Popular Candlestick Chart Patterns

Candlestick Chart Patterns

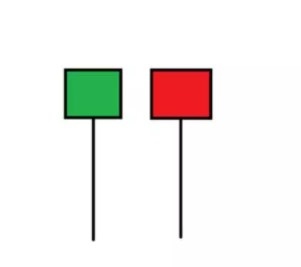

In our previous article, we talked about two types of markets. Now we will examine the popular candle formations used in technical analysis to determine the trend direction depending on these markets. Candlestick patterns are divided into Bullish candlesticks and Bearish candlesticks.

Bull Market Candlestick Patterns

The bull market, with its original name Bullish Market, refers to the prices entering an upward trend in the relevant cryptocurrency exchange trading. It means that prices will be trending in a more optimistic, positive environment in the near future and cryptocurrency purchases will increase.

Hammer formation (Bullish Hammer)

Hammer, originally known as Bullish Hammer, is a bull candle formation with a long wick that beats the bottom level formed during the downtrend, with a short body and color difference. It is an indication that sellers are lowering prices when trading cryptocurrencies. Then a strong selling pressure follows the trend. Do not start trading as soon as you see this candle formation. Follow the trend direction for a few days. If the opposite is the case, verify the trend by trading volume. You can buy if the next candlestick exceeds the hammer height.

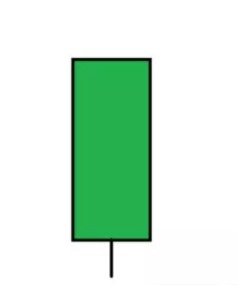

Waist Hold Formation (Bullish Belt Hold)

Candlestick, which consists of a single candlestick pattern, usually appears in a downtrend. For the formation of a Bullish Engulfing formation, it is essential that the candlestick does not fall below the opening value and that the prices move against the downtrend in the existing direction. The candlestick closes near its highest value. It should start lower than the previous candle. If you see this candle formation, you can buy if the next candle starts at a higher level.

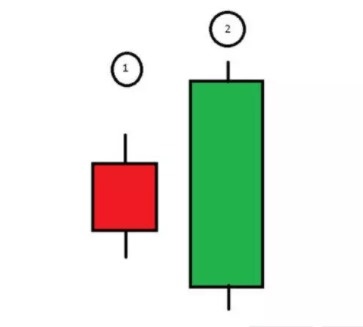

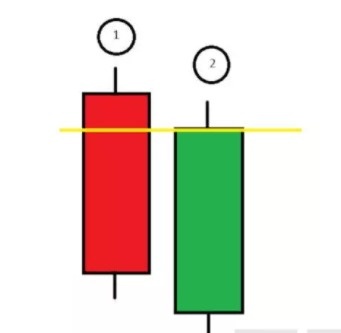

Bull Engulfing Pattern (Bullish Engulfing)

The Bullish Engulfing pattern, which consists of a large green candlestick enclosing the preceding red and smaller candlestick, is formed within a downtrend. Although it signals that the bear market continues, the bulls begin to lead the market within a certain time. Cryptocurrency buying pressure exceeds selling pressure. A buy can be made if the next candle opens above the big green candle.

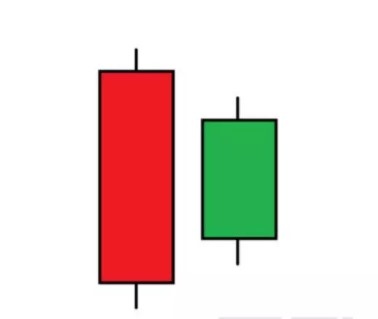

Pregnant Bull Pattern (Bullish Harami)

In a double candlestick formation resembling a pregnant woman, it consists of a large red candlestick with a large body followed by a small green candlestick inside the red candle. It is a sign of incompatibility in the market. It also indicates that the downtrend may be coming to an end. The word Harami means pregnant in Japanese. This pattern signals a reversal. A bear market weakens and a bull market prevails. A buy can be made if the next candle crosses the height of the big red candle.

Piercing Candles Pattern (Bullish Piercing Line)

The Piercing Candle Pattern is a bottom reversal pattern that occurs during a downtrend. As the bulls enter the market and push prices higher, it causes a trend reversal. The green candlestick opens lower than the close of the red candlestick. Bears, ie sellers, lose momentum in this price change. The trend initiates a bullish rise. Cryptocurrency can be bought if the next candlestick exceeds the high of the red candle.

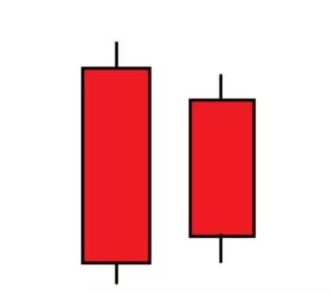

Pigeon Nest Formation (Bullish Homing Pigeon)

As shown in the figure, it is a candlestick formation in which a small red candle is in the range of a larger candle before it. This pattern can signal a weakening in the current downtrend. This indicates that an upward trend will begin. It can also herald a reversal turn. If the next candle in the Pigeon Yuvası formation exceeds the height of the first candle, it is possible to buy on the cryptocurrency exchange.

Three Green Soldier Formation (Bullish Three White Soldiers)

The Three Green Soldiers pattern, which resembles a ladder, is one of the most popular bullish patterns that clearly give a bullish signal. The downtrend is valid in the relevant cryptocurrency exchange. Three standard-length green candlesticks are then lined up in a row to form a ladder. The uptrend of the first candle is supported by high closes on the other two candles. Cryptocurrency can be bought if the next candle to form exceeds the height of the third candle.

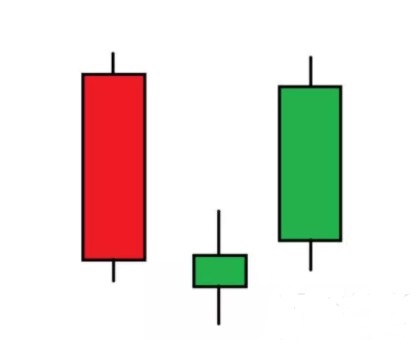

Morning Star Formation (Bullish Morning Star)

It is an important bottom reversal pattern consisting of three candlesticks. During a downtrend, the red candle confirms the downtrend. However, a small green candlestick developing on the downside indicates that the bear market is trying to push the price down. However, there is an inconsistency in bears in this process. There is an indecision. The third green candle starts an upward bull market. Cryptocurrency can be bought if the next candle in the Morning Star candlestick pattern exceeds the height of the third candle.

Bearish Candlestick Patterns

The bear market, originally called the Bearish Market, is a time of prolonged price declines. It typically represents a 20% or more drop in cryptocurrency prices due to negative trades. Bear markets can last for months or even years as investors avoid speculating in favor of boring, sure bets. For this reason, it is necessary to pay attention to the crypto money bear candle formations, which must be taken into account in order not to make any losses from cryptocurrencies. Examine the bear market candle formation examples below carefully.

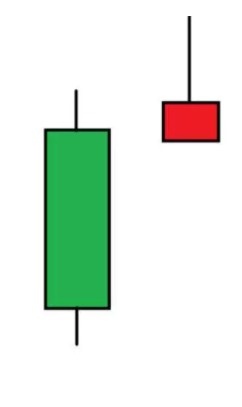

Falling star (Bearish Shooting Star)

The Shooting Star pattern is a candle formation with a long upper wick and also a red reverse hammer. It describes the market movement that develops in the opposite direction, referring to the hammer formation in a bull market. The Shooting Star pattern, originally called the Bearish Shooting Star, appears after a green bullish candle before it. This candle is almost reminiscent of a shooting star. If you see the Shooting Star pattern or simply the reverse hammer pattern, you are signaling that the bears will dominate the market. If the next candle falls below the red candle, you may think that you should sell Bitcoin now.

My other articles

https://www.bulbapp.io/p/7601dca5-c741-4ee5-8e8c-dab05cc2526c/bollinger-bands

https://www.bulbapp.io/p/9063353b-d553-4ef1-bb25-38b810cddf29/will-traditional-finance-be-replaced-by-decentralised-finance

https://www.bulbapp.io/p/0a4e0980-6717-413a-943a-3520331cb1d3/solana-the-shining-star-of-crypto

https://www.bulbapp.io/p/e45081ae-09b2-4bca-b620-dae045e3fad1/crypto-candlestick

https://www.bulbapp.io/p/4a6c396a-a513-4124-8518-be7ad3f71303/bitcoin-forks-upgrades-and-radical-blockchain-changes

https://www.bulbapp.io/p/da3be36b-dc65-4f9b-a90a-88d6821f7906/isolated-margin

https://www.bulbapp.io/p/024230d9-d391-42ed-b6ec-e2a9cb7411b1/the-evolution-and-significance-of-geometry-throughout-history

https://www.bulbapp.io/p/8fbd34c8-097a-4254-82ba-8ab56c3f5c5b/the-genesis-of-cryptocurrencies?s_id=83df371e-5150-4c30-a30f-dfda3c51a85b

https://www.bulbapp.io/p/a34b9be4-abdc-4d53-9fff-3873f3419ae

0/circadian-rhythm

https://www.bulbapp.io/p/d6ffdd3a-12bf-40f5-a60a-1c54d5648285/rsi-indicator

https://www.bulbapp.io/p/1ad7c62e-efde-4e4b-8805-931f8e40bd80/security-on-the-bitcoin-blockchain

https://www.bulbapp.io/p/35e7f919-4f1f-4b79-8d72-da926f43b843/smart-contract-coins

https://www.bulbapp.io/p/2e5ac54c-9f99-431e-a1f6-4f6edae7ca0c/turtle-and-scorpion

![[ℕ𝕖𝕧𝕖𝕣] 𝕊𝕖𝕝𝕝 𝕐𝕠𝕦𝕣 𝔹𝕚𝕥𝕔𝕠𝕚𝕟 - OM(G) , My Biggest Bag Was A Scam????](https://cdn.bulbapp.io/frontend/images/99de9393-38a8-4e51-a7ab-a2b2c28785bd/1)