How Big Banks Are Becoming Bitcoin Whales

With Bitcoin edging closer to its all-time high, the cryptocurrency’s ownership landscape is evolving as prominent U.S. financial institutions join the ranks of “Bitcoin Whales.” Defined as those who own vast amounts of Bitcoin, these new whales include investment giants such as BlackRock, Fidelity, and Grayscale, which have collectively acquired hundreds of thousands of Bitcoins, bolstering the cryptocurrency’s value and altering its distribution.

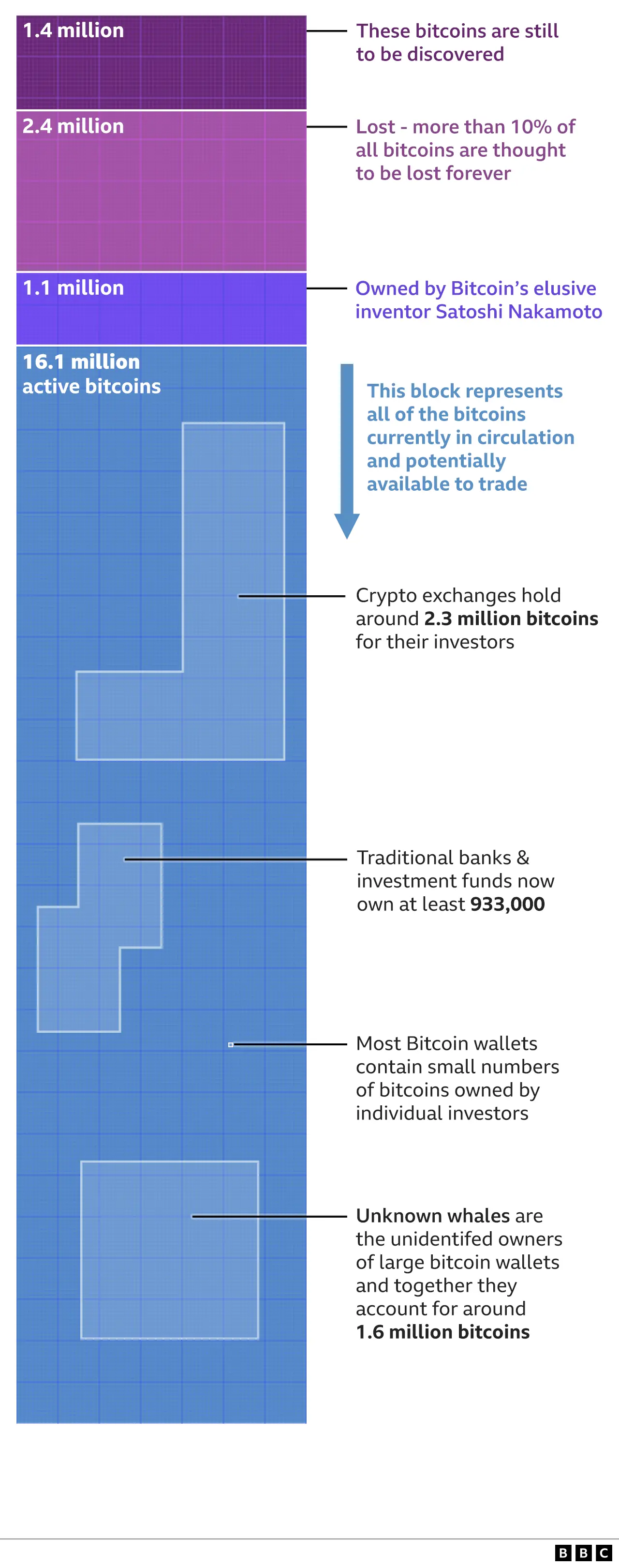

As of early 2024, there are nearly 21 million Bitcoins in total—an immutable cap hardcoded into Bitcoin’s software. Roughly 19 million of those are currently in circulation, though millions are thought to be permanently inaccessible due to lost passwords or defunct hardware. A limited supply combined with increased institutional demand is driving Bitcoin's value and reshaping the decentralized cryptocurrency model. K33 Research, a prominent crypto analytics firm, notes, “The largest Bitcoin holders today aren’t individual enthusiasts; they’re corporations and traditional financial institutions.”

With banks and regulated investment firms amassing Bitcoin at such scale, the balance of ownership has begun shifting away from early adopters and individuals towards institutional investors, a development that some crypto purists argue goes against Bitcoin’s foundational principle of decentralized finance.

The Rising Influence of Bitcoin Whales

The term “Bitcoin Whale” refers to entities or individuals whose holdings are substantial enough to influence market movements with their transactions. Large financial institutions now hold significant Bitcoin reserves, positioning them as market-moving whales. According to estimates, regulated investment firms hold approximately 933,000 Bitcoins, roughly 4.5% of the total supply. Grayscale alone, which began as a digital currency investment fund, has accumulated around 450,000 Bitcoins, while BlackRock and Fidelity follow closely with holdings of 150,000 and 102,000 Bitcoins, respectively.

The arrival of regulated entities into the Bitcoin ecosystem accelerated in early 2024 after U.S. authorities approved Bitcoin-linked financial products, notably Bitcoin ETFs (exchange-traded funds). These ETFs allow traditional investors to gain Bitcoin exposure indirectly, bypassing the need to hold the currency in its digital form. The launch of these products sparked a wave of buying among institutional investors, from hedge funds to individual stock traders.

As crypto-related financial products become mainstream, institutional demand is set to increase, driving both prices and Bitcoin’s perceived legitimacy in traditional financial circles. Analysts from K33 Research observed, “Financial giants are increasingly pushing up Bitcoin’s value through ETF investments, which have made Bitcoin accessible to traditional market investors without the complexity of direct ownership.”

The Complex World of Bitcoin Ownership

Bitcoin’s current ownership is segmented among various groups, including exchanges, unknown whales, and long-lost wallets. Here is a closer look at the diverse ownership landscape.

1. Cryptocurrency Exchanges

Cryptocurrency exchanges such as Binance, Bitfinex, and Coinbase hold approximately 2.3 million Bitcoins, or 11% of the total Bitcoin supply, either as reserves or on behalf of customers. Binance, the world’s largest crypto exchange, leads with approximately 550,000 Bitcoins. Bitfinex and Coinbase follow with 403,000 and 386,000 Bitcoins, respectively.

Exchanges allow users to trade, store, and access Bitcoin conveniently, though they come with risks. Following high-profile exchange collapses like FTX, customers are increasingly wary of leaving funds in custodial wallets, which can be vulnerable to loss or theft. While exchanges play a critical role in Bitcoin’s liquidity and accessibility, some Bitcoin advocates argue that reliance on these entities compromises the decentralized ethos of the cryptocurrency.

2. Dormant Coins and Lost Bitcoins

Estimates suggest that around 3.5 million Bitcoins, or roughly 16% of the total supply, may be permanently inaccessible. These “lost” Bitcoins can result from forgotten passwords, lost hardware, or owners passing away without sharing access details. Bitcoin’s structure is unforgiving when it comes to forgotten credentials, as there is no customer support or recovery system.

Chainalysis, a blockchain forensics firm, estimates that any Bitcoin inactive for five or more years could likely be lost forever. Notably, some of these dormant Bitcoins include a substantial portion believed to belong to Bitcoin’s creator, Satoshi Nakamoto. With approximately 1.1 million Bitcoins in wallets attributed to Nakamoto, the anonymity surrounding Bitcoin’s origins further shrouds these coins in mystery.

Bitcoin’s Institutionalization: Benefits and Critiques

The introduction of major financial institutions into Bitcoin ownership has brought benefits such as increased stability and credibility for the cryptocurrency. Regulated ETFs allow investors to gain exposure to Bitcoin with fewer risks and complexities than holding actual coins, a change that many believe will attract further institutional interest. Bitcoin’s growing integration with the traditional financial sector also boosts its recognition as an asset class and has helped push its valuation to new heights.

However, the consolidation of Bitcoin ownership among traditional financial institutions has sparked debate within the crypto community. Bitcoin was originally designed as a peer-to-peer, decentralized currency—a digital cash system free from central banks and government control. With banks and regulated firms now holding substantial portions of the total supply, the ideals of Bitcoin as a decentralized asset are being challenged.

Prominent crypto analyst Timothy Lee states, “As institutional players like BlackRock and Fidelity enter the space, Bitcoin’s control is gradually shifting from individuals to traditional financial entities. This trend, while boosting prices, risks undermining the decentralized principles that Bitcoin was founded upon.” For enthusiasts who see Bitcoin as a vehicle for financial sovereignty, the influx of institutional ownership represents a paradoxical development.

Other Key Players in the Bitcoin Ecosystem

Beyond traditional finance, several other notable entities hold substantial Bitcoin reserves, each with its unique impact on the cryptocurrency landscape:

Unknown Whales

Blockchain data shows that roughly 1.6 million Bitcoins are held by anonymous wallets containing over 10,000 Bitcoins each, though the identity of these large holders remains unknown. These wallets are closely monitored by crypto analysts as any significant movement could affect the market. The anonymity surrounding these holdings often sparks speculation about whether these whales are individuals, organizations, or even institutions that prefer to remain out of the public eye.

Government Seizures and Holdings

Law enforcement agencies worldwide hold an estimated 335,000 Bitcoins seized from cybercrime and illicit marketplaces. In the U.S. alone, government agencies have seized nearly 200,000 Bitcoins from major operations. Governments typically auction off these assets over time, though some remain held in cold storage.

Corporate Entities and Influential Investors

Companies such as MicroStrategy and Block.One, alongside high-profile investors like Michael Saylor and Tim Draper, collectively hold hundreds of thousands of Bitcoins. MicroStrategy, led by Bitcoin advocate Michael Saylor, currently holds around 193,000 Bitcoins. Draper, a well-known venture capitalist, acquired 30,000 Bitcoins in a high-profile government auction and has reportedly continued accumulating since.

Additionally, countries like El Salvador have made Bitcoin part of their national treasury holdings. The small Central American nation has acquired around 2,800 Bitcoins, positioning it as a notable state-level Bitcoin investor. This strategy has drawn international attention as El Salvador aims to leverage Bitcoin as part of its broader economic policy.

The Path Forward: Decentralization or Institutionalization?

The growing presence of large institutions in Bitcoin ownership marks a pivotal shift in the cryptocurrency's trajectory. While banks and financial giants are elevating Bitcoin’s value and legitimacy, their increasing control over Bitcoin reserves raises essential questions about the future of decentralization.

As Bitcoin approaches a new era defined by institutional engagement, its original vision as a decentralized, peer-to-peer currency faces an unprecedented challenge. For investors, the future holds both opportunity and uncertainty as Bitcoin’s identity continues to evolve in response to the forces reshaping its ownership.

https://www.bbc.com/news/technology-68434579

![[LIVE] Engage2Earn: McEwen boost for Rob Mitchell](https://cdn.bulbapp.io/frontend/images/c798d46f-d3b8-4a66-bf48-7e1ef50b4338/1)