The Risks of Stablecoins: What You Need to Know?

25

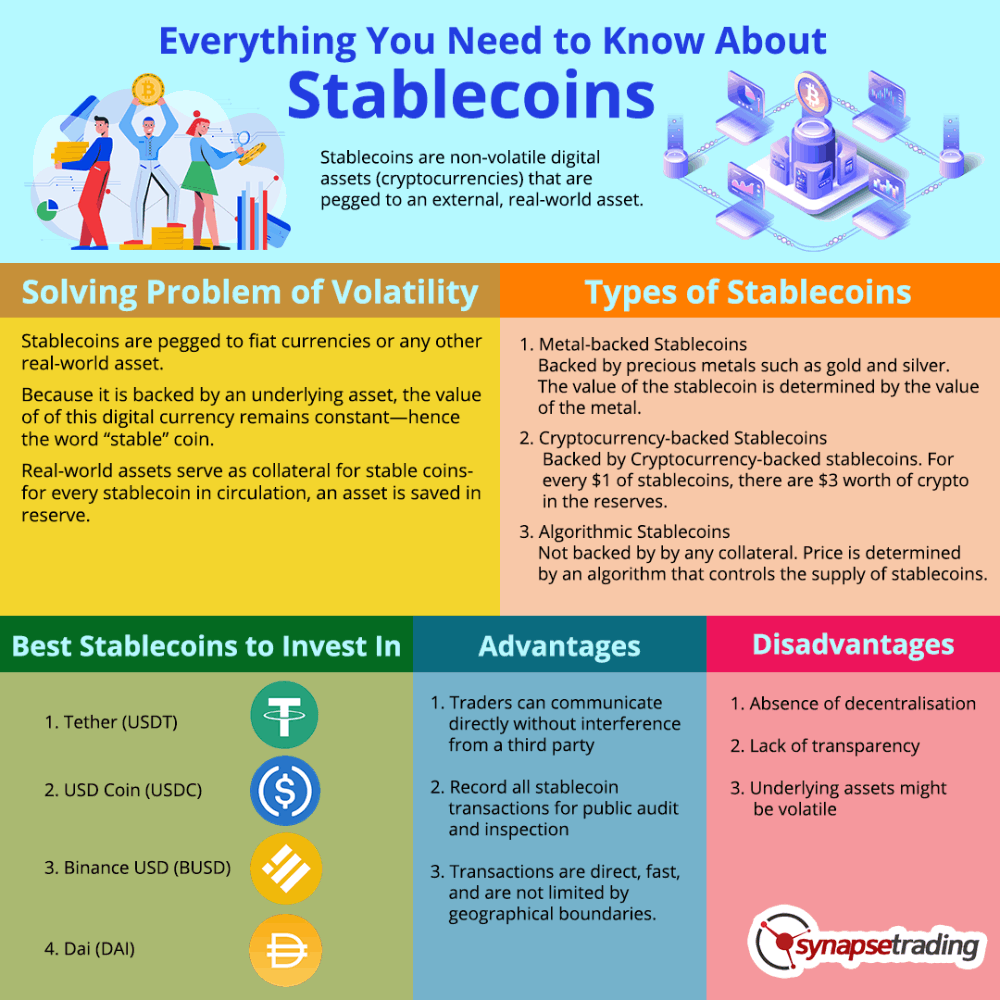

Stablecoins, while offering stability in value compared to cryptocurrencies like Bitcoin, still pose risks.

Here are some key points to consider:

- Centralization Risk: Many stablecoins are issued and controlled by a central authority, which could lead to potential issues such as censorship, regulatory crackdowns, or mismanagement.

- Regulatory Risk: Stablecoins face regulatory scrutiny, especially regarding their backing, issuance, and use cases. Changes in regulations could impact their value and availability.

- Counterparty Risk: If a stablecoin is backed by assets or fiat currency held by a third party, there's a risk of default or insolvency from the backing entity.

- Market Liquidity Risk: Stablecoins rely on market demand to maintain their peg to a fiat currency. In times of high demand or market stress, liquidity may dry up, causing the stablecoin's value to deviate from its peg.

- Transparency Risk: Some stablecoins lack transparency regarding their reserves and auditing practices, which can lead to distrust among users.

- Technology Risk: Smart contract vulnerabilities or technical glitches could compromise the stability and security of a stablecoin.

- Black Swan Events: Unexpected events, such as regulatory changes, cyber attacks, or market manipulation, could destabilize even the most well-established stablecoins.

Understanding these risks is crucial for anyone considering using or investing in stablecoins. It's important to conduct thorough research and assess the stability, transparency, and regulatory compliance of any stablecoin before engaging with it.

![[ℕ𝕖𝕧𝕖𝕣] 𝕊𝕖𝕝𝕝 𝕐𝕠𝕦𝕣 𝔹𝕚𝕥𝕔𝕠𝕚𝕟 - I Think I Have Crypto PTSD](https://cdn.bulbapp.io/frontend/images/819e7cdb-b6d8-4508-8a8d-7f1106719ecd/1)