Educate yourselves on personal finance topics

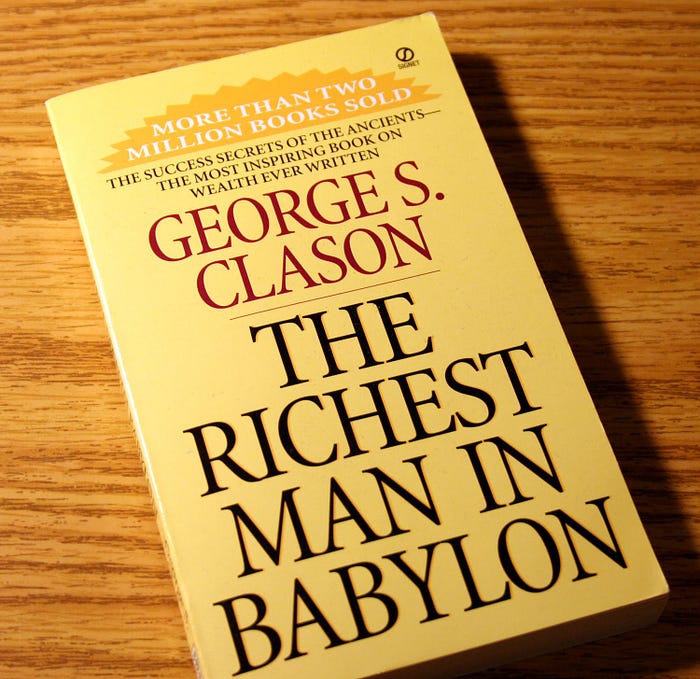

"The Richest Man in Babylon"

by George Samuel Clason

"The Richest Man in Babylon," written by George Samuel Clason, is a timeless classic that has helped countless readers around the world understand the principles of wealth creation and financial success. First published in 1926, the book uses parables set in ancient Babylon to convey practical lessons about money management, savings, and investment. Despite its age, the wisdom it imparts is as relevant today as it was nearly a century ago.

What the Book Teaches

"The Richest Man in Babylon" provides readers with valuable financial lessons through a series of engaging parables. Here are some of the core teachings:

1. Pay Yourself First

One of the most important lessons from the book is the concept of "paying yourself first." This means setting aside a portion of your income for savings and investments before you spend on anything else. Clason recommends saving at least 10% of your earnings. This practice ensures that you build wealth over time and have a financial cushion for the future.

2. Live Below Your Means

The book emphasizes the importance of living below your means. This entails controlling your expenses and not spending more than you earn. By being mindful of your spending habits and avoiding unnecessary expenditures, you can save more and invest in opportunities that will grow your wealth.

3. Make Your Money Work for You

Investing your savings wisely is a crucial step in building wealth. The parables in the book illustrate the importance of making your money work for you through sound investments. This could involve investing in businesses, real estate, or other ventures that generate passive income. The key is to ensure that your investments are secure and offer a reasonable return.

4. Seek Advice from Experts

Another important lesson is the value of seeking advice from knowledgeable and experienced individuals. The book encourages readers to consult experts and learn from those who have successfully navigated the path to financial success. This can help you make informed decisions and avoid costly mistakes.

5. Protect Your Wealth

Protecting your wealth from loss is another fundamental principle taught in the book. This involves being cautious and avoiding risky investments that could lead to financial ruin. Diversifying your investments and thoroughly researching opportunities before committing your money are essential practices for safeguarding your wealth.

6. Increase Your Earning Capacity

Continuous self-improvement and education are emphasized as ways to increase your earning potential. By enhancing your skills and knowledge, you can take advantage of better job opportunities, negotiate higher salaries, and explore additional income streams. The book encourages a proactive approach to personal and professional development.

7. The Importance of Willpower and Discipline

Discipline and willpower are crucial for adhering to these financial principles. The book highlights that the journey to wealth requires consistent effort and the ability to resist temptations that could derail your progress. Developing good habits and maintaining focus on your financial goals are vital for long-term success.

Timeless Lessons in Modern Context

While "The Richest Man in Babylon" is set in ancient times, the lessons it imparts are universally applicable. Here’s how these timeless principles can be adapted to the modern context:

- Automated Savings: Today, setting up automatic transfers to savings and investment accounts can help ensure you consistently pay yourself first.

- Budgeting Apps: Modern technology offers various tools and apps that make it easier to track expenses and live below your means.

- Online Investment Platforms: The internet has democratized investment opportunities, making it easier for individuals to invest in diverse assets.

- Access to Expert Advice: With the rise of online financial advisors and educational resources, seeking expert advice has never been more accessible.

- Continual Learning: Online courses and educational resources enable continuous self-improvement and skill development, enhancing earning capacity.

"The Richest Man in Babylon" by George Samuel Clason remains a must-read for anyone seeking to improve their financial literacy and build wealth. Its simple yet profound lessons on saving, investing, and managing money have stood the test of time. By incorporating these principles into your life, you can achieve financial stability and success. Whether you are a novice in personal finance or an experienced investor, the wisdom contained in this book offers valuable insights that can help you navigate your financial journey.

Thank you!

_________________________________

Your most valuable asset is your time. Invest him properly!

DYOR

Not your keys, Not your crypto!

Find useful articles to read: HERE

My referal links: