Bitcoin Price Drops Despite Donald Trump Signing First Crypto Executive Order

Trump’s executive order calls for the creation of a task force to study a national digital asset reserve initiative and create a regulatory framework to support the cryptocurrency industry.

On January 24, US President Donald Trump signed his first executive order on cryptocurrency, with the goal of creating a task force to lead the US in the cryptocurrency space.

#Trump signed the crypto executive order handed to him by @DavidSacks pic.twitter.com/NnlmAqBSLe

— MartyParty (@martypartymusic) January 23, 2025

The move came just hours after the 47th President spoke at the World Economic Forum in Davos, Switzerland. In it, Mr. Trump not only emphasized the initial achievements that his administration has achieved but also affirmed his ambition to make the United States the "cryptocurrency capital" of the world. Trump said:

“The United States has the largest oil and gas reserves in the world, and we will take advantage of this resource to reduce the cost of all goods and services and make the United States a manufacturing superpower, a global leader in artificial intelligence and cryptocurrencies."

Trump addressed Davos remotely in a scathing rebuke to the Liberal economic agenda. pic.twitter.com/EvsUxb3idM

— Geopolitics.wiki (@GeopoliticsW) January 23, 2025

Specifically, the signed executive order calls for the establishment of an internal working group led by White House Crypto and AI Policy Advisor David Sacks. The group is tasked with:

- Recommending a comprehensive federal regulatory framework for the digital asset industry, including cryptocurrencies.

- Considering and evaluating the possibility of establishing and maintaining a national digital asset reserve, which could leverage assets held by the government The U.S. Seized.

- A look at the risks and opportunities of the digital asset sector, with the goal of making the United States a global innovation hub.

Today President Trump signed Executive Orders to make the U.S. the global leader in both Crypto and AI. I appeared on @FoxBusiness to discuss. pic.twitter.com/TkLDdkhVG5

— David Sacks (@DavidSacks) January 24, 2025

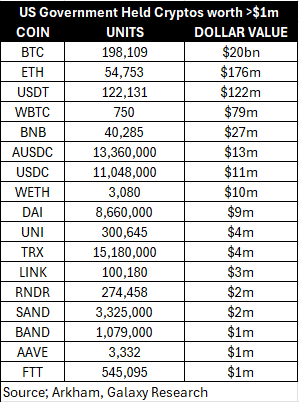

Researcher Alex Thorn from Galaxy Digital has compiled a list of cryptocurrencies currently held by the U.S. government as evidence of criminal confiscation, with a total value of over $20 billion.

"stockpile" is jargon that means holding what they have, but not necessarily buying anything

according to @arkham, here's all the coins that the USG holds over $1m pic.twitter.com/CtLEuP5utA

— Alex Thorn (@intangiblecoins) January 23, 2025

The group will include senior officials from key US government agencies such as the Secretary of the Treasury, Attorney General, Secretary of Commerce, the Chairman of the US Securities and Exchange Commission (SEC), the Chairman of the Commodity Futures Trading Commission (CFTC), and leaders at other federal agencies.

The group will have six months to make specific policy and legislative recommendations to President Donald Trump.

In addition, the executive order also includes the following contents:

Prohibiting the issuance and use of the US Central Bank Digital Currency (CBDC), the order emphasizes that CBDC can harm the stability of the financial system and seriously violate personal privacy. Instead of relying on CBDC, stablecoins are considered a superior solution, both protecting financial freedom and strengthening the dominant position of the USD through stablecoins.

The order aims to make the United States a global center for AI and crypto.

Focusing on building regulations friendly to the cryptocurrency industry, creating a clear legal environment and supporting crypto companies.

Repealing the executive order issued in March 2022 by former President Joe Biden, which required federal agencies to study aspects of the cryptocurrency sector with the aim of building a complete regulatory framework.

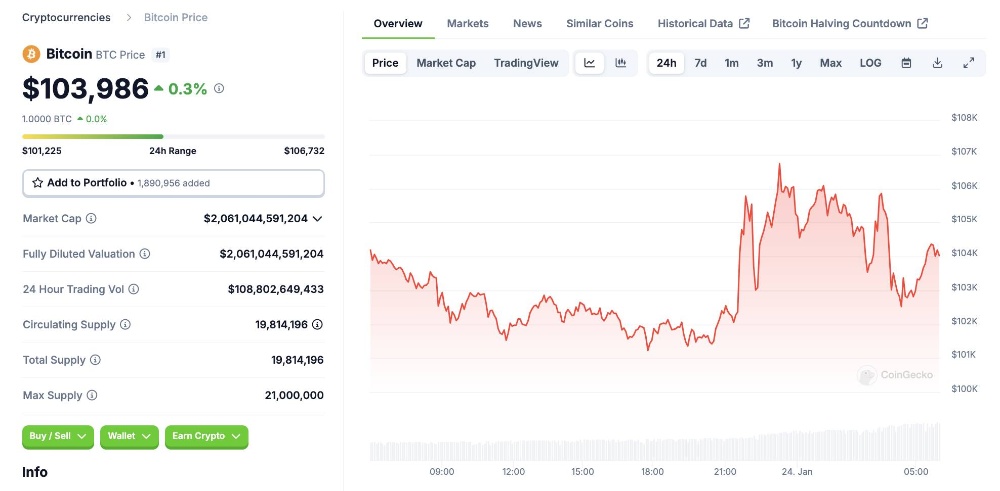

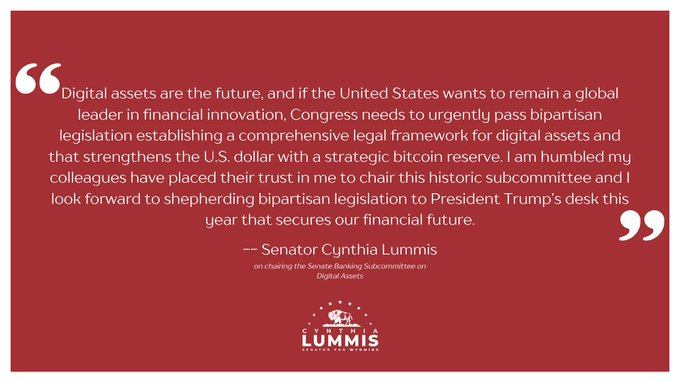

The crypto market experienced significant volatility shortly after President Trump signed the executive order. Initially, the price of Bitcoin surged from $102,100 to $106,000 thanks to a cryptic social media post by Senator Cynthia Lummis. She hinted that “big things” were coming to Bitcoin, leading the investment community to believe that the White House was preparing to announce an executive order regarding the establishment of a national Bitcoin reserve.

However, the fact that the Senator's post only mentioned her appointment as Chair of the Senate Banking Subcommittee on Digital Assets caused the Bitcoin price to quickly fall back to $103,000.

The official text of the executive order then did not directly mention Bitcoin as a national reserve asset. Instead, it focused on studying and evaluating the possibility of establishing a more general digital asset reserve. This led to a major departure from the initial expectations of many investors, causing the Bitcoin price to continue falling to $102,000 and is currently hovering around $103,900 at the time of writing.

The BTC price correction not only reflects the market's disappointment in the lack of a bold move from the administration, but also stems from the fact that establishing a strategic Bitcoin reserve is something that cannot be done immediately with just an executive order.

David Sacks also confirmed in an interview with Fox Business that the administration has not yet made a final decision on implementing a digital asset reserve. He said:

“We will evaluate this carefully. Right now, there is no official decision. We need to do more research before we take any action.”

Although the executive order has not had an immediate positive impact on the market, major investors and leaders in the cryptocurrency industry have welcomed it as a major step forward. MicroStrategy CEO Michael Saylor gave a positive assessment: “The crypto renaissance has officially begun.”

Cryptocurrency analyst Will Clemente III also emphasized that despite the BTC price drop, we have seen an incredible change in just a few years. From the turmoil of late 2022 to the US starting to research a national digital asset reserve, all in just three years, it shows that the crypto market has overcome the most difficult period.

Former Binance CEO Changpeng Zhao is optimistic:

"A strategic Bitcoin reserve in the US has almost certainly been confirmed."

Even in the first days of taking office, although he did not mention crypto in the executive order signing ceremony, President Donald Trump quickly made important moves to show support for the industry. The appointment of Ms. Caroline Pham and Mr. Mark Uyeda as acting CFTC Chair and acting SEC Chairman, respectively, marked the first time that both of these important agencies were led by people with positive views on cryptocurrencies.

Most notably, President Trump’s decision to pardon Silk Road founder Ross Ulbricht sent a clear message that Trump is ready to deliver on his campaign promises regarding cryptocurrencies.

In parallel with this decision, the SEC under Mark Uyeda also announced plans to establish a crypto task force, focusing on building a comprehensive and clear policy framework to create a transparent legal foundation for the cryptocurrency industry.

These moves mark a shift in the US approach to cryptocurrency regulation, especially when compared to the strict policies under the Biden administration and the strict regulations of the SEC under former Chairman Gary Gensler. Under President Trump, the United States is affirming its determination to usher in a new era where the cryptocurrency industry is not only facilitated to thrive but also plays a central role in shaping the country's position as a leading power in the digital finance sector globally.

![[ℕ𝕖𝕧𝕖𝕣] 𝕊𝕖𝕝𝕝 𝕐𝕠𝕦𝕣 𝔹𝕚𝕥𝕔𝕠𝕚𝕟 - $TRUMP Screwed All ALTS](https://cdn.bulbapp.io/frontend/images/49370a56-af23-4b34-aef0-ee4024df6703/1)