The Rise of Cryptocurrency

Cryptocurrencies have gained significant attention and popularity in recent years, transforming the financial landscape. Here are some key points to consider:

- Bitcoin: Bitcoin, introduced in 2009, is the first and most well-known cryptocurrency. It operates on a decentralized network called blockchain, which ensures transparency, security, and immutability of transactions. Bitcoin's value has experienced significant volatility, with periods of rapid growth followed by sharp declines.

The Brutal truth about Bitcoin

- Increased Adoption: Cryptocurrencies have gained broader acceptance and adoption globally. Major companies, including Tesla, PayPal, and Square, now accept cryptocurrencies as a form of payment. Some countries have even embraced cryptocurrencies as legal tender, such as El Salvador adopting Bitcoin.

Bitcoin as legal tender in El salvador

- Altcoins and Tokenization: Bitcoin's success has led to the emergence of numerous alternative cryptocurrencies, often referred to as "altcoins." These include Ethereum (ETH), Ripple (XRP), Litecoin (LTC), and many others. Additionally, the concept of tokenization has gained traction, enabling the creation of digital assets representing real-world items like real estate, art, or even intellectual property.

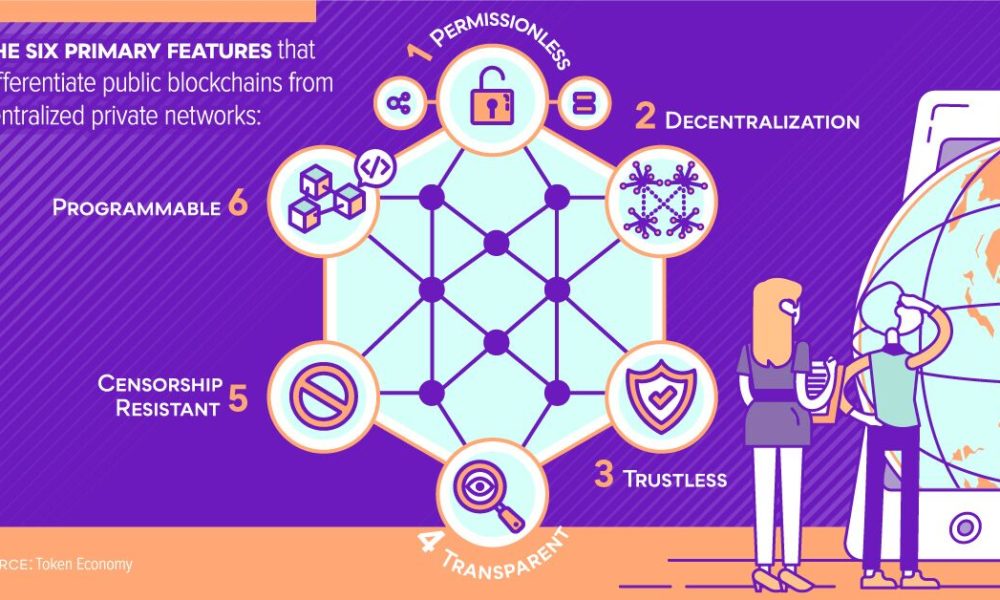

- Decentralized Finance (DeFi): DeFi refers to a range of financial applications built on blockchain networks. It aims to provide open, permissionless, and decentralized alternatives to traditional financial intermediaries. DeFi applications enable lending, borrowing, staking, and yield farming, among other activities, without relying on centralized authorities.

DeFi - An emerging alternative to financial system

- Initial Coin Offerings (ICOs) and Security Tokens: Initial Coin Offerings became popular fundraising methods in the cryptocurrency space, allowing projects to raise capital by selling tokens. However, regulatory scrutiny increased due to concerns over fraud and investor protection. Security tokens, which represent real-world assets, have emerged as a regulated alternative.

- Central Bank Digital Currencies (CBDCs): Some countries are exploring the development of Central Bank Digital Currencies. These are digital representations of national fiat currencies issued and regulated by central banks. CBDCs aim to enhance financial inclusion, streamline transactions, and improve monetary policy effectiveness.

![]() CBDC - A crisis recovery tool for government

CBDC - A crisis recovery tool for government

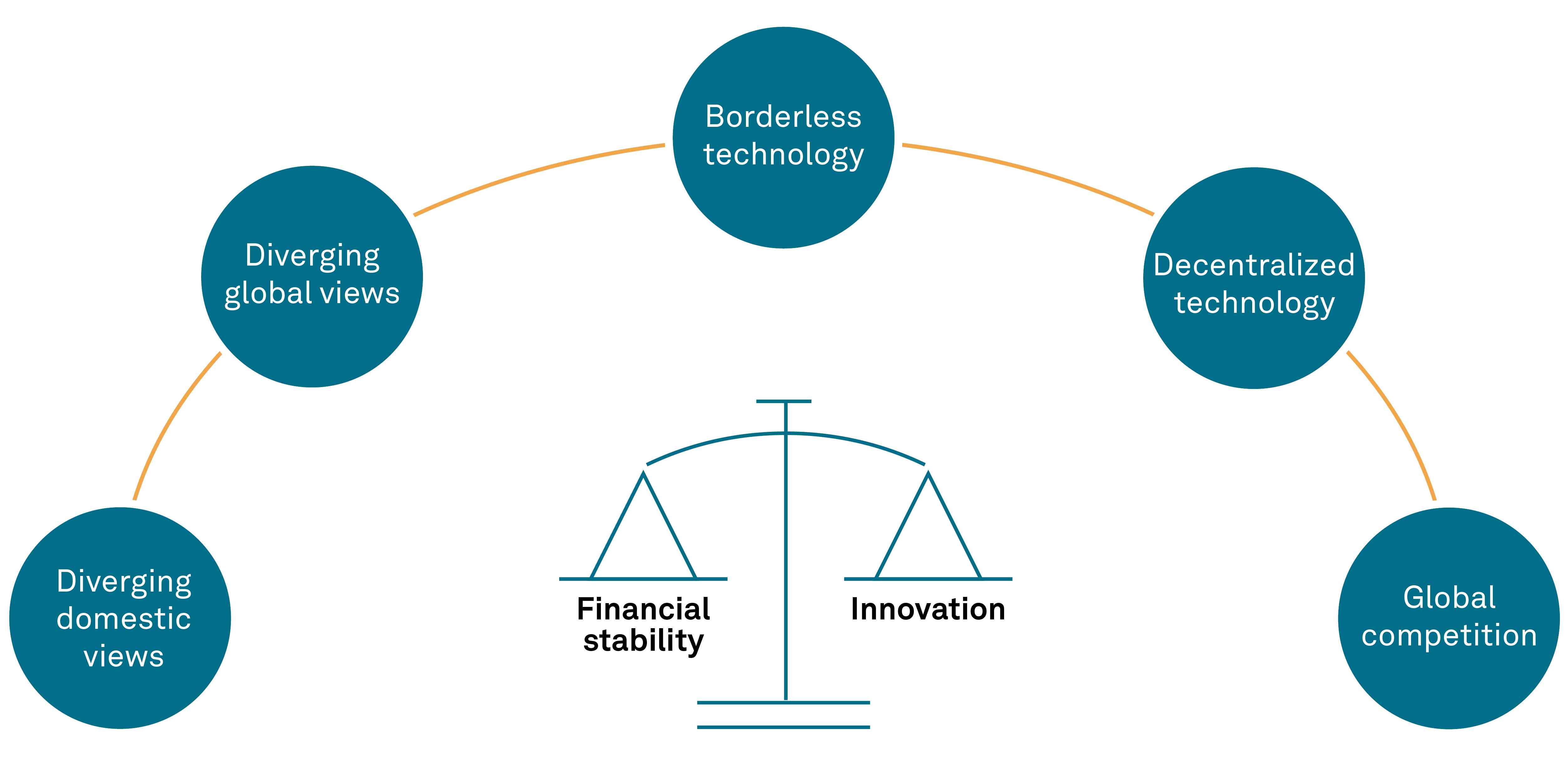

- Regulatory Challenges: The rise of cryptocurrencies has presented regulatory challenges worldwide. Governments and regulatory bodies are grappling with how to classify and regulate cryptocurrencies, balancing innovation with investor protection, preventing illicit activities, and ensuring tax compliance.

A bid to frame, tame and game the ecosystem

- Environmental Impact: Cryptocurrency mining, particularly for proof-of-work-based blockchains like Bitcoin, has raised concerns about its environmental impact. The significant energy consumption required for mining has prompted discussions on transitioning to more energy-efficient consensus mechanisms, such as proof-of-stake.

Is Bitcoin mining bad for the planet

It's important to note that the cryptocurrency space is highly dynamic and subject to rapid changes. New developments, regulations, and market fluctuations can significantly impact the landscape.

Impact of the Rise of Cryptocurrencies

The impact of the rise of cryptocurrencies on the financial world is a topic of debate, and opinions vary. Here are some perspectives on how the rise of cryptocurrencies can be seen as both positive and negative:

Positive Aspects:

- Financial Inclusion: Cryptocurrencies can provide access to financial services for the unbanked and underbanked populations, especially in developing countries. Individuals without traditional banking infrastructure can participate in global financial transactions.

- Innovation and Technological Advancement: Cryptocurrencies and blockchain technology have spurred innovation in various sectors. They have the potential to streamline processes, reduce costs, enhance transparency, and enable new business models through smart contracts and decentralized applications.

- Borderless Transactions: Cryptocurrencies allow for near-instantaneous cross-border transactions without relying on traditional intermediaries. This can facilitate international trade, remittances, and financial interactions without the need for currency conversions.

Negative Aspects:

- Volatility and Risk: Cryptocurrencies are known for their price volatility, which can lead to significant gains but also substantial losses. Rapid price fluctuations can be risky for investors, potentially destabilizing financial markets and impacting investor confidence.

- Regulatory Challenges: The decentralized nature of cryptocurrencies poses regulatory challenges. Governments and regulatory bodies are grappling with how to address issues like money laundering, tax evasion, fraud, and consumer protection. Regulatory uncertainties can create risks for investors and hinder wider adoption.

- Potential for Illegal Activities: Cryptocurrencies have been associated with illicit activities due to their pseudonymous nature. They can be used for money laundering, ransomware payments, and illegal transactions on the dark web. However, it's important to note that the majority of cryptocurrency transactions are legitimate.

- Lack of Consumer Protection: Unlike traditional financial systems, cryptocurrencies often lack the same level of consumer protection mechanisms, such as deposit insurance and fraud reimbursement. This can leave users vulnerable to hacks, scams, and theft if proper security measures are not followed.

- Environmental Concerns: The energy consumption associated with cryptocurrency mining, particularly for proof-of-work blockchains, has raised environmental concerns. The carbon footprint of cryptocurrencies is a topic of debate, and the industry is exploring more energy-efficient alternatives.

Overall, the impact of the rise of cryptocurrencies on the financial world is complex and multifaceted. It has the potential to bring positive changes such as increased financial inclusion and innovation, but it also poses risks and challenges that need to be addressed through appropriate regulations and safeguards.

![[LIVE] Engage2Earn: McEwen boost for Rob Mitchell](https://cdn.bulbapp.io/frontend/images/c798d46f-d3b8-4a66-bf48-7e1ef50b4338/1)

![[ℕ𝕖𝕧𝕖𝕣] 𝕊𝕖𝕝𝕝 𝕐𝕠𝕦𝕣 𝔹𝕚𝕥𝕔𝕠𝕚𝕟 - And Now What.... Pray To The God Of Hopium?](https://cdn.bulbapp.io/frontend/images/79e7827b-c644-4853-b048-a9601a8a8da7/1)