The Significant Influence of Bitcoin in the Whole Crypto Market

Bitcoin, the pioneer of cryptocurrencies, remains the most significant and influential digital asset in the market.

Its price movements, market trends, and overall dominance play a crucial role in shaping the dynamics of the entire cryptocurrency ecosystem.

This article explores the substantial influence Bitcoin wields over the crypto market, examining how its fluctuations impact other digital assets, particularly meme tokens, and the broader market sentiment.

Bitcoin: The Benchmark of the Crypto Market

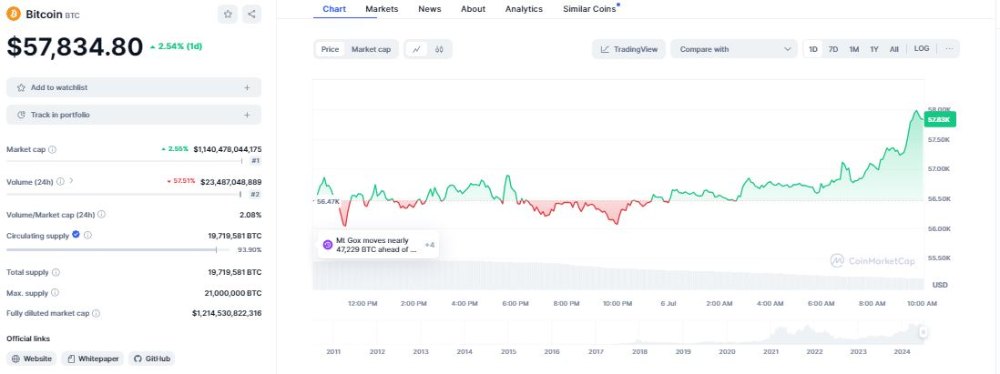

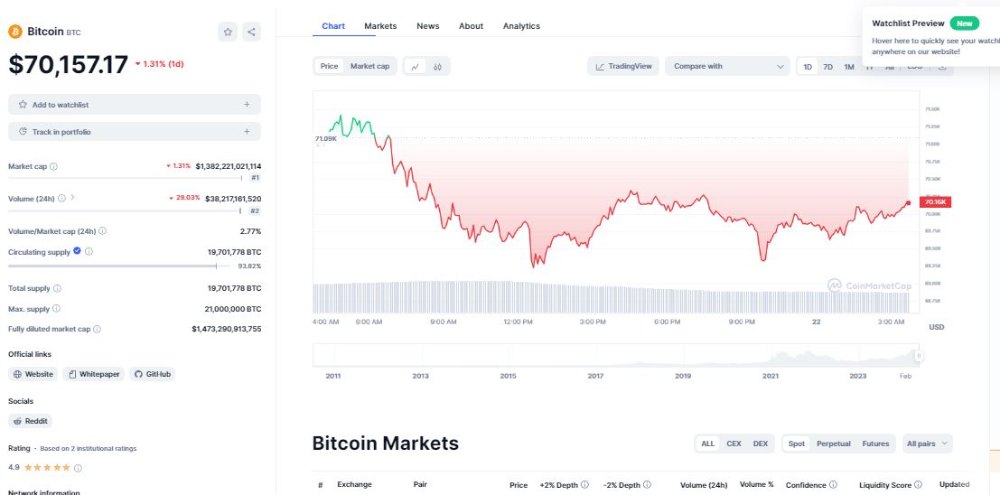

Bitcoin's status as the first and most valuable cryptocurrency has established it as the benchmark for the entire market.

Its price movements are closely watched by investors, traders, and analysts, as they often set the tone for other cryptocurrencies.

Price Movements and Market Trends

Conversely, sharp declines in Bitcoin's value can lead to widespread panic and sell-offs among other digital assets.

For instance, a recent 3% rise in Bitcoin's price to $56,713 within 24 hours not only boosted market confidence but also led to substantial gains in various meme tokens, such as BONK, PEPE, and BRETT.

These tokens saw increases of over 15%, highlighting Bitcoin's influence on investor sentiment and market dynamics.

Market Capitalization and Dominance

Bitcoin's market capitalization and dominance are key metrics in the cryptocurrency landscape.

With a market cap exceeding $1 trillion, Bitcoin accounts for a significant portion of the total crypto market value. Its dominance, which currently stands at 53.64%, underscores its critical role in the market.

Bitcoin's dominance means that its price fluctuations can significantly impact the overall market cap of cryptocurrencies.

A positive movement in Bitcoin often translates to a rise in the global crypto market cap, as seen recently with a 3.2% increase to $2.08 trillion. This correlation underscores the interdependence between Bitcoin and other digital assets.

The Ripple Effect: Bitcoin's Impact on Altcoins

Bitcoin's influence extends beyond its own market performance. Its price trends and market behavior can create a ripple effect that impacts altcoins, including popular meme tokens and other alternative cryptocurrencies.

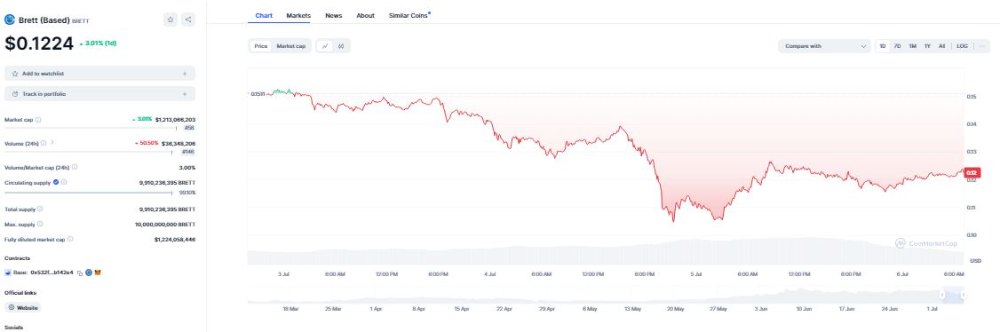

Meme Tokens and Bitcoin's Influence

Meme tokens, often characterized by their volatility and speculative nature, are particularly susceptible to Bitcoin's influence. When Bitcoin's price surges, it boosts investor confidence and encourages investment in alternative coins, including meme tokens.

For example, during Bitcoin's recent price rise, meme tokens like BONK, PEPE, and BRETT experienced significant gains.

BONK, based on Solana, surged by 12%, while Ethereum-based PEPE rose by 8.6%. BRETT, launched just four months ago, also saw an 8% increase. These tokens benefitted from the positive market sentiment driven by Bitcoin's upward movement.

Altcoins and Market Sentiment

Altcoins, or alternative cryptocurrencies, often follow Bitcoin's lead in terms of price movements and market trends.

Positive changes in Bitcoin's value can lead to increased investment in altcoins, as investors seek to diversify their portfolios and capitalize on the bullish sentiment.

The recent rise in Bitcoin's price to $56,713 created a favorable environment for altcoins, leading to a surge in their value.

This phenomenon demonstrates how Bitcoin's performance can set the stage for broader market trends, influencing investor behavior and market dynamics across various digital assets.

Psychological and Behavioral Aspects

Bitcoin's influence on the crypto market is not only financial but also psychological. Its price movements can significantly impact investor sentiment and behavior, shaping market dynamics and investment strategies.

Investor Confidence and FOMO

Bitcoin's price surges often lead to increased investor confidence and a phenomenon known as FOMO (fear of missing out).

When Bitcoin's value rises, investors fear missing out on potential gains and rush to invest in the market. This influx of investment drives up the prices of Bitcoin and other cryptocurrencies, creating a positive feedback loop.

For example, the recent 3% rise in Bitcoin's price spurred investor confidence, leading to increased interest in meme tokens and other altcoins. This surge in investment activity highlights how Bitcoin's performance can influence investor behavior and market sentiment.

Market Sentiment and Speculation

Bitcoin's price movements can also influence market sentiment and speculative behavior. Positive changes in Bitcoin's value often lead to bullish market sentiment, encouraging speculative investments in altcoins and meme tokens.

The recent rise in Bitcoin's price to $56,713 created a speculative frenzy in the market, with investors flocking to meme tokens like BONK, PEPE, and BRETT. This speculative behavior demonstrates how Bitcoin's influence extends beyond its own market performance, shaping broader market trends and investment strategies.

The Future of Bitcoin's Influence

As the cryptocurrency market continues to evolve, Bitcoin's influence is likely to remain significant. However, the dynamics of the market are constantly changing, and new trends and developments could impact Bitcoin's role in the future.

Emerging Trends and Technologies

Emerging trends and technologies, such as decentralized finance (DeFi) and non-fungible tokens (NFTs), could influence Bitcoin's role in the market.

These innovations are creating new opportunities and reshaping the cryptocurrency landscape, potentially impacting Bitcoin's dominance and influence.

For example, the rise of DeFi platforms and NFTs has led to increased interest in Ethereum and other blockchain networks. While Bitcoin remains the benchmark for the market, these emerging trends could influence its role and impact in the future.

Regulatory Developments

Regulatory developments could also impact Bitcoin's influence on the market. As governments and regulatory bodies around the world develop frameworks for cryptocurrency regulation, these changes could shape the dynamics of the market and influence Bitcoin's role.

For example, increased regulatory scrutiny could impact Bitcoin's price and market behavior, influencing investor sentiment and market trends. As the regulatory landscape evolves, it will be important to monitor how these developments impact Bitcoin and the broader crypto market.

Conclusion

Bitcoin's significant influence on the cryptocurrency market is undeniable. Its price movements, market trends, and overall dominance shape the dynamics of the entire market, impacting altcoins, meme tokens, and investor behavior.

As the benchmark for the crypto market, Bitcoin's performance sets the tone for broader market trends and investment strategies.

Understanding Bitcoin's influence is crucial for investors, traders, and analysts navigating the complex and ever-evolving cryptocurrency landscape. By recognizing the factors that drive Bitcoin's performance and its impact on the market, stakeholders can make more informed decisions and capitalize on the opportunities presented by this revolutionary digital asset.

References

- CoinMarketCap: Bitcoin Price

- CoinMarketCap: BONK Price

- CoinMarketCap: PEPE Price

- CoinMarketCap: BRETT Price

- Major Histocompatibility Complex (MHC)

- Pheromones and Attraction

- Dopamine and Reward

- Serotonin and Mood

- Oxytocin and Bonding

- Assortative Mating

- Mere Exposure Effect

- Emotional Intelligence

- Social Status and Attraction

- Psychology of Reciprocity

- Cultural Influences on Love

![[LIVE] Engage2Earn: McEwen boost for Rob Mitchell](https://cdn.bulbapp.io/frontend/images/c798d46f-d3b8-4a66-bf48-7e1ef50b4338/1)

![[ℕ𝕖𝕧𝕖𝕣] 𝕊𝕖𝕝𝕝 𝕐𝕠𝕦𝕣 𝔹𝕚𝕥𝕔𝕠𝕚𝕟 - And Now What.... Pray To The God Of Hopium?](https://cdn.bulbapp.io/frontend/images/79e7827b-c644-4853-b048-a9601a8a8da7/1)