Ripple v. SEC: What court’s latest decision means for XRP

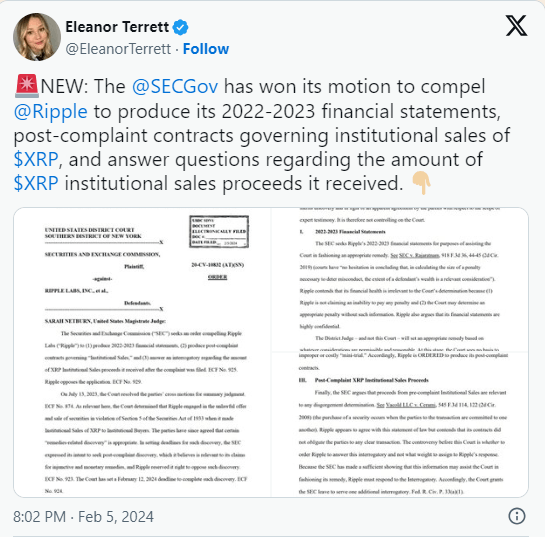

Sarah Netburn, the Judge of the New York Southern District Court, has asked Ripple [XRP] to produce its 2022-2023 financial statements, as the U.S. SEC had pleaded.

However, the court did not only demand that document from the blockchain-payment firm.

According to the ruling, Judge Netburn also asked Ripple to provide the post-complaints contracts regarding the institutional sales of XRP.

Eleanor Terret, a FOX Business correspondent, shared this information on X (formerly Twitter).

It’s not a win for Ripple this time

A few weeks back, AMBCrypto reported how the SEC has urged the court to compel Ripple to provide the documents. Later, the firm argued that the financial statements were no longer relevant to the case.

In its response, the firm noted that the legal proceeding was no longer in the discovery phase where the documents might have been considered applicable.

However, the recent order meant that the court did not agree with Ripple’s argument. The order also implied that the court was committed to checking if an injunction was necessary or not.

But has this development affected XRP in any way? According to CoinMarketCap, XRP’s price changed hands at $0.50 at press time. This value represented a 0.46% decrease in the last 24 hours.This also indicated that the token was not exactly affected by the ruling.

In previous circumstances, decisions relating to the case impacted the price. The notable one has to be the judgment on the 13th of July 2023.

On the said date, Judge Analisa Torres declared that XRP was not a security. This gave Ripple a partial win over the SEC, and XRP’s price jumped almost 100% in reaction.

However, since hitting $0.96, XRP has failed to deliver such performance again. Despite the price decline, AMBCrypto discovered that the sentiment around XRP had changed from a negative to a positive one.

At press time, Ripple’s Weighted Sentiment was 0.40. Source: Santiment

Source: Santiment

XRP gains nothing from the development

From a technical perspective, the 4-hour XRP/USD chart showed that the token still lingered in the descending channel.Also, signals from the Relative Strength Index (RSI) showed that XRP was in a weak state. To exit this position, buying pressure around Ripple’s native token has to increase.But that seemed unlikely. In a highly bearish case, XRP might drop to $0.49. In the short term, the highly bullish scenario for the token could be around $0.52.

Indications from the On Balance Volume (OBV) reinforced XRP’s ailing state. As of this writing, the OBV was down to 5.42 billion.

The decline here implied that most market participants have refrained from buying XRP. Therefore, for trading decisions, the token did not seem to be in a good state to capitalize on its price action.

![[ℕ𝕖𝕧𝕖𝕣] 𝕊𝕖𝕝𝕝 𝕐𝕠𝕦𝕣 𝔹𝕚𝕥𝕔𝕠𝕚𝕟 - How To get Rich Quick In Crypto! (1)](https://cdn.bulbapp.io/frontend/images/ae260165-52b4-47cf-a20a-ebeaf50fdb08/1)