Ethereum: Top reasons why ETH to $5K in 2024 is certain

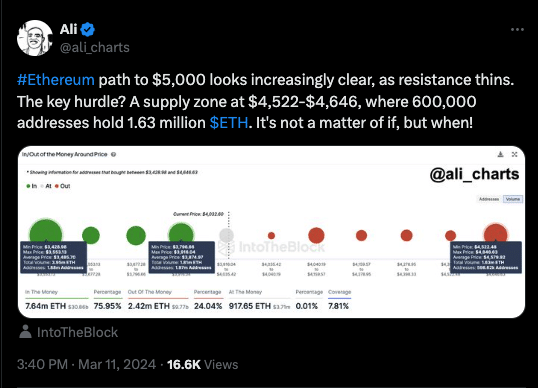

The price of Ethereum [ETH] might soon hit $5,000, according to analyst Ali Martinez. But the altcoin has to break through the supply wall between $4,522 and $4,646.

A supply zone is a cumulation of buy orders. In this instance, the intention is to create a barrier that prevents the price from going down. Martinez, who used IntoTheBlock’s data, noted that 600,000 addresses bought 1.63 million ETH around that region.

The season is already here

Therefore, the path was now a resistance for the cryptocurrency as some of the buyers might try to breakeven. While this might slow down Ethereum’s bullish strides, the climb to $5,000 looked almost certain.

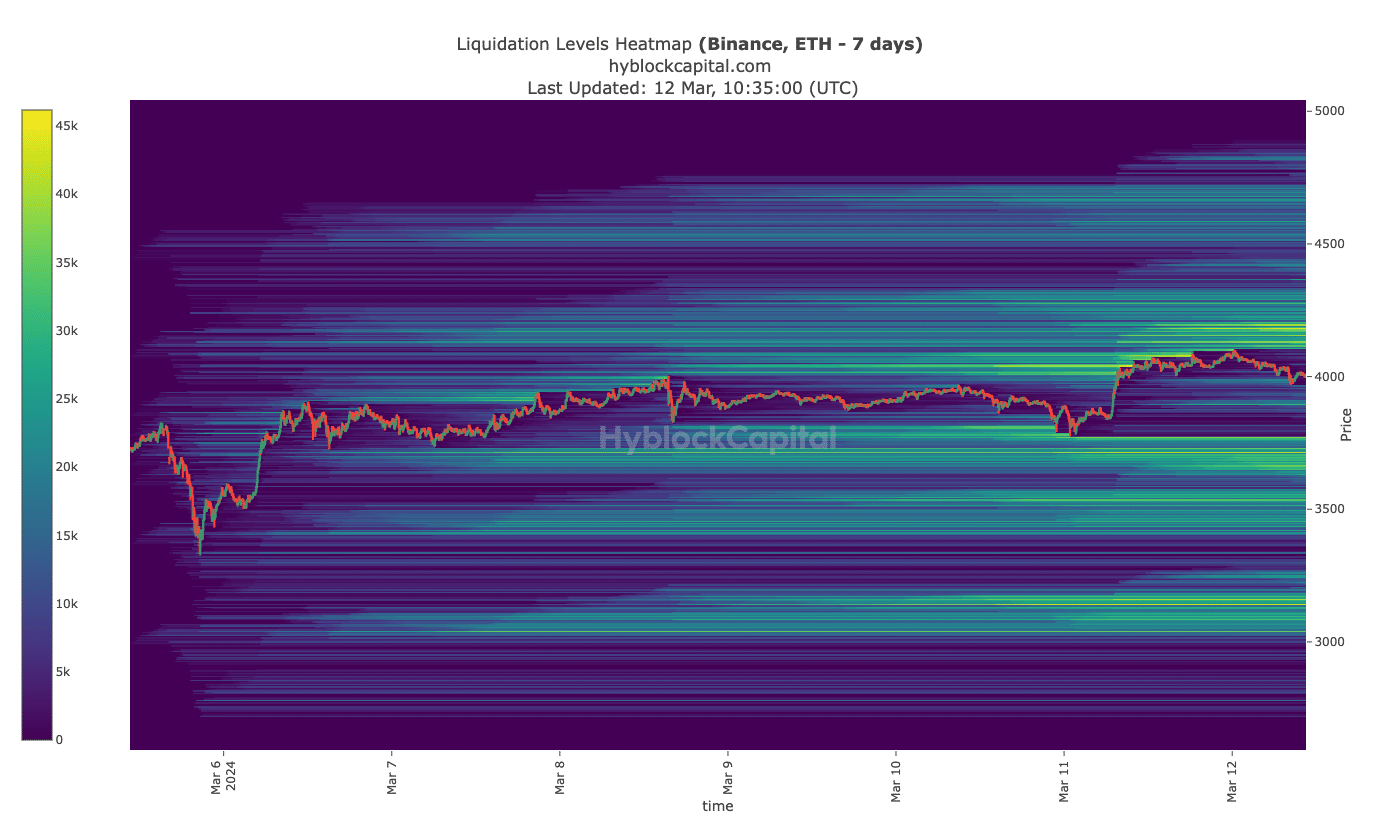

AMBCrypto came to this conclusion after analyzing the Liquidation Heatmap. In simple terms, the Liquidation Heatmap predicts price levels where large-scale liquidations might occur.

For the unfamiliar, liquidation occurs when a trader’s position is forcefully closed due to price fluctuations. It could also happen as a result of insufficient margin balance to cover the funding fee.

From our analysis of HyblockCapital’s data, large scale liquidations might occur if ETH hit $4,205. However, a successful close above this price could see the value climb higher.

For instance, the chart below showed that the altcoin might not face any major resistance below $4,310. Furthermore, if ETH rises past 4,860, the run to $5,000 could become very easy.

Bearish aggression is fuel for ETH’s rally

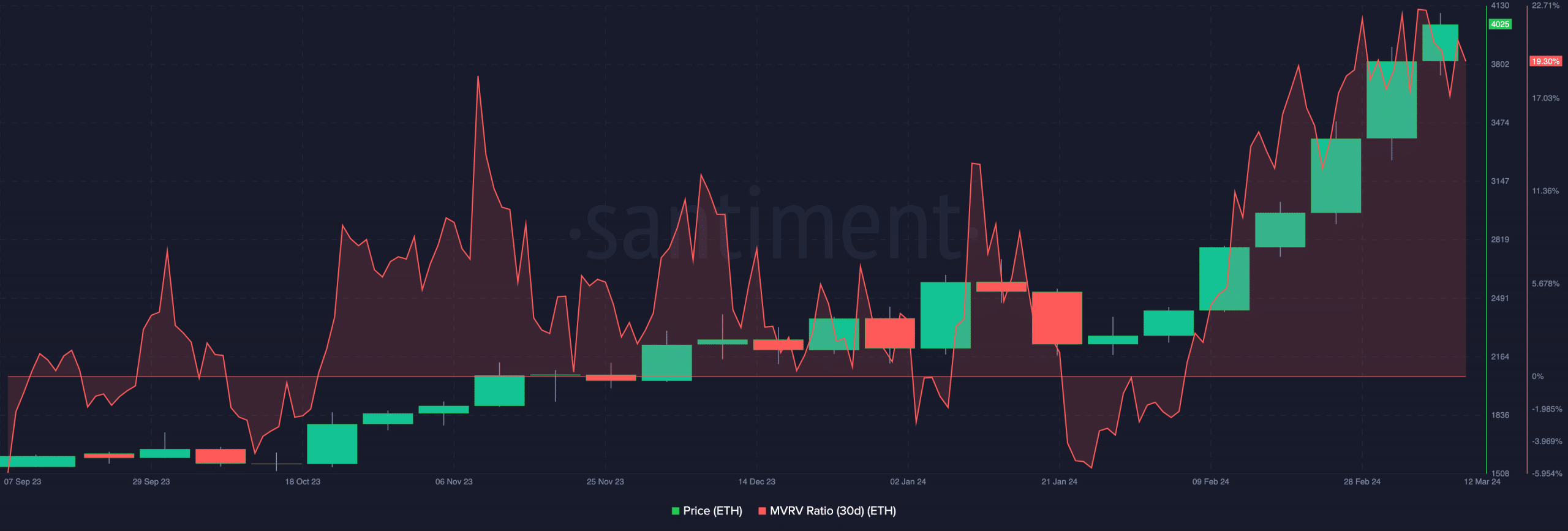

Another metric AMBCrypto assessed to check the likelihood of a rally was the Funding Rate. The Funding Rate is the difference between the price of a perpetual contract and the spot price of a cryptocurrency.

According to Santiment’s data, Ethereum’s aggregated Funding Rate was 0.068%. The positive Funding Rate implied that ETH was trading at a premium perp price above the index value.

The high reading of the metric alongside the rising ETH price suggests that short are aggressive. Unfortunately, their aggression is not being rewarded. Therefore, ETH’s price action is potentially bullish.

Beyond the happenings in the derivatives market, we also checked out the active addresses. At press time, the number of active addresses on the Ethereum network was 537,000. This was a significant increase from what the amount was on the 10th of March.

The rise in active addresses indicate growing interest and confidence in ETH. While it also means that the network has gotten healthier, traders might also view it as bullish signal.

In conclusion, a combination of the metric evaluated aligned with a price increase. However, ETH might experience some pullback as it targets a new all-time high.

But indicators showed that potential retracement might not last long.

![[ℕ𝕖𝕧𝕖𝕣] 𝕊𝕖𝕝𝕝 𝕐𝕠𝕦𝕣 𝔹𝕚𝕥𝕔𝕠𝕚𝕟 - Did This Poor Baby Make A Profit On The BTC He Sold?](https://cdn.bulbapp.io/frontend/images/255151e6-9e83-4151-9644-80af06e53b74/1)