Bitcoin Slides Towards $42K as Interest Rates Soar, Chainlink Defies Crypto Slump

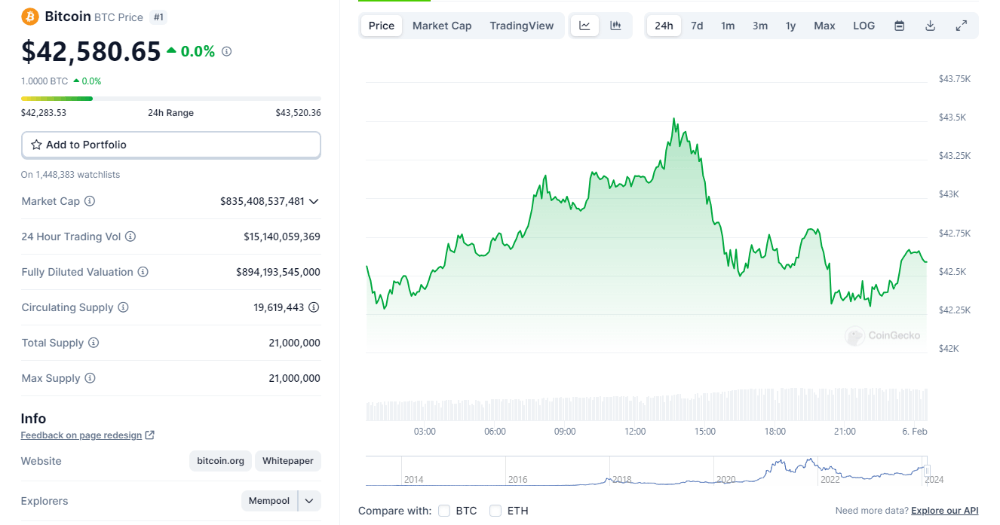

As interest rates continue to soar, the cryptocurrency market has experienced a significant slump, with Bitcoin slipping towards $42,000

However, Chainlink (LINK) has defied this trend, with its value increasing by 2% over the past 24 hours.

According to a recent article published by CoinDesk, the largest cryptocurrency by market capitalization, Bitcoin, has been hit hard by the recent rise in U.S. interest rates.

Treasury Bond Yield

The 10-year U.S. Treasury bond yield has jumped by 14 basis points in the past two days, reaching its highest level since mid-2019. This surge in interest rates has led to a broader shift in the market, with investors becoming more risk-averse and moving away from risky assets like cryptocurrencies.

This notes that the cryptocurrency market has been facing significant headwinds in recent months, with the ongoing bearish trend showing no signs of abating. The market capitalization of the entire cryptocurrency market has decreased by over $200 billion since the beginning of the year, with many cryptocurrencies experiencing sharp declines.

Despite this gloomy outlook, Chainlink (LINK) has bucked the trend, with its value increasing by 2% over the past 24 hours.

This could be due to the growing recognition of Chainlink's potential as a decentralized oracle network, which enables the use of smart contracts on various blockchain platforms.

The Upcoming Consensus 2024 Conference

In addition, the upcoming Consensus 2024 conference, organized by CoinDesk, is expected to be a major event for the cryptocurrency and blockchain industry. The conference will feature keynote speakers, workshops, and networking opportunities, providing a platform for industry leaders to discuss the latest trends and developments in the space.

While the cryptocurrency market continues to face challenges, Chainlink's (LINK) resilience and the upcoming Consensus 2024 conference suggest that there may be opportunities for growth and innovation in the space.

As the article notes, "The macro environment, monetary tailwinds, the U.S. election cycle, and gradually increasing demand from traditional financial investors allocating to bitcoin ETFs" could all contribute to a potential rally in cryptocurrency prices.

References:

Consensus 2024 Conference - 10 Years of Decentralizing the Future. (2024). Retrieved February 6, 2024, from https://consensus2024.coindesk.com/

Sandor, K. (2024, February 5). Bitcoin Slips Towards $42K as Interest Rates Soar; Chainlink’s LINK Defies Crypto Slump. Retrieved from https://www.coindesk.com/markets/2024/02/05/bitcoin-slips-towards-42k-as-interest-rates-soar-chainlinks-link-defies-crypto-slump/

Chainlink: What Is It, History and How to Buy - SmartAsset | SmartAsset. (2021, April 5). Retrieved from https://smartasset.com/financial-advisor/chainlink-what-is-it

Chen, J. (2023, August 21). Treasury Bond: Overview of U.S. Backed Debt Securities. Retrieved from https://www.investopedia.com/terms/t/treasurybond.asp

Chen, J. (2024, February 1). Treasury Yield: What It Is and Factors That Affect It. Retrieved from https://www.investopedia.com/terms/t/treasury-yield.asp

Hayes, A. (2024, January 29). Bond Yield: What It Is, Why It Matters, and How It’s Calculated. Retrieved February 6, 2024, from https://www.investopedia.com/terms/b/bond-yield.asp

elegant_solution. (n.d.). Retrieved January 13, 2024, from https://www.freepik.com/author/user28432665

Freepik - Goodstudiominsk. (n.d.). Retrieved January 5, 2024, from https://www.freepik.com/author/goodstudiominsk

My links

![[ℕ𝕖𝕧𝕖𝕣] 𝕊𝕖𝕝𝕝 𝕐𝕠𝕦𝕣 𝔹𝕚𝕥𝕔𝕠𝕚𝕟 - How To get Rich Quick In Crypto! (1)](https://cdn.bulbapp.io/frontend/images/ae260165-52b4-47cf-a20a-ebeaf50fdb08/1)