear chain testnet

What is Berachain?

Berachain emerges as an innovative Layer 1 solution built on the Cosmos SDK, featuring an EVM equivalent and employing the Proof of Liquidity (PoL) consensus — a variant of delegated Proof of Stake. This groundbreaking blockchain seeks to harmonize incentives between security and liquidity at the protocol level. Users can now earn rewards, in the form of the staking token (BGT), by providing liquidity to a set of designated DeFi primitives, fostering a symbiotic relationship between liquidity and security.

Proof of Liquidity (PoL): Revolutionizing Security and Liquidity

PoL serves as a sybil resistance mechanism, revolutionizing the synergy between security and liquidity within the network. In contrast to traditional proof of stake chains, where users must choose between staking for security or contributing to on-chain liquidity, Berachain enables users to achieve both simultaneously. By providing liquidity to embedded DeFi primitives, users contribute to network security and earn the Berachain governance token (BGT).

Why Berachain?

Berachain introduces a sustainable model for protocols to build their liquidity base and enhance capital efficiency over time. Successfully approved protocols through governance votes can reward their Liquidity Providers (LPs) with BGT, attracting more liquidity at lower costs. This aligns incentives, drawing the best protocols to build on Berachain, acting as effective user acquisition channels.

Tri-Token Structure: BERA, HONEY, and BGT

Berachain’s economic structure revolves around a tri-token system:

- BERA: The native token used for transaction gas on the chain.

- HONEY: The stablecoin collateralized 1-to-1 with USDC, earned by staking BGT.

- BGT: The staking and governance token, earned by providing liquidity to Berachain’s core primitives.

Why Stake BGT?

Staking BGT allows users to influence the direction of BGT emissions, earn fees in HONEY from PoL-powered protocols, and receive bribes from their chosen validator. It empowers users to actively shape the network’s development.

Why Burn BGT for BERA?

Users may choose to burn BGT into BERA for various purposes, including paying for gas, using in other chain applications, or selling their position.

Native dApps on Berachain

- BEX: Native AMM/DEX

- BEND: Native stablecoin lending platform

- BERPS: Native perpetual exchange

Berachain and Bong Bears NFT

While created by the same team, Berachain and Bong Bears NFT are separate projects. Berachain stands independently, offering users the opportunity to participate in its ecosystem without owning a Bong Bear NFT.

Getting Started and Building on Berachain

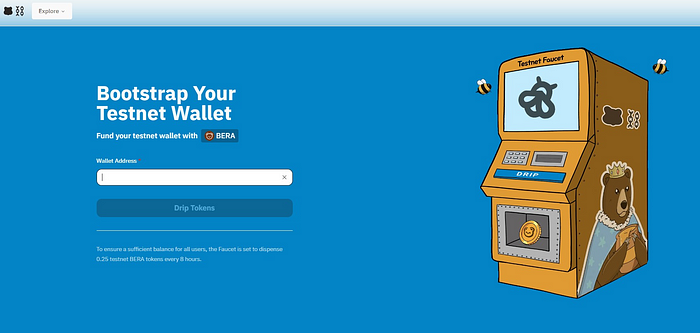

- Faucet: Users can acquire BERA, the gas token, by visiting Berachain Faucet.

- Minting HONEY: Visit Honey Minting to mint HONEY by swapping testnet BERA or other tokens for stgUSDC on the BEX.

- Building on Berachain: Developers can explore Berachain Documentation for detailed information. Protocols interested in building on Berachain can express their interest through this form, and the Ecosystem Growth Team will schedule a meeting.

Berachain opens new possibilities in the DeFi landscape, providing a unique blend of security, liquidity, and innovative economic structures. Join the Berachain community and be part of this exciting journey into the future of decentralized finance! 🚀🌐 #Berachain #DeFi #CryptoInnovation

Unlocking DeFi Potential: Your Step-by-Step Guide to a Headstart with Berachain

- Visit the Berachain Faucet and Request Testnet tokens.

2. Mint Honey

3. Follow Berachain on Twitter:

4. Follow SmokeyTheBera

5. Follow DevBear

6. Re-Post: https://twitter.com/intent/retweet?tweet_id=1745446022380408996

7. Join the Discord at : https://discord.com/invite/M2CuUfVGr9

8. Visit Berachain Docs

Answer the Quiz:

C. Proof-of-Liquidity

D. Providing liquidity on DAO approved protocols on Berachain

D. BTC

D. Polaris EVM

A. Faucet

Claim Your points

![[LIVE] Engage2Earn: auspol follower rush](https://cdn.bulbapp.io/frontend/images/c1a761de-5ce9-4e9b-b5b3-dc009e60bfa8/1)