Robert Kiyosaki Highlights 'Problem' With Gold, Silver, and Oil — Praises Bitcoin's Limited Supply

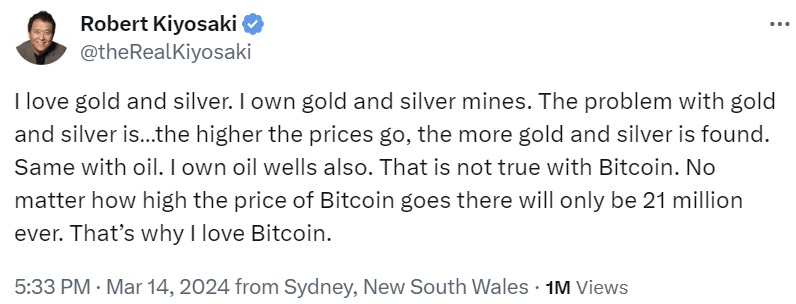

Rich Dad Poor Dad author Robert Kiyosaki has pointed out “the problem” with gold, silver, and oil, while confirming his ownership of gold, silver mines, and oil wells. Touting bitcoin’s limited supply, the famous author emphasized that no matter how high the price of bitcoin rises, there can only be 21 million coins. “That’s why I love bitcoin,” he shared.

Robert Kiyosaki on Gold, Silver, Oil, and Bitcoin

The author of Rich Dad Poor Dad, Robert Kiyosaki, has sounded the alarm about investing in gold, silver, and oil while emphasizing that the problem does not exist in bitcoin. Rich Dad Poor Dad is a 1997 book co-authored by Kiyosaki and Sharon Lechter. It has been on the New York Times Best Seller List for over six years. More than 32 million copies of the book have been sold in over 51 languages across more than 109 countries.

Kiyosaki explained on social media platform X Thursday that he loves gold, silver, and oil and he owns gold, silver mines, and oil wells. However, he stressed that the problem with the three commodities is that “the higher the prices go, the more” they are found. “That’s not true with bitcoin,” the renowned author emphasized, noting that no matter how high the price of BTC rises, there will only be 21 million coins ever. “That’s why I love bitcoin,” he wrote. The recent surge in bitcoin’s price, fueled by massive demand for spot bitcoin exchange-traded funds (ETFs), has spotlighted bitcoin’s limited supply. Currently, miners only generate around 900 new BTC each day and this supply is set to be cut in half at the halving event in April. Meanwhile, nine new spot bitcoin ETFs are rapidly accumulating bitcoin, exceeding the daily mining output by a significant margin.

The recent surge in bitcoin’s price, fueled by massive demand for spot bitcoin exchange-traded funds (ETFs), has spotlighted bitcoin’s limited supply. Currently, miners only generate around 900 new BTC each day and this supply is set to be cut in half at the halving event in April. Meanwhile, nine new spot bitcoin ETFs are rapidly accumulating bitcoin, exceeding the daily mining output by a significant margin.

Many people expect the price of bitcoin to rise substantially higher than the current level due to its supply-demand dynamic. Bernstein’s analysts are now more convinced that the price of BTC will reach $150,000 by mid-2025. Scott Melker, aka the “Wolf of All Streets,” sees the start of a major bull run for bitcoin and the broader crypto market. Galaxy Digital CEO Mike Novogratz echoes this sentiment, highlighting the “runaway momentum” in spot bitcoin ETFs. Bitwise’s CIO Matt Hougan takes it further, forecasting a potential rise above $200,000 this year, citing “too much demand and not enough supply.” Hougan even anticipates an “everything season.” Even billionaire investor Mark Cuban recognizes this trend, emphasizing bitcoin’s scarcity as a key factor in its value proposition.

A vocal bitcoin proponent, Kiyosaki has consistently made bold BTC price predictions. Last week, he declared bitcoin is “on fire” and is on its way to $300,000. He urges investors to act swiftly, emphasizing that even a $500 investment is a good start. Previously, he projected a $100,000 price point by June, viewing any dips as buying opportunities.

What do you think about Rich Dad Poor Dad author Robert Kiyosaki’s explanation about the problem with gold, silver, and oil, and why he loves bitcoin? Let us know in the comments section below.

![[LIVE] Engage2Earn: auspol follower rush](https://cdn.bulbapp.io/frontend/images/c1a761de-5ce9-4e9b-b5b3-dc009e60bfa8/1)