Winzo Clone App:Unlocking New Avenues in the Gaming Industry

In March, identifying the top 5 cryptocurrencies to invest in is crucial for maximizing returns and diversifying your digital asset portfolio. Bitcoin (BTC), the pioneer cryptocurrency, remains a solid choice, often viewed as a store of value akin to digital gold. Ethereum (ETH) is another promising option, especially with the upcoming Ethereum 2.0 upgrade set to enhance scalability and efficiency. Binance Coin (BNB) is gaining traction as Binance continues to expand its ecosystem and utility. Solana (SOL) has also emerged as a strong contender, offering fast transactions and low fees, making it attractive for decentralized applications (dApps). Lastly, Cardano (ADA) stands out for its focus on sustainability and scalability, with the potential to become a leading cryptocurrency development for smart contracts and dApps. Conduct thorough research and consider your investment goals and risk tolerance before making any investment decisions.

Solana (SOL) has also emerged as a strong contender, offering fast transactions and low fees, making it attractive for decentralized applications (dApps). Lastly, Cardano (ADA) stands out for its focus on sustainability and scalability, with the potential to become a leading cryptocurrency development for smart contracts and dApps. Conduct thorough research and consider your investment goals and risk tolerance before making any investment decisions.

What is Cryptocurrency?

Cryptocurrency is a digital or virtual form of currency that uses cryptography for security. Unlike traditional currencies issued by governments (fiat currencies), cryptocurrencies operate on decentralized networks based on blockchain technology. This technology ensures that transactions are secure, transparent, and immutable. Cryptocurrencies are not controlled by any central authority, such as a government or financial institution, making them immune to government interference or manipulation.

The most well-known cryptocurrency is Bitcoin, created in 2009 by an unknown person or group of people using the pseudonym Satoshi Nakamoto. Since then, thousands of other cryptocurrencies have been created, each with its unique features and purposes.

Cryptocurrencies can be used for various purposes, including online purchases, investments, remittances, and as a means of transferring value across borders. They have also given rise to new technologies and concepts, such as decentralized finance (DeFi) and non-fungible tokens (NFTs), which are revolutionizing the way we think about finance, ownership, and digital assets.

Top 5 Cryptocurrencies To Buy Right Now

1. Bitcoin (BTC)

Bitcoin (BTC) is the original and most well-known cryptocurrency. Launched in 2009, it introduced the concept of decentralized digital currency and has been a significant force in the financial technology (FinTech) landscape.

Bitcoin (BTC) is the original and most well-known cryptocurrency. Launched in 2009, it introduced the concept of decentralized digital currency and has been a significant force in the financial technology (FinTech) landscape.

Here’s a quick rundown of what Bitcoin is and its current state:

What is Bitcoin?

- Decentralized digital currency: Operates without a central bank or authority, relying on a peer-to-peer network for verification and transactions.

- Uses blockchain technology: Transactions are publicly recorded on a shared ledger, ensuring transparency and security.

- Limited supply: Only 21 million BTC will ever be created, contributing to its perceived value.

Current Status of Bitcoin:

Current Status of Bitcoin:

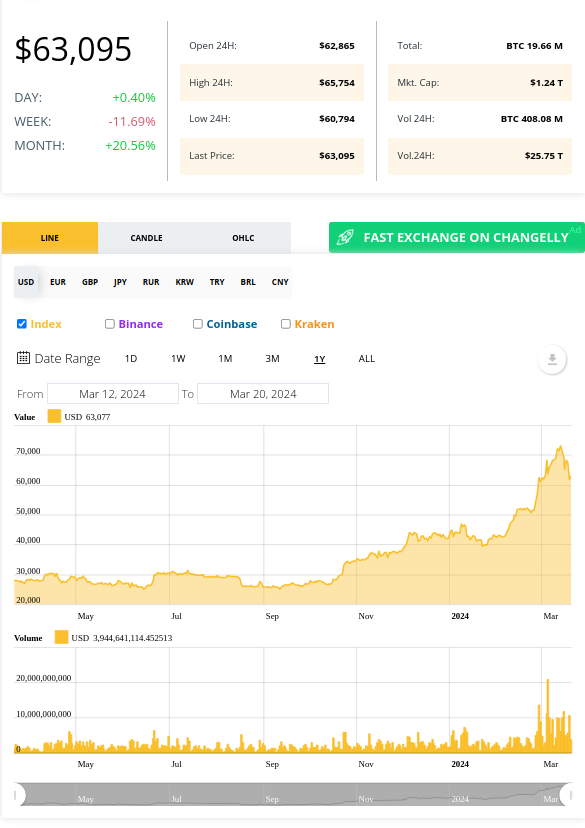

- Price: ~$63,000 USD (with fluctuations) — Bitcoin’s price has experienced a decrease in the last 24 hours.

- Market Cap: Over $1.2 trillion USD — This makes Bitcoin the most valuable cryptocurrency by market capitalization.

- Uses: While envisioned as a replacement for traditional currency, Bitcoin use varies. It can be used for online purchases, investment, or a store of value.

- Volatility: Bitcoin’s price is known to be quite volatile, meaning it can experience significant price swings in a short period.

- Security: While generally secure, there have been instances of theft from digital wallets and exchanges.

- Regulation: Regulations surrounding cryptocurrency use and trading vary by country.

2. Fetch.ai (FET)

Fetch.ai (FET) is a decentralized machine learning network that aims to democratize access to artificial intelligence (AI) technology. Launched in 2019, it creates an open, permissionless environment for users to connect and leverage a global network of data through autonomous AI agents.

Fetch.ai (FET) is a decentralized machine learning network that aims to democratize access to artificial intelligence (AI) technology. Launched in 2019, it creates an open, permissionless environment for users to connect and leverage a global network of data through autonomous AI agents.

Key points about Fetch.ai (FET):

- Decentralized Machine Learning Network: Built on blockchain technology, Fetch.ai facilitates secure and transparent AI operations.

- Autonomous Agents: Users can deploy AI agents on the network to perform tasks and access data collaboratively.

- Democratizing AI: Fetch.ai aims to make AI technology accessible to a wider audience, not just large corporations with substantial resources.

- Utility Token (FET): The FET token serves multiple purposes within the Fetch.ai ecosystem:

- Network Fees: Users pay FET for transactions and services on the network.

- Staking: FET holders can participate in staking to validate network operations and earn rewards.

- Access & Governance: FET grants access to network functionalities and plays a role in network governance.

Current status of Fetch.ai :

Current status of Fetch.ai :

- Price: ~$2.53 USD (with fluctuations)

- Market Cap: ~$2.1 billion USD

- Circulating Supply: 839.8 million FET (with no maximum supply limit)

3. Bittensor (TAO)

Bittensor (TAO) is an open-source protocol that powers a decentralized, blockchain-based machine learning network. Here’s a closer look at what Bittensor offers:

Bittensor (TAO) is an open-source protocol that powers a decentralized, blockchain-based machine learning network. Here’s a closer look at what Bittensor offers:

- Collaborative AI Training: Bittensor enables machine learning models to train collaboratively. Imagine a giant, shared brain where models learn from each other, fostering faster development and innovation.

- Market for AI Services: The network functions as a marketplace. Users can access AI services and applications built on Bittensor by paying with TAO tokens.

- Incentivized Participation: Training models on the Bittensor network contribute to collective intelligence. Models that provide valuable information are rewarded with TAO tokens, creating an incentive for users to participate.

- Open and Transparent: Bittensor is an open-source project, meaning its code is publicly accessible, fostering trust and collaboration within the developer community.

TAO Token Details :

TAO Token Details :

- Price: ~$617.39 USD (fluctuations occur)

- Market Cap: ~$3.9 billion USD

- Circulating Supply: 6.4 Million TAO (out of a total supply of 21 Million TAO)

4. SingularityNET (AGIX)

SingularityNET (AGIX) is a blockchain-based platform that aims to create a globally accessible marketplace for AI services. Here’s a breakdown of what SingularityNET offers and how it relates to AGIX tokens:

SingularityNET (AGIX) is a blockchain-based platform that aims to create a globally accessible marketplace for AI services. Here’s a breakdown of what SingularityNET offers and how it relates to AGIX tokens:

What is SingularityNET?

- A decentralized platform facilitating the creation, sharing, and monetization of AI services.

- Users can browse, test, and purchase various AI tools using the platform’s native token, AGIX.

- Developers can publish and sell their AI creations on the marketplace and track their performance.

- Aims to foster the development of Artificial General Intelligence (AGI), a theoretical future intelligence on par with humans.

The Role of AGIX Tokens:

- Transaction fees: AGIX is used to pay for transactions on the SingularityNET marketplace.

- Decentralized Governance: AGIX token holders participate in voting on proposals that shape the future of the SingularityNET platform.

- Staking: AGIX holders can stake their tokens to contribute to network security and earn rewards.

- Multi-chain compatibility: AGIX functions on multiple blockchains, including Ethereum and Cardano, enhancing its reach and flexibility.

Current Status of SingularityNET:

Current Status of SingularityNET:

- Price: ~$1.03 USD (subject to change)

- Market Cap: ~$1.3 billion USD

- Circulating Supply: 1.28 Billion AGIX (out of a maximum supply of 2 Billion AGIX)

5. Render (RNDR)

Render (RNDR) is a distributed GPU rendering network that utilizes the power of blockchain technology. Here’s a breakdown of what it is and how it works:

Render (RNDR) is a distributed GPU rendering network that utilizes the power of blockchain technology. Here’s a breakdown of what it is and how it works:

What is Render (RNDR)?

- A network facilitating GPU rendering tasks.

- Connects artists and studios needing rendering power with providers who rent out their GPUs.

- Built on the Ethereum blockchain for secure transactions and decentralized governance.

- Launched in 2017 by OTOY Inc.

How does Render work?

- Artists use RNDR tokens, the network’s cryptocurrency, to pay for GPU compute power from providers (node operators).

- The network employs a proof-of-work system, called proof-of-render, to verify successful rendering before payment and artwork release. This verification system can involve both manual and automatic processes.

Additional details about RNDR:

Additional details about RNDR:

- Price: ~$11.00 USD (with some fluctuations)

- Market Cap: ~$4.1 billion USD

- Circulating Supply: 380 Million RNDR (out of a maximum of 530 Million)

Step-by-step guide to buying cryptocurrencies

Here’s a step-by-step guide to buying cryptocurrencies:

- Choose a Cryptocurrency Exchange: Research and select a reputable cryptocurrency exchange. Some popular exchanges include Binance, Coinbase, and Kraken.

- Create an Account: Sign up for an account on the chosen exchange. Provide the required information, including your email address, phone number, and proof of identity, if necessary.

- Secure Your Account: Enable two-factor authentication (2FA) to add an extra layer of security to your account.

- Deposit Funds: Deposit funds into your exchange account using a bank transfer, credit card, or other accepted payment methods.

- Select a Cryptocurrency: Choose the cryptocurrency you want to buy. Bitcoin (BTC) and Ethereum (ETH) are popular choices, but there are thousands of other cryptocurrencies to choose from.

- Place an Order: Decide whether you want to place a market order (buy at the current market price) or a limit order (set a specific price at which you want to buy).

- Execute the Order: Once you’ve placed your order, the exchange will execute it and the cryptocurrency will be credited to your account.

- Store Your Cryptocurrency Safely: Consider transferring your cryptocurrency to a secure wallet for added security. Hardware wallets like Ledger and Trezor are highly recommended.

- Monitor Your Investment: Keep an eye on the market and your investment. Cryptocurrency prices can be volatile, so it’s important to stay informed.

- Consider Long-Term Storage: If you plan to hold your cryptocurrency for the long term, consider storing it in a secure wallet rather than leaving it on the exchange.

Remember, investing in cryptocurrencies carries risks, so it’s important to do your own research and only invest money you can afford to lose.

![[ℕ𝕖𝕧𝕖𝕣] 𝕊𝕖𝕝𝕝 𝕐𝕠𝕦𝕣 𝔹𝕚𝕥𝕔𝕠𝕚𝕟 - OM(G) , My Biggest Bag Was A Scam????](https://cdn.bulbapp.io/frontend/images/99de9393-38a8-4e51-a7ab-a2b2c28785bd/1)

![Nekodex – Earn 20K+ NekoCoin ($20) [Highly Suggested]](https://cdn.bulbapp.io/frontend/images/b4f0a940-f27c-4168-8aaf-42f2974a82f0/1)