CENTRIFUGE

Today, I will take a closer look at the Centrifuge Protocol, an infrastructure platform designed to enable decentralised financing of real-world assets on the blockchain. Let's dive into the @centrifuge

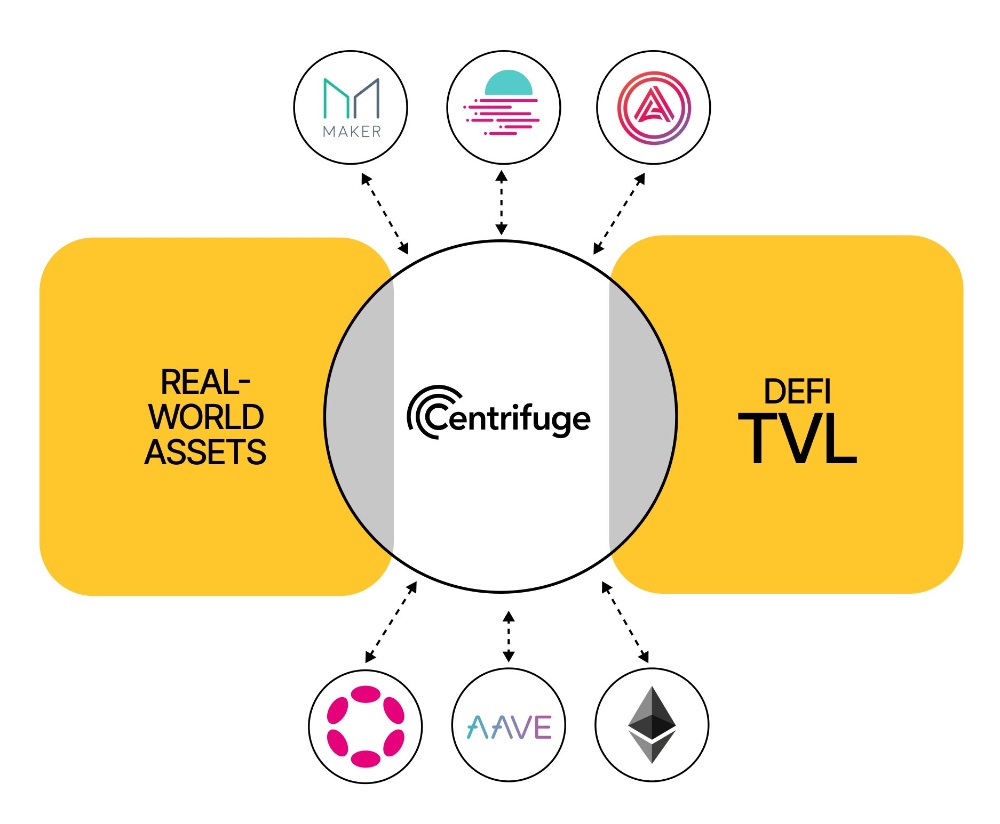

Centrifuge is an infrastructure designed to enable decentralized financing of real-world assets on the blockchain, eliminating unnecessary intermediaries for transparent transactions between borrowers and lenders. It offers fully collateralized asset pools, legal recourse for liquidity providers, and supports a wide range of asset classes, including mortgages, invoices, microlending, and consumer finance. The protocol aims to reduce borrowing costs for businesses globally while providing DeFi users with a stable, collateralized yield independent of volatile crypto markets. By bringing the structured credit market onto the blockchain, @centrifuge aims to create a more transparent, affordable, and limitless financial system, addressing the disparity in access to capital between large corporations and SMEs. Centrifuge has led the creation of the Tokenized Asset Coalition, a collaboration between industry leaders such as @AaveAave, @circle, @coinbase, @rwa_xyz and others. This coalition's goal is to advance real-world asset tokenization, aiming to bring a trillion dollars' worth of assets onto blockchain platforms, with a strong focus on education and advocacy.

At the time of preparing this review, Centfrifuge's TVL was $246M.

Tokenization and Private Data Sharing

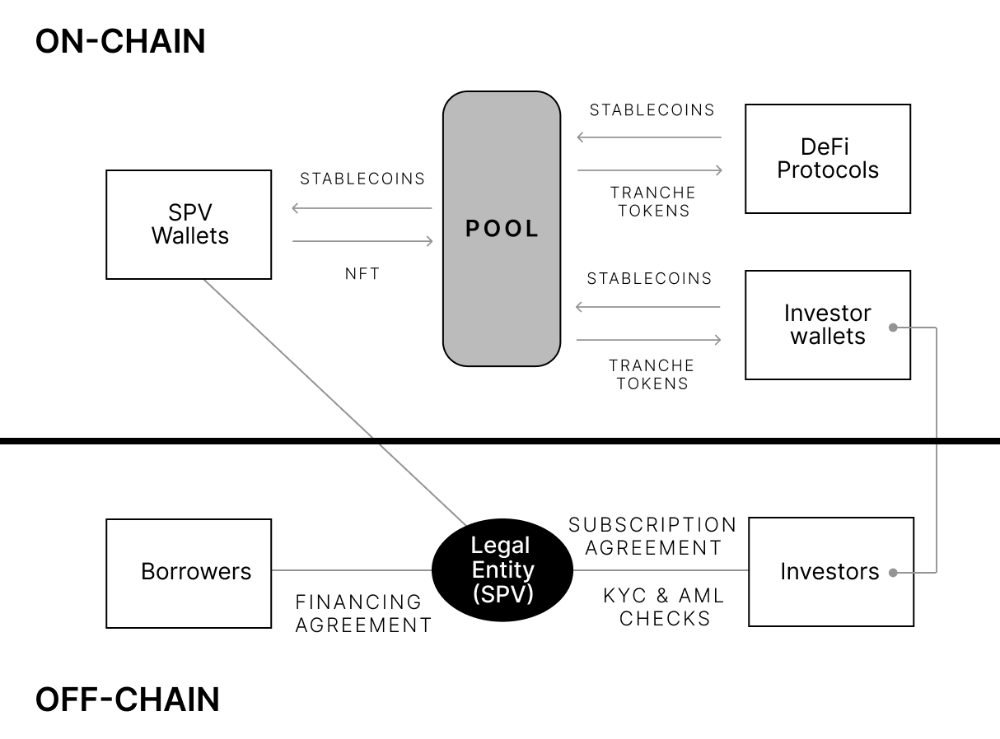

▫️ Borrowers mint NFTs to represent off-chain assets for financing.

▫️ On-chain data linked to NFTs is public, but private data is secured with the Private Data Layer.

▫️ Private Data Layer is a peer-to-peer network (PODs) for secure information sharing.

▫️ Issuers and investors decide how and with whom to share asset data privately.

▫️ On-chain transparency provides immutable financial transaction records. On-chain

▫️ Real world assets are illiquid, so pooling assets for financing is essential.

▫️ Revolving pools allow continuous investment and redemption orders.

▫️ Mechanisms include epochs for coordination and on-chain Net Asset Value (NAV) calculation.

▫️ Pricing considers different loan types and asset defaults.

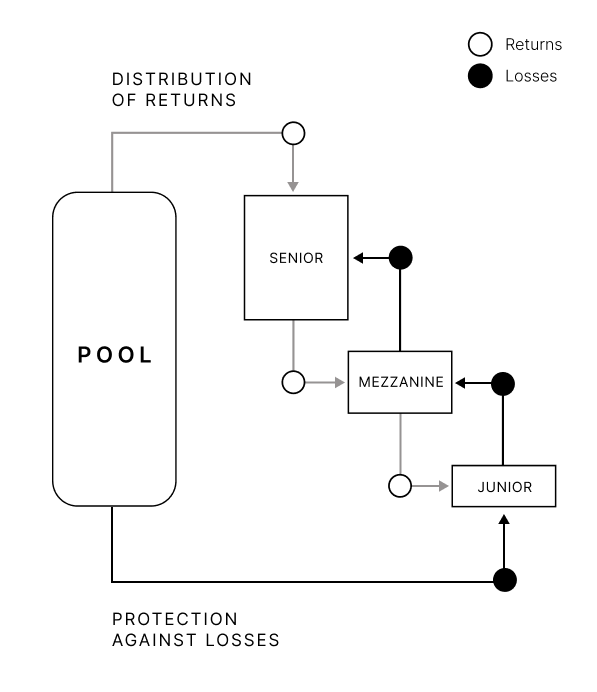

▫️ Tranching allows investors to choose risk profiles, and tokens represent tranches. Tranche tokens are securities and require KYC for holders.

▫️ Centrifuge Protocol is built on @centrifuge Chain, a dedicated blockchain for real world assets.

▫️ Advantages include lower costs, flexibility, dedicated blockspace, and on-chain governance.

▫️ CFG token holders govern the blockchain and pay transaction fees. Integrated with DeFi ▫️ Centrifuge Protocol provides Connectors for direct integration with EVM blockchains. ▫️ This enables DeFi protocols to invest in real world asset pools.

▫️ A multi-chain ecosystem is possible with multiple chain interactions.

▫️ Real-world legal structures, such as special purpose vehicles (SPVs), mirror the protocol.

▫️ Legal entities separate asset originators from financing activities.

▫️ Recovery processes for defaulted assets vary by asset class.

▫️ KYC and accreditation checks are necessary for investor onboarding.

▫️ Third-party e-KYC providers assist with onboarding and verification.

![[ℕ𝕖𝕧𝕖𝕣] 𝕊𝕖𝕝𝕝 𝕐𝕠𝕦𝕣 𝔹𝕚𝕥𝕔𝕠𝕚𝕟 - Did This Poor Baby Make A Profit On The BTC He Sold?](https://cdn.bulbapp.io/frontend/images/255151e6-9e83-4151-9644-80af06e53b74/1)