Reasons driving Bitcoin price above $43,000

Bitcoin surpassed the $43,000 mark on Monday for the first time in two weeks, up significantly from its intraday low of $41,735. The leading cryptocurrency by market capitalization is currently worth around $855 billion and has a trading volume of over $22 billion.

Bitcoin prices have rebounded as the market weighs the possibility of an interest rate pause at this week's US Federal Open Market Committee (FOMO) meeting.

Reduced current output from Grayscale

There are also signs that outflows from Grayscale Investments' spot Bitcoin exchange-traded fund (ETF) are slowing.

Recent activity suggests that outflows from digital asset manager Grayscale are dwindling. Market intelligence from Arkham indicates that Grayscale transferred 6,900 BTC (worth $289.5 million) to Coinbase, marking a nearly 34% decrease from the previous transfer.

Compared to last week's average daily transfer size of $530.2 million, this represents a decrease of more than 45%. The crypto community sees the gradual decrease in outflows as a positive signal, with notable analysts, such as DonAlt highlighting Bitcoin's ability to absorb selling pressure, a strong indicator of strength. market.

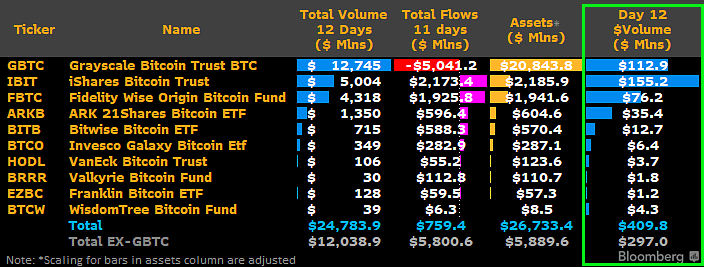

Bloomberg Intelligence ETF analyst James Seyffart writes on X:

“It's only been about an hour since trading started, but IBIT has already surpassed GBTC in volume through January 29. January 29 could be the first day that one of the nine new funds trades more than GBTC. $155 million to $113 million.”

Source: James Seyffart

Recent liquidation

The cryptocurrency market has seen significant liquidations, with Coinglass data showing a total of $120.54 million in liquidations in the past 24 hours.

Notably, the majority of these are Short positions, totaling $63.41 million, as opposed to $57.13 million in Long positions. The liquidation trend is also evident in shorter time frames, with $51.71 million liquidated in the last four hours alone, 76.78% of which were Short.

Major exchanges such as Binance and OKX contribute significantly to these figures, with the number of Short position liquidations consistently higher than Long positions across the board. This shows that bearish bets are being squeezed as Bitcoin prices surge.

The largest digital asset by market capitalization is up more than 3.3% in the past 24 hours and is trading for $43,620.

The possibility of the Fed temporarily suspending interest rates

Bitcoin's upward move comes as the market is expecting the US Federal Reserve (Fed) to pause interest rates at this week's FOMC meeting. According to the CME FedWatch tool, there is a 97.9% chance that Fed funds rates will remain at their current target level of 5.25–5.5%.

Ryze Labs emphasized the classification of Bitcoin as a “risky” asset, suggesting the potential to outperform in a strong bull market. This scenario could be facilitated by interest rate pauses and potential interest rate cuts.

However, Ryze Labs founder Mathew Graham said the possibility of the Fed suspending interest rates has largely been taken into account in the market.

“The Fed is expected to pause interest rates, so this week's FOMC meeting is probably mostly priced in. However, after the pause, if the Fed lowers interest rates more than expected, this will definitely benefit BTC prices.”

Ryze Labs analysts added that institutional interest in Bitcoin will continue to grow, with expectations for spot Bitcoin ETF inflows increasing as fund managers ramp up their selling cycles and teams. Sales familiarize yourself with new products.

![[ℕ𝕖𝕧𝕖𝕣] 𝕊𝕖𝕝𝕝 𝕐𝕠𝕦𝕣 𝔹𝕚𝕥𝕔𝕠𝕚𝕟 - And Now What.... Pray To The God Of Hopium?](https://cdn.bulbapp.io/frontend/images/79e7827b-c644-4853-b048-a9601a8a8da7/1)

![[LIVE] Engage2Earn: McEwen boost for Rob Mitchell](https://cdn.bulbapp.io/frontend/images/c798d46f-d3b8-4a66-bf48-7e1ef50b4338/1)