HAI - A decentralized and overcollateralized stablecoin

Ever heard the saying “Don’t get high on your own supply”?

Well, HAI flips that on its head

Use LSTs & OP native assets as collateral to get HAI — a decentralized and overcollateralized stablecoin

Ready to get HAI? Let’s dive in

1/ Introduction to @letsgethai

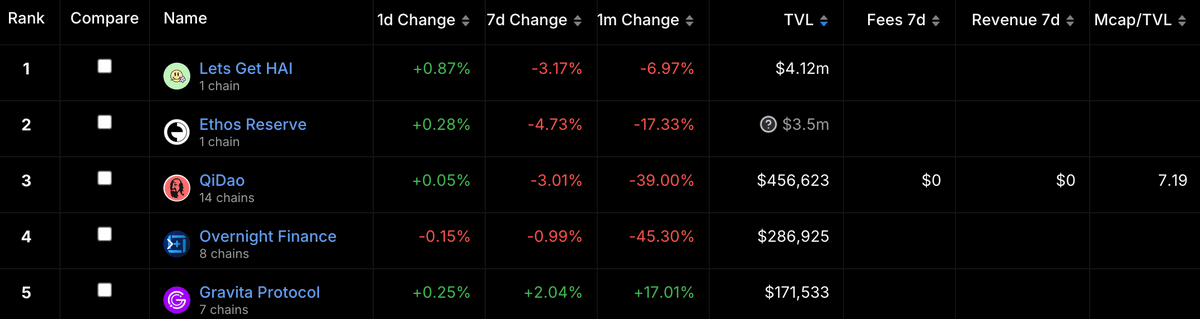

Largest CDP protocol on #Optimism

Where you can deposit collateral like WETH, wstETH, rETH, OP, etc., and take a loan in HAI

Over 45% of TVL across all CDPs on OP is in HAI Vaults

2/ HAI An over-collateralized CDP-minted stablecoin

Has a diverse collateral base including LSDs & other tokens

Uses a floating peg, unlike USDC/USDT, which are hard pegged to the $

The peg is set by a Proportional-Integral-Derivative (PID) controller to induce stability

3/ HAI has two important prices

• Market Price (MP): What people are paying for HAI in the market

- Redemption Price (RP): What the HAI system believes HAI should be worth, initially $1

4/ HAI mechanics

The system uses a smart PI controller to adjust HAI’s value

If MP > RP

The system sets a negative interest rate, making it cheaper to owe HAI over time

This encourages selling HAI to stabilize the price

5/

If MP < RP

The system sets a positive interest rate, making it more expensive to owe HAI over time

This prompts buying HAI to pay off debts, pushing the price up

6/

These adjustments help keep HAI’s value close to $1, balancing supply and demand

Basically, HAI’s smart controller tweaks interest rates based on market conditions to keep its value stable

HAI is a multi-collateral fork of RAI @reflexerfinance with the same basic mechanics

7/ Simplified

The market price of HAI can’t deviate from the RP for too long due to smart incentives

- If the price is too high, people borrow and sell HAI

- If the price is too low, borrowers buy back HAI

This helps keep HAI’s value stable and in line with its target RP

8/

Ensuring that it remains a reliable and predictable stablecoin

Users must carefully manage HAI minting

If collateral value drops too much, it can be seized and sold in a collateral auction to protect HAI’s value and ensure confidence in the protocol

9/ KITE

Governance token for ensuring a decentralized and community-driven approach

KITE holders can vote on system changes and the protocol’s development, like adding/removing collateral types

10/ Plus, HAI boasts the best dapp design in the game

It’s user-friendly and efficient

Easy to deposit collateral and take out loans

Check it out for yourself and get HAI on your own supply

11/ Official Links

Discord

https://discord.com/invite/pX8m6zXNKu…

X

@letsgethai

Telegram

https://t.me/+0iIhX0f9DDAxODE5…

Website

https://www.letsgethai.com/

![[ℕ𝕖𝕧𝕖𝕣] 𝕊𝕖𝕝𝕝 𝕐𝕠𝕦𝕣 𝔹𝕚𝕥𝕔𝕠𝕚𝕟 - How To get Rich Quick In Crypto! (1)](https://cdn.bulbapp.io/frontend/images/ae260165-52b4-47cf-a20a-ebeaf50fdb08/1)