Solana airdrop

5 in-one Solana airdrop guide: Solblaze, Marginfi, Kamino, Sharky & Tensor

With Solana airdrop season in full swing, you want to get the biggest bang for your buck in interacting with protocols to be eligible for airdrops.

This involves getting every $1 of capital you to deploy to work across multiple protocols that have or are planning airdrops.

This article will run through a strategy I’m executing that will help qualify for the following five airdrops:

- Solblaze

- MarginFi

- Kamino

- Sharky

- Tensor

This guide will set out five steps to qualify for these airdrops, which includes an overview of each platform (including the airdrop criteria), what you need to do to qualify, and what the returns and risks are.

Let's get started

Disclaimer: This is a strategy I am currently executing. A few of these steps involve leverage and the risk of loss. I have included the key risks throughout to help inform your decision-making. Please ensure you fully understand the risk profile if you choose to replicate this strategy and consult a financial advisor as applicable

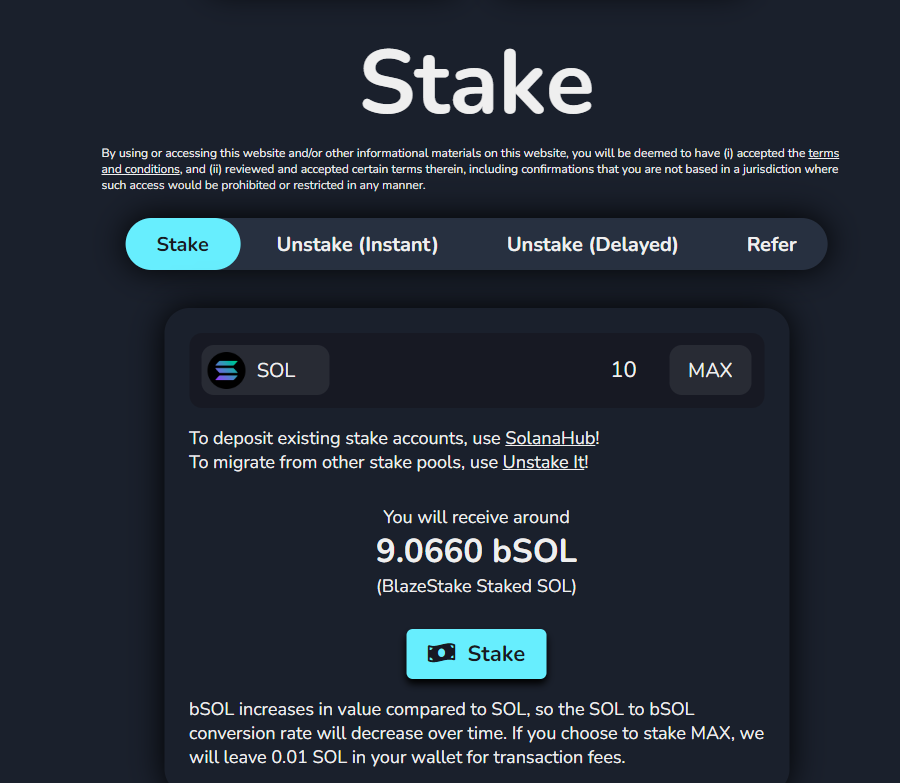

Step 1: Stake SOL on Solblaze for bSOL

- What is Solblaze (including airdrop criteria):

- Solblaze is a liquid staking platform that allows you to get a liquid staked token in exchange for your staked SOL (i.e. stake SOL to get bSOL). This differs from traditional SOL staking where you lock up your SOL and simply earn a return from it

- Staking will enable you to get airdropped $BLZE tokens, which are currently trading at $.002 (see a detailed overview from Solblaze

- What you need to do to qualify:

- Navigate to Solblaze staking, and input the amount of SOL you would like to stake. You will receive bSOL at a specified rate

- You can use my referral link here to go to Solblaze staking:

Solblaze staking

Solblaze staking

- Returns: The current APY on staked SOL is ~8.5%, with 1.71% of this coming from $BLZE tokens (the rest in SOL)

- Risks: The main risk here is a bug in the smart contract (inherent in any DeFi platform where you lock away your funds) that leads to a hack. However, Solblaze has audited their smart contract seven times by five different organizations as per their whitepaper

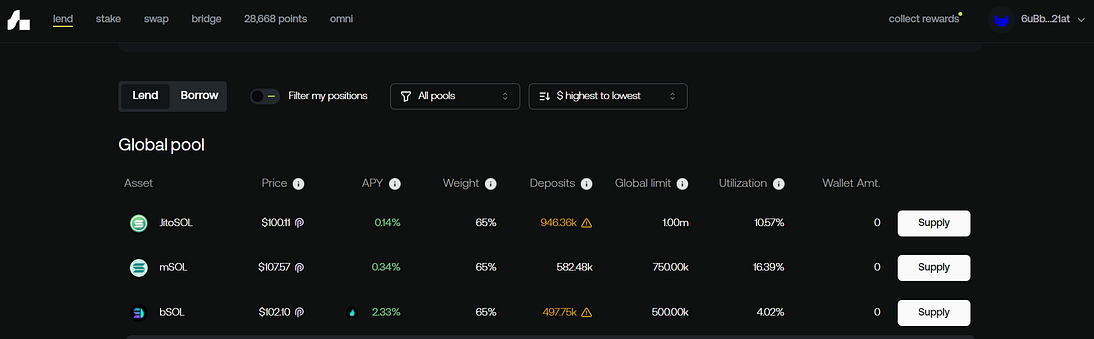

Step 2: Lend bSOL on marginfi

- What is marginfi (including airdrop criteria):

- MarginFi is a Solana borrowing and lending platform, enabling you to earn yield on your assets and borrow on others

- MarginFi has introduced a points system, which is highly likely to be converted directly for a marginfi token. Currently, you earn 1 point per $1 lent, and 4 points per $1 borrowed

- What you need to do to qualify:

- Navigate to marginfi. Put the display on “pro mode” (at the bottom), and click “supply” next to bSOL. Then supply (i.e. lend) all of your bSOL tokens.

- You can use my referral link here to access marginfi: https://www.mfi.gg/refer/37f7d643-035c-43ed-b4bb-d3b70f922197

- Note: If you have additional assets you can lend these as well, which will help for step 3, as you will be able to borrow more collateral

bSOL’s lending pool on marginfi

bSOL’s lending pool on marginfi

- Returns: Current APY is ~2.3%, with 1 marginfi point per $1 lent

- Risks: Smart contract risk (as above). There is also liquidation risk, if the price of bSOL falls below a certain price (which will be displayed on marginfi)

Step 3: Borrow SOL on marginfi

- What you need to do to qualify:

- Navigate to marginfi. Switch from “Lend” to “Borrow” and borrow SOL (noting that this pool is often heavily utilized so you may need to wait until some SOL becomes available)

- Returns: You will pay ~5% APR in interest, but earn 4 points $1 lent

- Risks: Liquidation risk — a liquidation price will display, which changes according to how much collateral you have lent and how much you have borrowed.

Note: Kamino Finance, a borrowing and lending protocol like marginfi, will be launching a points system shortly. You can replicate the same steps 2+3 when Kamino launches to become eligible for an airdrop

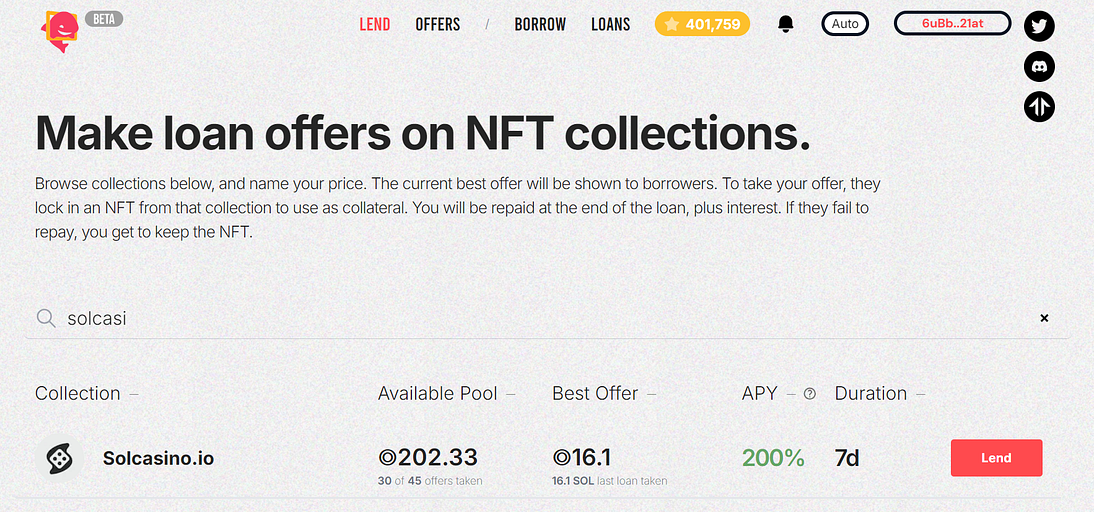

Step 4: With the borrowed SOL, lend it against an NFT on Sharky

- What is Sharky (including airdrop criteria):

- Sharky is an NFT lending and borrowing platform on Solana.

- They have announced a token called $HARK, which is almost certainly going to be airdropped. Sharky has said that borrowing and lending on their platform will be “rewarded” (i.e. with $HARK)

- What you need to do to qualify:

Sharky loan interface

Sharky loan interface

- Returns: You earn interest on each of your loans, at a predetermined APY (e.g., Solcasino.io’s APY is 200%)

- Risks: Default risk — if the floor price of the NFT falls below your loan amount, the borrower will usually elect to default -leaving you with an NFT

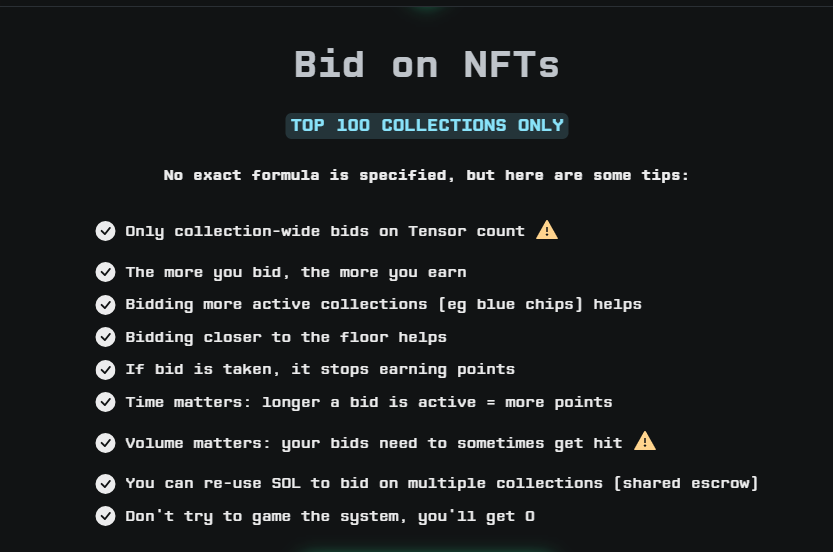

Step 5: Put a collection level bid on Tensor OR list any defaulted NFTs from Sharky

- What is Tensor:

- Tensor is the largest NFT marketplace on Solana. It has adopted a similar “season” style points system like Blur. Tensor is currently in season 3, and is heavily speculated to have an airdrop

- As per Tensor’s website, you can earn points by 1) Putting collection level bids on top 100 projects and 2) Listing top 100 project NFTs

- What you need to do to qualify:

- List defaulted NFTs: If you have any NFTs from Sharky that have defaulted, you can list these on Tensor. The duration of your listing counts towards your points (along with proximity to the floor price), so try to put it relatively close to the floor price

Tensor points requirements

Tensor points requirements

- Put collection level bids: Using the SOL you borrowed (or existing SOL), put a collection level bid on an top 100 NFT collection. Again your best bet is to put a bid on a collection where you are happy to hold the NFT. You get more points for the longer your bid is active, so ideally, put a price a bit lower than the floor value

- Risks: Price risk — NFTs prices will change over time, resulting in either capital gains or losses

And that's it! Remember for this strategy to continuously monitor your exposure across all the platforms to avoid liquidation

![[LIVE] Engage2Earn: Julian Hill Bruce boost](https://cdn.bulbapp.io/frontend/images/dbf23bb3-aba5-43ea-9678-e8c2dbad951c/1)

![[ℕ𝕖𝕧𝕖𝕣] 𝕊𝕖𝕝𝕝 𝕐𝕠𝕦𝕣 𝔹𝕚𝕥𝕔𝕠𝕚𝕟 - And Now What.... Pray To The God Of Hopium?](https://cdn.bulbapp.io/frontend/images/79e7827b-c644-4853-b048-a9601a8a8da7/1)