Crypto Investment Strategies: A Guide for Beginners

Cryptocurrency

A logo for Bitcoin, the first decentralized cryptocurrency

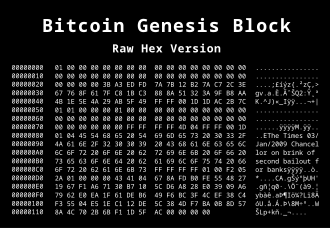

A logo for Bitcoin, the first decentralized cryptocurrency The genesis block of Bitcoin's blockchain, with a note containing The Times newspaper headline. This note has been interpreted as a comment on the instability caused by fractional-reserve banking.[1]: 18

The genesis block of Bitcoin's blockchain, with a note containing The Times newspaper headline. This note has been interpreted as a comment on the instability caused by fractional-reserve banking.[1]: 18

A cryptocurrency, crypto-currency, or crypto[a] is a digital currency designed to work as a medium of exchange through a computer network that is not reliant on any central authority, such as a government or bank, to uphold or maintain it.[2]

Individual coin ownership records are stored in a digital ledger, which is a computerized database using strong cryptography to secure transaction records, control the creation of additional coins, and verify the transfer of coin ownership.[3][4][5] Despite the term that has come to describe many of the fungible blockchain tokens that have been created, cryptocurrencies are not considered to be currencies in the traditional sense, and varying legal treatments have been applied to them in various jurisdicitons, including classification as commodities, securities, and currencies, cryptocurrencies are generally viewed as a distinct asset class in practice.[6][7][8] Some crypto schemes use validators to maintain the cryptocurrency. In a proof-of-stake model, owners put up their tokens as collateral. In return, they get authority over the token in proportion to the amount they stake. Generally, these token stakers get additional ownership in the token over time via network fees, newly minted tokens, or other such reward mechanisms.[9]

The world of cryptocurrency can be exciting and complex. If you're interested in investing in crypto, it's crucial to have a strategy in place to manage risk and maximize your returns. Here's a look at some popular crypto investment strategies for beginners:

1. Dollar-Cost Averaging (DCA): This is a favorite for those new to crypto. DCA involves investing a fixed amount of money into a cryptocurrency at regular intervals, regardless of the price. This approach helps average out the cost per coin over time, reducing the impact of market volatility.

2. Buy and Hold (HODLing): This strategy is all about buying cryptocurrencies and holding them for the long term, with the belief that their value will appreciate over time. HODLing is a passive approach that works well for those who are comfortable with a long-term investment horizon.

3. Diversification: Don't put all your eggs in one basket! Diversify your crypto portfolio across different cryptocurrencies with varying purposes and functionalities. This helps spread risk and reduces the impact of a single coin's price fluctuations.

4. Research is Key: Before investing in any cryptocurrency, conduct thorough research. Understand the underlying technology, the project's roadmap, and the team behind it. Stay updated on market trends and news to make informed investment decisions.

5. Security First: Cryptocurrencies are stored in digital wallets. It's crucial to choose a secure wallet and employ strong password practices to safeguard your crypto holdings.

Remember: Cryptocurrencies are a volatile asset class. Always invest what you can afford to lose, and never chase quick profits. These strategies are a starting point, and consult a financial advisor for personalized advice before making any investment decisions.

References

Pagliery, Jose (2014). Bitcoin: And the Future of Money. Triumph Books. ISBN 978-1629370361. Archived from the original on 21 January 2018. Retrieved 20 January 2018.

Milutinović, Monia (2018). "Cryptocurrency". Ekonomika. 64 (1): 105–122. doi:10.5937/ekonomika1801105M. ISSN 0350-137X. Archived from the original on 16 April 2022. Retrieved 18 April 2022.

Andy Greenberg (20 April 2011). "Crypto Currency". Forbes. Archived from the original on 31 August 2014. Retrieved 8 August 2014.

Polansek, Tom (2 May 2016). "CME, ICE prepare pricing data that could boost bitcoin". Reuters. Archived from the original on 23 April 2022. Retrieved 3 May 2016.

Pernice, Ingolf G. A.; Scott, Brett (20 May 2021). "Cryptocurrency". Internet Policy Review. 10 (2). doi:10.14763/2021.2.1561. ISSN 2197-6775. Archived from the original on 23 October 2021. Retrieved 23 October 2021.