Research Report: ChainLink

Public blockchains are unable to access external data due to their security properties. Smart contracts designed for various use cases require access to external data sources, for which they rely on service providers capable of providing external data feeds to applications and smart contracts built on different public blockchain networks.

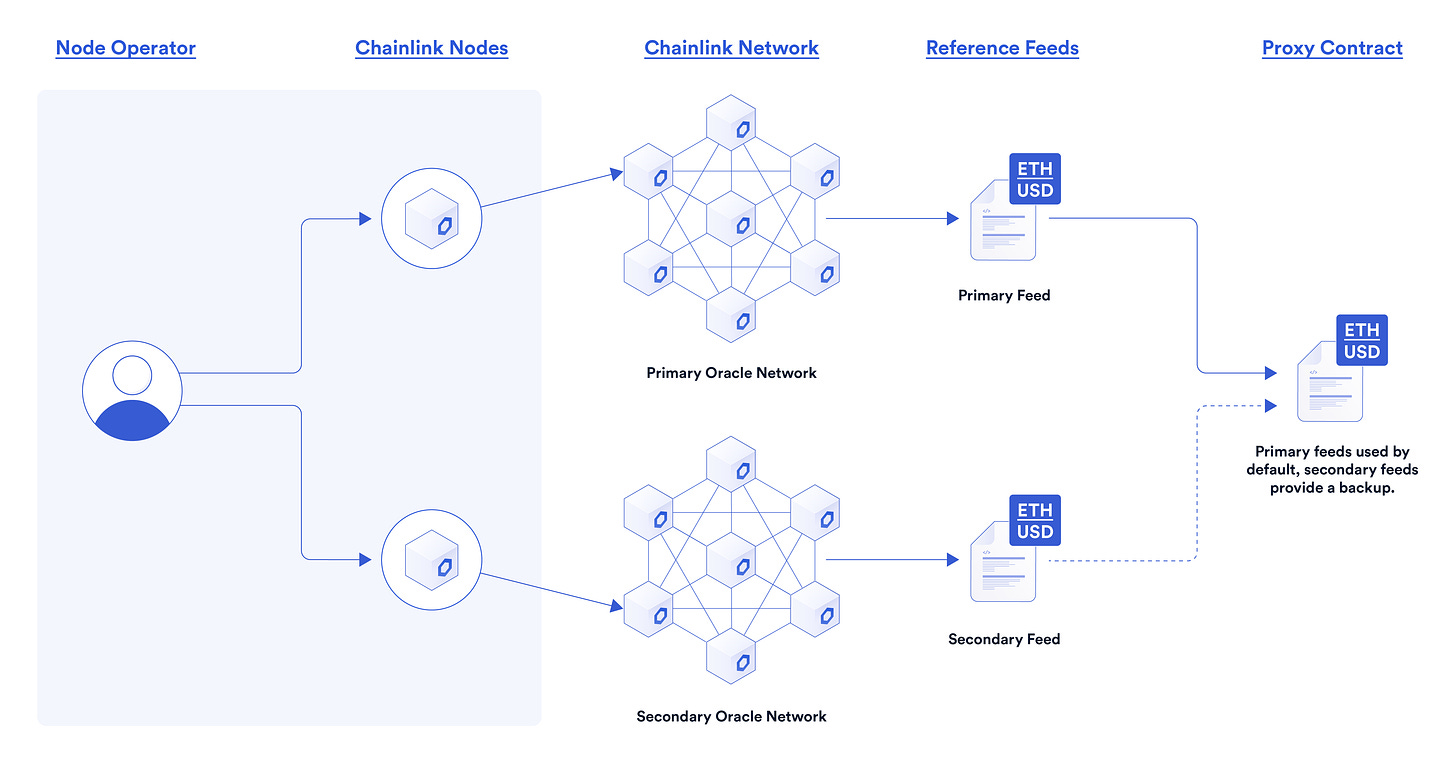

Chainlink has built a decentralised network of node operators who operate the necessary software and hardware setups to access external data feeds. These data feeds are then published to a decentralized Oracle network, which in turn provides these data to applications on various blockchains supported by Chainlink.

Node operators who manage the decentralized Oracle network are rewarded with $LINK tokens for the data they publish on the network.

ChainLink has built an extensive network of 1000+ Oracle networks that support over 14+ blockchains and 11+ different data categories. Chainlink offers six products to its clients: Data Feeds, Developer Platform, Smart Contract Automation, Cross-Chain Communication, VRF, and Proof of Reserve.

Key Metrics

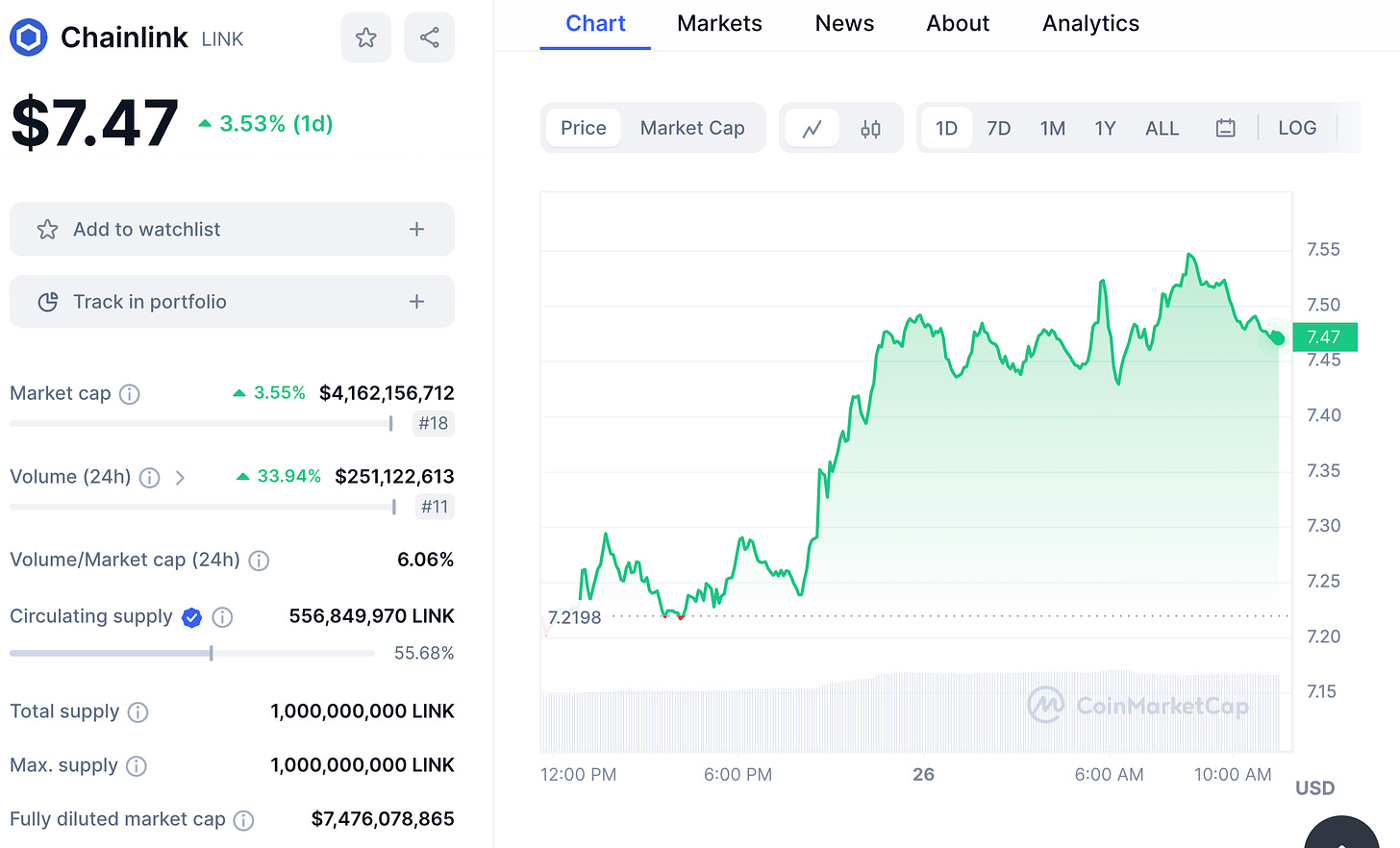

Price: $7.17

MarketCap: $3.98B

FDV: $7.16B

ATH: $52.82

Down from ATH: -86.4%

Total Supply: 1B

Circulating Supply: 556.8M(55.68%)

Protocol Secured: 344

Total Value Secured: $11.48B

Key Partners: Google, SWIFT, Binance

Clients/Partners: +2500

Oracle Networks: 989

Note: Metrics was recorded on 24th sep, data points could be different depend on the date you are reading this report.

Tokenomics

Token Utility

LINK has multiple utilities: It's used as the primary fees token within the Chainlink ecosystem. Node operators are required to stake a minimum of 1000 $LINK as collateral. Community members also stake $LINK and delegate their stake to node operators to earn rewards.

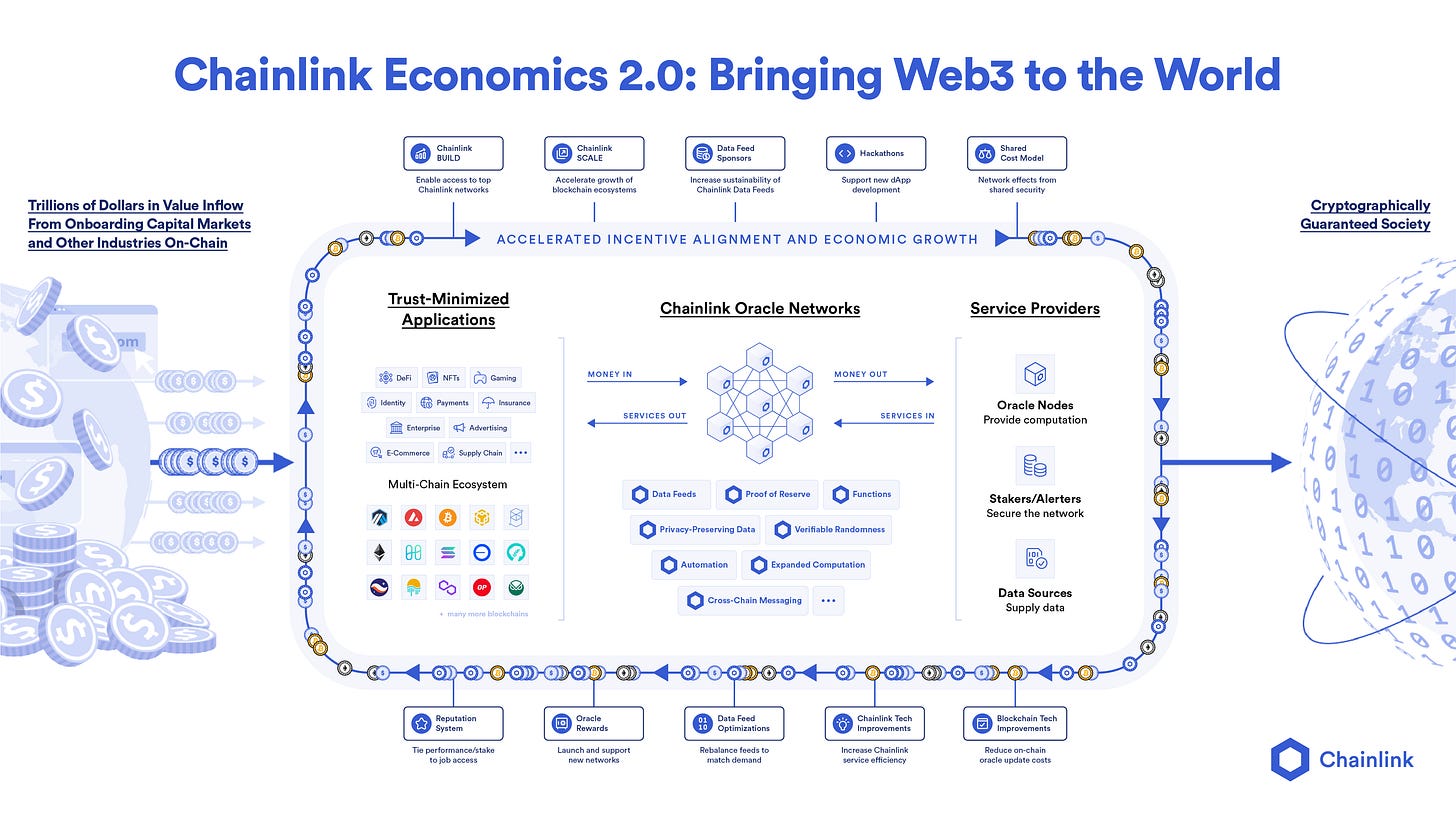

Demand Drivers

Chainlink has successfully developed various products on top of its decentralized oracle network infrastructure. The increasing usage of Chainlink Data Feeds, CCIP, VRF, and other products is expected to drive greater demand for $LINK.

Value Capture

Chainlink share the entire revenue with node operators who publish data feeds, and validate cross chain transactions.

Supply Distribution

Chainlink pre-mined a 1 billion supply at the genesis block. They sold 35% of the tokens in the public sale, allocated 30% of the tokens to the team, and reserved 35% of the tokens for node operator rewards, subject to the current annual inflation rate of 7%, which is expected to decrease in the coming years. Meanwhile, the team still holds over 20% of the LINK supply.

Tractions

Product: Market Data Feeds

Chainlink Data Feeds provide external data to Smart contract use-cases for DeFI, NFT, RWA., and many more.

Chainlink Data Feeds are available on 14 Public Blockchains; Ethereum, Polygon and BNB Chain have the most number of Data Feeds integrated.

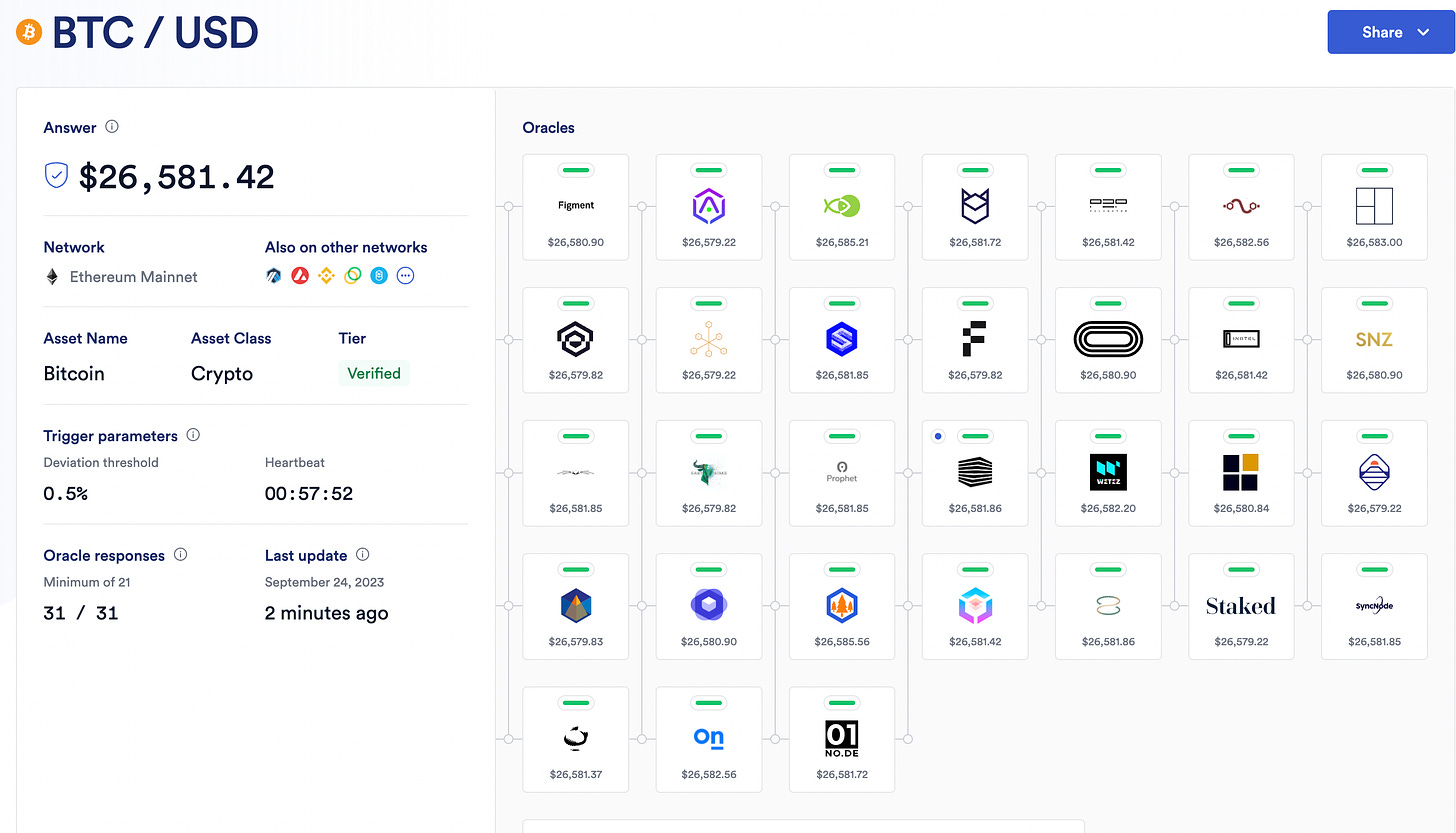

Cryptocurrency price feeds is the most used Data feed, ETHUSD, BTCUSD are the most popular price feeds.

Product: ChainLink VRF

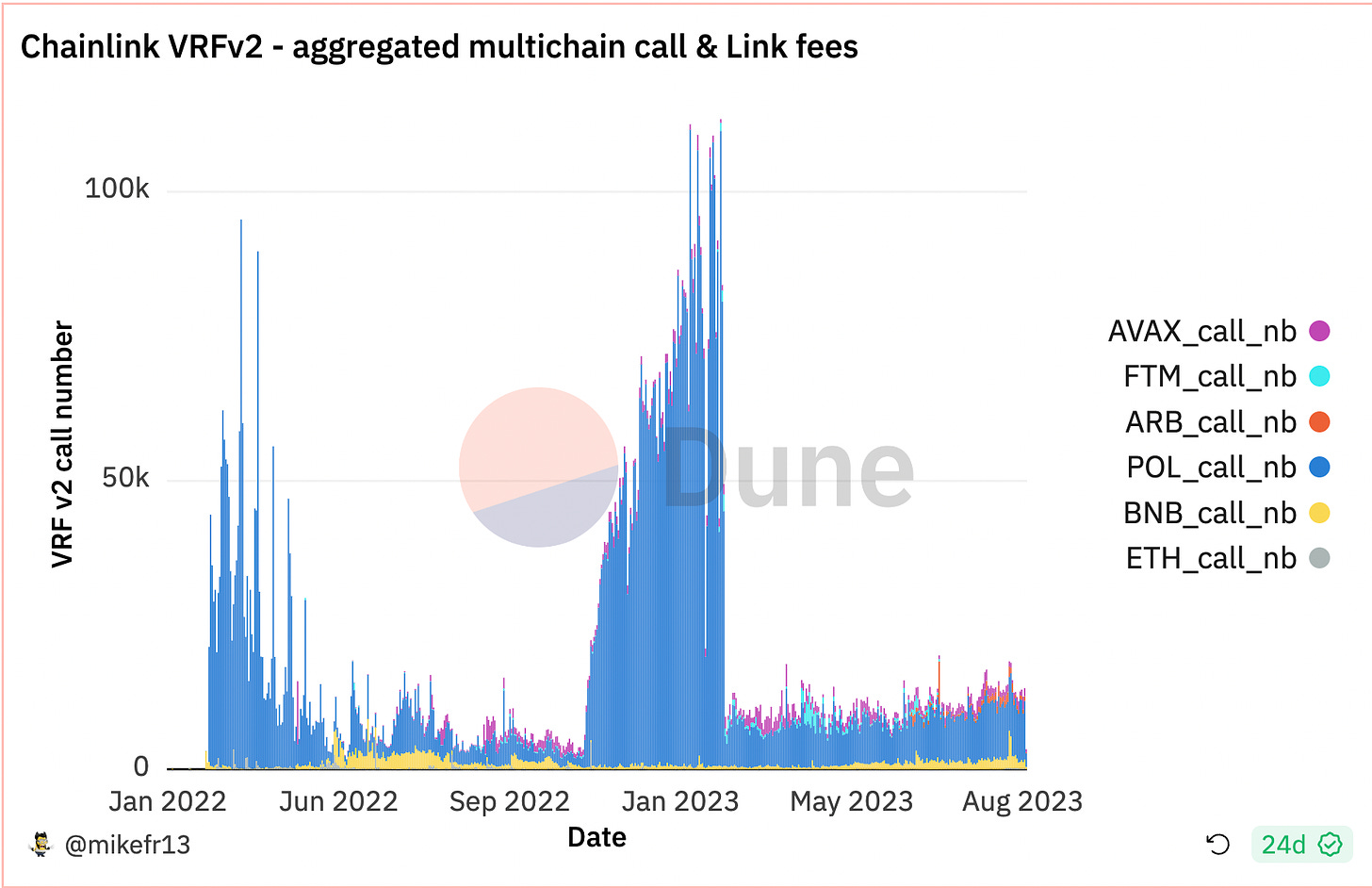

Chainlink VRF is a popular product used by NFT collections to generate multiple random NFTs based on given parameters. Chainlink VRF was heavily used during the NFT bull run in 2021-22, but now, during the current bear market, the demand for VRF has decreased. However, given that gaming and NFTs are emerging markets, ChainLink VRF could see increased demand again in the near future.

Product: CCIP

Chainlink launched its highly anticipated product for early access users, following testing by 25 partners, including Synthetix and AAVE.

CCIP utilizes two decentralized oracle networks: one for routing transactions and the other for monitoring transactions, enabling secure cross-chain communication between two different blockchain networks.

The goal of CCIP is to establish a secure bridge between private blockchains and public blockchains. This bridge allows institutions to access crypto tokens, while crypto investors gain access to RWA assets issued by these institutions.

Onchain Insights

Category: Data Feeds Total FullFilled Requests(this month): +7.012M

Total FullFilled Requests(this month): +7.012M

Total Rewards paid to Operators(this month): +198.6K

Total Fulfilled Requests MoM growth: -5.98%

Total Rewards paid to Operators MoM Growth: -23.57%

Operator with Highest Rewards: ChainLayer

Blockchain with Highest Requests: Ethereum

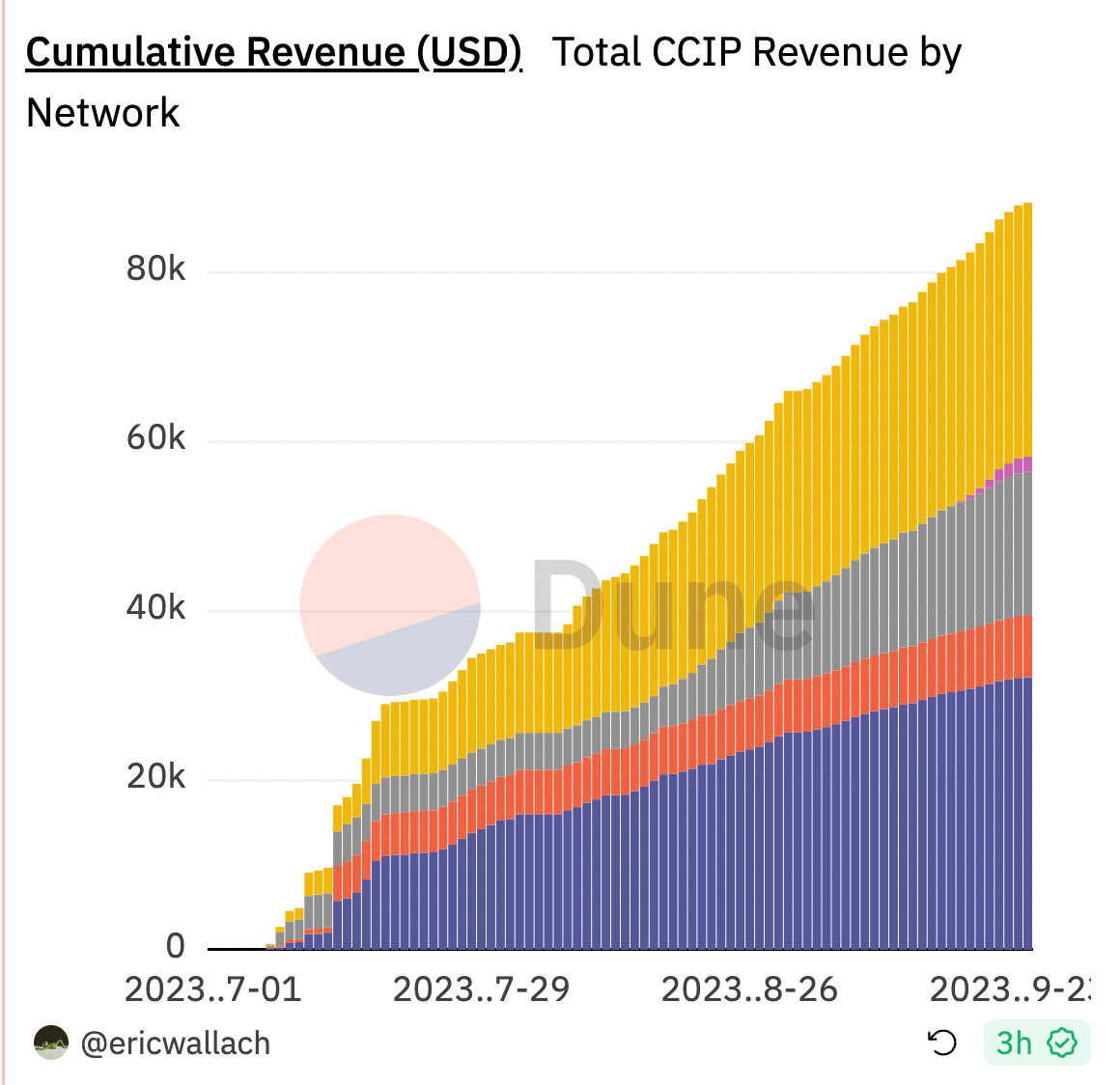

Category: CCIP

Total Revenue in LINK: 13.33K

Total Revenue in USD: $88.25K

Note: Metrics based on the top 30 grossing (LINK) nodes on Arbitrum, Avalanche, BSC, Ethereum, Optimism, Polygon.

Milestones

- Chainlink has entered into a strategic partnership with the financial communication protocol SWIFT to facilitate banks' access to public blockchains using the enterprise abstraction layer CCIP.

- SWIFT is planning to commence the initial testing phases with 12 major banks, including ANZ and PNB Paribas.

- ANZ, one of the Big Four Banks in Australia, became the first bank to successfully demonstrate the purchase of tokenized assets on the Ethereum Sepolia testnet using ANZ Stablecoin through CCIP.

- Other banks like BNP Paribas, Citi, and BNY Mellon will also be conducting various tests involving cross-chain transactions using the CCIP layer.

- The Chainlink community, fondly called Link Marines, is building hype about these ongoing trials on social media. The partnership with SWIFT could potentially open the floodgates to 11,000 banks for ChainLink in the near future. SWIFT processes over $5 trillion every day, and even 1% of that could bring $50 billion worth of volume to ChainLink in the future.

- ChainLink is focusing on enterprise adoption as they have entered into a partnership with PwC Germany to offer data oracle solutions to enterprise clients.

The Future

- Promoting the adoption of CCIP through various partnerships will be a key priority for ChainLink in the near future, and the partnership with SWIFT is the first step in that direction.

- Chainlink plans to expand the DApps ecosystem by offering grants and support programs named SCALE and BUILD.

- Additionally, Chainlink intends to enhance the cryptoeconomic security of the network by including more participants in its staking program.

- Strategically, Chainlink is moving towards becoming an abstraction layer for Real World Asset (RWA) assets through partnerships like SWIFT.

Conclusion

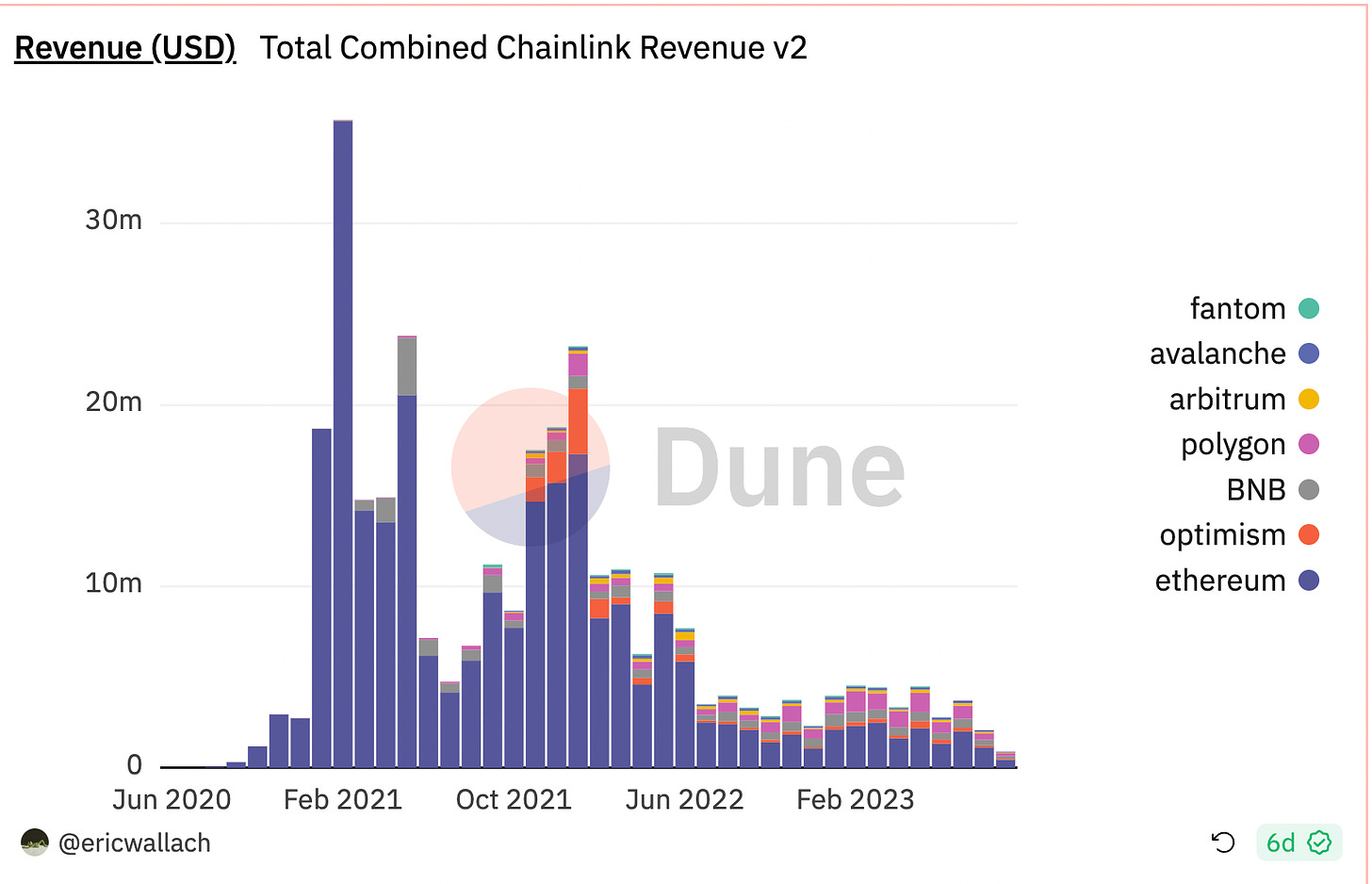

Chainlink has successfully built a sustainable network of decentralized oracles. They still have over 25% of the supply reserved for node operator incentives, which could aid in scaling the infrastructure further in the near future. Recent developments around ChainLink have been bullish, particularly the launch of CCIP and their partnership with SWIFT for trials. If these trials are successful, I believe ChainLink will enter the next growth phase, eventually tapping into $5 trillion worth of daily volume.

Chainlink's data feed usage has been down in the past 18 months due to the current bear market. However, I anticipate that Chainlink's data feeds could experience increased demand during the upcoming bull market. Additionally, they have launched a grant and support program to onboard the next generation of web3 dApps onto their network.

Overall, I am bullish on the future growth of the Chainlink network, and I believe that increased demand for the Chainlink Network will eventually drive more buying pressure on the LINK price. The Link Marines are also back to promote these partnership announcements, reminiscent of the old days, which could potentially provide additional support from the community.

Disclaimer: The information contained in this report is based on data available up to 24 Sep 2023. It is intended for informational purposes only and should not be considered as financial or investment advice. Readers are encouraged to conduct their own research and seek professional advice before making any investment decisions.

![[LIVE] Engage2Earn: Sam Rae for Hawke boost](https://cdn.bulbapp.io/frontend/images/6b43c624-bd70-48c8-b0bc-7bc27c86e0ee/1)

![[ℕ𝕖𝕧𝕖𝕣] 𝕊𝕖𝕝𝕝 𝕐𝕠𝕦𝕣 𝔹𝕚𝕥𝕔𝕠𝕚𝕟 - And Now What.... Pray To The God Of Hopium?](https://cdn.bulbapp.io/frontend/images/79e7827b-c644-4853-b048-a9601a8a8da7/1)