Safeguarding Societies: Bitcoin’s Role in Combating Hyperinflation

In this article, we delve into the critical relationship between hyperinflation and Bitcoin. Astronomically high inflation poses a severe threat to countries and societies, particularly those relying on fiat currencies. Hyperinflation, a unique economic catastrophe, has never manifested in economies operating on the gold or silver standard. Contrarily, historical examples, as discussed in previous articles, illustrate that currencies like sea shells and glass beads lost their monetary significance gradually, allowing a replacement currency to seamlessly take over purchasing power.

The Destructive Impact of Hyperinflation

Governments issuing money at virtually zero production cost create an environment where savings in the form of money vanish within months, and sometimes weeks. Hyperinflation extends beyond the devaluation of economic value for individuals; it triggers the collapse of the intricate economic production structures societies have painstakingly built over centuries and even millennia.

Unraveling Economic Structures

As money collapses, the ability to trade, produce, and engage in anything beyond basic survival becomes impossible. The intricate production and trade structures developed over centuries disintegrate as consumers, producers, and employees find themselves unable to transact. The goods that were once taken for granted begin to vanish. Capital disappears, and a society experiences a cascading effect where luxury goods vanish first, followed by essential commodities. The decline in the quality of life is stark, leading to widespread despair, anger, and the search for scapegoats. Opportunistic politicians exploit this turmoil to gain power, turning a dire situation into a breeding ground for demagoguery. Governments, over the span of a century, have witnessed these tumultuous times.

Bitcoin as a Beacon of Hope

In response to this precarious state of affairs, Bitcoin emerged as a beacon of hope. It presents a viable solution for societies devastated by hyperinflation. Envisioning a future where the Bitcoin standard is adopted, we believe it holds the key to a hyperinflation-free world. Unlike traditional fiat currencies, Bitcoin operates on a decentralized and finite system, immune to the whims of governments printing money unchecked.

A Hyperinflation-Free Future with Bitcoin

Embracing the Bitcoin standard would insulate societies from the destructive cycle of hyperinflation. The decentralized nature of Bitcoin ensures that the value is not subject to arbitrary manipulation, providing a stable and secure alternative. As societies grapple with economic uncertainties, adopting the Bitcoin standard could pave the way for a more resilient and robust financial ecosystem.

In conclusion, the perils of hyperinflation have historically wreaked havoc on societies, eroding economic structures and fostering societal unrest. Bitcoin emerges as a transformative force, offering a lifeline to societies navigating the tumultuous waters of hyperinflation. The prospect of a hyperinflation-free world through the adoption of the Bitcoin standard signifies a potential paradigm shift in the realm of economic stability.

Mesut İnan

Bitcoin

Btc

Cryptocurrency

Crypto Follow

Follow

Written by Dr. Mesut İnan

7 Followers

kriptokoin.com yazarı. #Bitcoin ve #altcoin sevdalısı. #AVAX hayranı.

More from Dr. Mesut İnan

Dr. Mesut İnan

Dr. Mesut İnan

in

Coinmonks

Navigating Negativity: Empowering Perspectives in the Cryptocurrency Realm

In the realm of Bitcoin and cryptocurrency, negative indoctrination often casts a shadow, influencing decisions and potentially hindering…

2 min read

·

Jan 8

5

Dr. Mesut İnan

Dr. Mesut İnan

Navigating the Bitcoin Seas: Lessons from a Fisherman’s Proverb

A timeless fisherman’s proverb draws a parallel to the world of Bitcoin, suggesting that 40,000 wishes won’t fill the hive with fish…

2 min read

·

Jan 8

5

Dr. Mesut İnan

Dr. Mesut İnan

Navigating Bitcoin Hatred: A Closer Look at Perspectives and Critiques

Bitcoin has been no stranger to criticism since its inception, with detractors expressing their disdain for various reasons. Notably, gold…

2 min read

·

Jan 8 Dr. Mesut İnan

Dr. Mesut İnan

in

Coinmonks

The Motivation Behind Bitcoin: Unraveling Satoshi Nakamoto’s Vision

The inception of Bitcoin has left many of us pondering the motivations that spurred its creation. Motivation, a potent driving force…

2 min read

·

Sep 5, 2023

4

Recommended from Medium

Scott Galloway

Scott Galloway

2024 Predictions

Each year, we review/make predictions re the past/coming year. Most years, we hit more than we miss. But we do miss — if we made 10…

11 min read

·

Jan 6

8.5K

116

Financeable

Financeable

12 Side Hustles You Can Do From Your Phone ($600+ Per Day)

Let’s be honest, if you’re reading this article, you probably have a phone or a laptop. And with this thing, you can make as much as $600…

13 min read

·

Dec 25, 2023

5.7K

106

Lists

Modern Marketing52 stories

Modern Marketing52 stories

·

368

saves

Generative AI Recommended Reading52 stories

Generative AI Recommended Reading52 stories

·

622

saves

Unicorn Ultra

Unicorn Ultra

in

Unicorn Ultra

What is BRC-20? How BRC-20 Tokens Are Revolutionizing The Bitcoin Blockchain

The cryptocurrency world has witnessed a significant development with the emergence of BRC-20 tokens, a novel token standard on the Bitcoin…

5 min read

·

Dec 21, 2023

15 0xAnn

0xAnn

in

Crypto 24/7

Making Money Scalping Crypto

“Why do you work 9–5 when crypto trading is basically free money?”

·

7 min read

·

Jan 10

423

10

Shawn Forno

Shawn Forno

in

The Startup

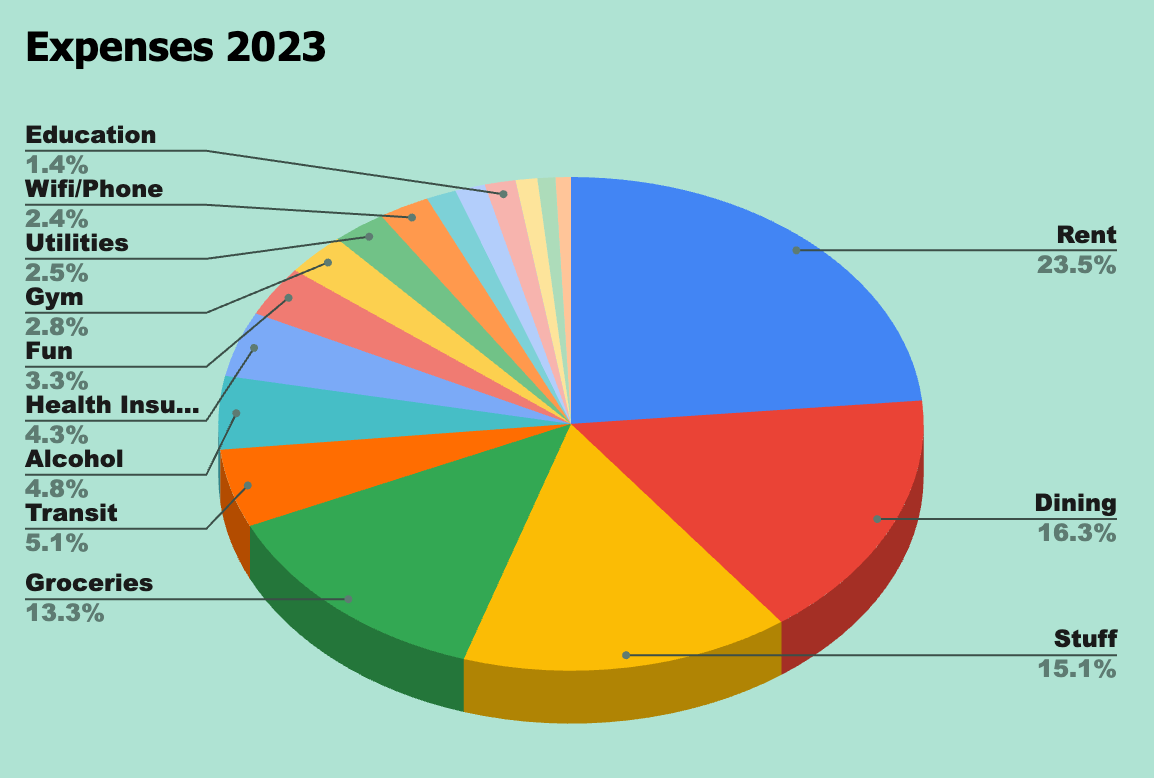

Here’s Exactly How Much it Costs to Live in Spain for One Year

An honest look at our average monthly expenses in Galicia, Spain

·

12 min read

·

Jan 6

2.6K

49 James Presbitero Jr.

James Presbitero Jr.

in

Practice in Public

These Words Make it Obvious That Your Text is Written By AI

These 7 words are painfully obvious. They make me cringe. They will make your reader cringe.

4 min read

·

Jan 1

12.2K

365