Ways to Earn with Cryptocurrencies

Futures and Spot Trading

Earning with cryptocurrencies presents a range of opportunities within a world that goes beyond traditional finance. These opportunities can sometimes yield average profits, while other times they may allow you to become a server owner. In this regard, we will explore these opportunities in two separate blog posts under four main headings.

Futures and Spot Trading.

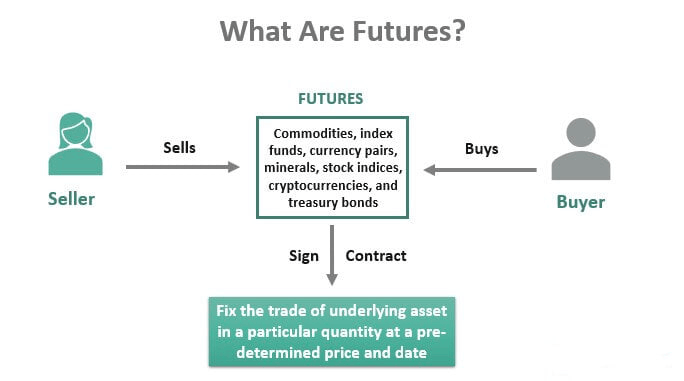

Futures Trading:

Cryptocurrency futures trading allows investors to trade contracts related to the future price movements of a specific asset. It provides the opportunity to increase investment potential using leverage but also involves high risk. Profits can be achieved with the right strategy and risk management. So, how do we create these correct strategies?

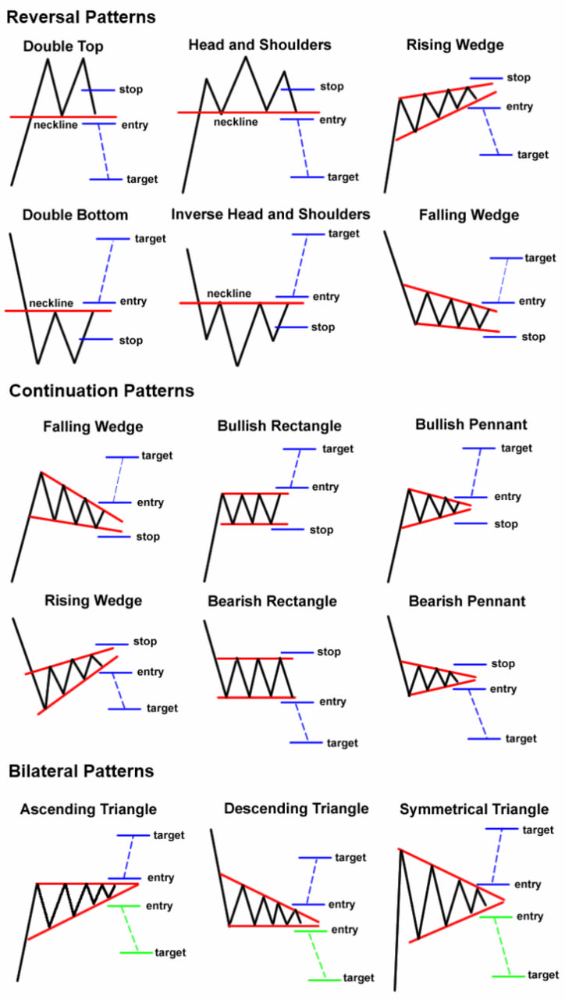

a) Proficient Technical Analysis:

Technical analysis is crucial for all trading operations (futures and spot) and financial markets. Mastering the interpretation of candle movements and price patterns through careful analysis is essential for success.

b) News Flow:

In financial markets, news flows are of significant importance. Sometimes, a real or false piece of news related to a project can lead to substantial gains. However, being on the wrong side can also result in significant losses. We will delve into this topic in our next strategy.

c) Risk Management and Portfolio Management:

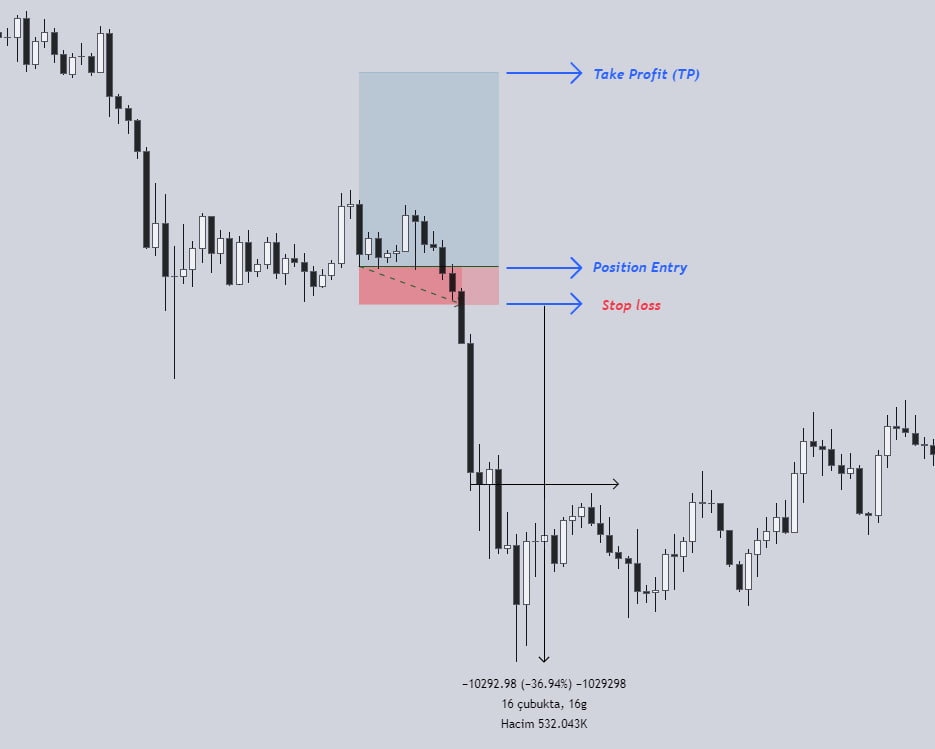

Aside from acquiring the necessary information when trading in financial markets, indispensable elements of your strategy should be portfolio management and risk management. One of the fundamental principles of risk management is to "cut losses." In highly volatile and risky financial markets, employing stop-loss helps traders avoid significant losses. Portfolio management advises against making amateur moves by investing all your funds in a single trade. Losing your entire portfolio in one transaction puts you out of the game. To stay in the game, it is recommended to create a disciplined trading strategy by dividing your portfolio.

Aside from acquiring the necessary information when trading in financial markets, indispensable elements of your strategy should be portfolio management and risk management. One of the fundamental principles of risk management is to "cut losses." In highly volatile and risky financial markets, employing stop-loss helps traders avoid significant losses. Portfolio management advises against making amateur moves by investing all your funds in a single trade. Losing your entire portfolio in one transaction puts you out of the game. To stay in the game, it is recommended to create a disciplined trading strategy by dividing your portfolio.

Spot Trading

Spot trading, or instant buying and selling, aims to capitalize on the daily price movements of cryptocurrencies. It involves direct asset trading on cryptocurrency exchanges. While the risk ratio is lower compared to futures trading, there is still a significant risk in spot trading. However, managing positions is easier. Although there is no liquidation price, the absence of a liquidation price should not deter you from using a stop-loss. In every financial market, "patience" is the safest weapon for traders. Patient and well-analyzed purchases, coupled with spot trading, can lead to wealth accumulation for traders. Especially in unregulated and highly volatile markets like the crypto market, the logic of "high risk, high reward" works to its full extent. While you can multiply your investment in a short time with a cryptocurrency, you can also wipe out your entire capital in spot trading.

Spot trading, or instant buying and selling, aims to capitalize on the daily price movements of cryptocurrencies. It involves direct asset trading on cryptocurrency exchanges. While the risk ratio is lower compared to futures trading, there is still a significant risk in spot trading. However, managing positions is easier. Although there is no liquidation price, the absence of a liquidation price should not deter you from using a stop-loss. In every financial market, "patience" is the safest weapon for traders. Patient and well-analyzed purchases, coupled with spot trading, can lead to wealth accumulation for traders. Especially in unregulated and highly volatile markets like the crypto market, the logic of "high risk, high reward" works to its full extent. While you can multiply your investment in a short time with a cryptocurrency, you can also wipe out your entire capital in spot trading.  all experienced this with Terra Luna (LUNA) when the recent bull run ended. Immense fortunes vanished in a matter of days. Hence, it is crucial always to use a stop-loss.

all experienced this with Terra Luna (LUNA) when the recent bull run ended. Immense fortunes vanished in a matter of days. Hence, it is crucial always to use a stop-loss.

In the second part of my writing, I will continue with the "Win-Win" strategy of projects and users through Airdrop Hunting.

![[ℕ𝕖𝕧𝕖𝕣] 𝕊𝕖𝕝𝕝 𝕐𝕠𝕦𝕣 𝔹𝕚𝕥𝕔𝕠𝕚𝕟 - Did This Poor Baby Make A Profit On The BTC He Sold?](https://cdn.bulbapp.io/frontend/images/255151e6-9e83-4151-9644-80af06e53b74/1)