What is Staking? Types of Crypto Staking

Cryptocurrency staking has rapidly become a cornerstone of blockchain investment, offering individuals the opportunity to earn rewards while supporting network security. In essence, staking allows participants to "lock" their digital assets, which are then utilized to validate transactions, maintain the blockchain’s operations, and achieve decentralization. While mining traditionally served these functions for early blockchain networks, staking introduces a more energy-efficient approach aligned with today’s shift toward sustainable technology.

Cryptocurrency staking has rapidly become a cornerstone of blockchain investment, offering individuals the opportunity to earn rewards while supporting network security. In essence, staking allows participants to "lock" their digital assets, which are then utilized to validate transactions, maintain the blockchain’s operations, and achieve decentralization. While mining traditionally served these functions for early blockchain networks, staking introduces a more energy-efficient approach aligned with today’s shift toward sustainable technology.

This article explores the mechanisms behind crypto staking, its types, and how it has transformed the way investors engage with digital assets.

Understanding Crypto Staking

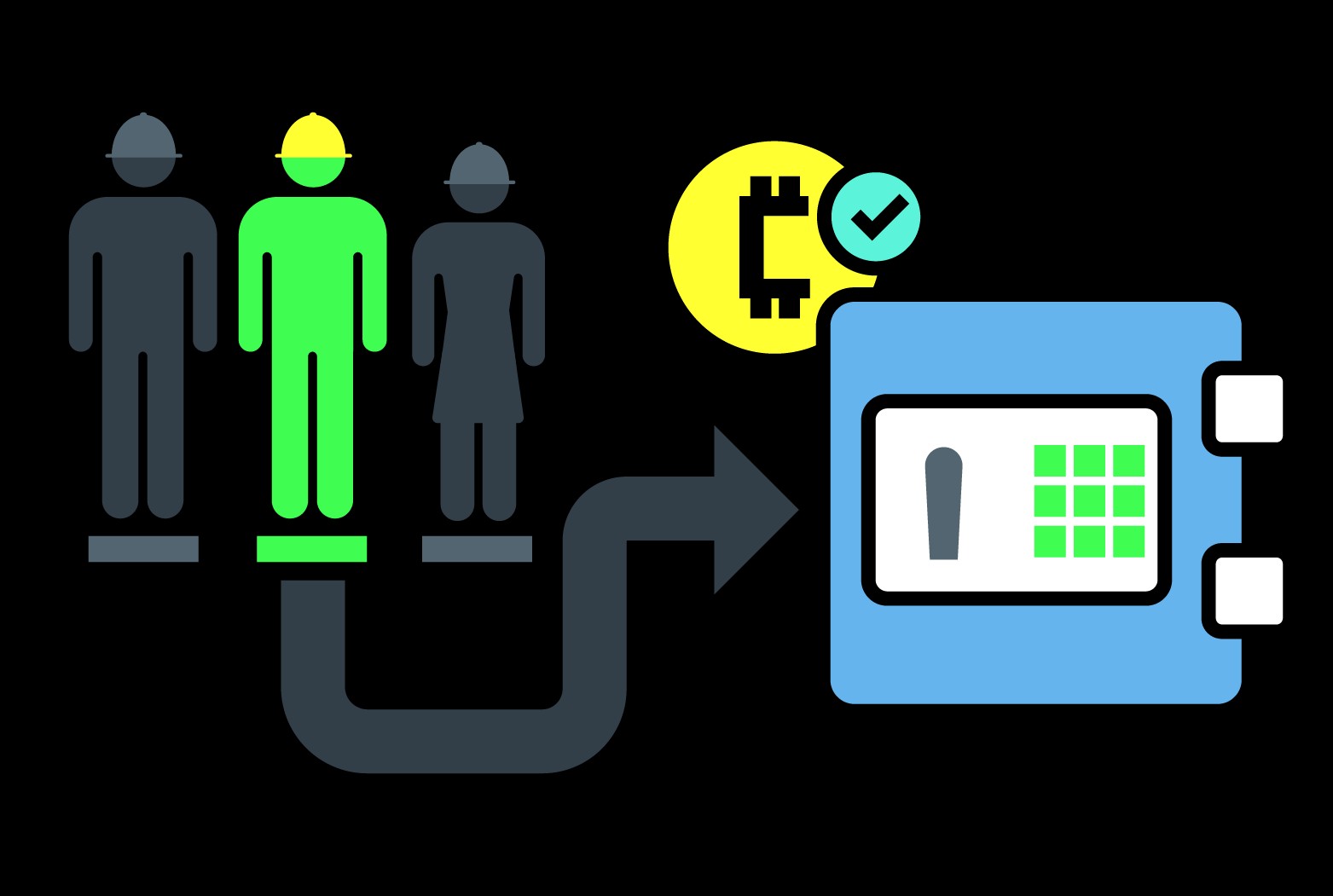

Staking, in the context of cryptocurrencies, involves committing a portion of one's digital assets to support the security and operation of a blockchain network. When investors stake their assets, they effectively lend them to the network, helping validate transactions through consensus mechanisms like Proof of Stake (PoS) rather than the energy-intensive Proof of Work (PoW) used by Bitcoin and early networks.

The PoS model assigns transaction validation responsibilities to users holding significant amounts of the network’s currency, creating a system where asset ownership plays a key role in the maintenance of network security. As an incentive, stakers receive rewards in the form of new tokens proportional to their staking commitment, making it a profitable avenue for crypto investors.

Delegated Proof of Stake (DPoS): Stakers delegate their tokens to "validators" who are responsible for confirming transactions, promoting network integrity while decentralizing power. DPoS systems often allow users to vote on key decisions within the network.

Proof of Authority (PoA): In PoA staking, a small, vetted number of nodes validate transactions based on their reputation rather than token ownership. While not as decentralized as other models, PoA networks generally achieve high transaction speeds.

Types of Crypto Staking

Crypto staking has evolved into a diversified domain with several methods available to investors, each carrying its own risk and reward profiles. These options vary depending on the degree of user involvement, required technical knowledge, and potential profitability.

Direct Staking: This is the traditional form of staking where users stake their assets directly on the network to earn rewards. For instance, Ethereum 2.0, Polkadot, and Cardano all support native staking, allowing users to participate by holding tokens within their wallets or on supported platforms.

Pooled Staking: Pooled staking allows small investors to participate in staking by pooling their assets together, achieving the threshold necessary for staking rewards. Pooled staking is particularly popular for high-stakes networks, like Ethereum 2.0, where staking on one's own might otherwise require a significant financial commitment.

Staking-as-a-Service (SaaS): SaaS platforms are third-party providers who facilitate staking on behalf of users, making the process accessible to those with limited technical skills. The service provider manages all technical aspects of staking while users earn rewards after fees are deducted. Platforms like Binance and Coinbase offer SaaS staking options for numerous assets.

Yield Aggregators and DeFi Staking: In the decentralized finance (DeFi) space, yield aggregators offer staking alongside other yield-generating activities. These platforms optimize returns by pooling assets into yield farms, lending protocols, or liquidity pools.

Advantages and Challenges of Staking

Benefits: Staking offers unique benefits to crypto investors beyond traditional trading and holding, including:

- Passive Income Generation: Staking rewards provide an ongoing source of passive income, which can potentially outpace traditional savings or fixed-income products.

- Network Security Enhancement: By staking, users actively contribute to the stability and security of the blockchain network, strengthening its decentralization.

- Reduced Environmental Impact: Unlike mining, staking is energy-efficient, aligning with the growing demand for eco-friendly solutions in blockchain technology.

Challenges: Despite its benefits, staking presents a few challenges:

- Lock-Up Periods: Some staking models require users to commit their assets for a set period, during which they cannot access or sell them. This lack of liquidity can be a downside, particularly in volatile markets.

- Validator Risks: Staking requires delegating assets to validators, which may expose users to risks if a validator behaves maliciously or fails to meet operational standards, potentially leading to slashing penalties.

- Market Volatility: Since staking rewards are often given in the native token of the staked asset, their real-world value can fluctuate, impacting the actual returns of staking activities.

How to Choose the Right Staking Option

Selecting a suitable staking option depends on various factors such as risk tolerance, investment size, and technical comfort. Each method has unique attributes tailored to different investor profiles, which are important to consider before committing assets.

Assess the Staking Model: Traditional staking, for instance, may offer greater control but require more capital. Pooled staking suits small investors, while SaaS is ideal for those seeking convenience.

Evaluate Lock-Up Requirements: Investors should be aware of the asset lock-up duration, as liquidity constraints may impact access to funds during market shifts.

Risk Assessment of Validators: Understanding validator quality is essential to minimize risks, especially in delegated staking models. Selecting trustworthy validators with a history of reliable performance is recommended.

Diversify Across Platforms: For those who wish to manage risks, diversifying staking investments across multiple platforms can be beneficial. This diversification minimizes exposure to platform-specific risks and enhances potential rewards.

Conclusion

Staking has become a critical component of cryptocurrency investment strategies, bridging the gap between passive asset holding and active blockchain participation. By choosing the right type of staking method, investors can earn rewards while bolstering blockchain security. However, each staking model comes with its own trade-offs, from liquidity restrictions to validator risk, and should be chosen with a clear understanding of one’s financial goals and risk tolerance. Crypto staking represents a transformative shift in asset engagement and presents investors with a dynamic, rewarding avenue in the blockchain landscape.

References

- https://www.businessinsider.com/personal-finance/investing/proof-of-stake?r=US&IR=T#:~:text=Proof%2Dof%2Dstake%20(PoS,the%20next%20block%20of%20transactions.Staking vs. Mining

- What is Delegated Proof of Stake?

- Understanding Ethereum 2.0 Staking

- Staking on Binance: How it Works

- Coinbase Staking FAQ

- Yield Aggregators Explained

- Risks and Rewards of Staking

- How Validators Work

- Eco-Friendly Blockchain Models