Explore Grid Trading on Binance Futures.

Explore Grid Trading on Binance Futures courtesy of Binance

courtesy of Binance

1.Main Takeaways

2.Introduction

3.What is Binance grid trading?

4. How does Binance grid trading work?

5. What are the benefits of grid trading on Binance Futures?

6. Why crypto beginners need to try Binance grid trading

7. How novice traders can use auto parameters in Binance grid trading

8. Why experienced Crypto traders need to use Binance grid trading

9. How to set up a custom Binance grid trading strategy from scratch

10. Conclusion

11. Disclaimer

Main Takeaways

- Trading Binance futures contracts can become an automated endeavour through a tool called Binance grid trading.

- Binance grid trading is carried out at predetermined time intervals using a preset price range

- Futures traders make profits from little price deviations especially during periods of volatility.

- Binance grid auto-trading is simple to use; just a click will start you off in the right direction.

- Setting up a custom Binance grid trading strategy is simpler than most people often think.

Introduction Photo: courtesy of Binance support

Photo: courtesy of Binance support

Trading futures has been made easy by Binance grid trading which is a latest addition to Binance innovative products to assist all users to profit from price fluctuations in the crypto-market.

Grid trading is an automated tool with preset factors and it capitalizes on minute price swings to generate profits for the trader. Its usage is more profitable when the crypto-markets are unstable and the fluctuations of crypto-assets prices, large.

Trading Binance futures by grid method usually involves placing buy orders below prevailing market prices and placing sell orders above market prices. Thus this kind of trading comprises of a series of ‘Buys’ and ‘Sells’ within the price range which the trader had preset.

Thus, Binance grid trading enables the trader to accommodate several small price ranges within the initial price range preset by him.

For example, trader A decided to trade BTC on Binance futures for 24 hours. He checked the market price of BTC for that day and saw that it was $35,000. From his BTC charts, he saw that BTC price was rising and thus he envisaged that the BTC Price could escalate to a maximum of $42,000 at the end of 24 hours.

With this speculative information at hand, he decided to preset his price range for his grid trading at $35,000 to $42,000. He could now determine smaller price ranges to automatically buy and sell his crypto-asset within this overall price range. These smaller price ranges are what formed grids from where grid trading got its name.

The frequency of grid trades is directly proportional to the number of preset grids. If you want to apply the knowledge of Dollar-cost averaging, Binance grid trading is what you need as it is programmed to buy low, sell high within your predetermined price range and grid intervals.

There are several benefits that comes with grid trading on Binance platform and you will come across them later in this piece of writing which is aimed at exploring the basic things you need to know about Binance grid trading.

What is Binance Grid trading? Photo: courtesy of Binance

Photo: courtesy of Binance

It is a trading method that utilizes grids on the Binance futures platform. A grid is a frame work of spaces or a network of lines and in futures trading, this represent different prices at which a crypto-asset or a crypto-derivative is preset to buy and sell.

Because Binance grid trading is an automated tool, it carries out precise limit orders within predetermined range of prices and at pre-calculated duration and this, results in good profit making despite the petite price deviations.

The power of grid trading is often unleashed when you are trading a crypto-asset that has stagnated for a long time, has wide margin of price range and large price fluctuation. Higher number of grids often translate to smaller trading profit because of shorter intervals between grids.

Binance grid trading has two modes. The first mode is called Arithmetic mode and the second one, Geometric mode. Arithmetic mode has a grid characterised by same price difference while the Geometric mode contains the same price-ratio difference.

While grid trading, you have the option to use the Auto mode or the Manual mode. If you are new to grid trading, it would be sensible and safer to use the Auto mode. Experienced traders can go for the manual mode because it help them to customize their parameters of choice for a self-tailored trading experience.

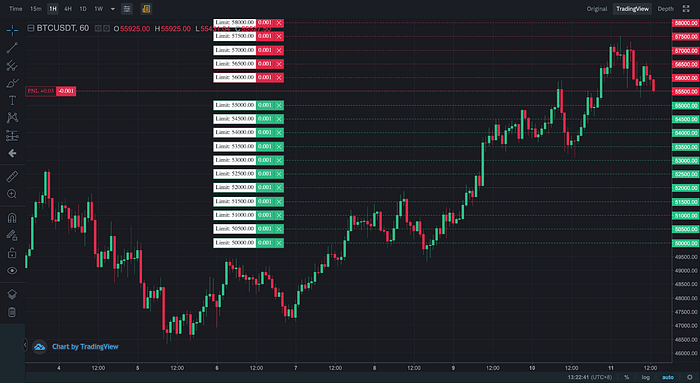

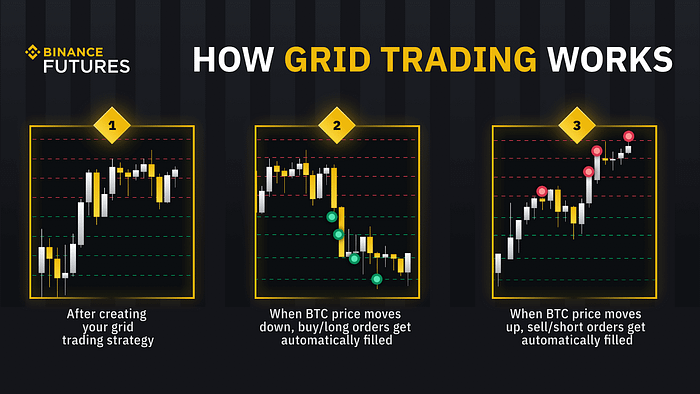

How does Binance grid trading work? As mentioned in the introduction, grids are a series of predetermined buy and sell orders that are set up by you, the trader, to be executed at preset intervals of your choice.

As mentioned in the introduction, grids are a series of predetermined buy and sell orders that are set up by you, the trader, to be executed at preset intervals of your choice.

The Binance grid trading automated system will execute these buy and sell orders at the slightest fluctuation in the price of the crypto-asset you are trading in. An increase in price will result in the execution of a sell order by the grid system and a decrease in the price will trigger a buy order to be executed. Both buy and sell orders are executed at a price higher and lower than the current market prices respectively.

The performance of Binance grid trading, from an analytical point of illustration, has a zigzag pattern. When a sell order is executed, a buy order is placed at a price lower than the sell price and when a buy order is executed, a sell order is placed above the buy price. Thus this rhythmic trend of buy low, sell high give rise to a graphic ‘zigzag’ pattern.

What are the benefits of grid trading on Binance Futures? Photo: Courtesy of Binance

Photo: Courtesy of Binance

Binance grid trading has several advantages which include the following:

1.You do not need to predict the trend of crypto prices and this promotes a consistent trading.

2.When you create a grid strategy, you are spared the efforts of having to observe market price movements.

3.You cut down on technical analysis and this saves you a lot of time for other income generation activities.

4. You do not need to invest your emotions and this creates a peace of mind for you.

5.You regain your personal freedom and you have more time for sleep, recreation and nutrition.

6.Binance grid trading is a creditable system that has been tested and found proficient and reliable.

7.It is profitable because of its inbuilt auto-parameters that make futures trading seamless, viable and with a better return on investment.

8.It is easy to use and thus it is effortless to adapt to in a very short time.

9. Grid trading provides a better liquidity than other trading methods especially when it’s auto-piloting.

10.With Binance grid trading, the trader can diversify his crypto-portfolios to include multiple trading pairs without hitches.

11.Grid trading, because of its automation features, can easily be used by bots to enhance trading experience and profits.

12.Binance grid trading has very low maker and taker fees.

13.using Binance grid trading would mean trading in a crypto-market with the largest liquidity in the world and thus both buy and sell orders are filled up instantly.

14.Grid traders make profits irrespective of price movements, whether crypto-asset is increasing or decreasing as far as these price fluctuations do not go outside the predetermined price range.

Why Crypto beginners need to try Binance grid trading

Crypto newbies have a lot to gain from Binance grid trading. But the primary reason why beginners need to try Binance grid trading is the already done-for-you auto-parameters and the auto-trade mechanism which enables the beginner to carry out a trade without a fundamental technical know-how or the burden of having to input trading parameters manually.

These auto-features makes grid trading very simple and easily adapted by crypto-beginners who also profit from it.

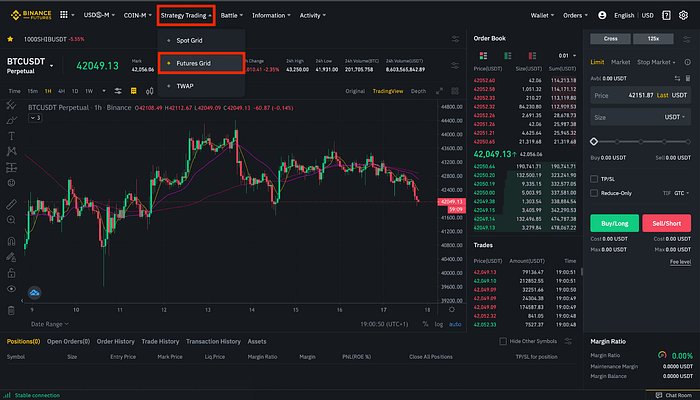

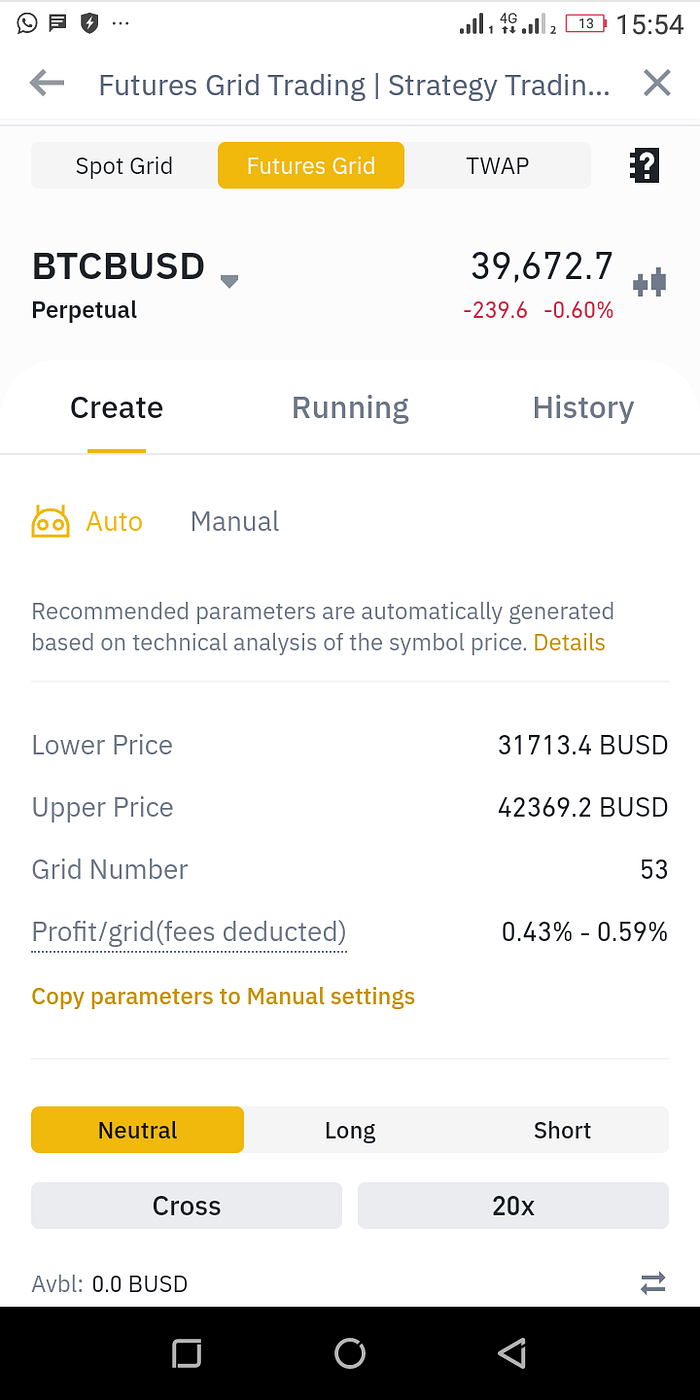

How novice traders can use auto parameters in Binance grid trading If you are new to Binance grid trading, you should use the Auto grid setting by clicking on the Auto button after you have accessed the Binance grid trading page. Avoid using the manual button because this will require you to manually input parameters or values.

If you are new to Binance grid trading, you should use the Auto grid setting by clicking on the Auto button after you have accessed the Binance grid trading page. Avoid using the manual button because this will require you to manually input parameters or values.

The Auto mode is already programmed for you by Binance and all you need to do is to click the ‘create’ button and you are good to go.

As you become conversant with the Auto grid trading, you can now navigate around the customizable features by clicking on ‘Manual’ mode. This will help familiarize yourself the Binance grid trading features.

Summarily, to use the auto-parameters in Binance grid trading, you need to log in to the Binance app home page. When you are on this page, tap on ‘strategy trading’ and then on the ‘Auto’ icon to get started.

You should have a sufficient amount of the crypto-asset that you want to trade with and you can adjust this quantity to a preferred level by sliding the quantity/order a bar to the left or right. Select the trade position , the margin type and the level of leverage that you want to use in entering the grid trade.

The price range together with its upper and lower price limits, the number of grids that would be used and the grid trading profit value in percentage are all determined by the Binance grid auto mode. Other risk management factors such as stop-loss and take-profit etc. are also predetermined by the Auto mode

Why experienced Crypto traders need to use Binance grid trading

As an advanced trader, you can do a manual customization from the inbuilt grid trading parameters with the goal of making modest trading profits. These parameters are advanced in operation and would enhanced your overall grid trading experience. You do not to code these parameters from scratch which is a time saver.

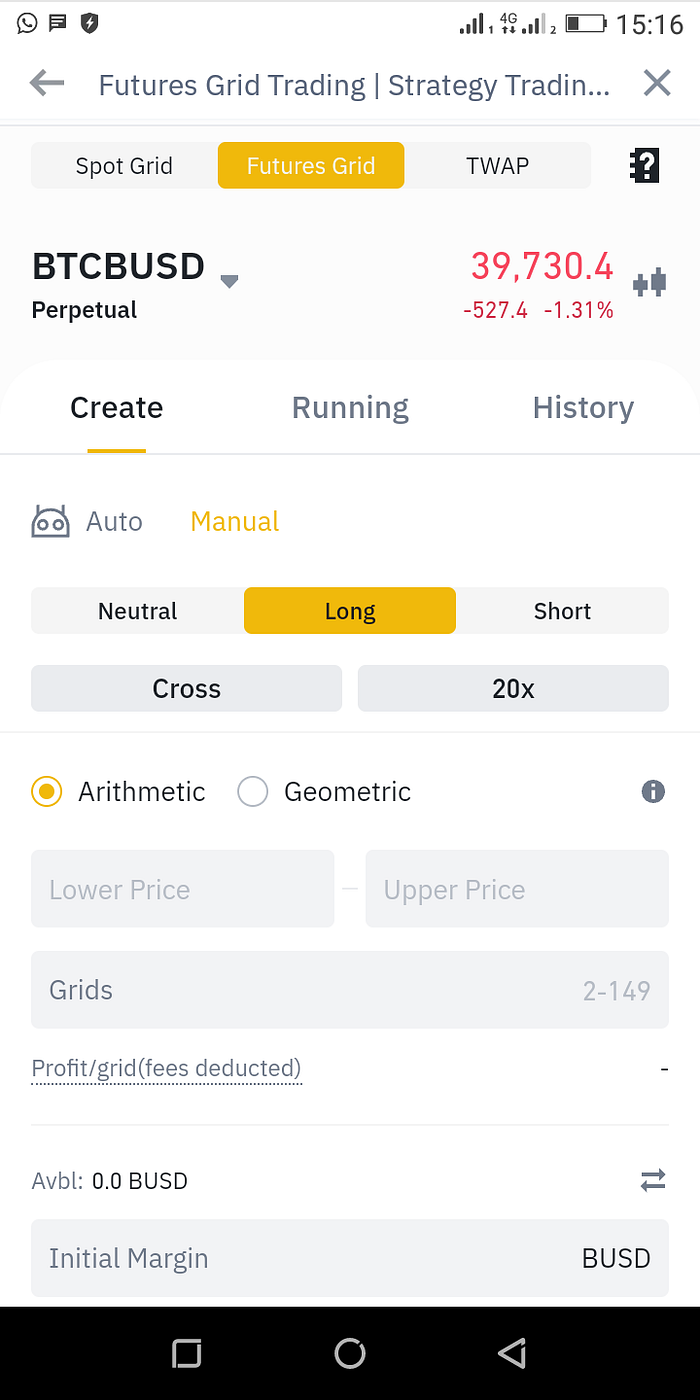

How to set up a custom Binance grid trading strategy from scratch Whether or not, you are an experienced grid trader, you might want to know the simple steps about customizing a Binance grid strategy manually. This gives you the option to custom-set the various values to your taste. These steps are:

Whether or not, you are an experienced grid trader, you might want to know the simple steps about customizing a Binance grid strategy manually. This gives you the option to custom-set the various values to your taste. These steps are:

Step One: Log into your Binance Mobile App

Step Two: Click on ‘Strategy trading’ to access your Binance futures grid trading page

Step Three: Select your grid trading pair by tapping a small grey triangle

Step Four: Select ‘Create’

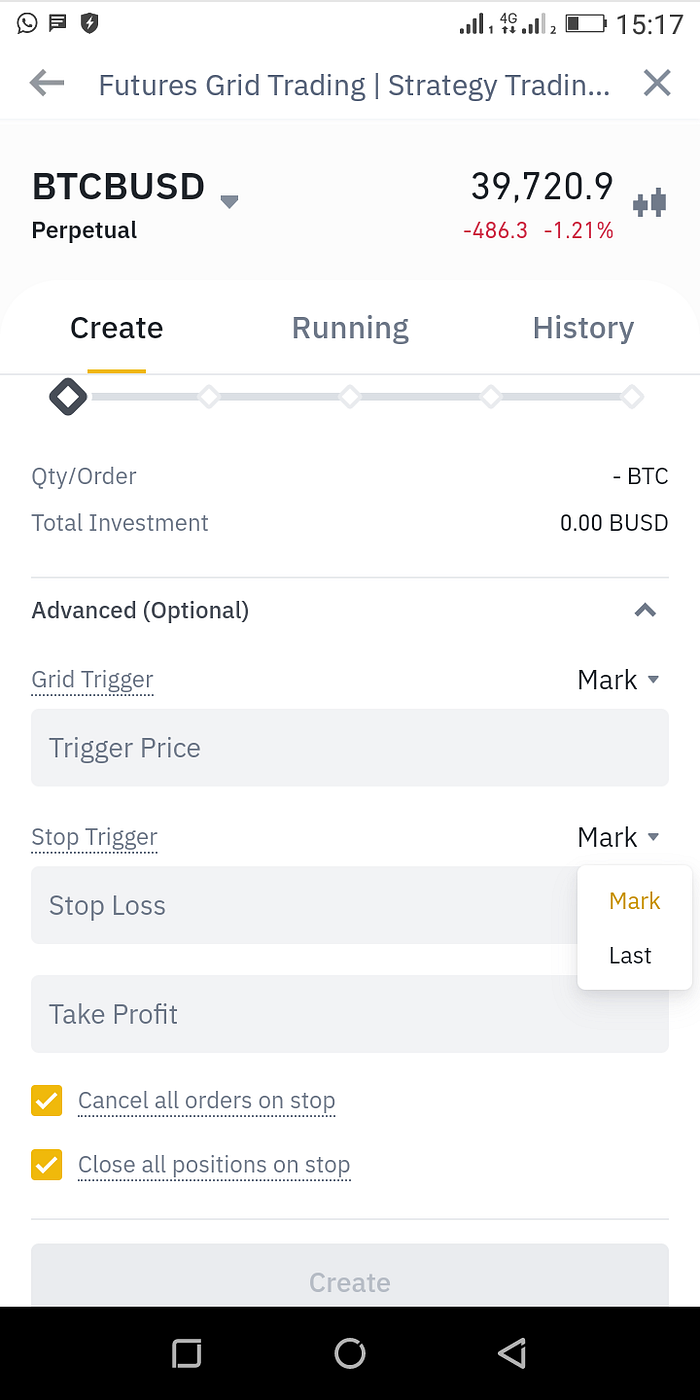

Step Five: Tap on ‘Manual’. This will display the following buttons 1.position types: Neutral, Long and Short 2.Margin types: Cross and isolated margin(20x) buttons 3.Grid types i.e Arithmetic and Geometric 4. Price range: Lower price and Upper Price 5. Grids and 6. Initial Margin

Step Six: Customize your parameters by select the various buttons of your choice.

Step Seven: Customize your advanced options by tapping the grey ‘V’ icon beside ‘Advanced(optional)’. These options include Grid Trigger, Trigger price, Stop Trigger, stop loss, Take Profit, Cancel all orders on stop and Close all positions on stop Step Eight: Click on ‘Create’ Button and confirm grid trade. You are done with Binance grid trading customization

Step Eight: Click on ‘Create’ Button and confirm grid trade. You are done with Binance grid trading customization

Brief Note on Binance Grid Trading Parameters

Grids: set up your grid intervals by determining the quantity of grids you want to use between your price range. The programmed number of grids range from a minimum of 2 to a maximum of 149

Margin: Cross or isolated are the two types of margin

Leverage: click on 20x to adjust leverage. After you have adjusted your leverage, click on ‘confirm’ button. Binance grid trading Leverage ranges from a minimum of 1x to a maximum of 50x

Price limit: Enter an appropriate value in the upper price and lower price rectangular button to predetermine your price range

Grid type: Select either Arithmetic or Geometric grid type

Grid trigger: select Mark or Last

Stop trigger: select Mark or Last

Trade positions:1.Neutral: use it to create grids without positions. Good for range -bound markets

2. Long: Use this to open long positions. Good for unstable bullish markets

3. Short position: use during unstable bearish markets

Running Button: to view active grid trades

History: click on it to view history of past grid trades

Create: Click on it to create a grid trade

TWAP: Time-weighted Average Price

Conclusion

Binance grid trading as you can observe from this write up is easy to use and has the potential to make modest profit for every trader. The best part is that, it is an automated trading which has been vetted by experienced professional traders and found viable to generate profits even for newbies. Why not consider using the Binance grid trading and trade your way to modest profits?

To get started with Binance grid trading, you can sign up for a Binance account and benefit from a $50 sign up bonus by using this official incentive link: https://accounts.binance.me/en/register?ref=11515767

You can also learn more about Binance grid trading by visiting these official Binance pages:

https://www.binance.com/en/blog/futures/benefits-of-grid-trading-on-binance-futures-421499824684903550/?ref=11515767

https://www.binance.com/en/strategy/futures/grid/BTCBUSD/?ref=11515767

https://www.binance.com/en/buy-sell-crypto/?ref=11515767

Disclaimer

Binance grid trading is not without a risk. When market prices swing outside your predetermined price range for a particular crypto-asset, the grid automated system might not give you the required outcome. This might warrant you to adjust the auto- parameters or some losses could be incurred. The opinion presented herein is solely that of the writer who has painstakingly researched the subject matter and in no way constitute a financial advice. If you are in doubt about using Binance grid trading, please consult your financial adviser.

Note.

I featured this piece on medium and is accessible there through: https://medium.com/@mikhailikpoma/explore-grid-trading-on-binance-futures-4819069ec52b

![[ℕ𝕖𝕧𝕖𝕣] 𝕊𝕖𝕝𝕝 𝕐𝕠𝕦𝕣 𝔹𝕚𝕥𝕔𝕠𝕚𝕟 - And Now What.... Pray To The God Of Hopium?](https://cdn.bulbapp.io/frontend/images/79e7827b-c644-4853-b048-a9601a8a8da7/1)

![[LIVE] Engage2Earn: McEwen boost for Rob Mitchell](https://cdn.bulbapp.io/frontend/images/c798d46f-d3b8-4a66-bf48-7e1ef50b4338/1)