Gold's Price Surge to Nearly $2,200 Overshadowed by Bitcoin's ‘Speculative Mania,’ Peter Schiff Clai

In a manner similar to bitcoin and the overall crypto market, gold’s value has climbed, nearly touching $2,200 per ounce this week. This uptick is widely attributed to demand from central banks, with surveys indicating both Wall Street and Main Street anticipate higher prices in the upcoming week. At the same time, gold enthusiast Peter Schiff contends that bitcoin’s so-called speculative frenzy is “preventing the media and investors from noticing the breakout.”

Gold Price Breakout Continues, But Bitcoin Steals the Limelight

Bloomberg strategist Simon White suggests that the current upswing in gold prices is primarily fueled by central banks seeking alternatives to the dollar. He explains, “Gold’s new high signals global central banks are likely accumulating the precious metal in an effort to diversify away from the dollar, as persistently large fiscal deficits threaten to further erode its real value and lead to more inflation,” White conveyed in a recent investor memo. Gold almost touched the $2,200 mark per ounce this week, witnessing a 4.63% increase over the last five days. Currently, the rate for one ounce of .999 fine gold stands at $2,179. In anticipation of the upcoming week, Kitco News conducted a poll among Wall Street and Main Street investors, revealing a consensus that gold’s value will either rise or remain steady in the next seven days.

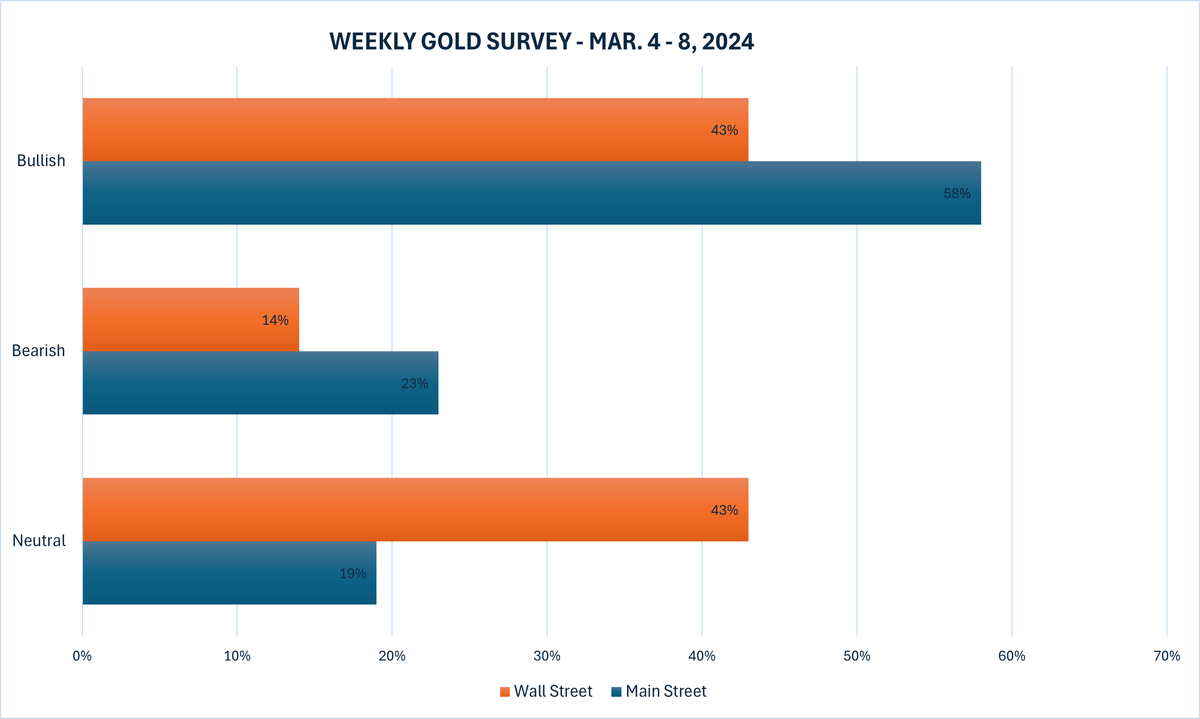

Gold almost touched the $2,200 mark per ounce this week, witnessing a 4.63% increase over the last five days. Currently, the rate for one ounce of .999 fine gold stands at $2,179. In anticipation of the upcoming week, Kitco News conducted a poll among Wall Street and Main Street investors, revealing a consensus that gold’s value will either rise or remain steady in the next seven days. Kitco Weekly Gold Survey.

Kitco Weekly Gold Survey.

The fragile state of the economy and the impending closure of the U.S. central bank’s Bank Term Funding Program (BTFP) on Monday are cited by some as key factors influencing this outlook. Meanwhile, Peter Schiff has expressed discontent as bitcoin (BTC) diverts attention from gold’s recent price peaks. On X, the gold bug and economist said, Despite gold’s record daily/weekly close of about $2,178, CNBC has barely mentioned the rally.” Schiff added:

The GDXJ, an index of junior gold mining stocks actually closed lower on the day. The speculative mania in bitcoin is preventing the media and investors from noticing the breakout.

Google Trends indicates a heightened curiosity in bitcoin (BTC) when compared to related search terms. Globally, the search term “bitcoin” achieved a perfect score of 100 during a 90-day period, peaking on March 5. In contrast, the search interest for “gold” is at 82 out of a possible 100, suggesting that bitcoin is garnering more attention than gold, at least in the realm of online queries.

What do you think about gold’s market performance and Peter Schiff’s comments about bitcoin overshadowing the yellow metal’s rise? Share your thoughts and opinions about this subject in the comments section below.